December 2024

Retail Logistics Market is estimated to reach USD 622 Billion by 2030 with a CAGR of 12%

The Global Retail Logistics Market size accounted for USD 231 Billion in 2021 and is estimated to reach USD 622 Billion by 2030.

According to our worldwide retail logistics industry analysis, the market is expected to bolster due to the global transportation infrastructure expansion. Increased world trade activity is one of the retail logistics market trends that is fueling industry demand all over the world. As a result, the retail logistics market forecast suggests that the industry is expected to grow with a 12% CAGR throughout the projected years from 2022 to 2030 Retail logistics is the process of managing the flow of goods between the manufacturer and the consumer. Retail logistics system facilitates the proper flow of products to customers through efficient logistics movement.

Retail Logistics Market Growth Drivers:

Retail Logistics Market Restraints:

Retail Logistics Market Opportunities:

Report Coverage

| Market | Retail Logistics Market |

| Market Size 2021 | USD 231 Billion |

| Market Forecast 2030 | USD 622 Billion |

| CAGR During 2022 - 2030 | 12% |

| Analysis Period | 2018 - 2030 |

| Base Year | 2021 |

| Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Solution, By Mode of Transport, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | APL Logistics Ltd, C.H. Robinson Worldwide, A.P. Moller – Maersk, Inc., DSV, DHL International GmbH, FedEx, Nippon Express, Kuehne + Nagel International, United Parcel Service, Schneider, and XPO Logistics, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

| Customization Scope |

10 hrs of free customization and expert consultation |

Retail Logistics Market Dynamics

The rising implementation of digital freight brokerage in logistics services is one of the trends fueling the retail logistics market revenue. The digital freight brokerage service enables on-demand delivery of goods. Furthermore, these services provide real-time tracking of the commodities being transported, providing greater security and lowering the risk of loss in transit. The growing integration of advanced technologies in the retail and logistics sector is another trend that is anticipated to boost the global retail logistics market value. Artificial intelligence, machine learning, blockchain, and other cutting-edge technologies are expected to see widespread adoption in the retail industry. AI benefits include tailored experiences, improved data management, predictive analysis, and real-time support. Additionally, virtual assistants, chatbots, and other AI applications assist retailers in staying in touch with their customers. This increases company profits by informing customers about promotions and sales.

Another key factor driving demand for retail logistics is the rising trend of online purchasing. Online purchasing has increased the demand for easy and quick delivery and pick-up of products chosen by customers, which has increased the demand for logistics both nationally and internationally. However, the change in consumer behavior following the COVID-19 pandemic has negatively impacted the retail logistics market growth. Global lockdowns, supply and demand disruptions, inventory delays, evolving consumer shopping behaviors, and changing trade policies have all been challenges for business owners during the pandemic.

The growing e-commerce industry is the leading aspect that is expected to generate numerous growth opportunities for the market in the coming years. Since in-store or physical retail is the principal channel in this industry, kinds of non-store retailing are becoming extremely prevalent too. E-commerce or online retailing channels are gaining traction in many global markets. Many retailers use an omnichannel model, that aims to seamlessly integrate offline and online channels. Furthermore, the advent of IoT in logistics and supply chain management is also likely to create several prospects during the forecast timeframe 2022 – 2030.

Retail Logistics Market Segmentation

The global retail logistics market segmentation is based on type, solution, mode of transport, and region.

Retail Logistics Market By Type

According to our findings, the traditional retail logistics segment is likely to hold the largest market share throughout the forecast period. This is due to the increasing adoption of traditional retail logistics services by consumers who have limited reliance on the internet and thus prefer to buy from traditional retail stores. However, the e-commerce retail logistics segment grew at a rapid pace over the same time period. The increase is primarily due to the global spread of the coronavirus pandemic, which resulted in an increase in sales for e-commerce outlets. Furthermore, rising internet penetration, along with benefits such as fast delivery, quick and free returns/exchanges, lower shipping costs, and a myriad of product alternatives, are all contributing to the segment's growth.

