December 2023

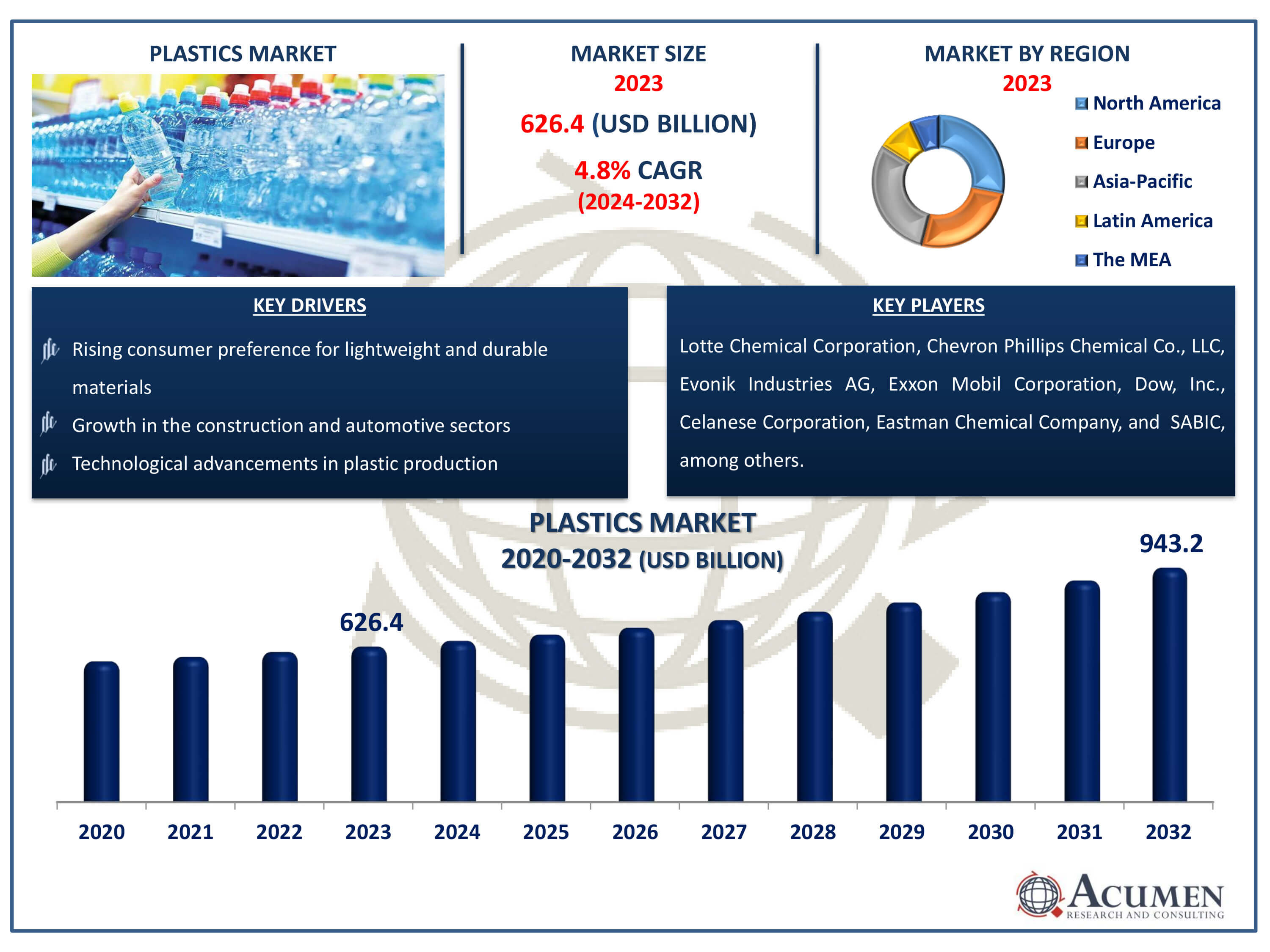

Plastics Market Size accounted for USD 626.4 Billion in 2023 and is estimated to achieve a market size of USD 943.2 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

The Plastics Market Size accounted for USD 626.4 Billion in 2023 and is estimated to achieve a market size of USD 943.2 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Plastics Market Highlights

The plastics market includes the manufacturing, distribution, and consumption of plastic materials used in a variety of industries, including packaging, automotive, construction, electronics, and healthcare. Plastics, which are predominantly manufactured from petrochemicals, are praised for their adaptability, lightweight design, durability, and cost-effectiveness. Major firms such as SABIC, Dow, Inc., and DuPont promote innovation in this area by creating new polymer technology and sustainable practices. The market faces obstacles like as environmental concerns and regulatory demands, prompting advances in biodegradable polymers and recycling techniques. Despite these obstacles, the plastics market continues to expand, playing an important role in modern manufacturing and consumer products by offering critical materials for a wide range of applications.

