January 2022

Quick Commerce Market Size accounted for USD 67.2 Billion in 2022 and is projected to achieve a market size of USD 467.9 Billion by 2032 growing at a CAGR of 21.7% from 2023 to 2032.

The Quick Commerce Market Size accounted for USD 67.2 Billion in 2022 and is projected to achieve a market size of USD 467.9 Billion by 2032 growing at a CAGR of 21.7% from 2023 to 2032.

Quick Commerce Market Highlights

Quick commerce refers to the emerging trend in e-commerce that focuses on ultra-fast and on-demand delivery of goods, typically within a very short time frame, often within an hour or less. This model aims to provide consumers with instant access to a wide range of products, ranging from groceries to household items, pharmaceuticals, and more. Quick commerce platforms leverage advanced logistics, technology, and a network of local fulfillment centers to fulfill orders rapidly, meeting the increasing demand for convenience and immediacy in the digital shopping experience.

The market growth of quick commerce has been significant and is expected to continue expanding. The acceleration of digital transformation, coupled with changing consumer preferences for faster and more convenient delivery options, has driven the rapid adoption of quick commerce services globally. Several startups and established e-commerce players have entered this space, investing in infrastructure, technology, and partnerships to enhance their capabilities in providing swift and efficient delivery services. The growth of quick commerce is also influenced by factors such as urbanization, the rise of smartphone usage, and the increasing expectation of on-demand services like groceries and food delivery.

Global Quick Commerce Market Trends

Market Drivers

Market Restraints

Market Opportunities

Quick Commerce Market Report Coverage

| Market | Quick Commerce Market |

| Quick Commerce Market Size 2022 | USD 67.2 Billion |

| Quick Commerce Market Forecast 2032 | USD 467.9 Billion |

| Quick Commerce Market CAGR During 2023 - 2032 | 21.7% |

| Quick Commerce Market Analysis Period | 2020 - 2032 |

| Quick Commerce Market Base Year |

2022 |

| Quick Commerce Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Payment Mode, By Technology, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Swiggy, Blink Commerce Private Limited, Dunzo, Supermarket Grocery Supplies Pvt Ltd (Big Basket), Flink, KiranaKart Technologies Private Limited (Zepto), Quickcommerce Ltd., Zapp, Delivery Hero, Rappi, MaplebearInc.(Instacart), and foodpanda. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Quick commerce, often abbreviated as Q-commerce, refers to a subset of e-commerce that focuses on providing ultra-fast and on-demand delivery services for everyday goods. It is characterized by the rapid fulfillment of orders, typically within an hour or even less. Quick commerce platforms leverage advanced logistics and technology to streamline the entire process, from order placement to delivery, catering to consumers who prioritize convenience and immediacy in their shopping experiences. The applications of quick commerce are diverse and span various sectors. One primary application is in the delivery of groceries and household essentials, allowing consumers to replenish their supplies quickly without the need to visit physical stores. Additionally, quick commerce is extended to the delivery of prepared meals and food items, making it a popular choice for those seeking instant meal solutions. The convenience of quick commerce is not limited to just food and groceries; it has expanded to include a wide range of products, from pharmaceuticals to electronics, meeting the urgent needs of consumers in various aspects of their daily lives.

The quick commerce market has experienced remarkable growth driven by changing consumer habits and the ongoing digital transformation of retail. The demand for instant delivery of everyday goods has surged, fueled by the convenience-seeking behavior of consumers. The COVID-19 pandemic acted as a significant catalyst, accelerating the adoption of quick commerce as lockdowns and safety concerns led more people to explore and embrace online shopping for essential items. Investors and businesses have recognized the potential in this sector, leading to substantial funding and investment in quick commerce platforms. Both established players and startups are competing to capture market share, resulting in rapid expansion and technological innovations within the quick commerce ecosystem. The market growth is expected to continue as companies refine their delivery networks, leverage data analytics for enhanced customer experiences, and explore opportunities in new geographic regions.

