April 2023

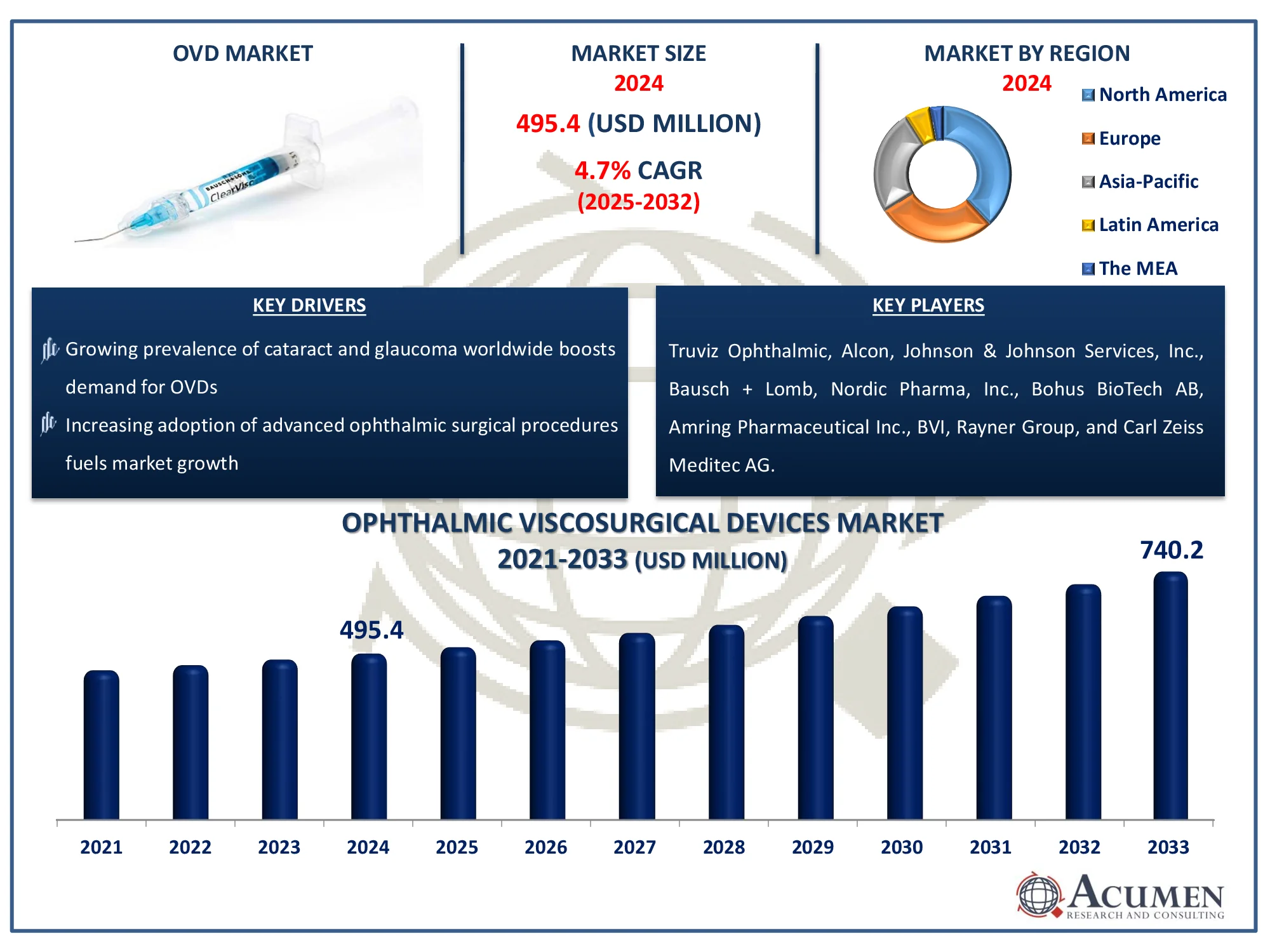

The Global Ophthalmic Viscosurgical Devices Market Size accounted for USD 495.4 Million in 2024 and is estimated to achieve a market size of USD 740.2 Million by 2033 growing at a CAGR of 4.7% from 2025 to 2033.

The Global Ophthalmic Viscosurgical Devices Market Size accounted for USD 495.4 Million in 2024 and is estimated to achieve a market size of USD 740.2 Million by 2033 growing at a CAGR of 4.7% from 2025 to 2033.

Ophthalmic viscosurgical devices are used in ophthalmic surgery for maintaining the anterior chamber during surgical maneuvers. The main function of ophthalmic viscosurgical devices are to maintain and preserve space, displace and stabilize tissue, and coat and protect tissue. Based on product type, different types of ophthalmic viscosurgical devices such as dispersive ophthalmic viscosurgical devices and cohesive ophthalmic viscosurgical devices are used. According to world Health Organization (WHO), more than 2.2 billion individuals worldwide struggle to see things up close or from a distance. At least one billion of these instances may have been avoided or are still untreated. 90% of persons who have not gotten vision care or are blind live in low- and middle-income nations. According to WHO, in 2021, there are more than 3 billion people of the global population, suffering from neurological disorders and more than 280 million people are suffering from depression.

