January 2020

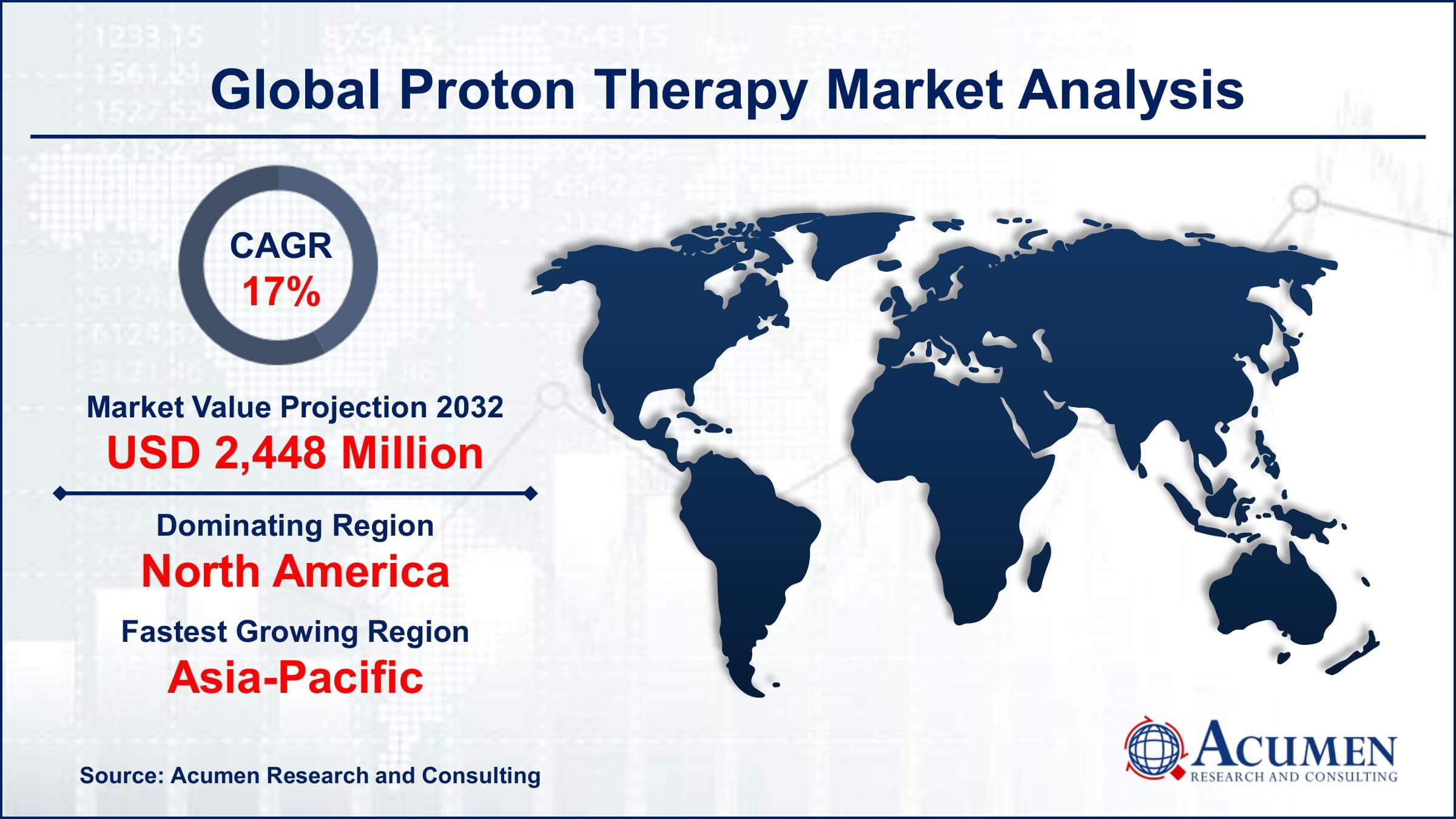

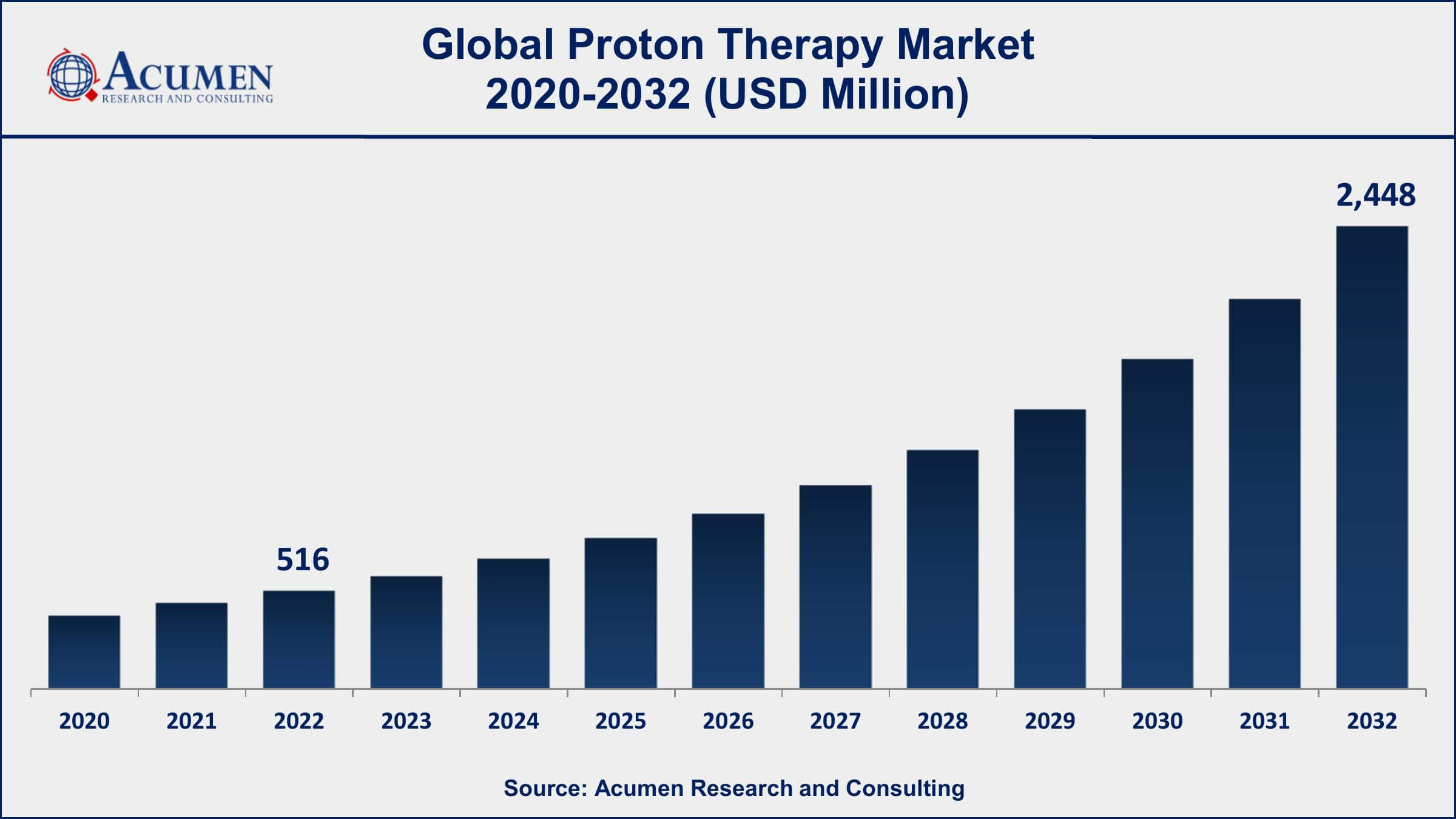

Proton Therapy Market Size accounted for USD 516 Million in 2022 and is projected to achieve a market size of USD 2,448 Million by 2032 growing at a CAGR of 17% from 2023 to 2032.

The Global Proton Therapy Market Size accounted for USD 516 Million in 2022 and is projected to achieve a market size of USD 2,448 Million by 2032 growing at a CAGR of 17% from 2023 to 2032.

Proton Therapy Market Highlights

Proton therapy is a type of radiation therapy that uses a high-energy beam of protons to treat cancer. Unlike traditional radiation therapy that uses X-rays, proton therapy delivers the radiation dose directly to the cancerous tumor while sparing surrounding healthy tissues from damage. This results in less radiation exposure to healthy tissue and reduces the risk of side effects. Proton therapy is particularly effective for treating tumors located near vital organs, such as the brain, spine, and prostate.

The market growth of proton therapy has been significant in recent years, with an increasing number of cancer centers adopting this technology. This growth is driven by several factors, including the increasing prevalence of cancer, the growing demand for non-invasive cancer treatments, and advancements in proton therapy technology. Moreover, the adoption of proton therapy is supported by the development of new facilities and the expansion of existing facilities, especially in developing countries, which is expected to further fuel market growth. However, the high cost of proton therapy remains a significant barrier to adoption, which could hinder market growth in some regions.

Global Proton Therapy Market Trends

Market Drivers

Market Restraints

Market Opportunities

