September 2023

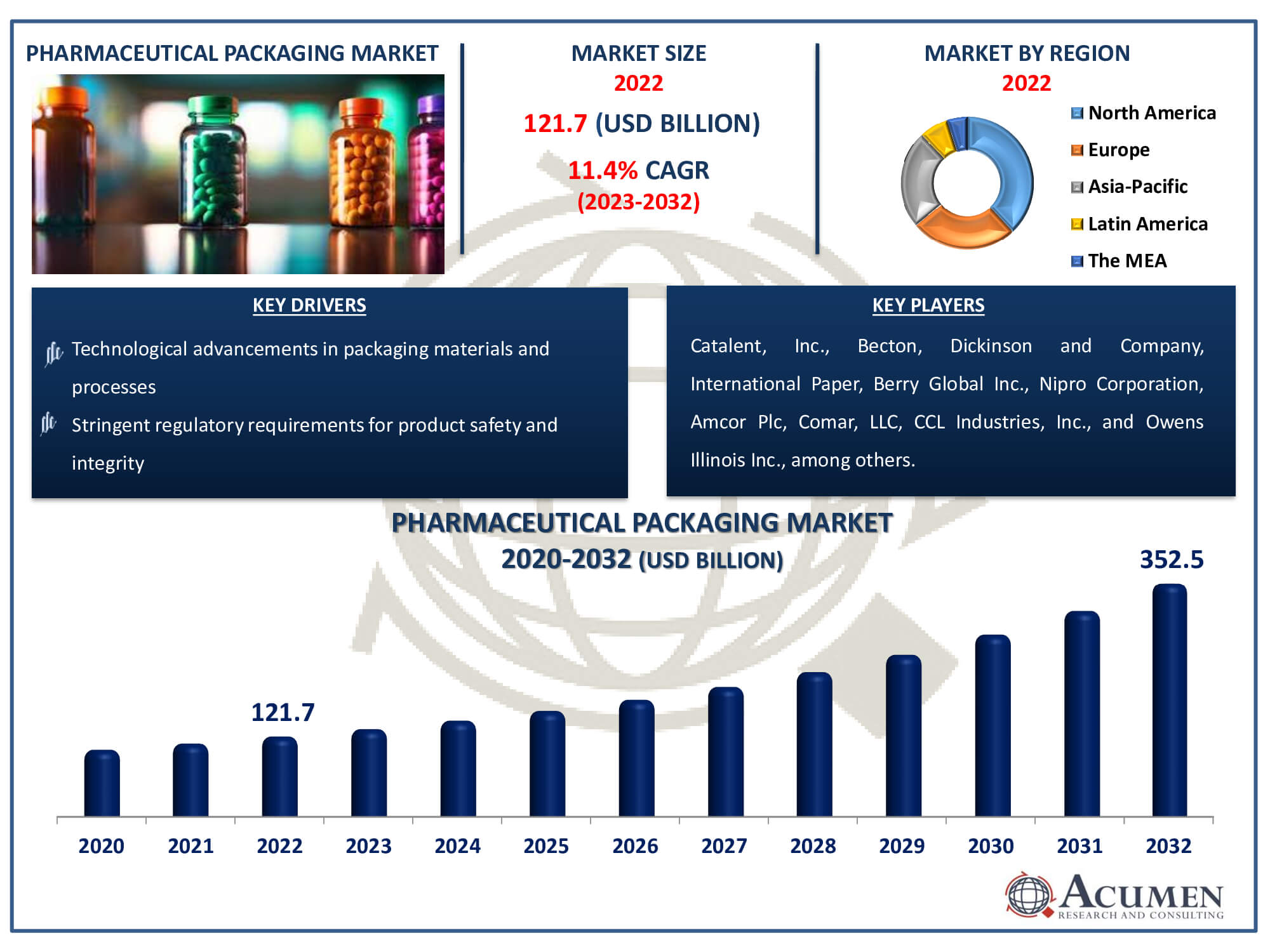

Pharmaceutical Packaging Market Size accounted for USD 121.7 Billion in 2022 and is estimated to achieve a market size of USD 352.5 Billion by 2032 growing at a CAGR of 11.4% from 2023 to 2032.