Global Plastics Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Plastics Market Report Coverage

| Market | Plastics Market |

| Plastics Market Size 2022 | USD 626.4 Billion |

| Plastics Market Forecast 2032 | USD 943.2 Billion |

| Plastics Market CAGR During 2023 - 2032 | 4.8% |

| Plastics Market Analysis Period | 2020 - 2032 |

| Plastics Market Base Year |

2022 |

| Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Lotte Chemical Corporation, Chevron Phillips Chemical Co., LLC, Evonik Industries AG, Exxon Mobil Corporation, Dow, Inc., Celanese Corporation, Eastman Chemical Company, SABIC, Sumitomo Chemical Co., Ltd., Arkema, and DuPont. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Plastics Market Insights

Stringent Regulations Imposed By Governments For The Recyclability Of Materials Are Expected To Drive The Global Plastics Market

Historically, materials like glass, steel, aluminum, and paper have been successfully recycled for food-contact use without significant contamination issues from post-consumer use. Aluminum beverage containers, on average, contain 70% recycled material, which is the highest percentage among beverage containers. In the EU, glass containers are recycled up to 74% of the time. Today, industrial packaging is the most significant sector utilizing plastic. Consequently, major global economies, including the United States and the European Union, have prioritized developing guidelines to ensure that recycled plastic products are suitable for packaging and food packaging. In the United States, manufacturers of recycled plastic articles must ensure the recycled material meets purity standards for its intended use and adheres to all specifications for virgin plastic, as outlined in Title 21 of the Code of Federal Regulations. Additionally, the Guidance for Industry - Use of Recycled Plastics in Food Packaging provides recommendations for using recycled plastic in product packaging. In the EU, Regulation No 282/2008 mandates that only food-contact materials and articles containing recycled plastic from authorized recycling processes can be marketed. The European Food Safety Authority (EFSA) evaluates petitions for recycling processes and issues safety opinions, with the European Commission making the final decision on accepting the recycling process.

The High Costs Involved In The Recycling Process Impede The Growth Of The Plastics Market Worldwide

Currently, the global market faces numerous inefficiencies, and unlike glass, aluminum, or paper, plastic is significantly more challenging to recycle. Most plastic ultimately ends up in landfills or incinerators. Despite efforts to promote plastic recycling, plastic production has outpaced recycling by a factor of five over the past decade. While increasing plastic recycling is a potential solution, it has limited effectiveness in reducing the excessive amount of plastic waste. Although most types of plastic can technically be recycled, inadequate infrastructure restricts recycling to only the most common types. For recycling to be feasible, communities need to collect and sort plastic at low costs, and businesses must be willing to process the material. Collection is particularly expensive because plastic bottles are light but bulky, making it difficult to efficiently gather large quantities of similar plastic. Consequently, only a few types of plastic have the supply and market conditions necessary for recycling.

Plastics Market Segmentation

The worldwide market for plastics is split based on product, application, end-use, and geography.

Plastic Market By Product

According to plastics industry analysis, polyethylene (PE) is the largest sector market due to its wide range of uses and excellent qualities. Because of its versatility, chemical resistance, and ease of manufacturing, PE is commonly used in packaging such as plastic bags, films, containers, bottles, and home items. Its cost-effectiveness and durability make it a popular material among producers. Additionally, the lightweight nature of PE saves transportation expenses and energy usage during manufacture. PE's significant demand is driven by its use in the construction, automotive, and healthcare industries. Furthermore, developments in polymerization methods have improved the performance properties of PE, allowing it to be used in a variety of industries. As a result, PE continues to dominate the global plastics market, outperforming other forms of plastics in terms of production and consumption.

Plastic Market By Application

The injection molding segment makes up the majority of the plastics market due to its versatility, efficiency, and wide range of applications. Injection molding provides great precision and detailed details, making it suited for producing complicated and elaborate plastic parts of constant quality. Its capacity to handle thermoplastics such as polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) enables diversified product manufacturing in industries such as automotive, packaging, electronics, and healthcare. Furthermore, injection molding allows for rapid manufacturing cycles, lowering lead times and total production costs. Its automated operations and low post-processing requirements help to boost productivity and cost-effectiveness. As manufacturers prioritize precision, speed, and cost effectiveness in manufacturing, injection molding remains the preferred technology, resulting in its domination in the plastics market.

Plastic Market By End-Use

The packaging segment stands out as the largest end-use category and it is expected to grow over the plastics industry forecast period due to its indispensable role in various industries. Plastics are extensively utilized in packaging applications owing to their versatility, durability, and cost-effectiveness. From food and beverage packaging to pharmaceutical and cosmetic packaging, plastics offer a wide array of solutions to meet diverse requirements. Their lightweight nature reduces transportation costs and energy consumption, while also providing excellent barrier properties to protect contents from moisture, air, and contamination. Furthermore, advancements in plastic technologies have led to innovations such as barrier films, biodegradable packaging, and smart packaging solutions, further driving the demand. As global consumption patterns evolve and e-commerce continues to expand, the packaging segment maintains its dominance in the plastics market as a vital component of modern supply chains and consumer lifestyles.