Quick Commerce Market Segmentation

The global Quick Commerce Market segmentation is based on product, payment mode, technology, and geography.

Quick Commerce Market By Product

According to the quick commerce industry analysis, the food & groceries segment accounted for the largest market share in 2022. This growth is driven by shifting consumer preferences towards convenient and on-demand access to fresh produce and daily essentials. The COVID-19 pandemic significantly accelerated this trend, as lockdowns and safety concerns prompted a surge in online grocery shopping. Quick commerce platforms specializing in food and groceries have capitalized on this demand by offering swift delivery services, often within the hour, providing consumers with a faster and more flexible alternative to traditional grocery shopping. The growth in this segment is further fueled by advancements in technology and logistics, allowing quick commerce platforms to optimize supply chain operations and streamline last-mile delivery.

Quick Commerce Market By Payment Mode

In terms of payment modes, the online segment is expected to witness significant growth in the coming years. The convenience of ordering products online, coupled with the ability to receive swift deliveries, has contributed to the significant expansion of the online quick commerce market. The COVID-19 pandemic has played a pivotal role in accelerating this growth, as lockdowns and social distancing measures have prompted a surge in online shopping across various sectors, including groceries, household items, and other essentials. The growth of the online segment is further driven by advancements in e-commerce technologies, user-friendly mobile applications, and seamless payment options. Quick commerce platforms operating in the online space have capitalized on these developments, offering a diverse range of products with rapid delivery services to meet the evolving expectations of consumers.

Quick Commerce Market By Technology

According to the quick commerce market forecast, the application-based operation segment is expected to witness significant growth in the coming years. This growth is driven by the widespread adoption of smartphones and the increasing reliance on mobile applications for everyday activities. Quick commerce platforms have leveraged mobile apps to streamline the ordering process, enhance user experiences, and provide real-time updates on deliveries. The ease of use and accessibility offered by these applications have contributed significantly to the success of the application-based operation segment. The COVID-19 pandemic has further accelerated the adoption of application-based quick commerce services, as lockdowns and social distancing measures prompted a surge in app usage for online shopping. Consumers appreciate the convenience of browsing a wide range of products, placing orders, and tracking deliveries-all within the palm of their hands. As businesses continue to invest in the development and improvement of their mobile applications, the application-based operation segment is poised for continued growth.

