November 2018

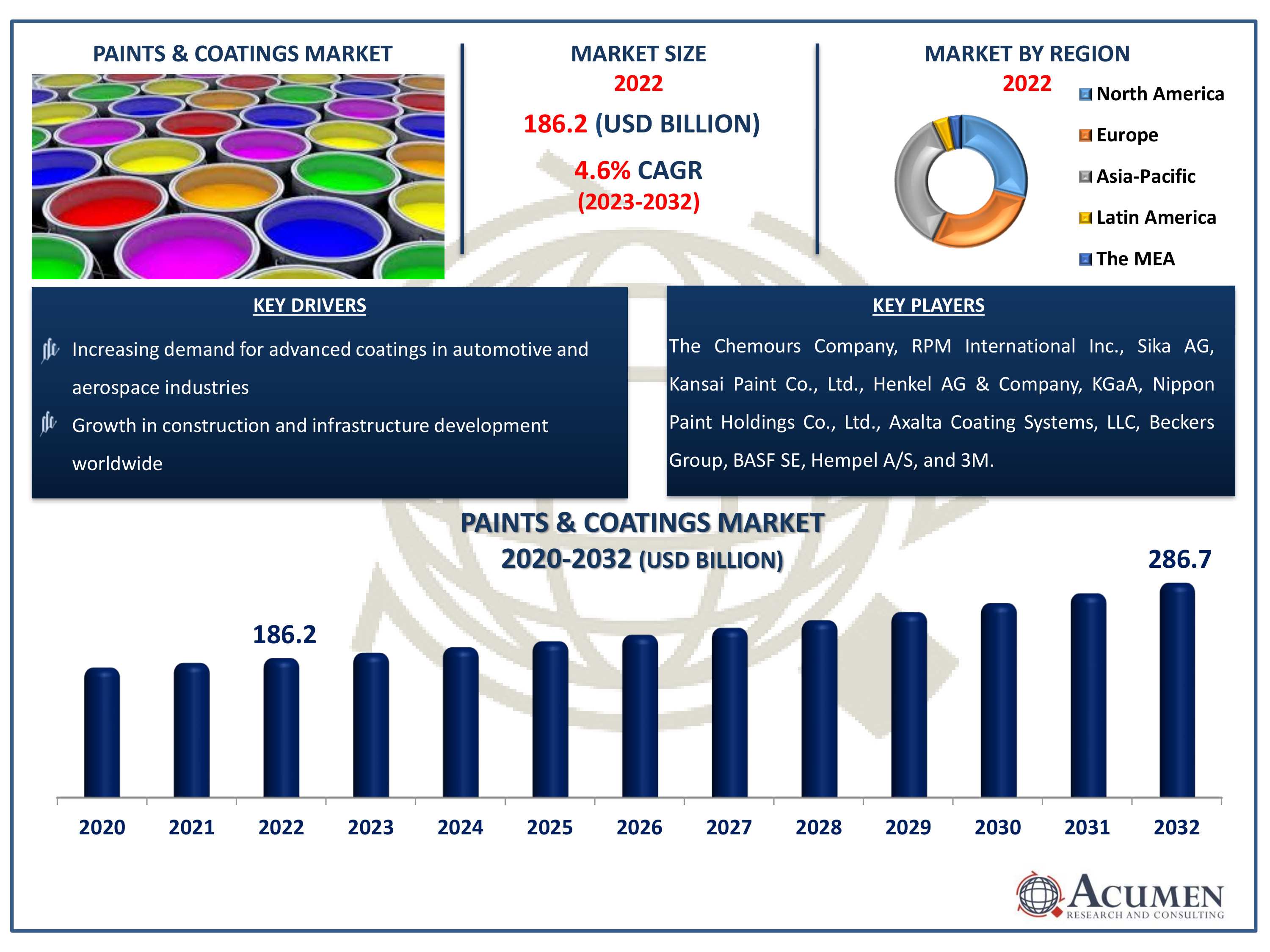

Paints & Coatings Market Size accounted for USD 186.2 Billion in 2022 and is estimated to achieve a market size of USD 286.7 Billion by 2032 growing at a CAGR of 4.6% from 2024 to 2032.

The Paints & Coatings Market Size accounted for USD 186.2 Billion in 2022 and is estimated to achieve a market size of USD 286.7 Billion by 2032 growing at a CAGR of 4.6% from 2024 to 2032.

Paints & Coatings Market Highlights

Industrial coatings, also known as protective coatings, serve an important function in protecting diverse substrates including steel and concrete from environmental degradation, corrosion, and wear. While these coatings frequently improve the look of the surface, their major role is to give long-lasting protection against the environment, such as moisture, chemicals, and UV radiation. This complicated market sector includes a vast range of goods designed for various applications and industries, including as oil and gas, maritime, construction, and manufacturing. Some coatings provide specialized qualities such as fire resistance, anti-fouling, or chemical resistance. The need for high-performance coatings is rising as companies want to extend the life of their assets, reduce maintenance costs, and comply with more severe environmental requirements.

