May 2023

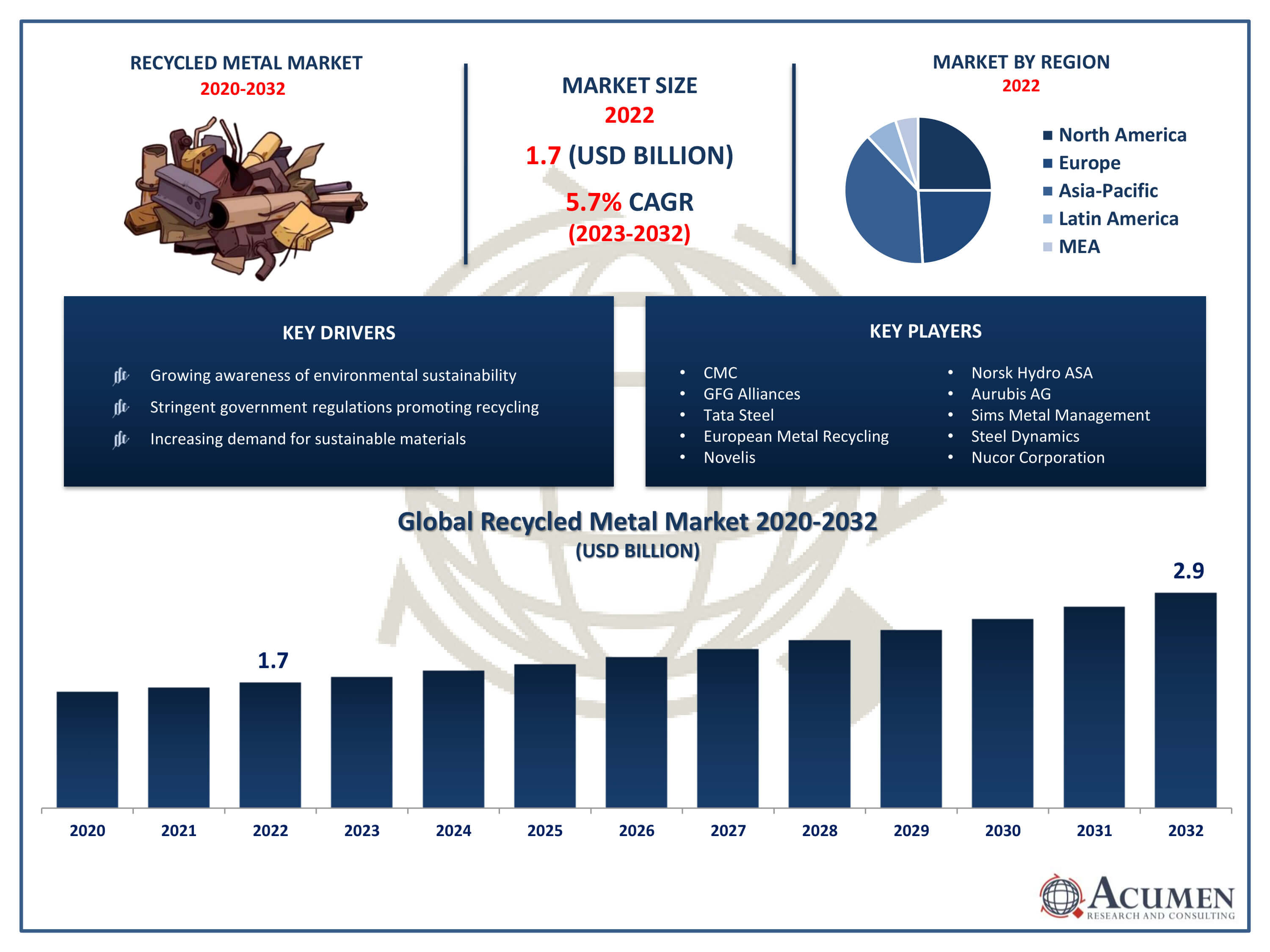

The Recycled Metal Market Size was USD 1.7 Billion in 2022 and is projected to reach USD 2.9 Billion by 2032, with a CAGR of 5.7% from 2023 to 2032.

