November 2021

Physical AI Market (By Component: Hardware, Software, Services; By Deployment: Cloud-based AI, On-device; By Technology: Computer Vision, Speech / NLP, Gesture / Movement Recognition, Reinforcement Learning & Control Systems, Others; By Robot Type: Industrial Robots, Service Robots, Humanoids/Social Robots, Cobots, Exoskeletons/Prosthetics, Mobile Robots/Drones; By Application: Healthcare, Manufacturing & Automotive, Logistics & Warehousing, Retail & Hospitality, Defense & Security, Agriculture, Education & Research, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

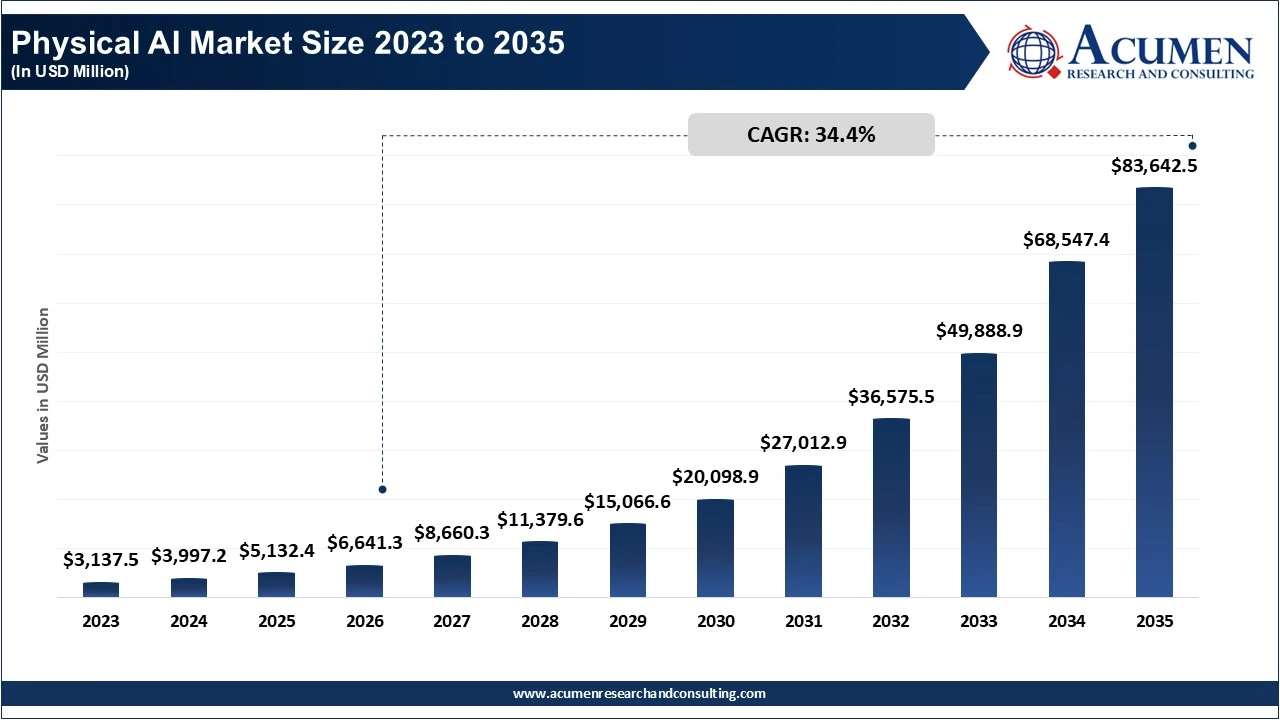

The global physical AI market size accounted for USD 3,137.5 million in 2025 and is estimated to achieve a market size of USD 83,642.5 million by 2035 growing at a CAGR of 34.4% from 2026 to 2035.

The significant growth of the physical AI market is due to advancements in robotics, edge AI, computer vision and reinforcement learning have enabled machines to operate autonomously in environments. Increasingly, industries including manufacturing, logistics and healthcare are adopting Intelligent robots to help increase productivity and improve safety while addressing rising labour shortages. The rising number of physical AI components being integrated into sensors, actuators, humanoids, cobots and exoskeletons is greatly accelerating deployment of physical AI solutions across industrial and commercial markets. The increase in demand for automated solutions, precision solutions and operational intelligence within physical AI is pushing Businesses toward adopting physical AI solutions.

