April 2020

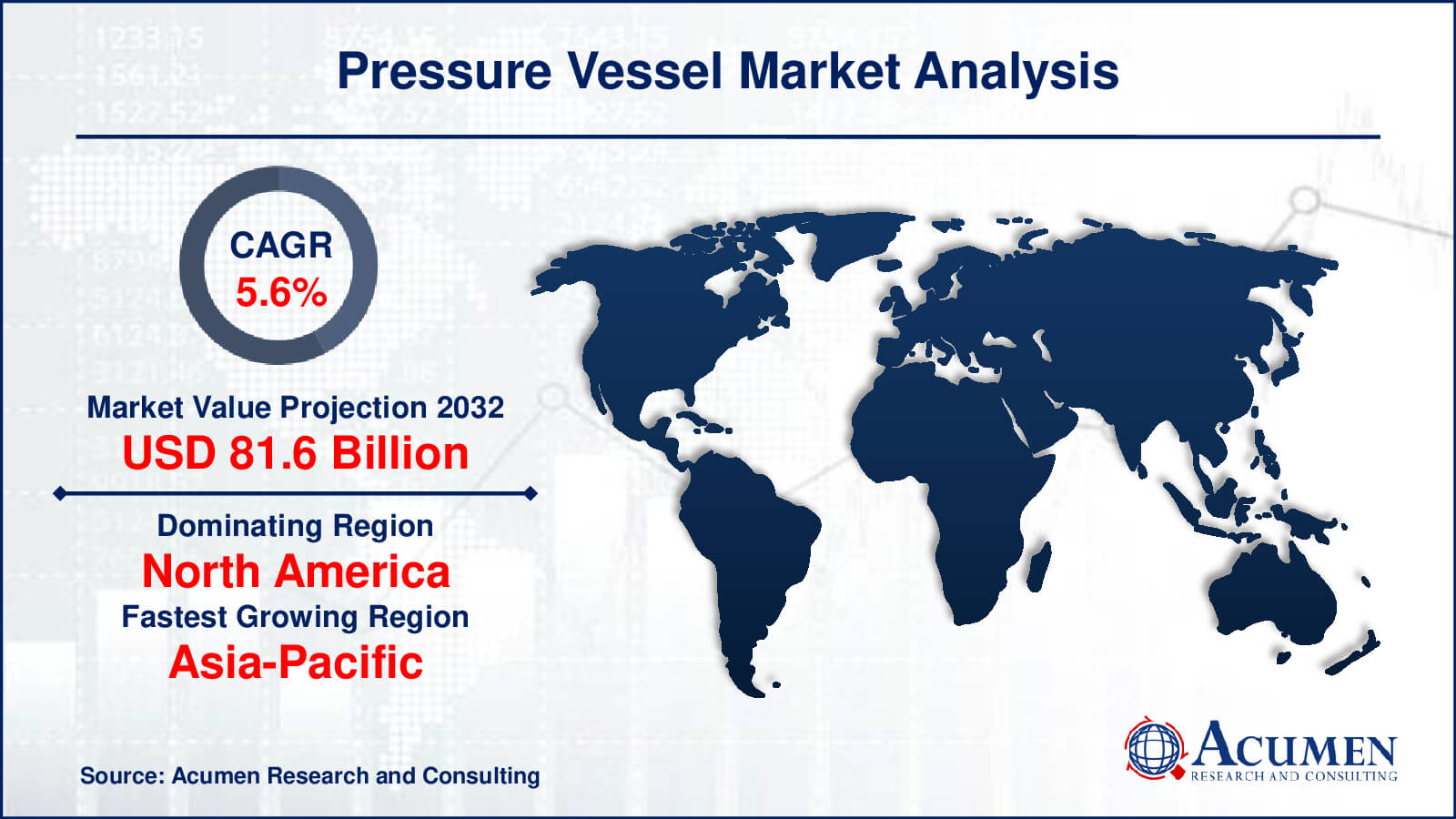

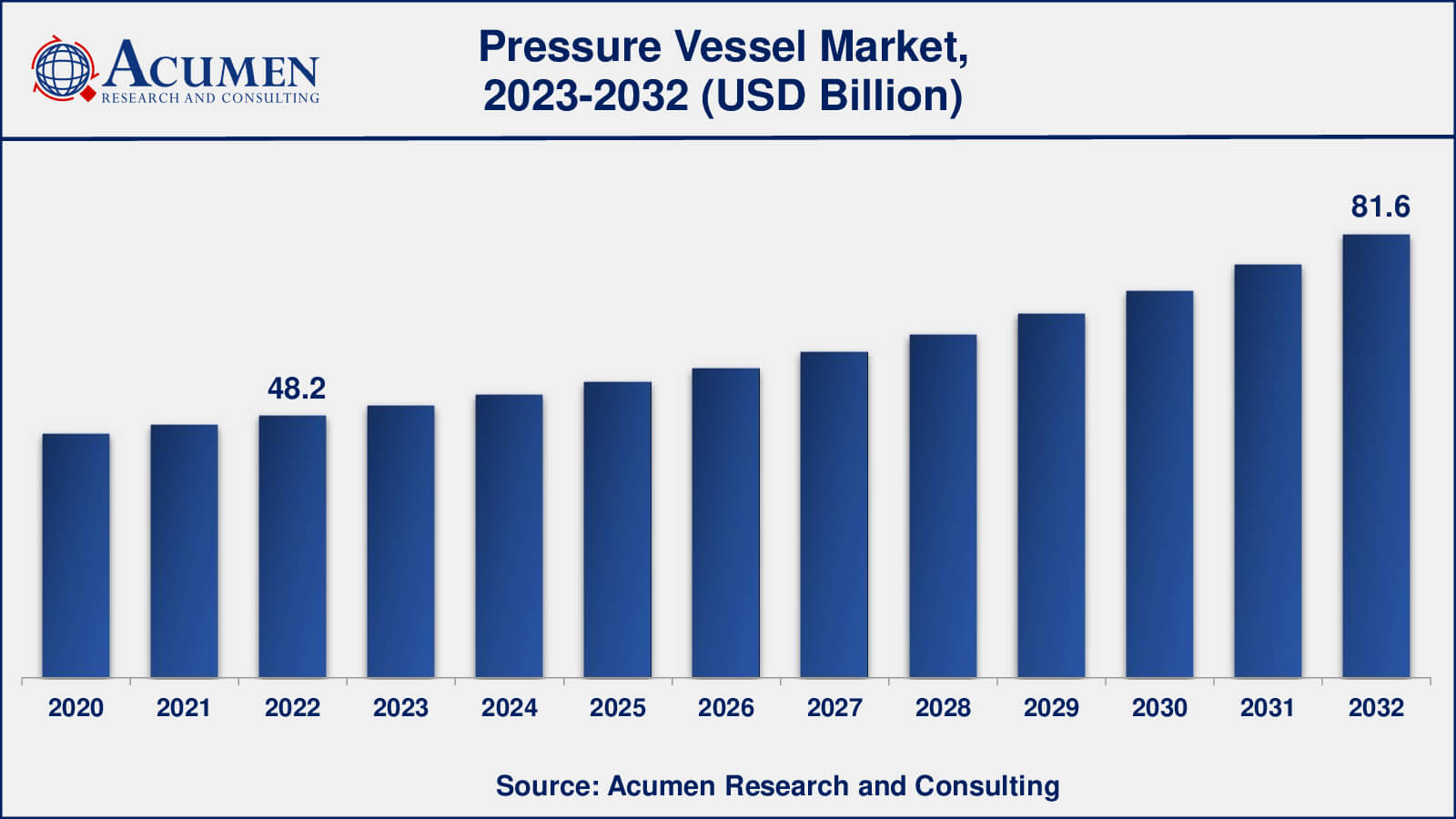

Pressure Vessel Market Size accounted for USD 48.2 Billion in 2022 and is estimated to achieve a market size of USD 81.6 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

The Global Pressure Vessel Market Size accounted for USD 48.2 Billion in 2022 and is estimated to achieve a market size of USD 81.6 Billion by 2032 growing at a CAGR of 5.6% from 2023 to 2032.

Pressure Vessel Market Highlights

Pressure vessels are used to contain liquids and gases under high pressure, making them closed containers. These vessels must adhere to domestic laws and regulations in terms of their basic parameters, with the primary requirement being the ability to withstand high internal pressures. Over time, through extensive research and stringent regulation, modern pressure vessels have become much safer compared to their predecessors.

The global pressure vessel market is being driven by increasing demand in the oil, gas, chemical, and petrochemical industries. Additionally, the growing popularity of alternative fuels will further boost the pressure vessel market. Pressure vessels used for storing fuel are typically constructed from materials like steel, titanium, aluminum, and nickel alloys. These vessels often have a cylindrical or spherical shape.

With the rising demand for alternative fuels such as biodiesel, electricity, ethanol, hydrogen, natural gas, and propane, the pressure vessel market is expected to experience significant growth in the upcoming years.

