April 2021

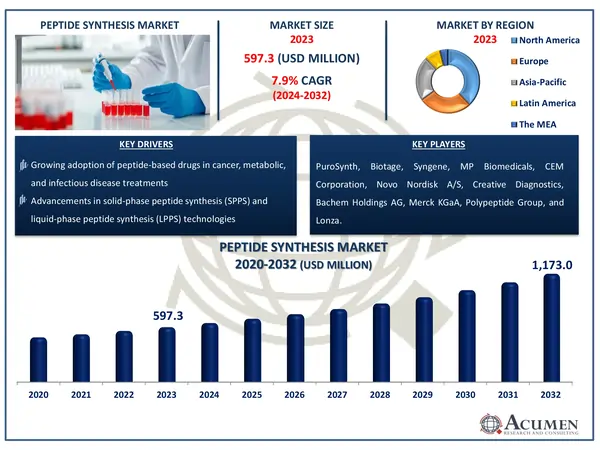

The Global Peptide Synthesis Market Size accounted for USD 597.3 Million in 2023 and is estimated to achieve a market size of USD 1,173.0 Million by 2032 growing at a CAGR of 7.9% from 2024 to 2032.

The Global Peptide Synthesis Market Size accounted for USD 597.3 Million in 2023 and is estimated to achieve a market size of USD 1,173.0 Million by 2032 growing at a CAGR of 7.9% from 2024 to 2032.

Peptides are organic molecules of a peptide (amide) bound amino acids. Peptide synthesis is the mechanism by which a carboxylic acid from one amino acid is compressed into the amino group of another, forming short sequences of peptides. The production of advanced peptide synthesizers is expected to drive market growth, such as increased use of peptides in pharmaceutical medicinal products, increased research activities, and availability of funds for R & D. The lack of a standardized set of rules for therapeutic peptides, however, is expected during the forecast period to limit the growth of this market.

While chemical synthesis is the most mature technology to synthesize peptide, lacking specificity and environmental impact are serious disadvantages that enzyme biocatalysis can in theory succeed in overcoming. Nonetheless, enzyme synthesis efficiency is lower. Biocatalyst cost is usually high and no validation and expansion protocols exist that reflect challenges which are actively faced by intensive research and development in this field.

|

Market |

Peptide Synthesis Market |

|

Peptide Synthesis Market Size 2023 |

USD 597.3 Million |

|

Peptide Synthesis Market Forecast 2032 |

USD 1,173.0 Million |

|

Peptide Synthesis Market CAGR During 2024 - 2032 |

7.9% |

|

Peptide Synthesis Market Analysis Period |

2020 - 2032 |

|

Peptide Synthesis Market Base Year |

2023 |

|

Peptide Synthesis Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Technology, By Application, By End Use, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

PuroSynth, Thermo Fischer Scientific, Inc., Biotage, Syngene, MP Biomedicals, CEM Corporation, Novo Nordisk A/S, Creative Diagnostics, Bachem Holdings AG, Merck KGaA, Polypeptide Group, and Lonza. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

To carry out the coupling reactions, multiple reagents are added to activate the amino acid carboxyl groups. Most of them include hydroxybenzotriazole (HOBT), phosphonium salts, and uranium. N-methylpirrolidone, dimethylacetamide, Chaotropic salts, and mixture of solvents are used in difficult sequences to improve binding performance and the elongation of the peptide chain. Sequence synthesis, chemical binding, and convergent synthesis are the main solid phase peptide synthesis (SPPS) techniques. Cells need a variety of chemical subsystems, including functionally supported peptides, split lipids and many small other molecules that form the basis of metabolization.

All species contain 7,000 natural peptides that have a large role in the biology of bacteria, plants, animals and people. Peptides and proteins are well known to be highly specific and powerful to their natural aim and to have a good human safety profile. This makes them a great choice for developing new biopharmaceutical products. Unmodified peptides and proteins often have short half-lives in blood due to kidney clearance, proteolytic degradation or specific absorption by the receptor. Synthetic peptides are rapidly growing. Such molecules are commonly used for work in biomedicine, biology, or the cosmetics industry. The downside of peptide processing is the vast amounts of toxic organic solvents (DCM) and DIMF, used in significant abundance for both solvent syntheses and solid-phase peptide synthesis.