|

Market |

Ophthalmic Viscosurgical Devices Market |

|

Ophthalmic Viscosurgical Devices Market Size 2024 |

USD 495.4 Million |

|

Ophthalmic Viscosurgical Devices Market Forecast 2033 |

USD 740.2 Million |

|

Ophthalmic Viscosurgical Devices Market CAGR During 2025 - 2033 |

4.7% |

|

Ophthalmic Viscosurgical Devices Market Analysis Period |

2021 - 2033 |

|

Ophthalmic Viscosurgical Devices Market Base Year |

2024 |

|

Ophthalmic Viscosurgical Devices Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Product Type, By Source, By Application, By End-Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Truviz Ophthalmic, Johnson & Johnson Services, Inc., Alcon, Bausch + Lomb, Nordic Pharma, Inc., Bohus BioTech AB, Amring Pharmaceutical Inc., BVI, Rayner Group, and Carl Zeiss Meditec AG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The growth of the market is primarily driven by the rising ophthalmic viscosurgical devices demand from cataract surgeries, glucoma surgeries, and other surgeries applications, increase in geriatric population across the globe, and technological advancements in ophthalmic viscosurgical devices. According to the National Institutes of Health (NIH), cataracts affect almost 70 million individuals globally, causing bilateral blindness or moderate to severe visual impairment. Furthermore, increase in demand and preference for non-invasive treatment and expanding base of diabetic patients worldwide, is estimated to boost the market growth. As per the World Health Organization (WHO), around 830 million people have diabetes globally.

Moreover, changing lifestyles of consumers across developed countries, growing pharmaceutical and medical industry, technological advancement and increase in the number of applications are expected to create opportunities for the manufacturers in the global market over the ophthalmic viscosurgical devices market forecast period. According to the ARC (Acumen Research and Consulting) survey, the pharmaceutical market size accounted for USD 1.5 Trillion in 2022 and is projected to achieve a market size of USD 2.8 Trillion by 2032 growing at a CAGR of 6.4% from 2023 to 2032. However, high cost of ophthalmic devices and risks associated with eye surgeries are expected to hamper the growth of the global ophthalmic viscosurgical devices market in the coming years.

Ophthalmic Viscosurgical Devices Market Segmentation

Ophthalmic Viscosurgical Devices Market SegmentationThe worldwide market for ophthalmic viscosurgical devices is split based on product type, source, application, end-use, and geography.

According to ophthalmic viscosurgical devices industry analysis, the dispersive OVD segment accounted for approximately 38% of the share in the global market in 2024. Increase in demand for surgical aid for performing ocular surgeries such as cataract, glaucoma, vitrectomy, and others, creating and maintaining space in anterior segment of the eye at the time of surgery, and rising incidences of various diseases is further expected to raise segment over the ophthalmic viscosurgical devices market forecast period. In terms of WHO, there are over 300 million surgical procedures performed each year globally.

The biological sector generates the greatest revenue among the source categories of the ophthalmic viscosurgical devices (OVD) market due to its superior biocompatibility and efficiency in ocular procedures. Biological OVDs, which are predominantly derived from natural sources such as hyaluronic acid, closely resemble the eye's native environment, making them suitable for space maintenance, tissue protection, and ease of manipulation during procedures such as cataract extraction. Their ability to give superior viscoelastic characteristics while lowering inflammation and improving postoperative recovery makes them popular among ocular surgeons. Furthermore, continual advances in the purification and manufacture of biologically based materials have improved product safety and efficacy, accelerating their adoption in both developed and emerging markets and supporting their substantial revenue contribution.

According to ophthalmic viscosurgical devices industry analysis, the cataract surgeries segment accounted for approximately 51% of the share in the global OVD market in 2024. Geriatric population across the globe and growing incidence of cataract, and rising demand for safe surgery is further expected to raise segment over the forecast period. For example National Institutes of Health (NIH) states that, cataract surgery improves visual acuity in up to 95% of patients, there are certain risks.

The hospitals segment accounted significant share in the global market in 2024. Growing demand for multi-specialty medical devices for vision correction and cataract procedures and growing consumer preference towards technology advanced surgical procedures performed in hospitals is further expected to raise segment over the forecast period. Owing to its growing number of surgery, growing number of devices requirement in hospitals, and supportive government initiatives further grows the demand for ophthalmic viscosurgical devices in hospitals applications during the forecast period.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Ophthalmic Viscosurgical Devices Market Regional Analysis

Ophthalmic Viscosurgical Devices Market Regional AnalysisNorth America accounted for the highest share of the market and the region is also expected to maintain its dominance over the forecast period. The region is experiencing the maximum growth owing to the rapid consumption of ophthalmic viscosurgical devices in various end user applications, presence of ophthalmic viscosurgical devices companies, favorable reimbursement policies, and rapidly growing geriatric population. Highly efficient reimbursement structure and developed healthcare infrastructure in the North America region is one of the key factors driving the consumption of ophthalmic viscosurgical devices in this region. Moreover, highly skilled neurosurgeons, growing number of hospitals and research centers in key countries such as US and Canada are also propelling the growth of ophthalmic viscosurgical devices in the North America region. For instance, according to the American Hospital Association there are around 6,093 hospitals in the United States. Europe is followed by the North America region in the ophthalmic viscosurgical devices market.

Asia-Pacific is expected to hold the fastest CAGR in the global market during the forecast period. The growing medical device industry, increase in innovation and development in ophthalmic viscosurgical devices, and growing geriatric populations, are expected to enhance the market growth in the global ophthalmic viscosurgical devices market during the forecasted years. For instance, according to the India Brand Equity Foundation, Imports from the United States, China, and Germany account for 70-80% of the Indian medical device market.

Some of the top ophthalmic viscosurgical devices companies offered in our report include Truviz Ophthalmic, Johnson & Johnson Services, Inc., Alcon, Bausch + Lomb, Nordic Pharma, Inc., Bohus BioTech AB, Amring Pharmaceutical Inc., BVI, Rayner Group, and Carl Zeiss Meditec AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

July 2023

January 2025

October 2024