Global Paints & Coatings Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Paints and Coatings Market Report Coverage

| Market | Paints & Coatings Market |

| Paints & Coatings Market Size 2022 | USD 186.2 Billion |

| Paints & Coatings Market Forecast 2032 |

USD 286.7 Billion |

| Paints & Coatings Market CAGR During 2024 - 2032 | 4.6% |

| Paints & Coatings Market Analysis Period | 2020 - 2032 |

| Paints & Coatings Market Base Year |

2022 |

| Paints & Coatings Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Resin, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | The Chemours Company, RPM International Inc., Sika AG, Kansai Paint Co., Ltd., Henkel AG & Company, KGaA, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, LLC, Beckers Group, BASF SE, Hempel A/S, and 3M. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Paints & Coatings Market Insights

Factors such as escalating construction expenditure, growing automotive industry, increasing urban population, rising household consumption expenditure, and improving economic conditions are expected to drive the growth of the paints and coatings market. However, this growth may be challenged by rising raw material prices and stringent regulations. Additionally, the increasing adoption of smart coatings for commercial applications, such as the restoration of historical buildings, will contribute to market growth during the paints & coatings market forecast period. Large-scale investment in the construction of projects such as hotels, apartments, offices, retail centers, and civic infrastructure is expected to boost in the paints & coatings industry forecast period.

Notable trends include the consolidation of market players, a growing preference for professional contractors, and the increasing use of natural ingredients by chemical corporations. The high demand for personalized paint solutions in developing economies and technological advancements, such as anticorrosive protection, low-VOC content coatings, and nanocoatings, will cater to numerous new and diverse consumer demands. Furthermore, the application of paints and coatings to protect machines and equipment from rust and corrosion in industries will drive market growth. These coatings also enhance consumer goods by preventing corrosion and improving aesthetics, which will further accelerate the growth of the paints and coatings market.

Paints & Coatings Market Segmentation

The worldwide paints and coatings market is split based on resin, product, application, and geography.

Paints & Coatings Resins

According to paints & coatings industry analysis, acrylic resin dominated the market in 2022. This is due to its weatherproof properties, making it ideal for outdoor applications. Acrylic resin can last for decades without yellowing when exposed to sunlight and provides excellent gloss and mechanical properties, such as scratch resistance, which enhances the shine of the paint. Epoxy resin has gained popularity in the automotive sector due to its compatibility with trending fiber components. Acrylic powder coatings offer a high-performance finish with outstanding weather resistance and high-gloss colors, making them ideal for outdoor applications with excellent exterior durability. These coatings range from thin-film clear coats to very smooth coatings and are typically water-based, easy to handle, moderately priced, and offer superior performance across a wide variety of applications such as roof and wall coatings. They cure through water evaporation, providing a reasonable degree of cohesive strength and excellent adhesion to most roof surfaces.

Paints & Coatings Products

Waterborne coatings dominate the paint and coatings market and are expected to maintain their dominance throughout the forecast period due to their eco-friendly nature. These coatings are followed in popularity by solvent-borne coatings and powder coatings. However, stringent regulations concerning VOCs will hinder the growth of the solvent-borne coatings market in the forecast period. Powder coatings are anticipated to grow at a moderate rate due to their advantages, such as zero VOC emissions, easy rework of workpieces, and the ability to reuse powder.

Paints & Coatings Applications

The architectural and decorative category leads the paints and coatings market due to its widespread application in residential, commercial, and infrastructure projects. This market category includes interior and outdoor paints for walls, ceilings, floors, and other surfaces, as well as decorative finishes such as textured coatings, wallpapers, and stains. Architectural and decorative coatings are necessary for both aesthetic and protective objectives, providing visual appeal while protecting structures from external elements such as rain, moisture, and UV radiation. The segment's expansion is being driven by increased urbanization, rising income levels, and a growing tendency towards house maintenance and renovation. Consumers want a variety of colors, finishes, and eco-friendly solutions, which drives producers to create new, high-quality coatings that fulfill these different tastes and regulatory requirements.

