February 2024

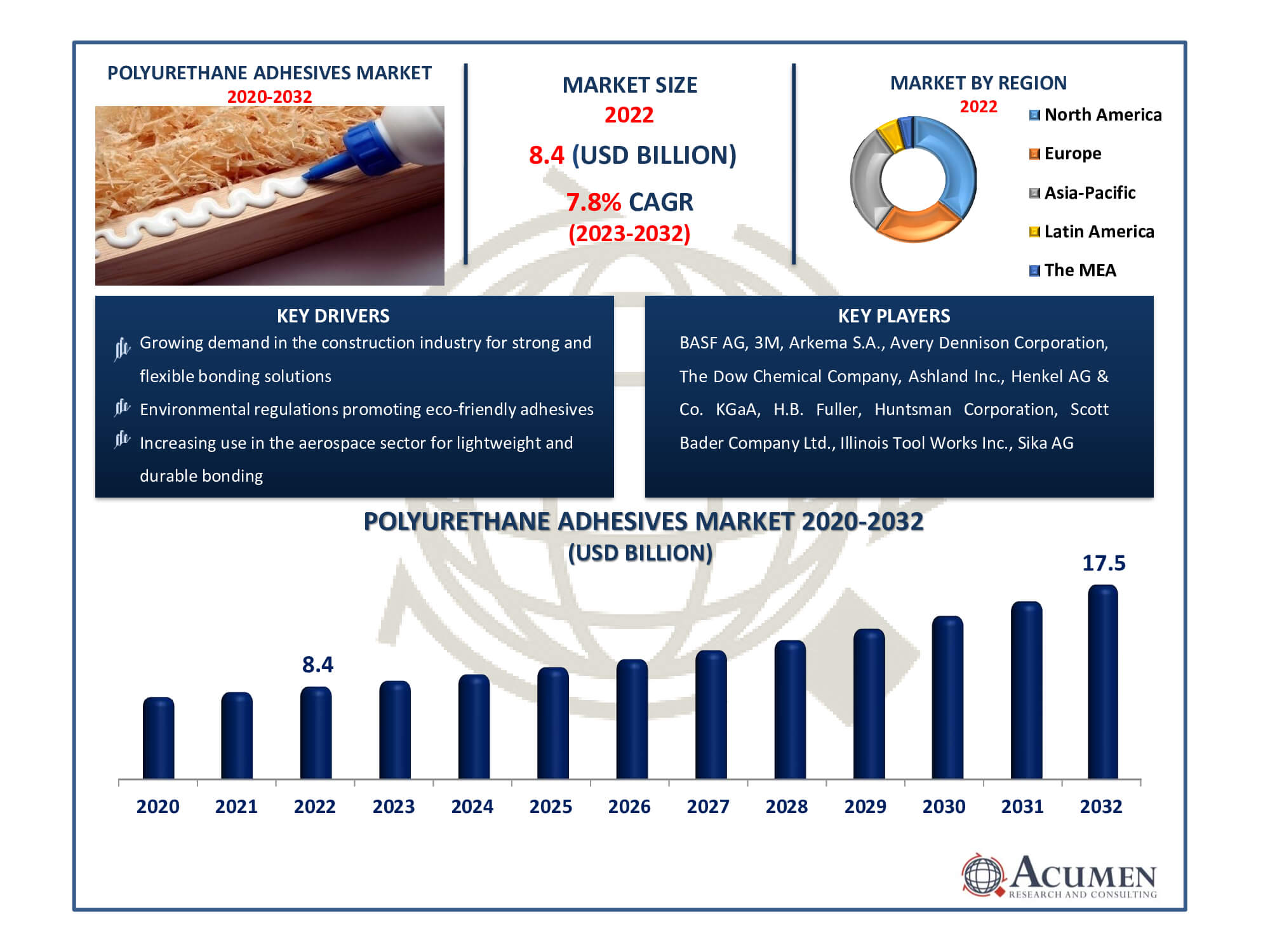

Polyurethane Adhesives Market Size accounted for USD 8.4 Billion in 2022 and is estimated to achieve a market size of USD 17.5 Billion by 2032 growing at a CAGR of 7.8% from 2023 to 2032.

The Polyurethane Adhesives Market Size accounted for USD 8.4 Billion in 2022 and is estimated to achieve a market size of USD 17.5 Billion by 2032 growing at a CAGR of 7.8% from 2023 to 2032.

Polyurethane Adhesives Market Highlights

Polyurethane adhesives, also known as elastic adhesives, are polymers produced through the reaction of polyols and isocyanates, resulting in linear chain units with carbamate or urethane links. Weather-resistant PU adhesives are typically suitable for outdoor applications, offering long-lasting, high-strength bonding for various end-use industries. Adhesives of the polyurethane kind are a flexible class with uses in many different sectors. These adhesives are created by reacting polyols with isocyanates to generate chains containing carbamate or urethane linkages. Because of their flexibility and resilience, these adhesives are also known as elastic adhesives. Weather-resistant polyurethane adhesives are unique in that they are suited for outdoor tasks and offer strong, long-lasting bonding solutions. These adhesives provide strong adhesion and resistance to a range of environmental factors, making them essential tools in the polyurethane adhesives market. Polyurethane adhesives are essential for guaranteeing strong and dependable bonding in a variety of industries, including manufacturing, aerospace, and the automobile and construction sectors. This piece explores the ever-changing landscape of polyurethane adhesives, looking at market trends, applications, and the main drivers of demand across a variety of end-use sectors.