Global Pressure Vessel Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Pressure Vessel Market Report Coverage

| Market | Pressure Vessel Market |

| Pressure Vessel Market Size 2022 | USD 48.2 Billion |

| Pressure Vessel Market Forecast 2032 | USD 81.6 Billion |

| Pressure Vessel Market CAGR During 2023 - 2032 | 5.6% |

| Pressure Vessel Market Analysis Period | 2020 - 2032 |

| Pressure Vessel Market Base Year |

2022 |

| Pressure Vessel Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Material, By Construction Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mitsubishi Heavy Industries, Ltd., General Electric Company, Doosan Heavy Industries & Construction Co., Ltd., Babcock and Wilcox Enterprises, Inc., Larsen & Toubro Limited, Bharat Heavy Electricals Limited, Dongfang Electric Machinery Co., Ltd., Samuel Pressure Vessel Group, IHI Corporation, Westinghouse Electric Company LLC |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pressure Vessel Market Insights

The major driving force behind the growth of the global pressure vessel market is the increasing demand for energy worldwide. Various energy generation processes, particularly boilers, are expected to dominate the pressure vessel market, driving demand during the forecast period. The growing emphasis on green energy has also significantly boosted demand in the pressure vessel market. Due to the increasing scarcity of natural fuels, which are a finite resource, global demand for pressure vessels has surged, particularly for renewable energy sources like solar power.

The growing demand in the chemical and petrochemical industry is another key driver of the global pressure vessel market. Pressure vessels are essential for transporting and storing chemicals and petrochemicals that may react aggressively with the environment. Therefore, the expanding chemical and petrochemical sector plays a vital role in the global pressure vessel industry. Customizability is yet another crucial factor contributing to the global pressure vessel market's success.

Pressure Vessel Market Segmentation

The worldwide market for pressure vessel is split based on product, material, construction type, application, and geography.

