August 2022

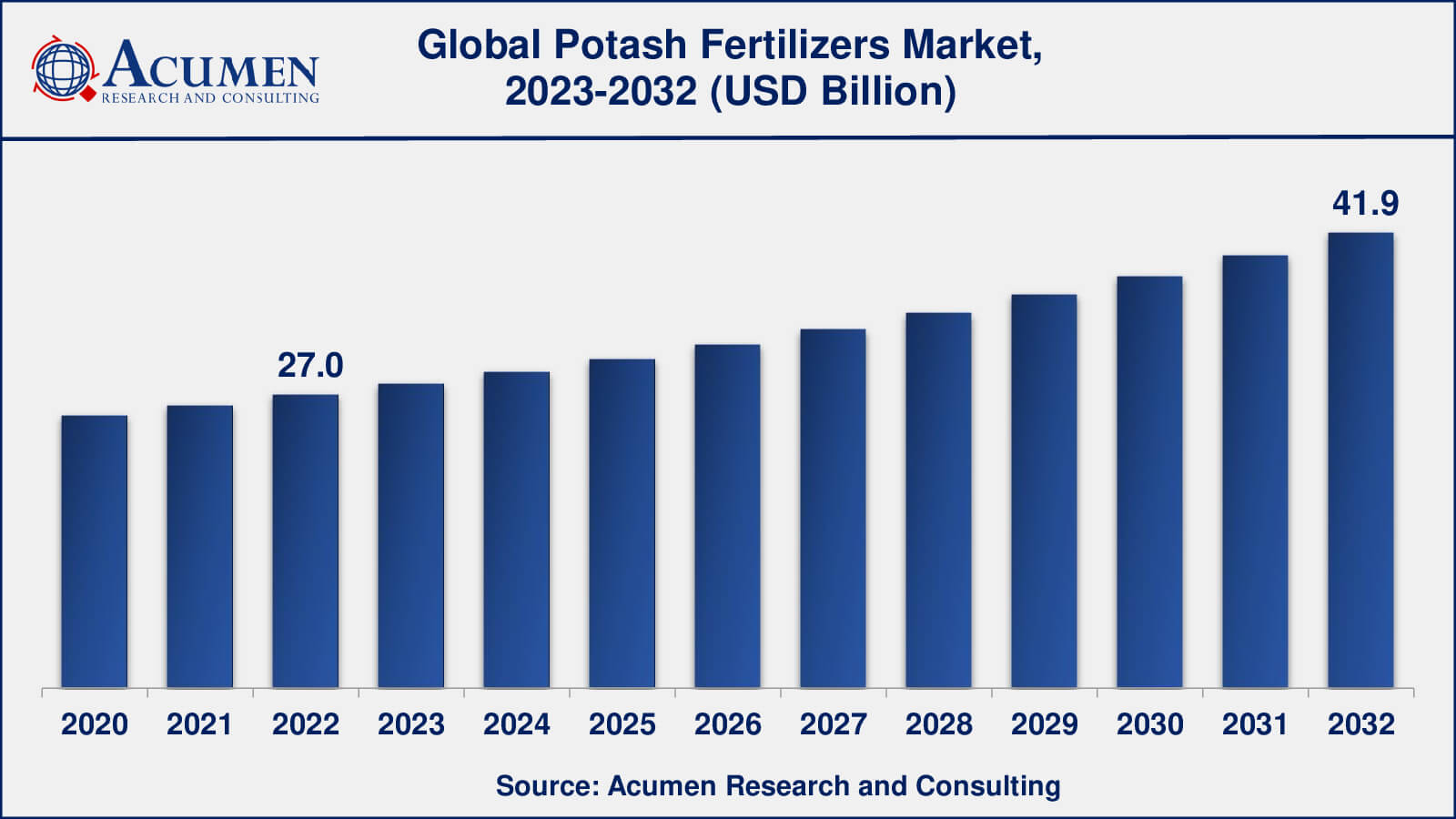

Potash Fertilizers Market Size accounted for USD 27 Billion in 2022 and is estimated to achieve a market size of USD 41.9 Billion by 2032 growing at a CAGR of 4.6% from 2023 to 2032.

The Global Potash Fertilizers Market Size accounted for USD 27 Billion in 2022 and is estimated to achieve a market size of USD 41.9 Billion by 2032 growing at a CAGR of 4.6% from 2023 to 2032.