The Recycled Metal Market Size accounted for USD 1.7 Billion in 2022 and is projected to achieve a market size of USD 2.9 Billion by 2032 growing at a CAGR of 5.7% from 2023 to 2032.

Recycled Metal industry Highlights

Metals that are recovered and repurposed by means of different procedures including melting, refining, and reprocessing are referred to as recycled metal. This includes abandoned consumer goods, wrecked infrastructure, and scrap metal from industrial waste. Recycling metal has several positive effects on the environment, such as lowering the need to extract raw materials, saving energy, and lowering greenhouse gas emissions related to the manufacture of metal. Furthermore, because metal trash may be diverted from disposal locations, recycling metal helps ease the burden on landfill capacity.

Metals that are recovered and repurposed by means of different procedures including melting, refining, and reprocessing are referred to as recycled metal. This includes abandoned consumer goods, wrecked infrastructure, and scrap metal from industrial waste. Recycling metal has several positive effects on the environment, such as lowering the need to extract raw materials, saving energy, and lowering greenhouse gas emissions related to the manufacture of metal. Furthermore, because metal trash may be diverted from disposal locations, recycling metal helps ease the burden on landfill capacity.

Recent years have seen a notable increase in the market for recycled metal due to a number of causes, such as growing public awareness of environmental concerns, strict government laws supporting recycling programs, and financial incentives related to metal recycling. The recycled metal market has also expanded as a result of the growing need for environmentally friendly and sustainable materials in sectors including manufacturing, transportation, and construction. Furthermore, as recycling technology have advanced, the cost and efficiency of processing recovered metal have decreased, making it a more appealing alternative for companies looking to save costs without sacrificing sustainability. For instance In April 2022, Apple Inc. declared that 59% of the aluminum used in Apple Inc. products was sourced from recycled materials in 2021, accounting for roughly 20% of all materials used in Apple Inc. goods.

Global Recycled Metal Market Trends

Market Drivers

Market Restraints

Market Opportunities

Recycled Metal Market Report Coverage

| Market | Recycled Metal Market |

| Recycled Metal Market Size 2022 | USD 1.7 Billion |

| Recycled Metal Market Forecast 2032 | USD 2.9 Billion |

| Recycled Metal Market CAGR During 2023 - 2032 | 5.7% |

| Recycled Metal Market Analysis Period | 2020 - 2032 |

| Recycled Metal Market Base Year |

2022 |

| Recycled Metal Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Metal, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | CMC, GFG Alliances, Tata Steel, ELG HanielGmbh and Schnitzer Steel, European Metal Recycling, Novelis, Norsk Hydro ASA, Aurubis AG, Sims Metal Management, Steel Dynamics, Commercial Metal Company, and Nucor Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Metal that has been recovered and processed from a variety of scrap sources, such as abandoned consumer goods, industrial trash, and demolished infrastructure, is known as recycled metal. These metals are converted into reusable materials by procedures including melting, refining, and reshaping, which lessens the need for obtaining new raw materials and reduces environmental effect. Among the metals that are frequently recycled are brass, copper, steel, and aluminum. In addition to protecting natural resources, recycling metal also saves energy and lowers greenhouse gas emissions from conventional metal manufacturing processes. Recycled metal has a wide range of uses in many different sectors. Recycled metal is utilized in roofing materials, reinforcing bars, and structural components in construction. It finds use in car bodywork, engines, and other components in the automotive industry. Furthermore, recycled metal is widely used in the production of consumer items including electronics, appliances, and packaging materials.