Another major factor for growth is significant investment from technology companies, robotics developers, and government agencies to promote the implementation of "Industry 4.0" and "smart factories" and the development of "AI-enabled" or "AI-based" infrastructure. Additionally, the emergence of on-device AI technology along with advances in multimodal learning and new use cases for robotics in various sectors including defense, agriculture, retail, and healthcare, is broadening the application of physical AI. The emergence of new classes of robotic technologies including service robotics, autonomous mobile robots, and AI-assisted devices, is creating numerous opportunities in the physical AI market.

| Attribute | Details |

| Physical AI Market Size 2025 | USD 3,137.5 Million |

| Physical AI Market Forecast 2035 | USD 83,642.5 Million |

| Physical AI Market CAGR During 2026 - 2035 | 34.4% |

| Physical AI Market Analysis Period | 2021 - 2035 |

| Physical AI Market Base Year | 2025 |

| Physical AI Market Forecast Data | 2026 - 2035 |

| Segments Covered | By Component, By Deployment, By Technology, By Robot Type, By Application, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SoftBank Robotics Group, Agility Robotics, Mech-Mind Robotics, Siemens, KUKA AG, Toyota Motor Corporation, FANUC, ABB, Boston Dynamics, Tesla, NVIDIA, and DeepMind. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

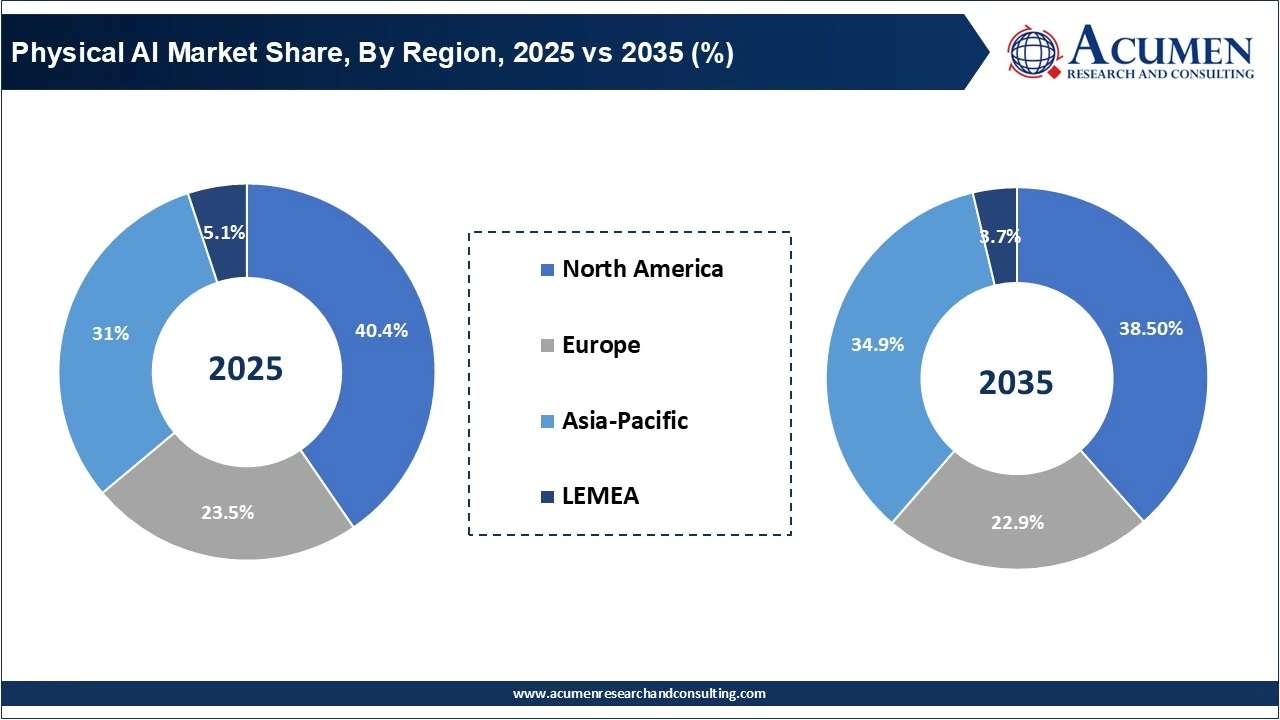

North America currently dominates the physical AI market, because of its advanced technology ecosystem, access to early adopter robotics & AI, along with many large companies innovating on healthcare robotics, industrial automation, autonomous systems, and AI chips. High research and development (R&D) spending and existing manufacturing infrastructure are key assets in North America that benefit from the regulators that support automation & artificial intelligence (AI) integrations.