Potash Fertilizers Market Highlights

Potash fertilizers can be used for many different applications including rice, vegetables, fruits, sugarcane, palm oil, soybean, and cotton. It helps in increasing crop yield, nutrient value, and enhances water retention levels, and makes crops resistant to diseases and harmful pathogens. Potash fertilizers improve the color and flavor of the fruit, increase its size, and reduce the occurrence of pests and diseases In addition, it helps in improving the taste and texture of the fruit, which is the primary function of potash fertilizer.

Global Potash Fertilizers Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Potash Fertilizers Market Report Coverage

| Market | Potash Fertilizers Market |

| Potash Fertilizers Market Size 2022 | USD 27 Billion |

| Potash Fertilizers Market Forecast 2032 | USD 41.9 Billion |

| Potash Fertilizers Market CAGR During 2023 - 2032 | 4.6% |

| Potash Fertilizers Market Analysis Period | 2020 - 2032 |

| Potash Fertilizers Market Base Year | 2022 |

| Potash Fertilizers Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Crop Type, By Type, By Physical Form, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | The Potash Corporation of Saskatchewan, Agrium Inc., Borealis AG, EuroChem Group AG, Sinofert Holdings Limited, K+S AG, The Mosaic Company, Yara International ASA, Israel Chemicals Ltd., JSC Belaruskali, HELM AG, and Sociedad Química y Minera de Chile S.A (SQM). |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Potash Fertilizers Market Insights

The development of the potash fertilizer market can be accredited to the need for advanced productivity and an increase in the applicability of potash fertilizers. Potash fertilizers are the most widely used source of potassium for crops other than naturally available potassium present in the soil. Apart from this, Potash (MOP) has been referred to as muriate and has great nutrient absorption. Potash fertilizers are used to increase nutrient growth in crops and improve the overall quality of plants. The majority of crops such as plantation crops and horticulture are fertilized with potassium chloride which is a key driver for the growth of this market. Although the use of potash fertilizer is increasing for potable plants, excessive use results in reducing the soil fertility, and in turn, causes depletion of crop yield in long term. Also, due to price fluctuation, the demand for potash fertilizer has slowed down during the global financial crisis and has been hindering market growth. The demand for organic food and food products has restrained the use of chemical fertilizers, thus hindering the growth of potash fertilizers.

Potash Fertilizers Market Segmentation

The worldwide market for potash fertilizers is split based on crop type, type, physical form, application, and geography.

Potash Fertilizer Crop Types

According to our potash fertilizers industry analysis, the cereals & grains are the largest sub-segment in the potash fertilizers market by crop type, accounting for the largest share of the market. This is due to the widespread cultivation of cereal and grain crops such as rice, corn, wheat, and barley, which require high potash fertilizer levels for optimal growth and yield.

Fruits and vegetables are the fastest growing crop type sub-segment in the potash fertilizers market. This is due to an increase in the demand for high-quality fruits and vegetables, which necessitate the use of high-quality potash fertilizers to increase yield and quality.

