September 2024

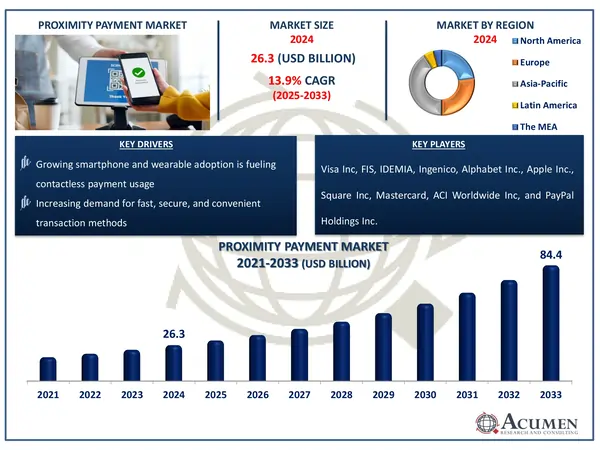

The Global Proximity Payment Market Size accounted for USD 26.3 Billion in 2024 and is estimated to achieve a market size of USD 84.4 Billion by 2033 growing at a CAGR of 13.9% from 2025 to 2033.

The Global Proximity Payment Market Size accounted for USD 26.3 Billion in 2024 and is estimated to achieve a market size of USD 84.4 Billion by 2033 growing at a CAGR of 13.9% from 2025 to 2033.

Proximity payment is a contactless payment technique that allows users to complete transactions by tapping or bringing a payment-enabled device, such as a smartphone, smartwatch, or contactless card, near a point-of-sale (POS) terminal. This strategy has grown in popularity because of its speed, convenience, and cleanliness benefits, particularly in retail, transportation, and hospitality. It uses technologies including near field communication (NFC), QR codes, and Bluetooth Low Energy (BLE) to enable safe, real-time payments without physical contact.

According to the Secure Technology Alliance, NFC is a standards-based wireless communication technology that allows data exchange between devices within a few centimeters. NFC-based mobile payments employ the same infrastructure as contactless credit and debit cards, including American Express ExpressPay, Discover Network ZipSM, MasterCard PayPass, and Visa payWave.

As digital wallets and wearable devices gain acceptance, proximity payments revolutionize the checkout experience, offering consumers faster and more seamless interactions with companies.

|

Market |

Proximity Payment Market |

|

Proximity Payment Market Size 2024 |

USD 26.3 Billion |

|

Proximity Payment Market Forecast 2033 |

USD 84.4 Billion |

|

Proximity Payment Market CAGR During 2025 - 2033 |

13.9% |

|

Proximity Payment Market Analysis Period |

2021 - 2033 |

|

Proximity Payment Market Base Year |

2024 |

|

Proximity Payment Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Offering, By Payment Type, By Technology, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Visa Inc, Alphabet Inc., Apple Inc., FIS, IDEMIA, Ingenico, Square Inc, Mastercard, ACI Worldwide Inc, and PayPal Holdings Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The growing proliferation of smartphones and wearable devices is a major driver in the proximity payment business. In the first half of 2024, India's smartphone market shipped 69 million devices, up 7.2% year on year. According to IDC's Worldwide Quarterly Mobile Phone Tracker, 35 million smartphones were shipped in the second quarter of CY24, representing a 3.2% rise. These gadgets frequently include NFC and other contactless technology, allowing users to perform quick and secure transactions with ease.

Consumers are increasingly lured to payment methods that provide speed, security, and convenience, particularly in retail and transportation. The World Bank's Fast Payments Toolkit emphasizes the importance of fast payments, noting that central bank RTGS systems are increasingly used to clear and settle such transactions. Reinforcing this trend, the National Payments Corporation of India (NPCI) stated in August 2022 that UPI would be extended to QR code-based in-store payments across all PayXpert point-of-sale devices in the UK. This highlights the global trend of quick, user-friendly payment options.

Despite the market's expansion, security and privacy concerns remain a major issue. Data breaches, unauthorized access, and fraud continue to erode customer confidence in contactless payment solutions.

The deployment of 5G and IoT creates significant opportunity to improve proximity payment infrastructure. According to the Atlantic Council, the World Radiocommunication Conference 2023 (WRC-23) transformed global mobile connectivity by allocating the 6 GHz band (6.425-7.125 GHz) for International Mobile Telecommunications (IMT) across all ITU regions, including Europe, the Americas, and Asia-Pacific. With support from countries representing more than 60% of the world's population, this harmonization represents a significant step forward in extending mobile broadband capacity.

