March 2023

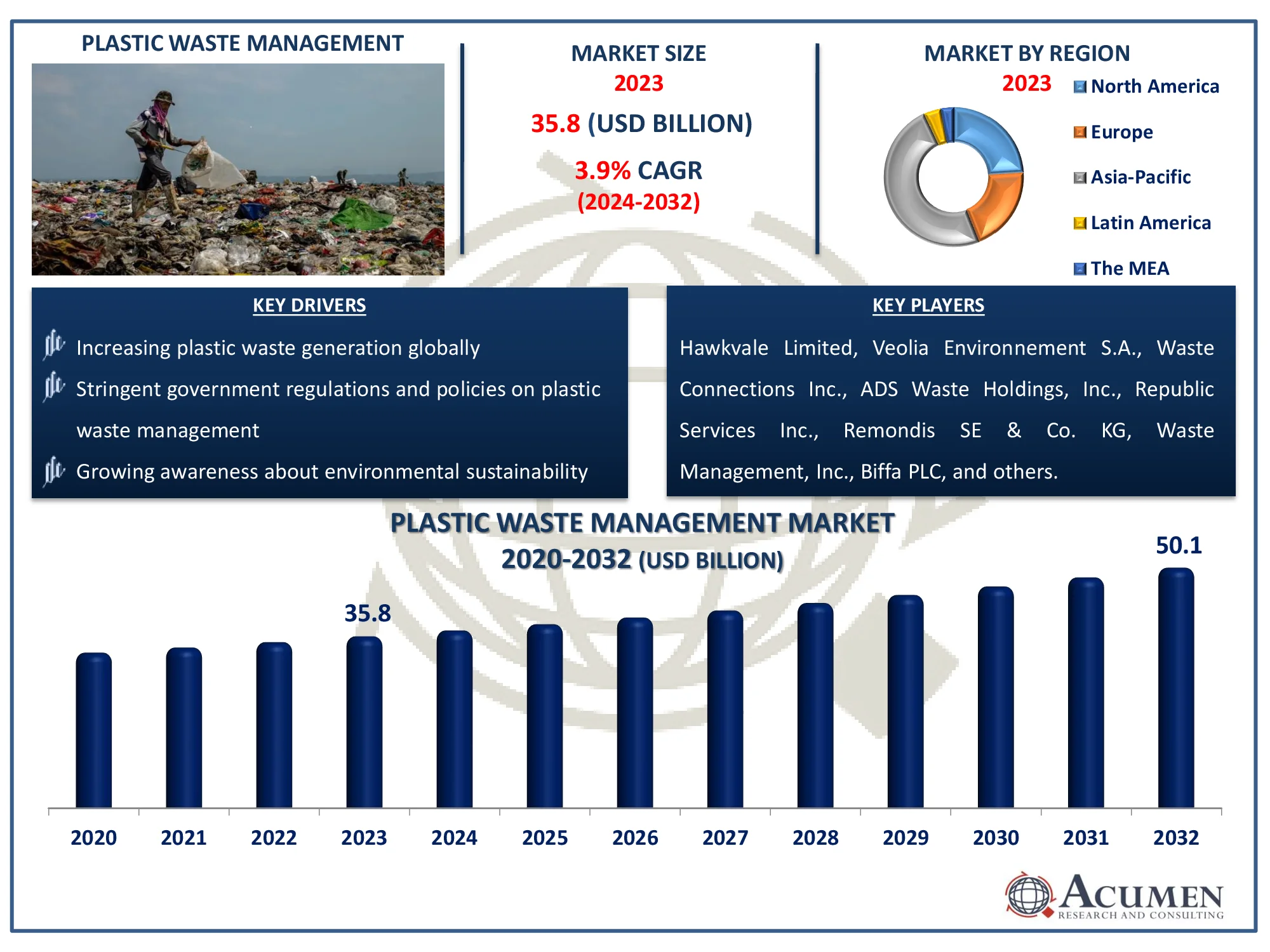

The Global Plastic Waste Management Market Size accounted for USD 35.8 Billion in 2023 and is estimated to achieve a market size of USD 50.1 Billion by 2032 growing at a CAGR of 3.9% from 2024 to 2032.

