May 2023

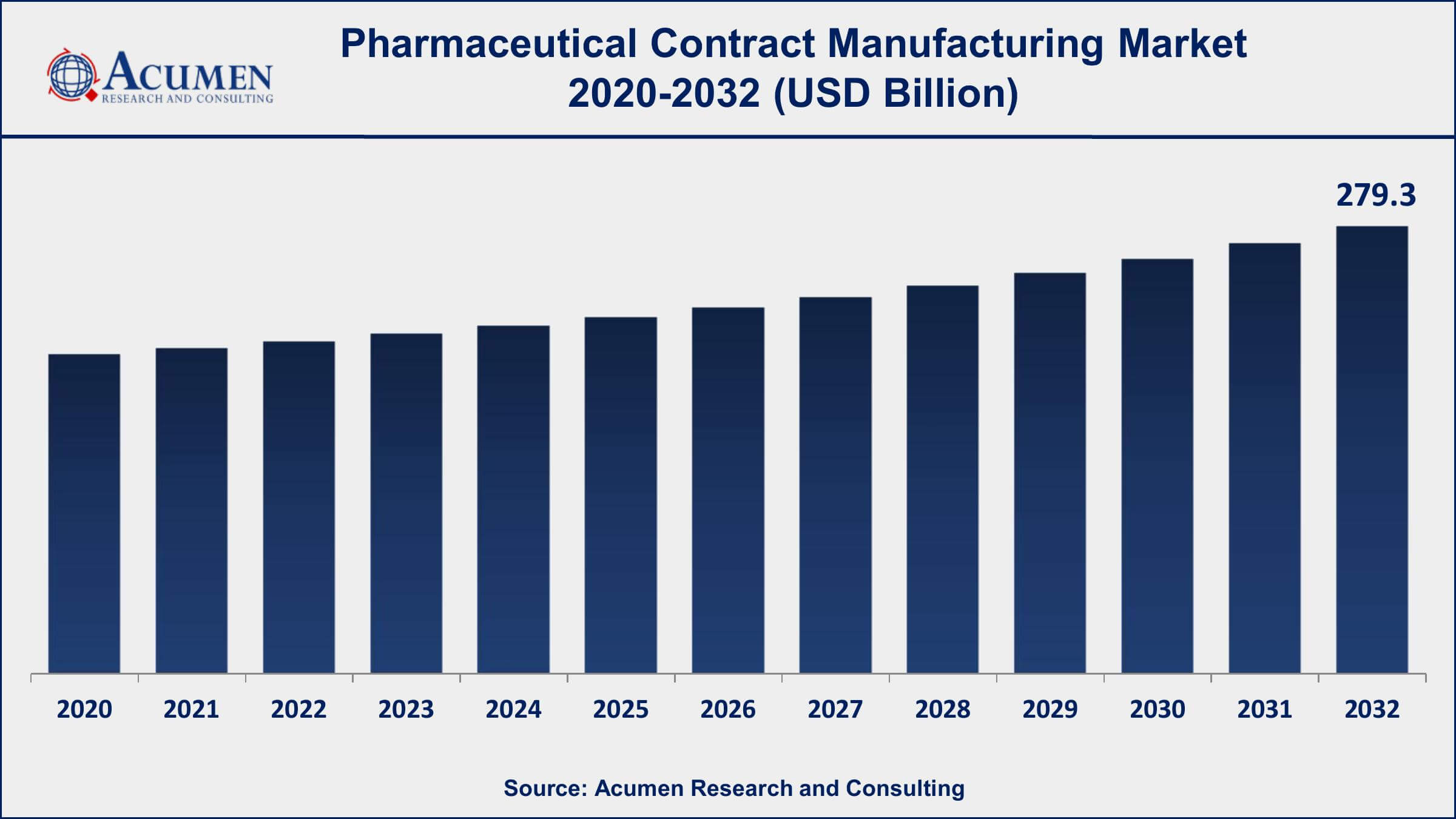

Pharmaceutical Contract Manufacturing Market Size accounted for USD 135.6 Billion in 2022 and is projected to achieve a market size of USD 279.3 Billion by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

The Global Pharmaceutical Contract Manufacturing Market Size accounted for USD 135.6 Billion in 2022 and is projected to achieve a market size of USD 279.3 Billion by 2032 growing at a CAGR of 6.8% from 2023 to 2032.

Pharmaceutical Contract Manufacturing Market Report Key Highlights

Pharmaceutical Contract Manufacturing (PCM) is a type of outsourcing service where a pharmaceutical company hires a contract manufacturing organization (CMO) to produce drugs or drug components on its behalf. PCM allows pharmaceutical companies to save on costs and resources by partnering with specialized CMOs that have the necessary expertise, equipment, and facilities to produce high-quality drugs at a lower cost and faster turnaround time.

Pharmaceutical contract manufacturing contributes significantly to the overall outsourcing market, due to its acceptance and widespread implementation by pharmaceutical companies. Cost-cutting concerns stemming from global economic restraints have put great pressure on pharmaceutical makers to keep end-product costs under control. Pharmaceutical contract manufacturing is the division of goods production by outside firms under the brand of another firm, giving service to numerous manufacturers based on unique designs or specifications. Historically, the pharmaceutical sector required enterprises to be vertically integrated, i.e., the company itself performed all production processes; however, investors now want to sustain strong fiscal profitability, and as a result, outsourcing has emerged as a prominent means of doing business.