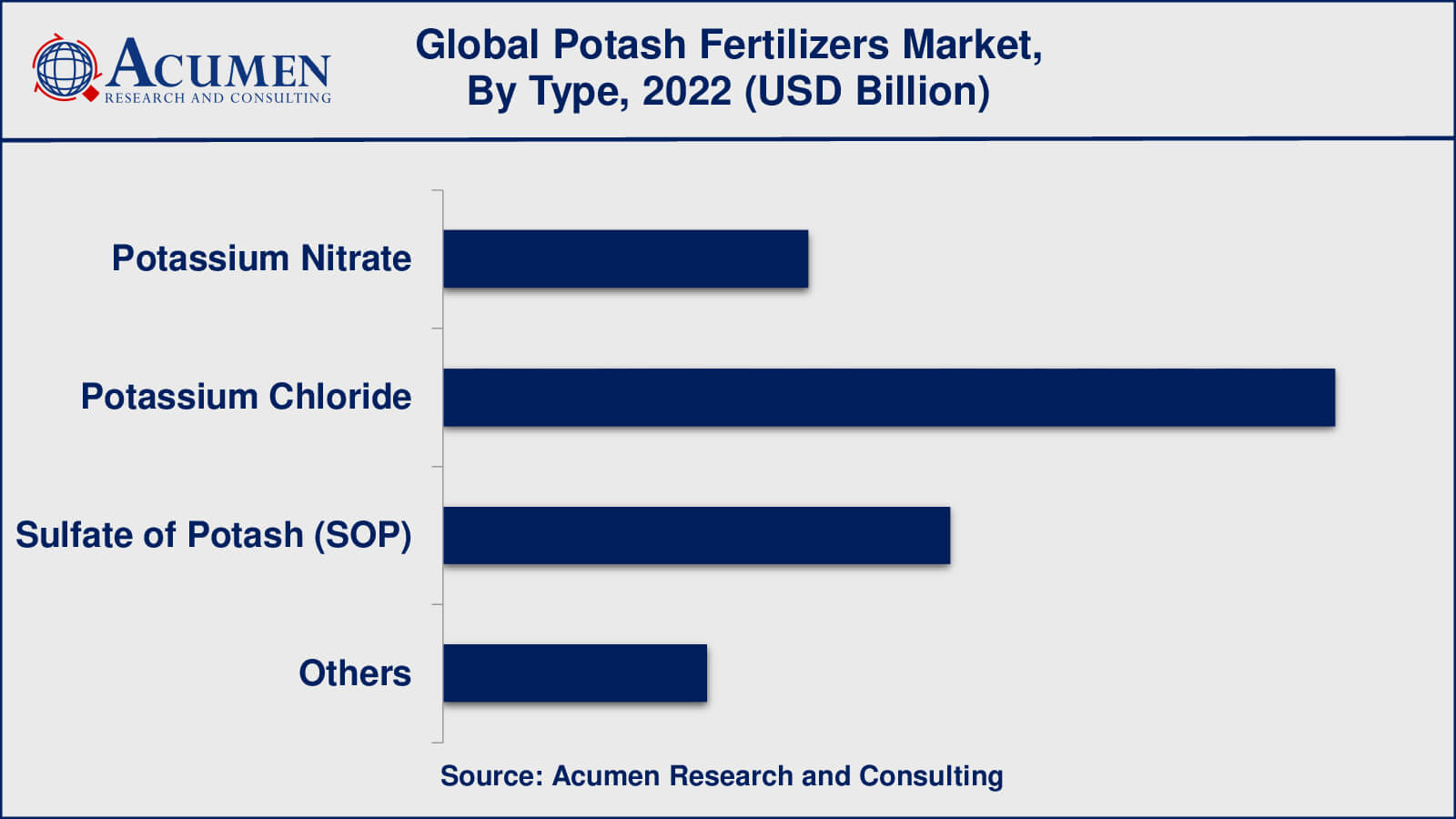

Potash Fertilizer Types

According to the potash fertilizers market forecast, potassium chloride is and will continue to be the largest sub-segment. This is due to the fact that potassium chloride is readily available, has a high potassium concentration, and is relatively inexpensive when compared to other types of potash fertilizers. Furthermore, potassium chloride is adaptable and can be used in a wide range of crops, making it a popular choice among farmers. Sulfate of Potash (SOP), on the other hand, is the fastest-growing sub-segment, as it is a premium potash fertilizer that is increasingly being used in high-value crops such as fruits and vegetables.

Potash Fertilizer Physical Forms

The potash fertilizers market is currently dominated by the solid sub-segment. In comparison to liquid fertilizers, solid potash fertilizers are easier to store, transport, and apply. They come in granular or powder form, making them easier to handle and apply precisely, lowering the risk of fertilizer loss. Solid fertilizers are also less susceptible to evaporation or leaching, both of which can result in nutrient loss. Solid potash fertilizers have a larger market share than liquid fertilizers because of these advantages. The liquid sub-segment, on the other hand, is expected to grow faster due to benefits such as better absorption, easy and precise application, and faster nutrient uptake.

