August 2023

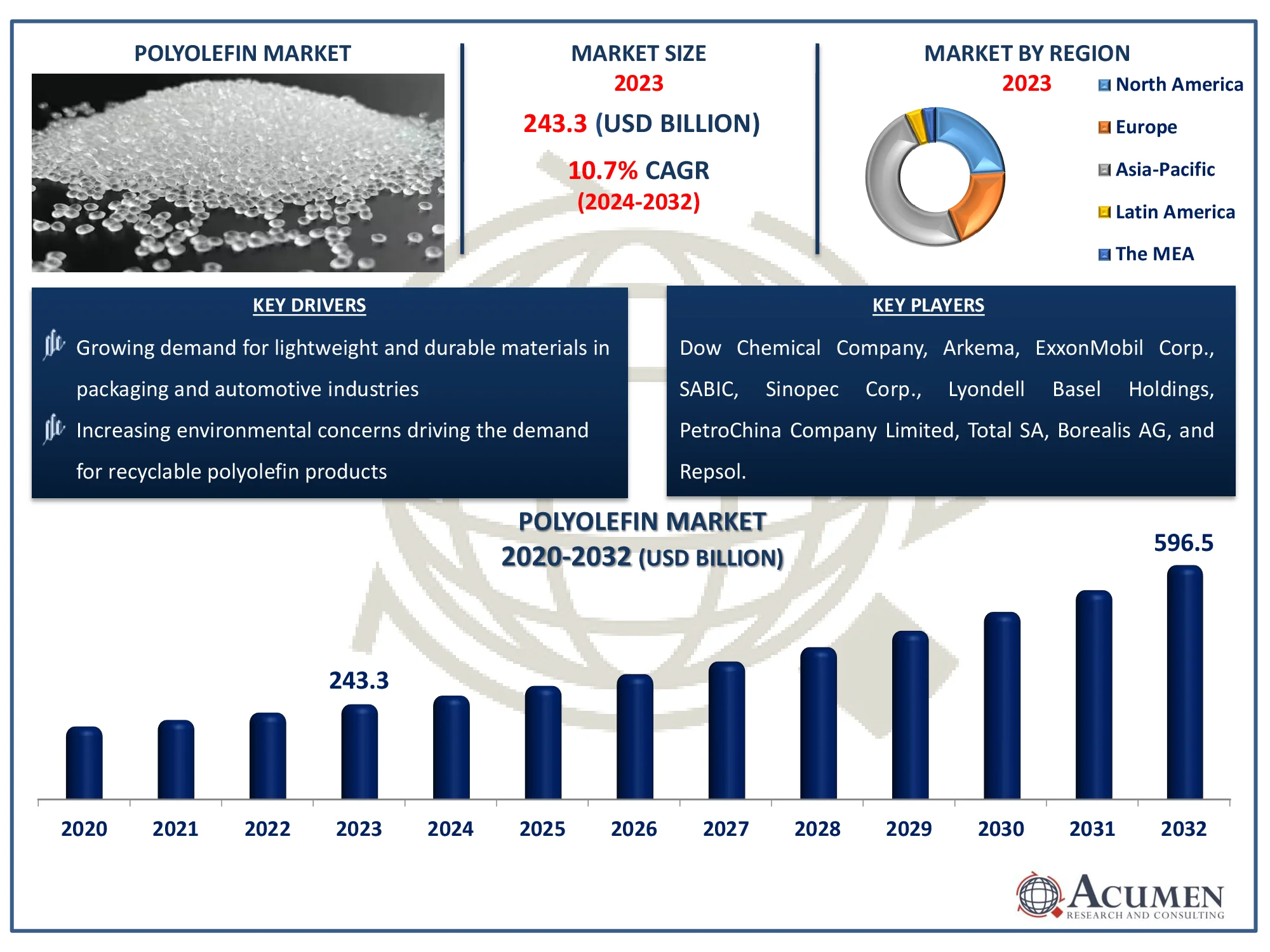

The Global Polyolefin Market Size accounted for USD 243.3 Billion in 2023 and is estimated to achieve a market size of USD 596.5 Billion by 2032 growing at a CAGR of 10.7% from 2024 to 2032.

The Global Polyolefin Market Size accounted for USD 243.3 Billion in 2023 and is estimated to achieve a market size of USD 596.5 Billion by 2032 growing at a CAGR of 10.7% from 2024 to 2032.