Asia Pacific is the fastest-growing region, due to the rapid growth of Industrialization, growing manufacturing bases, and increased Government initiatives are all driving the growth of AI, Robotics and Smart Factories. Countries such as China, Japan, South Korea and Singapore are investing heavily in industrial robots, service robots and autonomous systems with the hopes of boosting productivity, and addressing labour shortage. The rapid expansion of the electronics, automotive, health care and Logistics industries within Asia Pacific is accelerating the rate of deployment of robotics within these industries. Strong innovation support, high demand for automation and the capability to mass produce robots will continue to make Asia Pacific the fastest growing Market for Physical AI.

The worldwide market for physical AI is split based on component, deployment, technology, robot type, application, and geography.

Hardware is currently the dominant component in the physical AI market because of primary building block of robotic and autonomous systems including sensors, actuators, mobility unit, AI processor chips and integrated mechatronic systems. These components represent the largest percentage of the total cost of a system and provide the required precision, safety and ability to interact with the physical environment. As the automation of various industries expands and there is increased demand for the most advanced hardware available to support these applications from surgical robots to industrial robotics. Due to continued hardware innovation, introduction of new robotic form factors and broadening deployments, hardware remains in the top position for physical AI solutions.

| Component | Market Share (%) | Key Highlights |

| Hardware | 57.2% | Dominant due to high-cost sensors, actuators, robotic arms, chips, and mechanical systems essential for real-world interaction, safety, and precision. |

| Software | 30.8% | Fastest-growing segment driven by AI algorithms, perception models, reinforcement learning, cloud robotics, and digital twin platforms. |

| Services | 12% | Growing due to integration, maintenance, and AI-enabled operational support for robotic deployments. |

Software is the fastest-growing component, due to increased use of AI algorithms, real-time perception, control systems, and cloud robotics platforms. Software will continue to enable new degrees of adaptive automation, reinforcement learning models, digital twins, and predictive analytics, as the Physical AI space continues to evolve towards more complex, intelligent operations. The increasing dependence on AI-enabled decision-making, autonomous navigation, and cross-device orchestration forms the foundation for the increasing need for next-generation software platforms, resulting in faster growth than other areas within the ecosystem.

On-Device AI dominate the segment because to provide the user with low-latency processing, excellent reliability and real-time response, which are all critical requirements for medical robots, autonomous navigation, industrial arms and safety-critical systems. Further, its ability to function without the need for external connectivity makes it the best option for many of the environments in which these devices operate.

| Deployment | Market Share (%) | Key Highlights |

| On-Device | 51.7% | Dominant due to low latency, high reliability, and real-time decision-making required in surgery, navigation, and factory automation. |

| Cloud-Based | 48.3% | Fastest-growing driven by cloud robotics, remote fleet control, digital twins, and continuous AI model updates. |

Cloud-Based AI is the fastest-growing segment, due to an increase in the acceptance of cloud robotics platforms, federated learning, and remote fleet management along with continuous updates of AI models. A cloud-based system allows greater coordination, centralised training, and real-time optimisation of geographically dispersed robotic fleet. Increasing digital twin simulations and automation between locations are also driving this segment and increasing the speed at which cloud AI will grow as connected, multi-robot intelligent systems allow for larger and more flexible deployments.