The Global Plastic Waste Management Market Size accounted for USD 35.8 Billion in 2023 and is estimated to achieve a market size of USD 50.1 Billion by 2032 growing at a CAGR of 3.9% from 2024 to 2032.

Plastic waste management is the process of collecting, categorizing, recycling, and disposing of plastic trash in an environmentally friendly way. As plastic pollution continues to harm ecosystems, effective waste management is critical to minimizing environmental damage. It contributes to resource conservation, landfill waste reduction, and recycling promotion in pursuit of a circular economy. Proper plastic waste management also helps to reduce the negative impact on wildlife and public health. With increased worldwide plastic consumption, effective waste management is critical to a sustainable future.

|

Market |

Plastic Waste Management Market |

|

Plastic Waste Management Market Size 2023 |

USD 35.8 Billion |

|

Plastic Waste Management Market Forecast 2032 |

USD 50.1 Billion |

|

Plastic Waste Management Market CAGR During 2024 - 2032 |

3.9% |

|

Plastic Waste Management Market Analysis Period |

2020 - 2032 |

|

Plastic Waste Management Market Base Year |

2023 |

|

Plastic Waste Management Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Source, By Service, By Polymer Type, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Hawkvale Limited, Veolia Environnement S.A., Waste Connections Inc., ADS Waste Holdings, Inc., Remondis SE & Co. KG, Republic Services Inc., Waste Management, Inc., Biffa PLC, Covanta Holding Corporation, Clean Harbors, Inc., Stericycle Inc., Progressive Waste Solutions Ltd., United Plastic Recycling, Inc., SUEZ Environnement Company, and Hahn Plastics Limited. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

According to the World Economic Forum, global plastic garbage generation is growing, with an estimated 300 million tons created each year. Strong government measures to create critical waste management infrastructure are likely to drive the expansion of the global plastic waste management industry. For example, as of December 24, 2024, over 300,000 individuals had been educated on trash management, and 800+ waste conversion technologies had been evaluated, with 80 already in use. The Special Campaign 4.0, which has been running since 2021, focuses on the government's dedication to cleanliness and effective resource management, with significant results expected between December 2023 and July 2024. Governments in both developed and developing countries are investing extensively in the establishment of proper waste management systems, with numerous programs aimed at establishing waste management units are contributing to the market’s expansion.

Plastic is widely utilized in packaging across industries, which contributes significantly to waste generation. According to the United Nations Environment Programme, 400 million tons of single-use plastic (SUP) garbage are generated each year, accounting for 47% of total plastic waste. Efforts by large corporations to use recyclable plastics to reduce waste are projected to enhance market growth.

Key players' significant investments in waste management facilities, together with increased use of recyclable plastics, are projected to drive market expansion. Leading food and beverage corporations are creating sustainable packaging alternatives, with Coca-Cola promising to use 100% recyclable packaging by 2025. Similarly, Dow is sponsoring waste management programs to reduce global plastic leakage by 45%.

However, considerable capital expenditure, insufficient recycling infrastructure, and a lack of knowledge in plastic waste recycling impede market expansion.

Nonetheless, increased public and private sector expenditures in infrastructure development, together with increased collaboration between governments and private enterprises, are likely to generate new revenue streams. According to Invest India, India's infrastructure sector is poised for rapid expansion, with investments exceeding US$ 1.4 trillion by 2025. The government's National Infrastructure Pipeline (NIP) program intends to provide major funding for vital areas such as power, transportation, trains, and urban development. This will benefit the plastic waste management market by increasing demand for eco-friendly rubbish solutions in construction, urban development, and transportation.