The market for recycled metal has grown significantly throughout the recycled metal industry forecast period due to a confluence of factors including economic incentives, regulatory pressures, and environmental awareness. For example, the governments of India and the United Arab Emirates signed the Comprehensive Economic Partnership Agreement (CEPA) in May 2022. India should find it simpler to import scrap from the UAE as a result of this deal. By 2030, India hopes to increase its steel production from 118 million tons to 300 million tones. Recycled metal will thus be crucial to reaching the stated goal. The demand for recycled metal has increased as an environmentally suitable substitute for virgin metal as cultures throughout the world place a greater emphasis on sustainability. Governments and regulatory agencies have imposed strict regulations to encourage recycling and lessen dependency on the production of raw metals, which has further accelerated market expansion. Technological developments have also been a major factor in the recycled metal market's expansion. Technological advancements in recycling procedures have increased productivity, decreased expenses, and broadened the range of metals that may be recycled successfully. Thanks to these developments, recycled metal is now a more appealing and feasible choice for businesses looking to be economically competitive while yet achieving their environmental targets.

Recycled Metal Market Segmentation

The global recycled metal market segmentation is based on metal, end user, and geography.

Recycled Metal Market By Metal

According to the recycled metal industry analysis, regarding metals category, the ferrous metals sub segment held the most market share in 2022. The growing need for sustainable materials in sectors like manufacturing, automotive, and construction is one important motivator. These industries require a lot of ferrous metals, such steel and iron, therefore using recycled ferrous metals instead of raw resources is more ecologically benign. In order to satisfy sustainability goals while upholding quality and performance requirements, businesses are increasingly turning to recycled ferrous metals as awareness of the environmental effects of traditional metal manufacturing rises. Moreover, ferrous scrap metal processing is now more efficient and economical because to developments in recycling technology. Technological advancements including enhanced sorting methods, sophisticated shredding apparatus, and enhanced melting procedures have simplified ferrous metal recycling, rendering it a progressively appealing choice for manufacturers and customers alike.

Recycled Metal Market By End User

According to the recycled metal market forecast period, it's anticipated that the construction industry will expand significantly in the upcoming years. The growing focus on sustainability in the building sector is one important motivator. As stakeholders become more conscious of how building projects affect the environment, they are looking more and more to recycled metals as a greener substitute for raw resources. Steel and aluminium are two examples of recycled metals that function similarly to their virgin counterparts but have a far lower carbon footprint during extraction and processing, which makes them a popular option for environmentally friendly building projects. In addition, the construction industry has grown as a result of the growing demand for environmentally friendly building materials and sustainable construction methods. To help stimulate market growth, governments and regulatory organisations are also putting rules and incentives in place to encourage the use of recycled materials in construction.

Recycled Metal Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Recycled Metal Market Regional Analysis