Global Polyurethane Adhesives Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Polyurethane Adhesives Market Report Coverage

| Market | Polyurethane Adhesives Market |

| Polyurethane Adhesives Market Size 2022 | USD 8.4 Billion |

| Polyurethane Adhesives Market Forecast 2032 | USD 17.5 Billion |

| Polyurethane Adhesives Market CAGR During 2023 - 2032 | 7.8% |

| Polyurethane Adhesives Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Resin Type, By Technology, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BASF AG, 3M, Arkema S.A., Avery Dennison Corporation, The Dow Chemical Company, Ashland Inc., Henkel AG & Co. KGaA, H.B. Fuller, Huntsman Corporation, Scott Bader Company Ltd., Illinois Tool Works Inc., and Sika AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Polyurethane Adhesives Market Insights

The primary driver propelling the growth of the polyurethane adhesives market is the surge in global building and construction activities. In recent years, there has been a substantial increase in demand for polyurethane adhesives across various end-use industries, including clothing, automotive, construction, renovation, packaging, and electronics. Countries like India, China, and Brazil are experiencing significant growth in the construction and manufacturing sectors, driving up the demand for polyurethane adhesives. These nations are expected to witness continued demand growth, fueled by rising government expenditure on construction and an increasing number of companies operating in these regions. Furthermore, the automotive manufacturing sector's increasing reliance on polyurethane adhesives has led to a surge in demand, particularly in the production of passenger and commercial vehicles. These adhesives play a crucial role in meeting the demand for lightweight components, contributing to the sector's growth.

The market for polyurethane adhesives is driven by dynamic forces that sculpt its environment. With growing operations around the world, the construction sector continues to be a major driver. Additionally, there has been a noticeable increase in demand for polyurethane adhesives across a number of end-use industries, such as electronics, apparel, automobiles, construction, restoration, and packaging. The building and manufacturing industries are expanding in emerging countries like China, India, and Brazil as a result of government investments as well as the growth of new companies. It is anticipated that this growth will continue, adding to the rising demand for items made of polyurethane adhesive.

Polyurethane Adhesives Market Segmentation

The worldwide market for polyurethane adhesives is split based on resin type, technology, end-user, and geography.

Polyurethane Adhesive Resin Types

The thermoset sector is the largest in the polyurethane adhesives market, and market forecasts indicate that it will maintain this position. The key to its supremacy lies in the exceptional bonding and long-lasting properties of thermoset polyurethane adhesives. When cured, they form robust, permanent connections, making them ideal for a wide range of applications in the construction, automotive, and aerospace industries. Their formidable mechanical strength and resistance to heat and chemicals continue to drive their extensive use. As market forecasts suggest sustained demand for these qualities, the thermoset segment is expected to continue leading, meeting the need for durable and reliable adhesive solutions in various end-use sectors.

Polyurethane Adhesive Technologies

According to the industry, 100% solids are the largest segment in the market, followed by solvent-borne adhesives, a significantly dominant technology in the polyurethane adhesives market, excel in bonding performance and exhibit remarkable market resilience. They offer flexibility and can be tailored to adhere to a wide variety of substrates. These adhesives, in the context of market analysis, demonstrate lower sensitivity to contaminants, such as grease and oil on the substrate, compared to other adhesive types. However, it's important to note that solvent-borne adhesives contain significant quantities of hazardous organic compounds known as VOCs (Volatile Organic Compounds), which are typically irritants and subject to stringent regulations worldwide, particularly in the United States and Europe. Despite these regulatory challenges, they remain a popular choice in various end-user industries due to their superior adhesion properties, contributing to their continued prominence in the market.

Polyurethane Adhesive End-Users

Based on the end-user industry, the automotive & transportation segment holds the largest market share. Following that, the building & construction segment, supported by market analysis and market forecasts, commands the second-largest share in the polyurethane adhesives market. This is primarily due to the extensive utilization of polyurethane adhesives in the construction industry, where they are renowned for their robust and long-lasting adhesive properties, facilitating the bonding of various materials such as wood, concrete, and insulation. The dominance of this market is attributed to the ever-growing demand for these adhesives in construction and renovation projects, driven by urbanization and infrastructure development. Furthermore, the dependability and versatility of polyurethane adhesives make them the preferred choice for a wide range of building applications, reinforcing the building & construction segment's prominence in the market