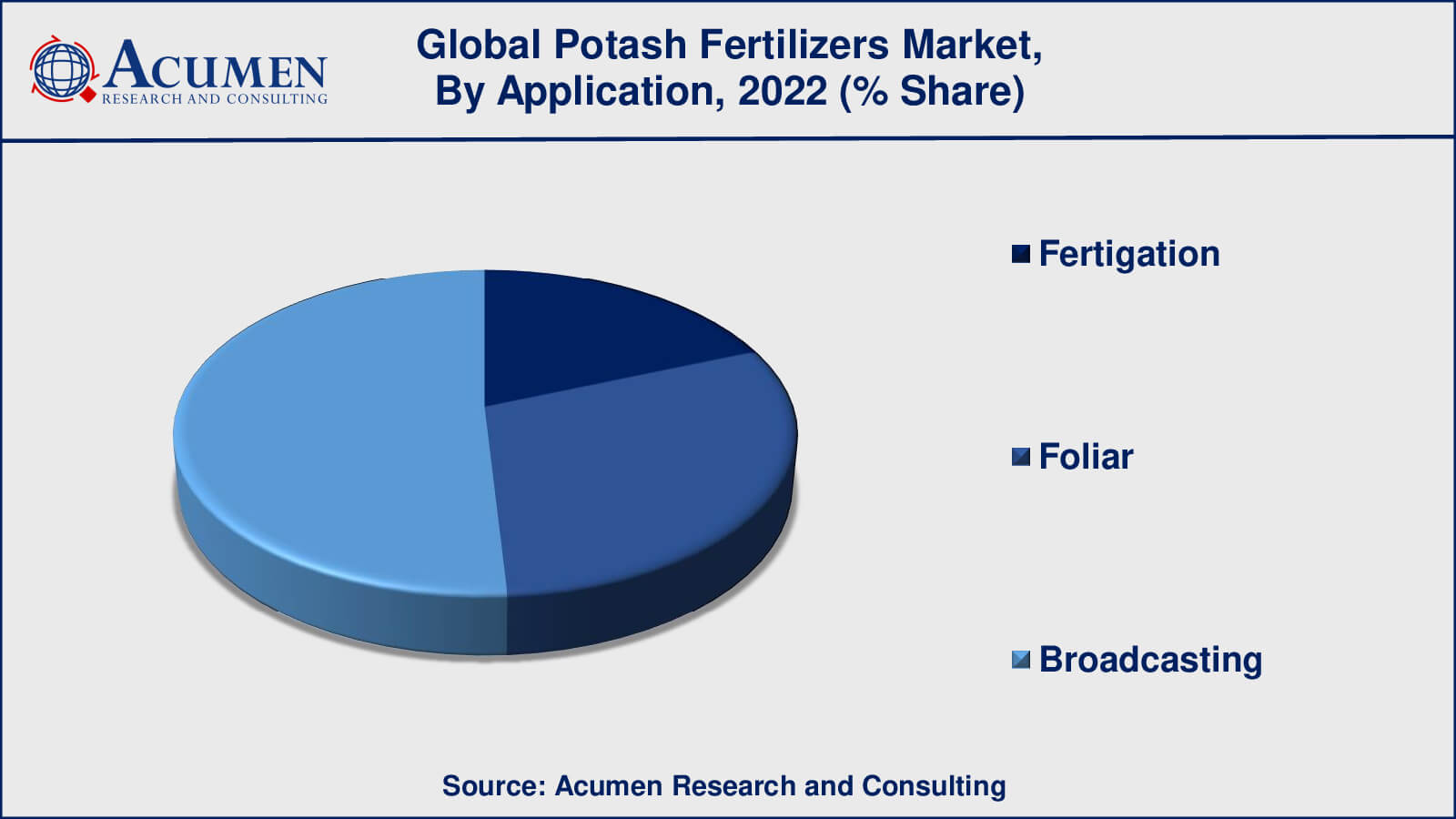

Potash Fertilizer Applications

Broadcasting is currently the most popular method of application in the potash fertilizer market. Broadcasting entails evenly spreading fertilizers across the soil surface, followed by tilling or ploughing to incorporate them into the soil. This method is widely used in large-scale farming and is especially effective in crops requiring deep root systems, such as wheat and corn.

Fertigation and foliar applications of potash fertilizers are also important methods of application, particularly in high-value crops such as fruits and vegetables. Fertigation is the application of liquid fertilizers via irrigation systems, whereas foliar application is the application of fertilizers directly onto the leaves of the plants.

Potash Fertilizers Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Potash Fertilizers Market Regional Analysis

The North American region contributes significantly to the potash fertilizers market, with the United States being the region's largest market. The increasing adoption of precision farming practices, rising demand for high-quality crops, and the need to improve soil fertility are driving demand for potash fertilizers in North America.

The European Union is a major player in the potash fertilizer market as well. The presence of several key players, rising demand for high-quality crops, and government support for the use of fertilizers to improve soil health and crop yields are driving market growth in Europe.

The Asia Pacific region is the largest but also fastest-growing market for potash fertilizers, with key markets including China, India, and Indonesia. The region's market growth is being driven by rising population, rising food demand, and the need to improve crop yields and soil fertility.

Potash Fertilizers Market Players

Some of the top potash fertilizers companies offered in the professional report include The Potash Corporation of Saskatchewan, Agrium Inc., EuroChem Group AG, Sinofert Holdings Limited, K+S AG, The Mosaic Company, Yara International ASA, Israel Chemicals Ltd., JSC Belaruskali, HELM AG, Sociedad Química y Minera de Chile S.A (SQM), and Borealis AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

August 2022

August 2020

February 2023

April 2023