Global Pharmaceutical Contract Manufacturing Market Trends

Market Drivers

Market Restraints

Market Opportunities

Pharmaceutical Contract Manufacturing Market Report Coverage

| Market | Pharmaceutical Contract Manufacturing Market |

| Pharmaceutical Contract Manufacturing Market Size 2022 | USD 135.6 Billion |

| Pharmaceutical Contract Manufacturing Market Forecast 2032 | USD 279.3 Billion |

| Pharmaceutical Contract Manufacturing Market CAGR During 2023 - 2032 | 6.8% |

| Pharmaceutical Contract Manufacturing Market Analysis Period | 2020 - 2032 |

| Pharmaceutical Contract Manufacturing Market Base Year | 2022 |

| Pharmaceutical Contract Manufacturing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Services, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lonza Group AG, Catalent, Inc., Thermo Fisher Scientific Inc., Patheon N.V., Evonik Industries AG, AbbVie Contract Manufacturing, Boehringer Ingelheim GmbH, Recipharm AB, Jubilant Life Sciences Limited, and Dr. Reddy's Laboratories Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The pharmaceutical contract manufacturing market has been experiencing significant growth in recent years, and this trend is expected to continue in the coming years. Contract manufacturing organizations (CMOs) provide pharmaceutical companies with a range of services, including drug development, formulation, manufacturing, and packaging. These services help pharmaceutical companies to reduce their operational costs and focus on their core competencies, such as research and development.

One of the key drivers of growth in the pharmaceutical contract manufacturing market is the increasing demand for innovative medicines. Pharmaceutical companies are under pressure to develop new and more effective treatments for a range of diseases, and outsourcing to CMOs can help them to bring these products to market more quickly and cost-effectively. Additionally, the growing prevalence of chronic diseases, such as cancer and diabetes, is driving demand for pharmaceutical products, which is fueling growth in the contract manufacturing market.

Another factor driving the growth of the pharmaceutical contract manufacturing market is the increasing globalization of the pharmaceutical industry. Many pharmaceutical companies are looking to expand their operations into emerging markets, such as Asia and Latin America, to take advantage of lower manufacturing costs and growing demand for pharmaceutical products in these regions. CMOs with a global presence are well-positioned to meet the needs of these companies and help them to establish a presence in these markets. Overall, the pharmaceutical contract manufacturing market is poised for continued growth in the coming years, driven by increasing demand for innovative medicines and the globalization of the pharmaceutical industry.

Pharmaceutical Contract Manufacturing Market Segmentation

The global Pharmaceutical Contract Manufacturing market segmentation is based on Services, End-user, and geography.

Pharmaceutical Contract Manufacturing Market By Services

According to a pharmaceutical contract manufacturing industry analysis, the drug development services segment is expected to garner significant market focus in the coming years. This segment includes a range of services, such as formulation development, analytical testing, clinical trials, and regulatory support. Contract manufacturers work closely with pharmaceutical companies to develop and produce safe and effective drugs, ensuring compliance with regulatory requirements and industry standards. The increasing demand for cost-effective and efficient drug development services has led to significant growth in the pharmaceutical contract manufacturing market, with a focus on innovative technologies and streamlined processes. The market is highly competitive, with numerous contract manufacturing organizations offering specialized services to meet the diverse needs of pharmaceutical companies.

Pharmaceutical Contract Manufacturing Market By End-user

According to the pharmaceutical contract manufacturing market forecast, generic pharmaceutical companies would rise rapidly in the coming years. The market for generic pharmaceuticals has grown rapidly in recent years, driven by the increasing demand for affordable and accessible healthcare products. This has led to increased outsourcing of manufacturing services to contract manufacturers, who can provide specialized expertise and capabilities in areas such as formulation development, regulatory compliance, and quality control. The generic pharmaceutical contract manufacturing market is highly competitive, with a large number of contract manufacturers offering a range of services to meet the needs of generic drug companies.

Pharmaceutical Contract Manufacturing Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Geographically, North America is dominating the pharmaceutical contract manufacturing market. This growth is due to various factors such as the availability of skilled labor, established regulatory framework, and advanced technological infrastructure. The region is home to some of the world's leading pharmaceutical companies, which have long-standing relationships with contract manufacturers for the outsourcing of drug development and production services. Additionally, the United States is the largest pharmaceutical market globally, with a high demand for cost-effective and efficient drug development services. The growing focus on personalized medicine, biologics, and biosimilars has also contributed to the growth of the pharmaceutical contract manufacturing market in North America, with contract manufacturers offering specialized expertise in these areas.

Pharmaceutical Contract Manufacturing Market Player

Some of the top pharmaceutical contract manufacturing market companies offered in the professional report includes Lonza Group AG, Catalent, Inc., Thermo Fisher Scientific Inc., Patheon N.V., Evonik Industries AG, AbbVie Contract Manufacturing, Boehringer Ingelheim GmbH, Recipharm AB, Jubilant Life Sciences Limited, and Dr. Reddy's Laboratories Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2023

April 2021

March 2024

June 2024