Proton Therapy Market Report Coverage

| Market | Proton Therapy Market |

| Proton Therapy Market Size 2022 | USD 516 Million |

| Proton Therapy Market Forecast 2032 | USD 2,448 Million |

| Proton Therapy Market CAGR During 2023 - 2032 | 17% |

| Proton Therapy Market Analysis Period | 2020 - 2032 |

| Proton Therapy Market Base Year | 2022 |

| Proton Therapy Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Indication, By Product, By Set-Up Systems, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Varian Medical Systems, Hitachi, Ltd., IBA Worldwide, Mitsubishi Electric Corporation, Advanced Oncotherapy plc, ProTom International, Sumitomo Heavy Industries, Ltd., Mevion Medical Systems, Inc., ProNova Solutions, LLC, Optivus Proton Therapy, Inc., Ion Beam Applications S.A., and Danfysik A/S. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Proton therapy is a form of radiation therapy that uses a beam of protons to treat cancer. Protons are positively charged particles that can be finely controlled to deliver their maximum energy at the site of a tumor, minimizing damage to surrounding healthy tissue. This makes proton therapy particularly useful for treating cancers in areas of the body where healthy tissue is sensitive or difficult to avoid. The therapy can be delivered using either a gantry (a machine that rotates around the patient to deliver the proton beam from different angles) or a fixed beam. Proton therapy has a wide range of applications in cancer treatment. It is particularly effective in treating tumors that are close to vital organs or structures, such as the brain, spine, or heart, where the risk of damage to healthy tissue is high. Proton therapy is also used for treating rare and complex cancers that are difficult to treat with other forms of radiation therapy.

