March 2023

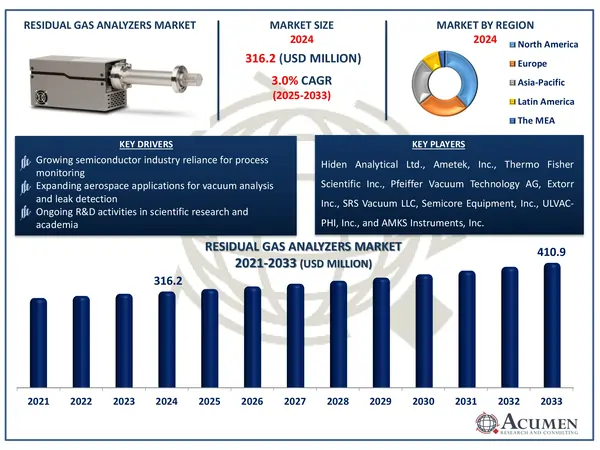

The Global Residual Gas Analyzers Market Size accounted for USD 316.2 Million in 2024 and is estimated to achieve a market size of USD 410.9 Million by 2033 growing at a CAGR of 3.0% from 2025 to 2033.

The Global Residual Gas Analyzers Market Size accounted for USD 316.2 Million in 2024 and is estimated to achieve a market size of USD 410.9 Million by 2033 growing at a CAGR of 3.0% from 2025 to 2033.

A residual gas analyzer (RGA) is a highly specialized and durable mass spectrometer primarily used for monitoring and analyzing gas species within vacuum systems. Its primary functions include tracking processes, detecting leakage, and ensuring the integrity of vacuum environments utilized in various industries like scientific research, semiconductor manufacturing, and aerospace applications. RGA systems come in two primary implementations: the open ion source (OIS) and the closed ion source (CIS), both employing intricate four-piece techniques. The core components of these implementations consist of an ionization chamber, a mass filter, an ion collector, and a detector.

A residual gas analyzer (RGA) is a highly specialized and durable mass spectrometer primarily used for monitoring and analyzing gas species within vacuum systems. Its primary functions include tracking processes, detecting leakage, and ensuring the integrity of vacuum environments utilized in various industries like scientific research, semiconductor manufacturing, and aerospace applications. RGA systems come in two primary implementations: the open ion source (OIS) and the closed ion source (CIS), both employing intricate four-piece techniques. The core components of these implementations consist of an ionization chamber, a mass filter, an ion collector, and a detector.

According to U.S. Department of Energy Office of Scientific and Technical Information (OSTI.GOV), the residual gas analyzer (RGA) is a quadrupole mass spectrometer used in fusion research to measure gas concentrations from 1 to 300 amu. It aids in studying outgassing of materials like graphite and is controlled by VAX FORTRAN software for data collection, analysis, and plotting.

|

Market |

Residual Gas Analyzers Market |

|

Residual Gas Analyzers Market Size 2024 |

USD 316.2 Million |

|

Residual Gas Analyzers Market Forecast 2033 |

USD 410.9 Million |

|

Residual Gas Analyzers Market CAGR During 2025 - 2033 |

3.0% |

|

Residual Gas Analyzers Market Analysis Period |

2021 - 2033 |

|

Residual Gas Analyzers Market Base Year |

2024 |

|

Residual Gas Analyzers Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Applications, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Hiden Analytical Ltd., Thermo Fisher Scientific Inc., Pfeiffer Vacuum Technology AG, Extorr Inc., SRS Vacuum LLC, Ametek, Inc., Semicore Equipment, Inc., ULVAC-PHI, Inc., AMKS Instruments, Inc., SENTECH Instruments GmbH, Stanford Research Systems, Inc, and Inficon Holding AG. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The global demand for RGA market is expected to experience significant growth, driven by their major applications in various industries such as metallurgy, vacuum coating, and semiconductor processing. These analyzers are essential tools for monitoring and ensuring the quality of vacuum environments in these critical sectors.

In the field of metallurgy, RGAs are utilized to maintain the desired conditions within vacuum processes for metal production. They help in safeguarding the purity and quality of the final metal and alloy products by ensuring that the vacuum environment remains free from contaminants.

In vacuum coating, this finds applications in industries like optics, electronics, and automotive manufacturing, RGAs play a pivotal role. They are instrumental in analyzing and controlling the composition of gases within vacuum chambers, ensuring that thin films and coatings are deposited with precise characteristics and uniformity.

Semiconductor processing is another industry where RGAs are extensively employed. Given the high dependence on vacuum systems for semiconductor fabrication, RGAs are vital for monitoring and controlling gas levels within vacuum chambers. They help maintain the purity and quality of semiconductor products, which are the foundation of modern electronics.

Furthermore, one of the major applications of RGAs is leak monitoring. These analyzers are used to detect and pinpoint leaks within vacuum systems, a critical task for maintaining the integrity of the systems and preventing loss of vacuum pressure. Early leak detection is essential for preventing contamination and ensuring the efficiency of operations.