Pressure Vessel Products

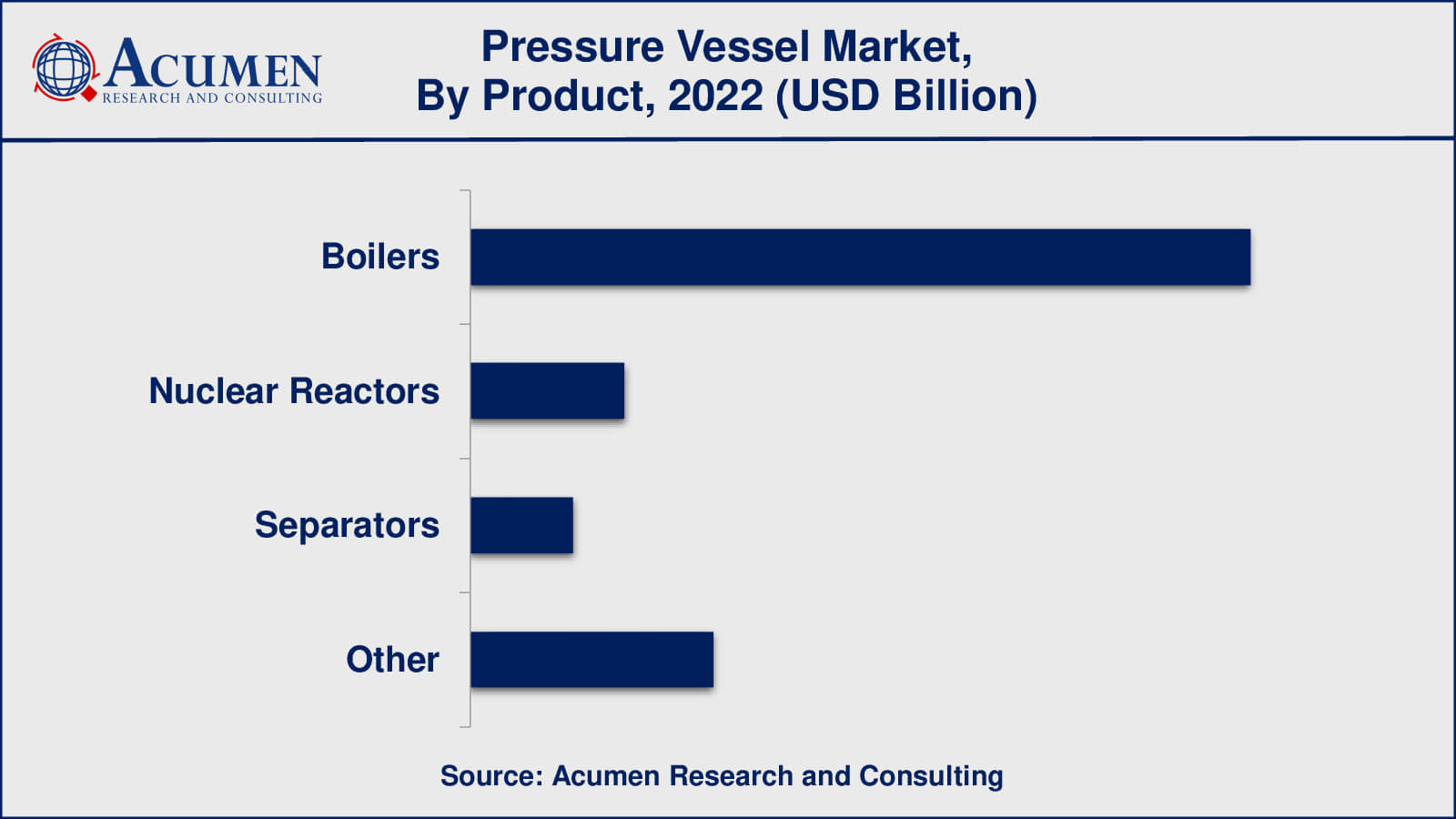

The pressure vessel market is segmented by products, including boilers, nuclear reactors, separators, and other related products. According to industry analysis, boilers have consistently held the largest market share in the product segment in recent years. Key factors driving this segment's growth include increasing R&D activities in the oil and gas industry and the expanding range of applications, including heating and power generation processes. The boiler segment encompasses various types, such as utility, industrial, super thermal power plant, and supercritical parameter boilers, with unit sizes up to 1,000 MW.

Nuclear reactors are expected to exhibit the highest compound annual growth rate (CAGR) over the forecast period. Additionally, another type of pressure vessel is the separator subsegment, which is used for separating well fluids produced from oil and gas wells into liquid and gaseous components.