The Pharmaceutical Packaging Market Size accounted for USD 121.7 Billion in 2022 and is estimated to achieve a market size of USD 352.5 Billion by 2032 growing at a CAGR of 11.4% from 2023 to 2032.

Pharmaceutical Packaging Market Highlights

Pharmaceutical packaging is the process of packaging pharmaceutical medicines using a variety of raw materials such as glass and plastic resins. As the pharmaceutical business becomes more sophisticated and diverse, developing nations are likely to drive worldwide demand. Advances in drug delivery technology are expected to propel the oral sector to the forefront in the pharmaceutical packaging market forecast period. Oral medicines, which are often used for broad drug administration, provide a simple and effective way to administer pharmaceuticals. As demand for oral pharmaceuticals increases, so will the need for creative and efficient pharmaceutical packaging solutions.

Global Pharmaceutical Packaging Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Pharmaceutical Packaging Market Report Coverage

| Market | Pharmaceutical Packaging Market |

| Pharmaceutical Packaging Market Size 2022 | USD 121.7 Billion |

| Pharmaceutical Packaging Market Forecast 2032 |

USD 352.5 Billion |

| Pharmaceutical Packaging Market CAGR During 2023 - 2032 | 11.4% |

| Pharmaceutical Packaging Market Analysis Period | 2020 - 2032 |

| Pharmaceutical Packaging Market Base Year |

2022 |

| Pharmaceutical Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Product, By Drug Delivery Mode, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Catalent, Inc., Becton, Dickinson and Company, International Paper, Berry Global Inc., Nipro Corporation, Amcor Plc, Comar, LLC, CCL Industries, Inc., Owens Illinois Inc., Drug Plastics Group, Aptargroup, Inc., and Gerresheimer AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pharmaceutical Packaging Market Insights

The pharmaceutical industry presents significant development opportunities for emerging economies such as China, India, and Brazil, which boast enormous potential in the pharmaceutical packaging market. Increasing life expectancy and higher disposable incomes further contribute to appealing growth prospects as companies seek to navigate stagnant mature markets, expiring patents, and increasing regulatory barriers.

Notably, a shift has been observed in the establishment of health infrastructure in these countries. Therefore, it is not feasible for emerging markets to adopt a one-size-fits-all strategy. Local peculiarities necessitate specific solutions tailored to these markets, particularly among the primary clusters of markets, including the economies of BRICMT (Brazil, Russia, India, China, Mexico, and Turkey).

Turkey, and the second-level nations in Southeast Asia, and Africa.

In 2022, the US dominated the North American market, representing the majority share. It is also recognized as the world's largest pharmaceutical market. The country's robust healthcare system, high per capita incomes, and significant investments in drug development are expected to drive growth in the pharmaceutical packaging industry.

However, recent uncertainties regarding the US government have led to hesitancy among major pharmaceutical clients, resulting in a decline in the country's pharmaceutical industry. Nonetheless, the growing importance of generic medicines and improved access to healthcare facilities are anticipated to create opportunities for market growth.

Several plastic vial companies, including Amcor Ltd. Inc., Gerresheimer AG, and Berry Plastics Group, are likely to have a presence in the nation, positively impacting the demand for plastic vials in the sector. The demand for plastics and polymers is expected to advance steadily over the pharmaceutical packaging industry forecast period.

Pharmaceutical Packaging Market Segmentation

The worldwide market for pharmaceutical packaging is split based on material, product, drug delivery mode, end-use, and geography.

Pharmaceutical Packaging Materials

According to pharmaceutical packaging industry analysis, the plastics & polymers category leads the market because to its adaptability, durability, and cost-effectiveness. Plastics and polymers provide a wide range of packaging alternatives, such as bottles, containers, blister packs, and flexible packaging choices such as pouches and film. These materials have exceptional barrier qualities, protecting pharmaceuticals from moisture, light, and contamination. Furthermore, plastics and polymers are lightweight, lowering transportation costs and carbon footprints. Their adaptability enables novel package designs and customization to meet individual product needs. With rising global demand for pharmaceutical items, the plastics & polymers segment is likely to continue its market leadership by providing effective and dependable packaging solutions for a wide range of healthcare products.