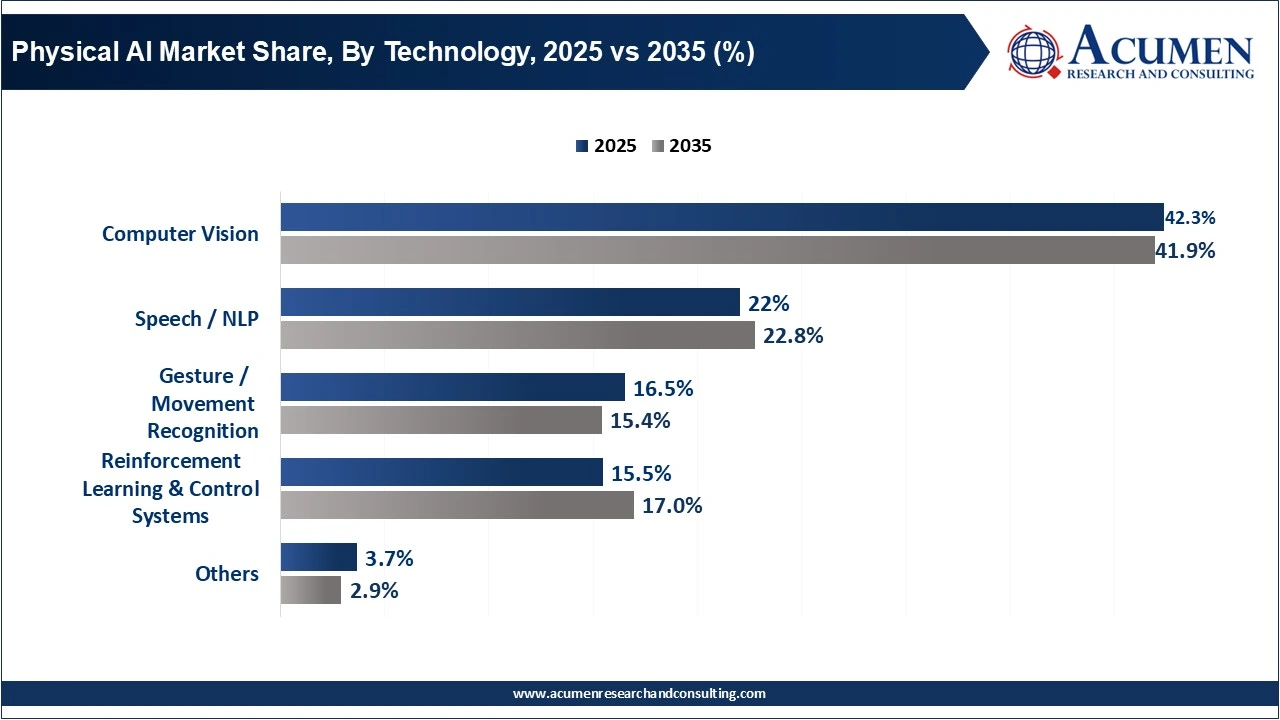

Computer vision is the dominant segment because it provides the essential capabilities for object detection, mapping an environment, inspecting the surroundings and navigating within the environment for virtually all physical systems employing Artificial Intelligence (AI). Many areas where robots are currently deployed such as healthcare, logistics, security, and manufacturing highly depend on vision based perceptions to perform their operations safely and accurately. Additionally, new developments in imaging sensors and the use of deep-learning Vision Models will continue to expand the use of computer vision across all robot application areas such as drone technology, surgical robots, warehouse automaton and industrial robotics.

| Technology | Market Share (%) | Key Highlights |

| Computer Vision | 42.3% | Dominant because robots rely on CV for navigation, object detection, inspection, and perception across all industries. |

| Speech/NLP | 22% | Expanding with conversational AI, voice-operated robots, and support systems. |

| Reinforcement Learning & Control Systems | 15.5% | Fastest-growing due to increasing demand for self-learning robots, adaptive systems, and autonomous decision-making. |

| Others (Multi-modal, Biomimetic AI) | 3.7% | Supports advanced AI behaviors, human-like interaction, and sensing fusion. |

Reinforcement Learning & Control Systems is the fastest-growing segment due to increasing demand for adaptive, self-learning and autonomous systems to improve decision-making capabilities in the field of robotics. The benefits of using reinforcement learning are especially evident in tasks that require interaction with constantly changing environments including mobile robots, robotic manipulation, and industrial applications such as exoskeletons and factory optimization. Additionally, As more factories embrace hyper-automation and the implementation of autonomous workflows to the demand for robots that can learn and adapt to their surroundings will continue to accelerate, further driving market demand for RL-based systems.