The worldwide market for peptide synthesis is split based on product, technology, application, end use, and geography.

According to peptide synthesis industry analysis, the reagents & consumables category dominates the market, accounting for 47%. This segment is critical for peptide manufacturing since it includes key components such as amino acids, resins, coupling reagents, and solvents. The segment's expansion is fueled by the ongoing need for these consumables in research, drug development, and manufacturing. The growing demand for peptide-based medications and diagnostics raises the demand for high-quality reagents and consumables, hence cementing the segment's market position.

Liquid phase peptide synthesis (LPPS) has emerged as the industry leader in peptide synthesis due to its ability to generate high-purity peptides on a massive scale. LPPS is widely used in the pharmaceutical and biotechnology industries, especially for synthesizing long-chain peptides and complicated sequences with little structural alterations. This approach provides improved solubility control and purification, making it appropriate for commercial peptide production. In comparison to Solid Phase Peptide Synthesis (SPPS), LPPS is more cost-effective in bulk synthesis, lowering reagent use while maintaining a high yield. Furthermore, developments in hybrid technologies using LPPS have increased its capabilities, boosting its dominance. The increasing demand for therapeutic peptides, particularly in drug research, is driving global LPPS usage.

Based on application the industry has been segmented into therapeutics, diagnosis, and research. Therapeutics segmented has dominated the global end-use industry in terms of revenue and is likely to maintain similar trend over the peptide synthesis market forecast period. Furthermore, diagnosis segment is projected to display fastest growth over the forecast period. Synthesized peptides are commonly used for cancer therapy and have made this segment a significant contributor to therapeutic revenue. Advancement in the manufacturing of peptides that play a key role in metabolic regulations should offer useful insights into the development of effective treatment approaches. Robust growth of the Peptide Therapeutics industry is a key driver for the dominance of end-use companies in the global pharmaceutical & biotechnology market.

Pharmaceutical and biotechnology companies account for the majority of revenue. This is mostly due to the growing use of peptides in medication development, notably in the discovery of new treatments for chronic diseases such as cancer, diabetes, and cardiovascular disease. These corporations make significant investments in research and development, increasing the demand for peptide synthesis for clinical trials and pharmaceutical manufacture. Furthermore, the rising prevalence of chronic diseases and the greater emphasis on personalized therapy contribute to the segment's rapid revenue development.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

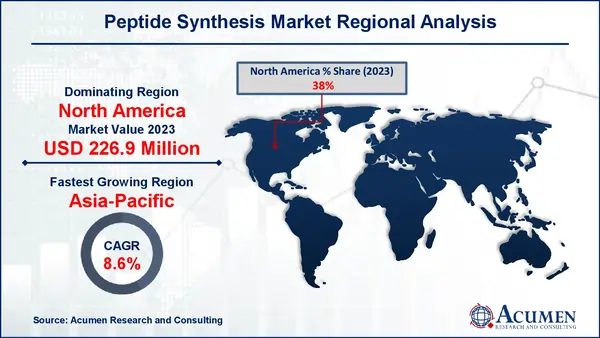

In terms of peptide synthesis market analysis, In terms of region the global market is segmented into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa. Asia-Pacific is anticipated to be the fastest growing region over the foreseeable future. Increasing investment by players across outskirts of Asia-Pacific coupled with economies of scale is projected to be the key factor for the optimistic market of peptide synthesis across this region.

North America made the most important contribution to the global market, due to the strong presence of major players in the industry, increased awareness of the available peptide synthesis technology and the increasing emphasis on commercially moving peptide products.

Some of the top peptide synthesis companies offered in our report includes PuroSynth, Thermo Fischer Scientific, Inc., Biotage, Syngene, MP Biomedicals, CEM Corporation, Novo Nordisk A/S, Creative Diagnostics, Bachem Holdings AG, Merck KGaA, Polypeptide Group, and Lonza.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2021

December 2023

April 2020

March 2024