Polyurethane Adhesive Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

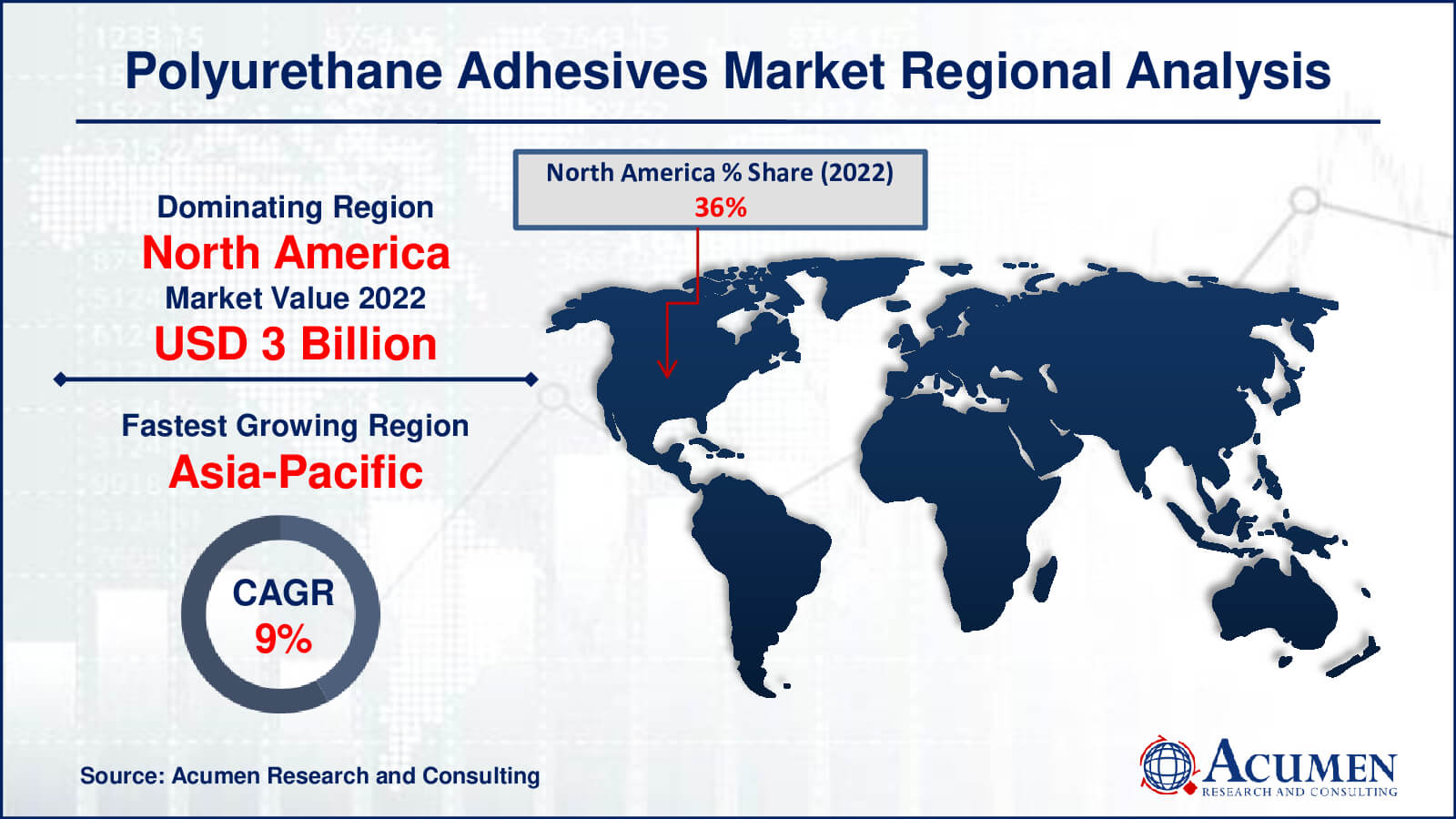

Polyurethane Adhesives Market Regional Analysis

North America holds a significant market share in the global polyurethane adhesives market and is projected to drive market growth during the forecast period. This growth is fueled by the increasing demand for polyurethane adhesives in building and renovation activities, the automotive sector, and transportation. It is expected that Asia-Pacific will achieve the fastest revenue growth, driven by rising demand from the telecommunications, electrical, and industrial sectors within the region.

Europe, led by countries like the UK, France, and Germany, is also likely to experience substantial growth in the forecast period. The presence of major automotive players such as Mercedes, BMW, and Audi in Europe contributes to the high demand for regional goods. The growth of the PU adhesives market is influenced by rapid industrialization, economic development, and stringent policy regulations.

The Middle East is one of the world's fastest-growing construction markets, primarily led by countries like Saudi Arabia and the UAE. The demand for polyurethane adhesives in this region is expected to bolster this positive outlook until 2032.

Polyurethane Adhesives Market Players

Some of the top polyurethane adhesives companies offered in our report includes BASF AG, 3M, Arkema S.A., Avery Dennison Corporation, The Dow Chemical Company, Ashland Inc., Henkel AG & Co. KGaA, H.B. Fuller, Huntsman Corporation, Scott Bader Company Ltd., Illinois Tool Works Inc., and Sika AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2024

September 2024

March 2024

February 2025