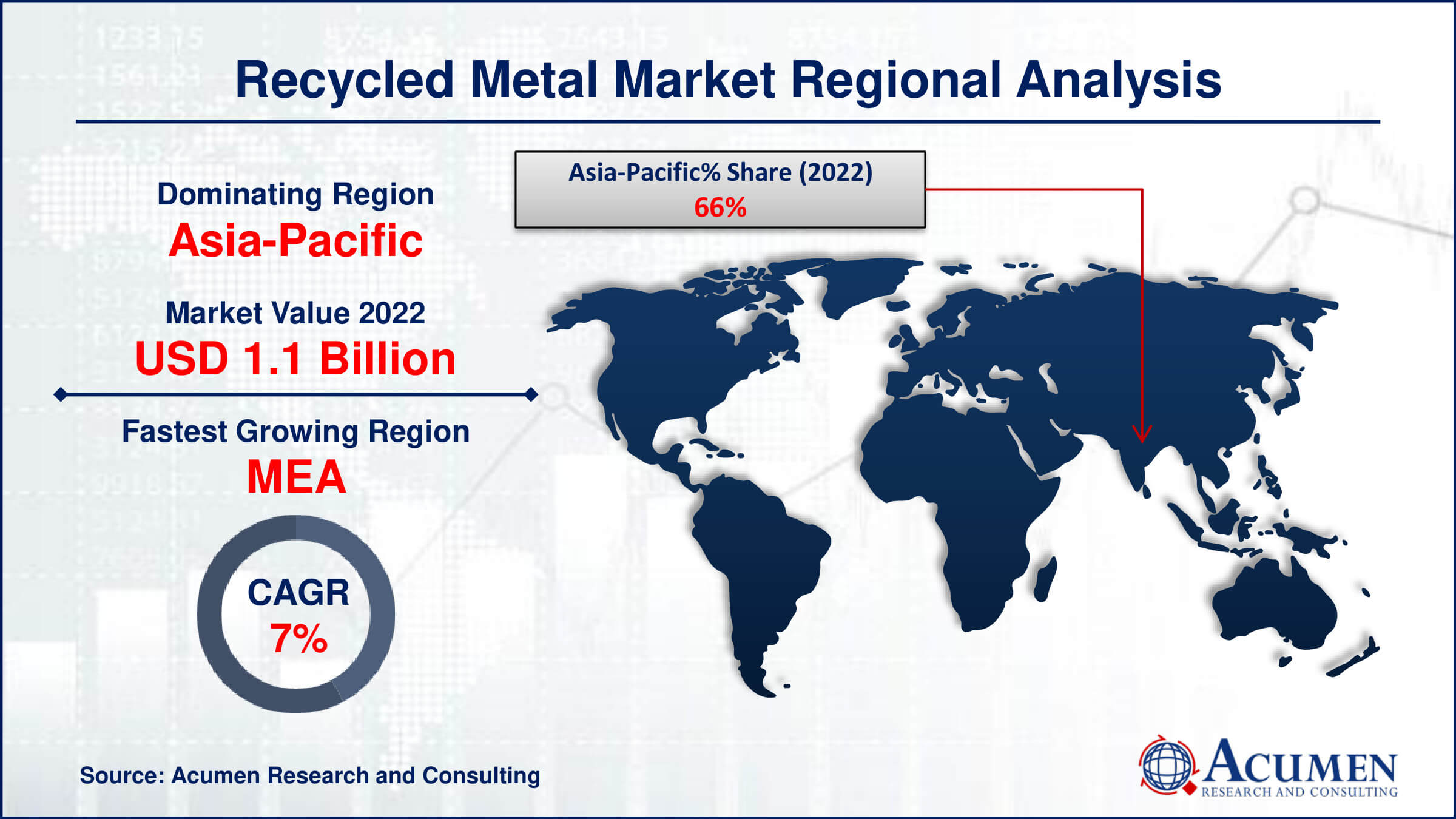

In terms of recycled metal market analysis, with a substantial market share, the Asia-Pacific region has become a dominant force industry due to a number of factors. First off, the manufacturing, construction, and consumer goods industries have produced a significant amount of metal trash as a result of the region's fast industrialization and urbanization. This plentiful supply of scrap metal supports a strong recycling ecosystem throughout the Asia-Pacific region by acting as a vital feedstock for the sector. In addition major Indian steel manufacturer Tata Steel announced plans to build a metal recycling facility in June 2019. It would be the first recycling facility in India.

Moreover, the Asia-Pacific area has adopted recycling activities more quickly due to growing environmental concerns and strict legislation meant to lower carbon emissions and promotes sustainable practices. Governments in nations including South Korea, Japan, China, and India have put laws and incentives in place to promote recycling and reduce dependency on the production of primary metals. For example, the governments of India and the United Arab Emirates signed the Comprehensive Economic Partnership Agreement (CEPA) in May 2022. These policies have encouraged industry to invest in recycling infrastructure and implement sustainable methods, which has fueled the increase of recycled metal. In addition, the growing industrial sector in the Asia-Pacific area and the expansion of infrastructure development projects has stimulated demand for recycled metal in a variety of industries.

Recycled Metal Market Player

Some of the top recycled metal market companies offered in the professional report include CMC, GFG Alliances, Tata Steel, ELG HanielGmbh and Schnitzer Steel, European Metal Recycling, Novelis, Norsk Hydro ASA, Aurubis AG, Sims Metal Management, Steel Dynamics, Commercial Metal Company, and Nucor Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2023

November 2020

April 2023

January 2021