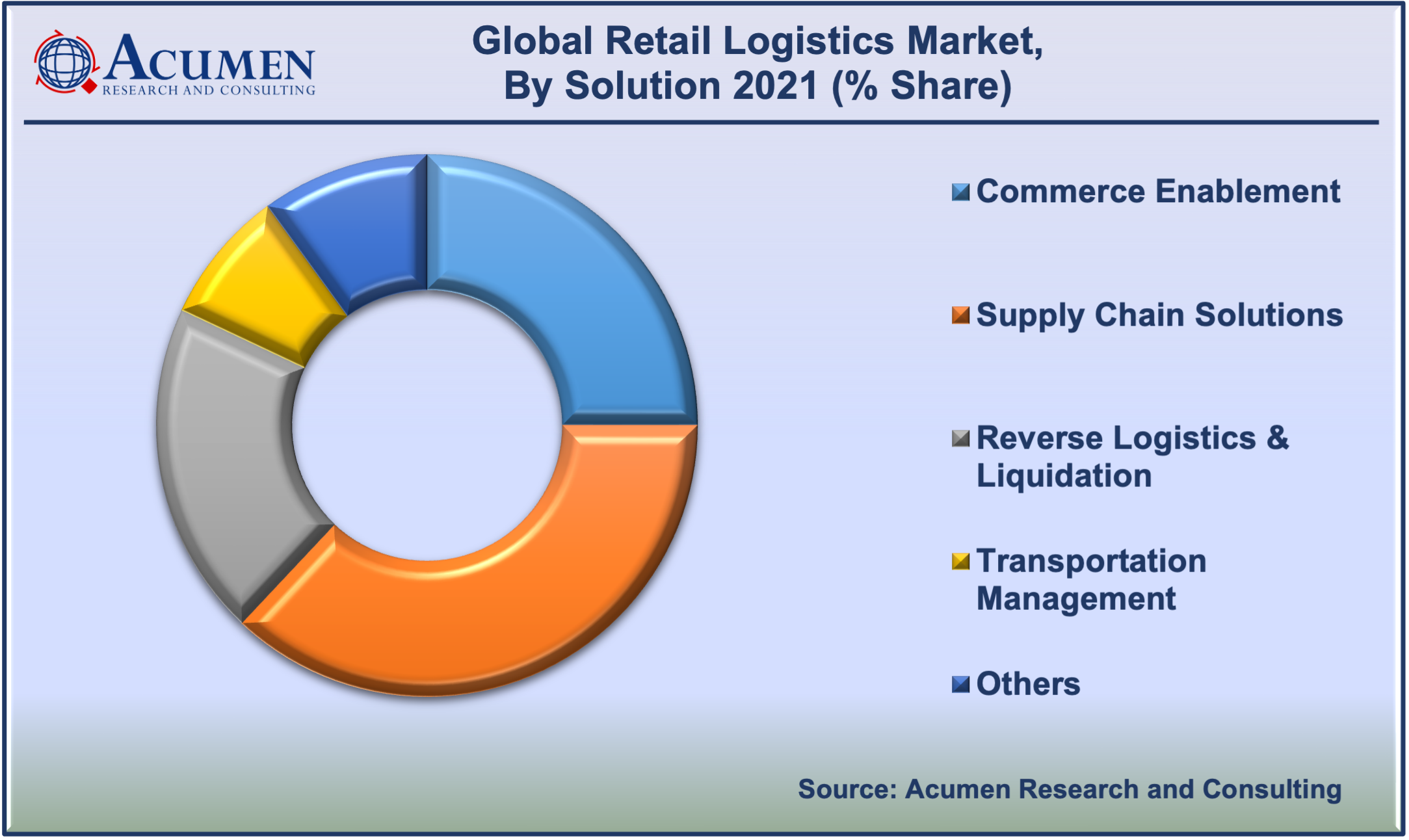

Retail Logistics Market By Solution

The supply chain solutions segment achieved a significant market share in 2021 and is expected to maintain this trend throughout the forecast timeframe. The segment's significant growth can be attributed to benefits such as on-time delivery, enhancement of omnichannel operations, personalizing kitting and order fulfillment, and effectively managing customer returns. Furthermore, supply chain solutions are expected to grow at a rapid pace in the coming year due to the increasing use of cloud-based supply chain systems, which aid in tracking and optimizing transportation and managing returns.