Pharmaceutical Packaging Products

The primary category dominates the pharmaceutical packaging market because it includes packaging materials that are directly in touch with pharmaceutical medicines. This comprises bottles, vials, blister packs, and ampoules, among other things. The primary packaging is critical for maintaining product integrity, preventing contamination, and guaranteeing accurate dose administration. It frequently has child-resistant closures and tamper-evident seals to improve safety. Furthermore, primary packaging is important for product identification and branding, which helps to build consumer confidence and loyalty. With increased global demand for pharmaceutical goods, the primary sector is likely to maintain its market leadership, driven by advancements in materials, designs, and technologies to suit changing industry requirements and customer preferences.

Pharmaceutical Packaging Drug Delivery Modes

For a variety of reasons, the oral drugs sector holds the highest share of the pharmaceutical packaging market. For starters, oral medications are among the most commonly prescribed and consumed pharmaceutical goods in the world, greatly increasing demand for packaging solutions. Second, oral medicine packaging frequently uses a number of formats such as tablets, capsules, and liquid formulations, necessitating a wide range of packaging solutions to accommodate varying dosage forms. Furthermore, patients often take oral drugs alone, necessitating user-friendly and tamper-evident container designs to guarantee optimum dose adherence and product safety. With the increased frequency of chronic illnesses and an ageing population, demand for oral drugs is likely to rise further, strengthening the oral drugs segment's dominance in the pharmaceutical packaging market.

Pharmaceutical Packaging End-Uses

In the pharmaceutical manufacturing, the leading market share in 2022 exceeded 49%. During the forecast period, this segment is expected to maintain its prominence. The growing population and increasing demand for better healthcare services are anticipated to positively impact the pharmaceutical sector's development over the forecast era. Furthermore, growing public support for the industry's growth in emerging countries is likely to drive packaging demand in the coming years.

Manufacturers increasingly prefer outsourcing packaging operations to third-party suppliers, which can drive demand for contract packaging. Outsourcing packaging operations has been enhanced to save time and costs for pharmaceutical industry players. Rather than investing in their own packaging, pharmaceutical companies are outsourcing employment to dedicated and competent contractors. The demand for the contract packaging segment is expected to be driven by these factors over the forecast period.

Rapid financial growth has led to improved prosperity and government health initiatives in Brazil, China, Mexico, Russia, India, and Turkey, resulting in increased demand for pharmaceuticals. This trend in manufacturing, which subsequently increases demand, has reduced the cost of pharmaceutical products. These factors are expected to positively influence business development during the forecast period.

Pharmaceutical Packaging Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Pharmaceutical Packaging Market Regional Analysis

In terms of pharmaceutical packaging market analysis, in 2022, North America accounted for over 38% of the market share, driven by an increase in the production of child-resistant packaging products. Additionally, the growing manufacturing of branded medicines, which require more packaging components to protect the medication from external factors, further supports regional product demand. The presence of leading producers of branded medicines, including Johnson & Johnson, Merck (Schering-Plough Canada Inc.), Pfizer, Sanofi-Aventis (Sanofi Pasteur), and GlaxoSmithKline Inc., also contributed to national development.

Asia-Pacific is projected to grow at the highest CAGR of approximately 13% during the forecast period. This growth is attributed to the increasing popularity of rigid plastics, particularly polyethylene terephthalate (PET) and polyethylene (PPE), as primary materials used in product manufacturing. The regional economy's development has been bolstered by heightened public regulations on drug safety. The use of pharmaceutical packaging is crucial to safeguard drugs from external environmental factors, underscoring its importance in ensuring drug safety.

Pharmaceutical Packaging Market Players

Some of the top pharmaceutical packaging companies offered in our report includes Catalent, Inc., Becton, Dickinson and Company, International Paper, Berry Global Inc., Nipro Corporation, Amcor Plc, Comar, LLC, CCL Industries, Inc., Owens Illinois Inc., Drug Plastics Group, Aptargroup, Inc., and Gerresheimer AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2023

October 2024

April 2023

April 2023