Polyolefin is a synthetic resin formed by the polymerization of olefins such as ethylene, propylene, butane, and their copolymer. These non-aromatic compounds are made up of carbon and hydrogen atoms and are often manufactured utilizing techniques such as extrusion, injection molding, blow molding, and rotational molding. Polyethylene and polypropylene, the two most commonly used polyolefins, are preferred for their inexpensive cost and wide range of applications. The polyolefin market is quickly growing and improving technologically, driven by increased demand for higher grades of polyolefin copolymers in emerging sectors like as solar energy and automotive.

|

Market |

Polyolefin Market |

|

Polyolefin Market Size 2023 |

USD 243.3 Billion |

|

Polyolefin Market Forecast 2032 |

USD 596.5 Billion |

|

Polyolefin Market CAGR During 2024 - 2032 |

10.7% |

|

Polyolefin Market Analysis Period |

2020 - 2032 |

|

Polyolefin Market Base Year |

2023 |

|

Polyolefin Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Application, By End-Use Industry, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Dow Chemical Company, Arkema, ExxonMobil Corp., SABIC, Sinopec Corp., Lyondell Basel Holdings, PetroChina Company Limited, Total SA, Borealis AG, and Repsol. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The polyolefin market is expected to rise moderately due to new applications, technical improvements, and rising demand for metallocene-catalyzed polyolefins in regions such as Europe and North America. Market growth is being driven by rising demand for plastic items, although difficulties such as a high capacity-to-demand ratio and worries about plastic waste impede progress. The introduction of bio-based polyolefins presents considerable growth prospects, however the rapidly expanding photovoltaic encapsulation sector for ethylene vinyl acetate (EVA) has some constraints with EVA copolymers, posing hurdles for the overall polyolefin market. For example, in November 2022, the Canadian government announced new laws targeted at minimizing plastic waste, which may have an influence on the polyolefins business by encouraging the use of recycled and bio-based materials.

The ACS publication states that polyolefins and polystyrene are chemical resources for a sustainable future. PS is primarily utilized as a packaging material for food and consumer products. The COVID-19 pandemic has compounded the worldwide plastic catastrophe by driving up demand for personal protective equipment and takeaway food packaging. The rising use of polyolefins in sustainable packaging solutions boosts industry growth.

According to the Plastics Europe Organization, European countries are expanding their recycling systems to accept a broader range of polyolefin-based waste, such as plastic films and rigid packaging (other than bottles), in domestic recycling collections. Recycled polyolefins are largely employed in non-food-related products such as construction materials, agricultural items, and non-food packaging, as current regulations ban the use of mechanically recycled polyolefins in food packaging for safety reasons. Expanding recycling systems and rising demand for recovered materials in non-food applications are driving growth prospects in the polyolefin industry.

Polyolefin Market Segmentation

Polyolefin Market SegmentationThe worldwide market for polyolefin is split based on product, application, end-use industry, and geography.

According to the polyolefin industry analysis, polyethylene (PE) is the most versatile, cost-effective, and widely used polyolefin. Its strong chemical resistance, flexibility, and durability make it suitable for use in packaging, construction, automotive, and consumer goods. PE's simplicity of processing and customization make it appropriate for both low- and high-density forms, catering to a wide range of industries. As a result, PE has the highest market share in the polyolefin industry.

The film and sheet segment dominates the polyolefin market due to its widespread use in packaging, agriculture, and industrial applications. These materials provide lightweight, long-lasting, and affordable options for protective coverings, food packaging, and insulation. Polyolefin films, notably polyethylene and polypropylene, have superior barrier characteristics and flexibility. Their increasing demand in sectors such as e-commerce and sustainable packaging strengthens their market position.

According to the polyolefin market forecast, packaging segment is expected to dominate the polyolefin business due to its importance in food preservation, product protection, and logistical efficiency. Polyolefins, such as polyethylene and polypropylene, are frequently utilized in both flexible and rigid packaging due to their lightweight, durability, and low cost. Rising demand for sustainable and recyclable materials accelerates the use of polyolefins in packaging. Growth in the e-commerce and consumer goods industries is fueling this dominance, making packaging a key component of the polyolefin industry.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