Paints & Coatings Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Paints & Coatings Market Regional Analysis

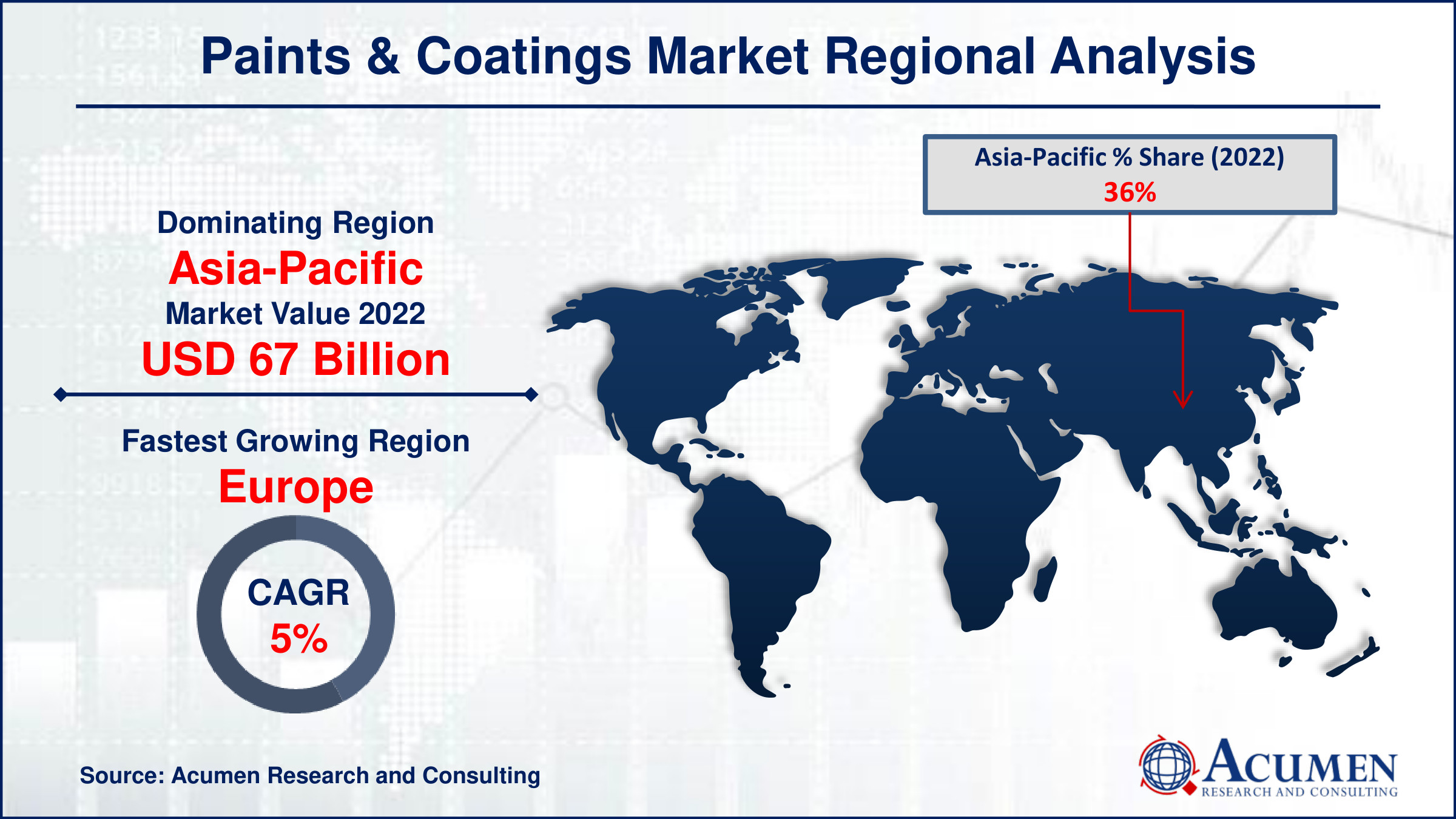

The Asia-Pacific region has a high market share in the global paints and coatings market and is likely to retain its dominance over the forecast period. Several important variables contribute to its expansion. One key driver is the increasing availability of innovative and cost-effective water-solvent paints, which respond to growing environmental concerns and demand for more sustainable goods. The urban population in the area is also displaying a penchant for personalized colors, which is driving the industry as customers seek customized paint solutions. Another element driving market expansion in the Asia-Pacific region is the increased repaint activity for used autos. As the automobile sector grows, the need for vehicle repair and customization increases, creating possibilities for paint and coating producers.

The Asia-Pacific paints and coatings market is largely driven by the strong performance of growing nations such as China, India, and Japan. These nations are experiencing increasing industrialization and urbanization, resulting in increased demand from the construction and automobile industries. Furthermore, multinational manufacturers are developing production facilities in the region, capitalizing on the low-cost labor force and rising consumer base. This infusion of big firms promotes market rivalry and innovation.

Paints & Coatings Market Players

Some of the top paints & coatings companies offered in our report includes The Chemours Company, RPM International Inc., Sika AG, Kansai Paint Co., Ltd., Henkel AG & Company, KGaA, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, LLC, Beckers Group, BASF SE, Hempel A/S, and 3M.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2018

January 2025

June 2022

October 2024