Industrial robots dominate the physical AI market due to their long-established role in manufacturing, automotive, electronics, and high engineering segments of the global economy for many years. The high precision, speed, and consistency of industrial robots make them Ideal solutions for welding, assembly, material handling, and quality inspections. As factory productivity and labor optimization continue to increase due to the Implementation of automation, industrial robots will continue to hold the largest market share. The proven reliability of industrial robots coupled with their significant installed base and ongoing upgrades of their AI-Based control systems strengthens their leading position globally.

| Robot Type | Market Share (%) | Key Highlights |

| Industrial Robots | 57.2% | Dominant because they are widely deployed in manufacturing, automotive, and heavy industries for precision, speed, and efficiency. |

| Service Robots | 14.3% | High adoption in healthcare, hospitality, logistics, and retail. |

| Humanoids / Social Robots | 13.7% | Increasing demand for customer service, elderly care, and human-like interaction. |

| Cobots | 12.4% | Fastest Segment due to rapid adoption in SMEs and factories for safe human-robot collaboration. |

| Exoskeletons / Prosthetics | 8.7% | Steady growth in rehabilitation, defense, and industrial support. |

| Mobile Robots / Drones | 12.7% | Widespread use in logistics, surveillance, and mobility operations. |

Cobots is the fastest-growing segment, because of companies continue to recognize the value of increasing human-robot collaboration for safety, flexibility, and efficiency in production environments. Unlike traditional industrial robots, cobots are relatively inexpensive, easy to implement, and designed for use by small-to-medium-sized businesses (SMEs) for requiring minimal physical infrastructure to support automation. Cobots can perform their function safely while working alongside humans in a variety of applications including packaging, inspection, assembly, and testing which has been driving rapid adoption across various industries. As industry shifts towards more agile forms of automation and additional labor augmentation via automation.

Manufacturing & Automotive dominate the physical AI market because of their widespread use of industrial robotics in assembly, welding, inspection of materials, handling of materials, and production automation. The Manufacturing and Automotive sectors are also the highest users of industrial robots and cobots, as well as the most integrated users of AI-enabled machinery due to their adoption of Industry 4.0 and modernizing smart factories. The significant emphasis on precision, efficiency and cost savings continues to provide the foundation for Manufacturing and Automotive's leadership position. As a result of these factors, the manufacturing and automotive sectors maintain their positions as the leading sector in the global physical AI market, as they deploy robots on a large scale, and investors from OEMs are heavily investing and providing long-term roadmaps for automated manufacturing.

| Application | Market Share (%) | Key Highlights |

| Manufacturing & Automotive | 23.1% | Dominant due to large-scale adoption of industrial robots, cobots, and AI-enabled automation across global factories. |

| Healthcare | 18% | Fastest-growing with demand for surgical robots, rehabilitation systems, and AI-enabled hospital automation. |

| Logistics & Warehousing | 13.5% | Strong adoption of AMRs, drones, and fulfillment robotics. |

| Retail & Hospitality | 12.5% | Growing use of service robots for customer support, delivery, and operations. |

| Defense & Security | 9.3% | Increasing use of autonomous systems, surveillance drones, and robotic units. |

| Agriculture | 8% | Expanding adoption of autonomous tractors, robotic harvesting, and crop monitoring. |

| Education & Research | 9% | Use of robots for training, experimentation, and R&D. |

| Others | 6.5% | Includes domestic robotics and facility management. |

Healthcare is the fastest-growing application segment due to the fast adoption of robotic-assisted surgical, rehabilitation and patient assistance devices as well as AI diagnostic platforms by hospitals. An increasing demand for precision Surgical procedures, the growing number of elderly patients and the lack of available workers in hospitals are accelerating the integration of robotic technologies into clinical practices. Additionally, we are seeing a massive increase in the number of companies that develop and sell robot-assisted surgical devices, Exoskeletons, and automated hospitals. As a result, healthcare providers around the world are adapting to the rapid growth of AI technologies for physical care.

By Component

By Deployment

By Technology

By Robot Type

By Application

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2021

April 2021

January 2023

December 2020