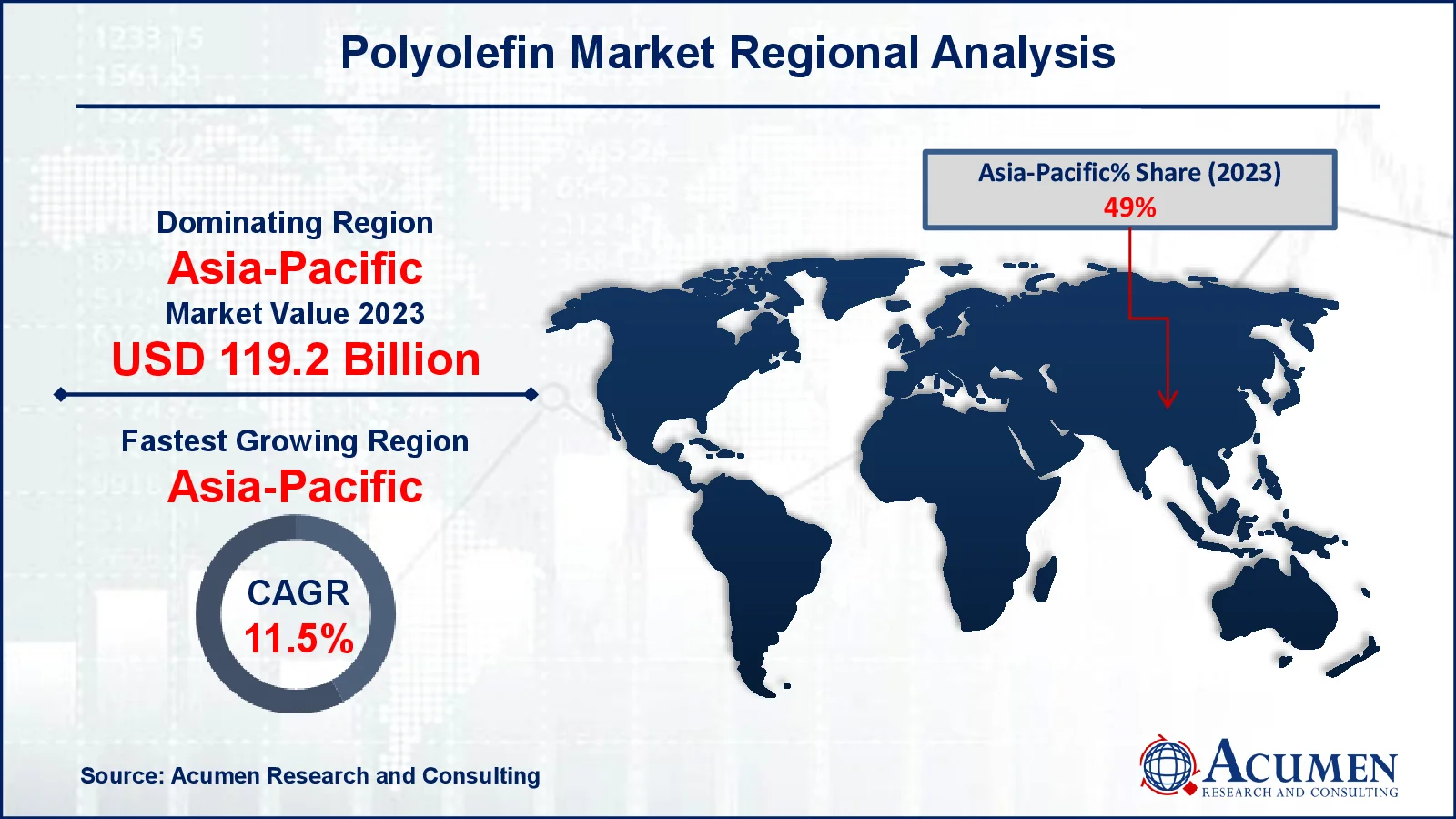

Polyolefin Market Regional Analysis

Polyolefin Market Regional AnalysisFor several reasons, the Asia-Pacific region has the largest and fastest-growing polyolefin market, followed by Europe and North America. The expansion of the plastic sector is the primary driver of growth in the Asia-Pacific polyolefin market. For example, the Plexconcil Organization reports that in December 2023, India exported plastics worth USD 1,115 million, up 12.7% from USD 989 million in December 2022. Rising demand for plastics from a variety of end-use industries, including solar power, automotive, plastic molding, and food and non-food packaging, is likely to drive market growth.

North America's polyolefin market is expanding rapidly, driven by rising demand for innovative plastic goods across a wide range of industries, including the developing plastics industry. For example, according to the Plastics Industry Association, the industry will make a considerable contribution in 2022, creating over a million jobs and shipping $548 billion in goods. Notably, Texas had the largest level of employment in the plastics business, while Indiana had the highest concentration of plastics workers. The industry's increase in real value-added outpaced that of the whole manufacturing sector. The region's emphasis on technological innovation, particularly in metallocene-catalyzed polyolefins, is helping to drive this expansion.

Some of the top polyolefin companies offered in our report include Dow Chemical Company, Arkema, ExxonMobil Corp., SABIC, Sinopec Corp., Lyondell Basel Holdings, PetroChina Company Limited, Total SA, Borealis AG, and Repsol.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2023

October 2022

April 2023

October 2018