Plastic Waste Management Market Segmentation

Plastic Waste Management Market SegmentationThe worldwide market for plastic waste management is split based on source, service, polymer type, end-user, and geography.

According to the plastic waste management industry analysis, plastic bottles are one of the leading contributors to plastic trash, dominating the industry due to their widespread use in beverages, personal care goods, and home items, they produce enormous trash each year. The significant recycling potential of plastic bottles increases the requirement for effective waste management solutions. With efforts such as extended producer responsibility (EPR) and more consumer awareness, there is a greater emphasis on recycling and reusing plastic bottles to lessen environmental effect.

According to the plastic waste management industry analysis, landfills dominate the market because of the large amount of plastic trash that ends up in disposal facilities. Despite efforts to recycle, a considerable part of plastic garbage remains unprocessed and ends up in landfills, as it is typically more cost-effective in areas without modern recycling facilities. Plastics that cannot be easily recycled are often disposed of in landfills. However, as worries about pollution and landfill overcapacity rise, there is a shift toward more sustainable solutions, such as recycling and waste-to-energy technology.

According to the plastic waste management industry forecast, polypropylene (PP) leads because to its broad application in packaging, automobiles, and consumer goods. Its appeal originates from its durability, low cost, and versatility, making it a common material in items such as food containers, plastic bags, and household goods. While PP is recyclable, it can be difficult to collect and process because it is frequently combined with other polymers. Efforts are being undertaken to enhance recycling rates and develop more sustainable disposal alternatives, which will help to grow the plastic waste management business.

According to the plastic waste management industry forecast, packaging is predicted to be the fastest-growing end-user due to rising demand for plastic packaging in industries such as food & beverage, retail, and consumer products. As the usage of plastic for packaging increases, so does the amount of garbage produced, necessitating the development of effective waste management systems. Furthermore, rising consumer awareness of the environmental impact of packaging waste is encouraging more sustainable practices, such as recycling and the use of eco-friendly alternatives. This move opens up huge growth potential for the plastic waste management industry.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Plastic Waste Management Market Regional Analysis

Plastic Waste Management Market Regional AnalysisFor several reasons, Asia-Pacific region dominates as a result of increasing government investment on waste management infrastructure expansion. For example, the Indian government promotes a circular economy through policies and programs. Waste processing has increased from 18% in 2014 to 68% in 2021, with more improvements expected under SBM (U) 2.0. According to the Central Pollution Control Board, urban India generates 72,368 MLD of sewage annually, which is expected to rise to 120,000 MLD by 2050. The government's goal of a circular economy and improved waste processing under SBM (U) 2.0 will boost demand for effective plastic waste management solutions, resulting in market growth. The growing tendency of strategic partnerships and agreements to expand client bases and increase revenue share is also expected to contribute to market growth in this area.

The North American industry is expected to take a considerable proportion of the worldwide market, owing to strong government limits on plastic usage. For example, the United States Environmental Protection Agency reports that the draft strategy was published in April 2023 and received almost 92,000 comments during the public comment period. Today's new strategy reflects that feedback and reaffirms the EPA's commitment to eliminate the release of plastic garbage into the environment by 2040. Furthermore, food and beverage makers' efforts to reduce waste by using recyclable plastics are projected to drive market expansion in the region. Furthermore, significant expenditures by key players in the construction of waste management facilities, together with developing public-private partnerships aimed at extending the customer base, are expected to support the market growth in North America.

Some of the top plastic waste management companies offered in our report include Hawkvale Limited, Veolia Environnement S.A., Waste Connections Inc., ADS Waste Holdings, Inc., Remondis SE & Co. KG, Republic Services Inc., Waste Management, Inc., Biffa PLC, Covanta Holding Corporation, Clean Harbors, Inc., Stericycle Inc., Progressive Waste Solutions Ltd., United Plastic Recycling, Inc., SUEZ Environnement Company, and Hahn Plastics Limited.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

January 2021

June 2024

July 2024