Quick Commerce Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

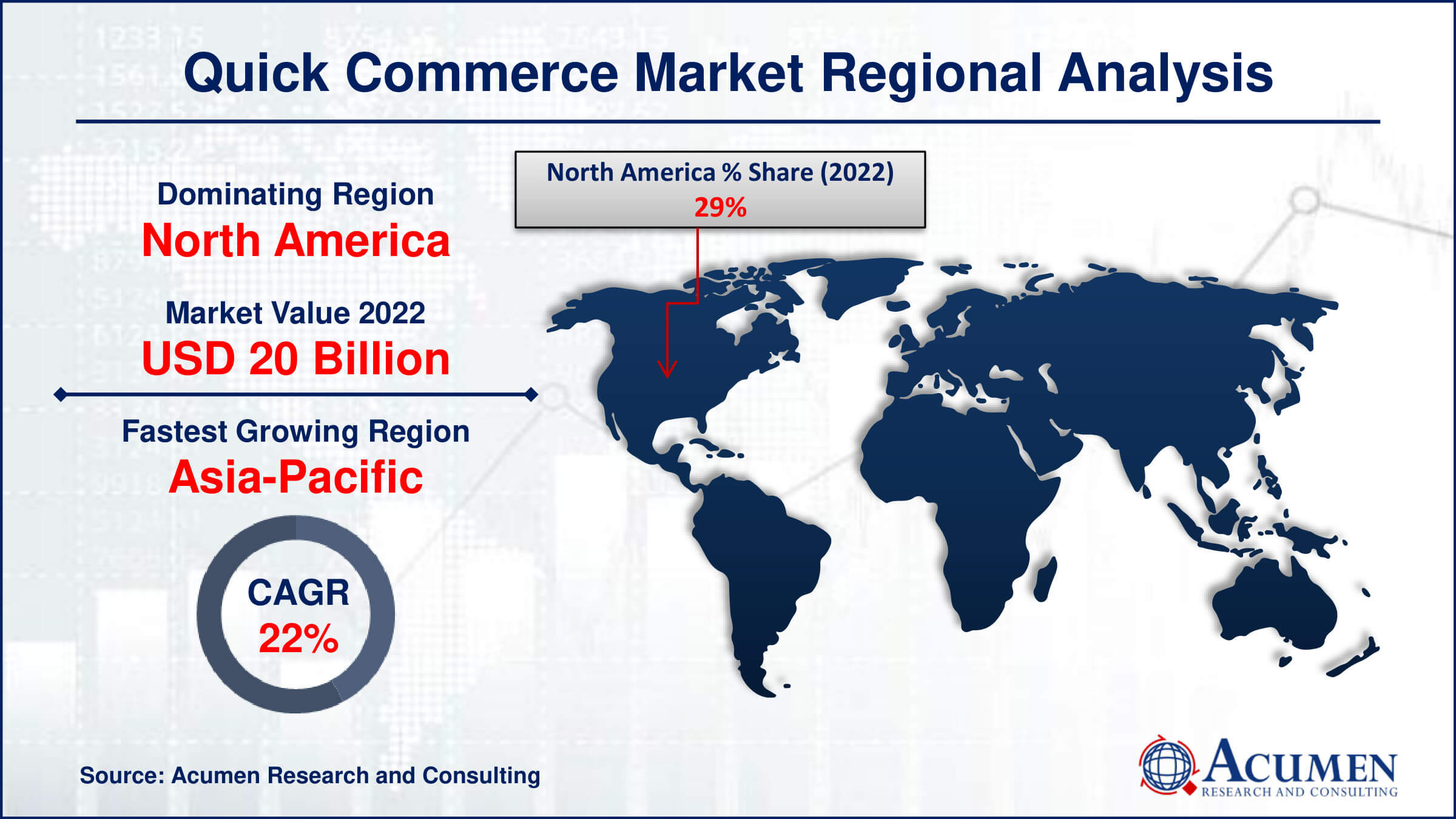

Quick Commerce Market Regional Analysis

Geographically, North America has emerged as a dominating region in the quick commerce market, showcasing significant growth and market share. One of the key drivers of this dominance is the well-established e-commerce infrastructure and tech-savvy consumer base in countries like the United States and Canada. Consumers in North America have quickly embraced the concept of on-demand, instant delivery for groceries, household items, and other essentials, contributing to the rapid expansion of quick commerce platforms. The presence of major players and early adoption of innovative technologies has further fueled North America's leadership in the quick commerce space. Established e-commerce giants and tech companies in the region have invested heavily in developing efficient last-mile delivery solutions, leveraging advanced logistics and data analytics to optimize operations. The competitive landscape has also driven continuous innovation, with companies focusing on enhancing user experiences, expanding product offerings, and improving delivery times. Additionally, the impact of the COVID-19 pandemic, which prompted a surge in online shopping and a shift toward contactless deliveries, has further solidified North America's position as a dominant force in the quick commerce market.

Quick Commerce Market Player

Some of the top quick commerce market companies offered in the professional report include Swiggy, Blink Commerce Private Limited, Dunzo, Supermarket Grocery Supplies Pvt Ltd (Big Basket), Flink, KiranaKart Technologies Private Limited (Zepto), Quickcommerce Ltd., Zapp, Delivery Hero, Rappi, MaplebearInc.(Instacart), and foodpanda.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2022

October 2020

January 2024

October 2023