The widespread acceptance of the 6 GHz spectrum is critical for the deployment of 5G-Advanced and future 6G technologies, which are expected to fulfill increasing mobile data demands. Improved connectivity through these technologies is predicted to greatly improve the proximity payment market, enabling faster, more secure, and reliable transactions.

The worldwide market for proximity payment is split based on offering, payment type, technology, application, and geography.

According to proximity payment industry analysis, solution offerings, dominates in business need integrated platforms that comprise hardware, software, and services. Mobile wallets, payment gateways, POS systems, and security measures all contribute to seamless and secure transactions. Companies want all-in-one packages to streamline operations and improve the customer experience. This comprehensive approach fosters acceptance in the retail, hospitality, and financial industries.

According to payment type, smartphones dominate the proximity payment business because they are the most accessible and extensively utilized devices for digital transactions. Smartphones with NFC, biometric security, and mobile wallet apps provide a convenient and secure way to make contactless payments. Customers prefer smartphones because they can link payments with loyalty programs, discounts, and receipts. Their multifunctionality makes them the principal tool pushing adoption in a variety of industries.

Based on technology, near field communication (NFC) leads the proximity payment market due to its quick, secure, and smooth transaction capabilities. NFC, which is widely used in smartphones, smartwatches, and point-of-sale terminals, allows for tap-and-go payments that improve consumer ease. Major platforms, such as Apple Pay, Google Pay, and Samsung Pay, rely largely on NFC technology. Bluetooth technology is utilized in location-based payment and loyalty systems, but acceptance has been delayed due to its complexity and setup requirements. QR codes are becoming increasingly popular, particularly in emerging economies, because of their inexpensive cost and ease of use without specialist technology.

According to proximity payment market forecast, grocery stores dominate the proximity payment industry because of their high frequency and volume of daily purchases. Shoppers prefer contactless payments due to their quickness and convenience, particularly during busy hours and in light of post-pandemic hygiene concerns. Retailers have largely used NFC-enabled POS systems to speed up checkouts and eliminate waits. Loyalty integration and promotional incentives via mobile wallets drive up usage in this group.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

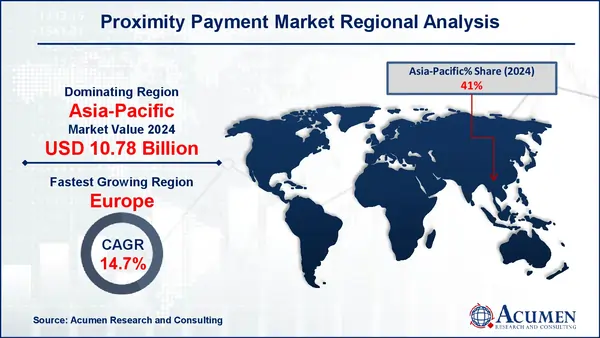

In terms of regional segments, Asia-Pacific dominates the proximity payment market, owing to significant smartphone adoption, powerful mobile wallet networks, and supportive government efforts. Countries such as China and India have quickly adopted digital payment services like Alipay, WeChat Pay, and Paytm. According to a Mastercard survey conducted in September 2022, 66% of Chinese consumers had reduced their cash usage in the last year. According to the Organisation for Research on China and Asia (ORCA), the People's Bank of China reported US$73.78 trillion in transaction value from 151.23 billion mobile payments in 2021, a 21.94% rise in value and 22.73% increase in volume over the previous year. The region's vast unbanked population, increased internet penetration, retail digitization, and urbanization all contribute to its market domination.

Europe is evolving as a fast-growing proximity payments region, driven by advanced fintech innovation and strong legislative frameworks such as PSD2. The presence of major industry players boosts its position. For example, in April 2024, Telefónica, IDEMIA Secure Transactions, and Quside formed a ground-breaking cooperation to implement quantum-safe solutions for IoT devices. This program establishes new security standards to secure device infrastructure and data from future quantum threats. Major markets such as the UK, Germany, and France continue to enhance their digital infrastructure, fostering future growth in the sector.

Some of the top proximity payment companies offered in our report includes Visa Inc, Alphabet Inc., Apple Inc., FIS, IDEMIA, Ingenico, Square Inc, Mastercard, ACI Worldwide Inc, and PayPal Holdings Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2024

July 2020

April 2025

November 2020