Plastics Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Plastics Market Regional Analysis

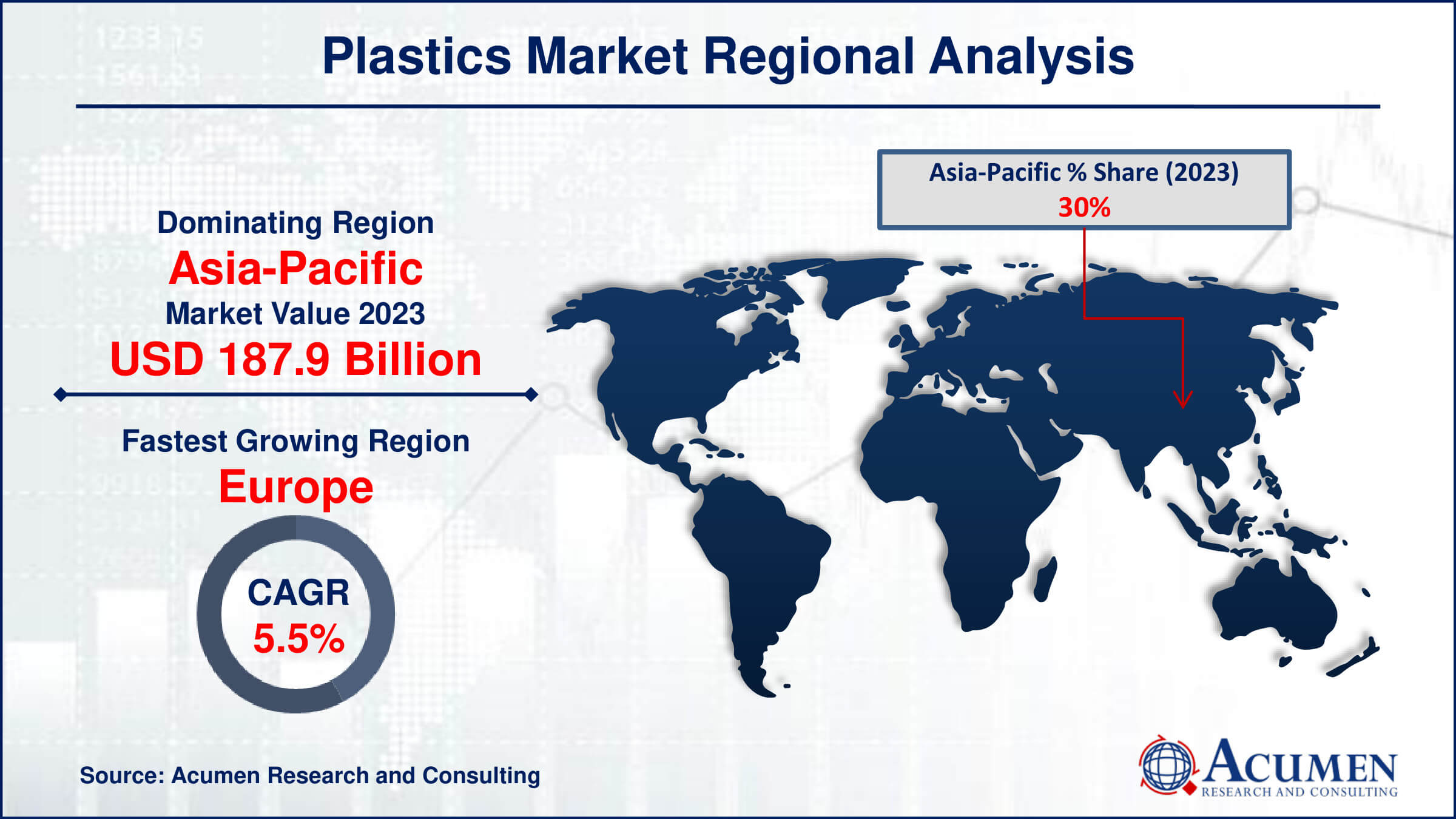

In terms of plastics market analysis, with rising industrialization and urbanization, Asia-Pacific has dominated the global industry. China and India make significant contributions due to their manufacturing prowess and expanding consumer markets. Packaging, construction, and automotive industries are major contributors, with an increasing emphasis on environmentally acceptable options.

Europe has the most rigorous environmental rules, which fosters a vibrant market for sustainable plastics and recycling programs. The packaging business, particularly food packing, is a major contributor, along with the automobile and construction industries. Investments in circular economy concepts and bioplastic research are common. Europe is expected to grow continue throughout the plastic market forecast period

Plastics Market Players

Some of the top plastics companies offered in our report includes Lotte Chemical Corporation, Chevron Phillips Chemical Co., LLC, Evonik Industries AG, Exxon Mobil Corporation, Dow, Inc., Celanese Corporation, Eastman Chemical Company, SABIC, Sumitomo Chemical Co., Ltd., Arkema, and DuPont.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2023

October 2024

July 2024

August 2023