Pressure Vessel Materials

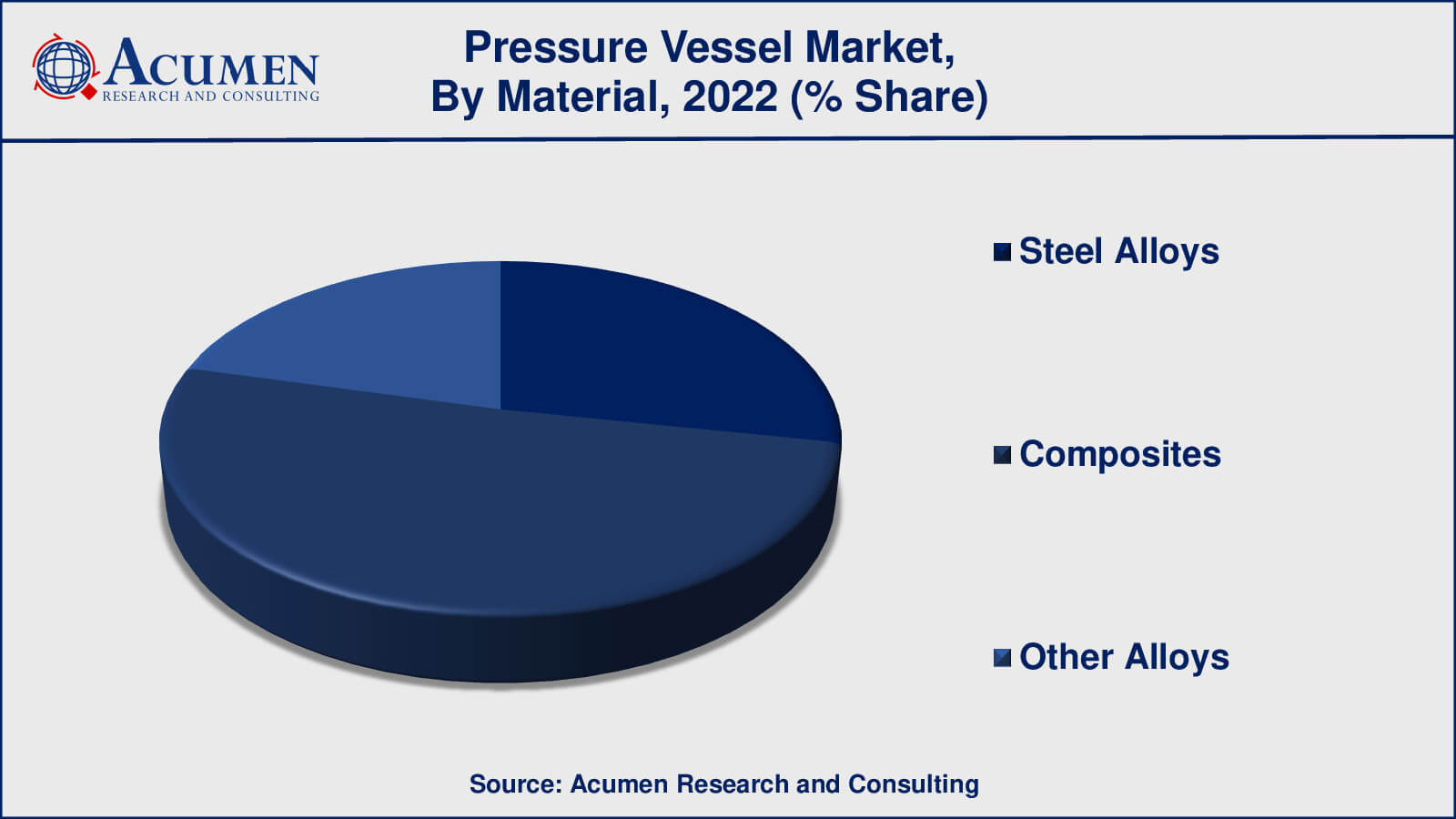

In terms of the material segment, the market is categorized into steel alloys, composites, and other alloys. Within the Material segment, Steel Alloys have consistently dominated in terms of revenue share in previous years. Steel alloys offer greater strength and formability, making them a preferred choice. Steel materials provide several advantages, including affordability, high resistance to corrosion, excellent tensile strength, resistance to vibrations and shocks, recyclability, and the ability to withstand humid conditions or high temperatures. Due to these benefits, the growth of this segment is expected to continue increasing in the upcoming years.

Pressure Vessel Construction Types

In terms of the construction segment, the market is divided into CNG Type I, CNG Type II, CNG Type III, and CNG Type IV. In recent years, the CNG Type I segment has emerged as the dominant construction type in the Pressure Vessel market. Type I constructions are easy to manufacture and produce, typically using steel materials, and they are heavyweight. The increasing adoption of Type I construction is primarily due to its affordability. For these reasons, the pressure vessel market is expected to continue growing in the near future.

Pressure Vessel Applications

In terms of the application segment, the market is segmented into oil & gas, chemical & petrochemical, power generation, and other applications. According to the Pressure Vessel market forecast, the Chemical & Petrochemical segments have dominated the market share and are expected to maintain their dominance throughout the forecasted timeframe, spanning from 2023 to 2032. This dominance is attributed to the increasing global demand for energy and power, driven by urbanization and industrialization. Energy and power processes rely on pressure vessels for their operations, further bolstering the growth of the chemical and petrochemical segments in the upcoming years.

In contrast, the oil & gas segment within the global pressure vessel market is anticipated to experience the highest Compound Annual Growth Rate (CAGR) over the forecast period. This growth is attributed to the rising demand for compressed natural gas (CNG) and liquefied natural gas (LNG) in the global energy landscape.

Pressure Vessel Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Pressure Vessel Market Regional Analysis

In North America and Europe, major players in the pressure vessel market are focusing on developing their pressure vessel capacity. The Middle East & Africa region has witnessed significant investments in new power projects, and existing infrastructures in the oil and gas sector have also driven regional demand.

Asia-Pacific has also held significant market share in the global pressure vessel market and is poised to continue its growth during the forecast period. This is primarily due to the rapid expansion of the power sector in the region, including the installation of nuclear power stations, and the growth of the oil and gas as well as chemical and petrochemical industries. Additionally, the emergence of a new economy in the Asia-Pacific region is creating opportunities for expansion.

In North America and Europe, major players in the pressure vessel market are focusing on developing their pressure vessel capacity. The Middle East & Africa region has witnessed significant investments in new power projects, and existing infrastructures in the oil and gas sector have also driven regional demand.

Furthermore, the growth of urban and industrial infrastructure in Latin America is expected to contribute to the demand for pressure vessels in the region.

Pressure Vessel Market Players

Some of the top pressure vessel companies offered in our report includes Mitsubishi Heavy Industries, Ltd., General Electric Company, Doosan Heavy Industries & Construction Co., Ltd., Babcock and Wilcox Enterprises, Inc., Larsen & Toubro Limited, Bharat Heavy Electricals Limited, Dongfang Electric Machinery Co., Ltd., Samuel Pressure Vessel Group, IHI Corporation, Westinghouse Electric Company LLC.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2020

August 2018

July 2024

May 2018