The proton therapy market has experienced significant growth in recent years, and this trend is expected to continue in the coming years. One of the major drivers of this growth is the increasing prevalence of cancer worldwide, which has resulted in a growing demand for effective cancer treatments such as proton therapy. Additionally, the increasing adoption of proton therapy by healthcare providers due to its high precision, low side effects, and high cure rates have also contributed to the market growth. Moreover, advancements in proton therapy technology, such as pencil beam scanning and intensity-modulated proton therapy (IMPT), have improved treatment efficacy and expanded the range of treatable cancers, further driving the market growth. However, the high cost of proton therapy remains a significant challenge to market growth, particularly in developing countries, where access to advanced cancer treatments is limited.

Proton Therapy Market Segmentation

The global proton therapy market segmentation is based on indication, product, set-up systems, end-user, and geography.

Proton Therapy Market By Indication

According to the proton therapy industry analysis, the CNS cancer segment accounted for the largest market share in 2022. The increasing prevalence of CNS tumors, coupled with the growing demand for non-invasive cancer treatments, is expected to drive market growth. Central Nervous System (CNS) cancer is one of the most common types of cancer, and the proton therapy for this segment is expected to experience significant growth in the coming years. CNS tumors are typically located in areas of the brain or spinal cord that are difficult to treat using conventional radiation therapy due to the risk of damaging healthy tissue. Proton therapy, with its ability to target tumors more precisely, has emerged as a viable treatment option for CNS tumors, particularly in children.

Proton Therapy Market By Product

In terms of products, the accelerator segment is expected to witness significant growth in the coming years. The increasing demand for proton therapy for cancer treatment, coupled with the need for more efficient and cost-effective accelerator systems, is expected to drive market growth. The accelerator segment is a critical component of proton therapy systems, and it plays a significant role in the overall market expansion. Proton therapy accelerators are used to produce high-energy proton beams, which are then directed toward the tumor site. The accelerator segment is expected to experience significant growth in the coming years, primarily driven by advancements in accelerator technology.

Proton Therapy Market By Set-Up Systems

According to the proton therapy market forecast, the multi-room systems segment is expected to witness significant growth in the coming years. The increasing demand for proton therapy, coupled with the need for more efficient treatment facilities, is expected to drive market growth. The multi-room systems segment is expected to experience significant growth in the coming years. Multi-room systems refer to proton therapy facilities with multiple treatment rooms, which allow for the treatment of multiple patients simultaneously. Multi-room systems offer several advantages over single-room systems, including improved patient throughput, increased treatment capacity, and reduced treatment times.

Proton Therapy Market By End-User

Based on the end-user, the hospital segment is expected to continue its growth trajectory in the coming years. The increasing prevalence of cancer, coupled with the growing demand for non-invasive cancer treatments, is expected to drive market growth in this segment. Hospitals are among the leading end-users of proton therapy systems, and the increasing demand for advanced cancer treatments in hospital settings is expected to drive market growth. Moreover, the development of advanced proton therapy technologies, such as pencil beam scanning and image-guided proton therapy, has improved treatment outcomes for cancer patients, making proton therapy an attractive option for hospitals.

Proton Therapy Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Proton Therapy Market Regional Analysis

North America dominates the proton therapy market, and this is primarily due to the increasing adoption of proton therapy in cancer treatment and the presence of several leading players in the region. The United States is one of the largest markets for proton therapy, with several proton therapy centers and treatment facilities spread across the country. The growing prevalence of cancer, coupled with the high healthcare expenditure in the region, is expected to drive market growth in North America. Moreover, the increasing adoption of advanced proton therapy technologies, such as pencil beam scanning and image-guided proton therapy, is expected to fuel market growth in the region. These technologies offer improved treatment outcomes for cancer patients, making proton therapy an attractive option for healthcare providers in North America. Additionally, the availability of skilled healthcare professionals and the supportive regulatory framework in the region are expected to drive market growth.

Proton Therapy Market Player

Some of the top proton therapy market companies offered in the professional report include Varian Medical Systems, Hitachi, Ltd., IBA Worldwide, Mitsubishi Electric Corporation, Advanced Oncotherapy plc, ProTom International, Sumitomo Heavy Industries, Ltd., Mevion Medical Systems, Inc., ProNova Solutions, LLC, Optivus Proton Therapy, Inc., Ion Beam Applications S.A., and Danfysik A/S.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2020

November 2018

August 2022

May 2024