Additionally, RGAs excel in analyzing gas species and steam within vacuum chambers and processes. This detailed analysis aids in process optimization, quality control, and troubleshooting. By monitoring gas species, pressure, and composition, RGAs help manufacturers maintain precise conditions for their processes, ultimately contributing to improved product quality and efficiency.

The increasing demand for RGA market in these applications is driven by the need for strict quality control, cost savings, the growing use of vacuum technology in various industries, environmental concerns related to gas emissions, and ongoing research and development activities. These factors collectively support the global growth of the residual gas analyzer (RGA) market, making them indispensable tools in maintaining the reliability and performance of vacuum systems across multiple sectors.

Residual Gas Analyzers Market Segmentation

Residual Gas Analyzers Market SegmentationThe worldwide market for residual gas analyzers is split based on type, application, and geography.

According to residual gas analyzers industry analysis, in 2024, open ion source (OIS) RGAs will have a substantial market share in 2024. In the open ion source configuration, the ionization chamber is open to the vacuum system, allowing gas molecules to enter and be ionized. The mass filter then separates ions based on their mass-to-charge ratio (m/z), permitting only specific ions to pass through. These selected ions are collected and detected, and the resulting ion currents are analyzed to identify gas species and their concentrations, aiding in process monitoring and leak detection.

Conversely, the closed ion source (CIS) seals the ionization chamber from the vacuum system and introduces gas molecules via a controlled leak. The mass filter and subsequent ion collection and detection processes are similar to the OIS. However, this sealed design minimizes the risk of introducing external contaminants into the vacuum system, making it particularly suitable for applications with stringent contamination requirements.

According to residual gas analyzers market forecast, segmented into industrial applications, laboratory research, and others, sees the industrial sector taking the lead. Industries spanning manufacturing, metallurgy, aerospace, and semiconductor fabrication employ RGAs to maintain vacuum environment quality and gas composition control. In semiconductor manufacturing, RGAs ensure the purity of vacuum chambers for microchip production. Industrialization's global surge and technological advancements fuel RGAs demand. Industries seeking advanced processes increasingly require precise gas analysis and control, sustaining industrial applications' growth.

Laboratory research, primarily in academic and scientific settings, uses RGAs for controlled gas analysis, chemical reaction study, and scientific exploration. While this segment's market share is smaller, it is critical for scientific progress. The 'others' category, encompassing specialized applications such as environmental monitoring and space exploration, also contributes to RGAs' diverse utility. The RGAs market predominant industrial focus stems from industries' need for sophisticated tools to maintain precise gas conditions in evolving processes, ensuring continued growth.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

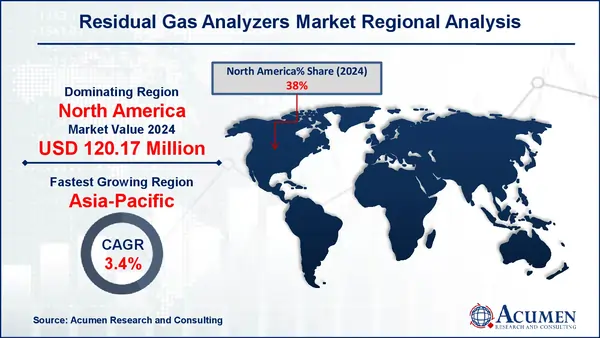

Residual Gas Analyzers Market Regional Analysis

Residual Gas Analyzers Market Regional AnalysisIn terms of regional segments, in North America, the RGA market benefits from a substantial industrial base, widespread awareness of advanced industrial and residual gas analyzers, the development of safety infrastructure, and a growing number of vendors involved in residual gas analyzers. These factors collectively make North America a region with lucrative opportunities for key vendors operating in the residual gas analyzers industry.

Asia-Pacific is expected to see a significant growth in residual gas analyzers industry. China is also poised for growth in the residual gas analyzer (RGA) market during the forecast period. This growth can be attributed to the increasing utilization of dissolved gas analyzers in large power transformer facilities, reflecting China's expanding industrial landscape and its focus on improving energy efficiency.

In Europe, the residual gas analyzer (RGA) market is expected to experience significant growth, driven by the implementation of energy-efficient programs and regulatory initiatives. These measures encourage the adoption of advanced gas analyzers.

Overall, the global residual gas analyzer (RGA) market is influenced by regional factors, such as industrial activity, regulatory environment, and infrastructure development, shaping opportunities and growth trajectories in each region.

Some of the top residual gas analyzers companies offered in our report include Hiden Analytical Ltd., Thermo Fisher Scientific Inc., Pfeiffer Vacuum Technology AG, Extorr Inc., SRS Vacuum LLC, Ametek, Inc., Semicore Equipment, Inc., ULVAC-PHI, Inc., AMKS Instruments, Inc., SENTECH Instruments GmbH, Stanford Research Systems, Inc, and Inficon Holding AG.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

October 2020

November 2024

April 2021