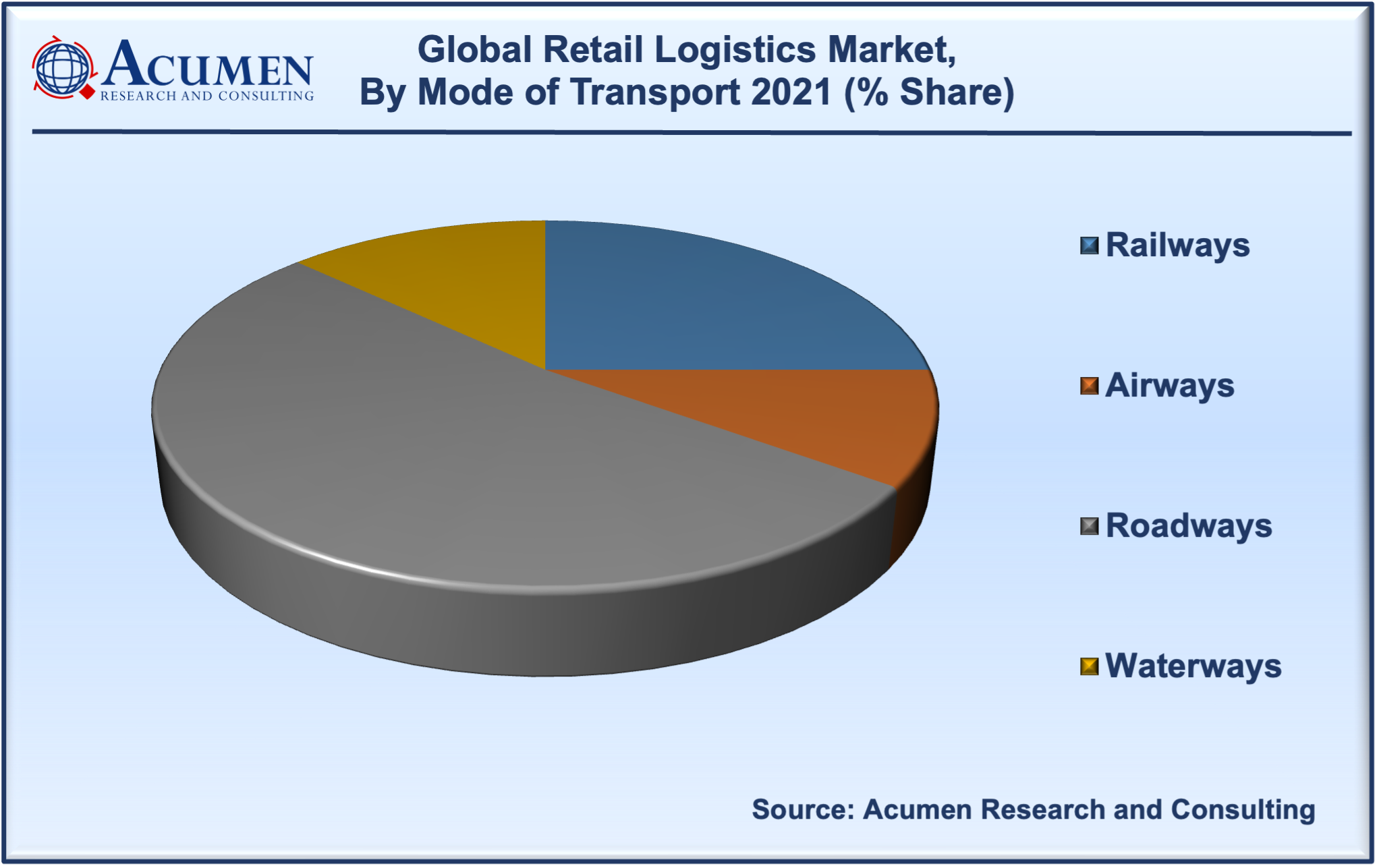

Retail Logistics Market By Mode of Transport

The roadway is expected to dominate the retail logistics market share in terms of mode of transport. This is due to the fact that the majority of logistics operations are carried out via roadway, as a result of massive investment in the freight transport industry. It also has a larger carrying capacity, which makes it a better option. Additionally, several government initiatives promote this sector growth. Furthermore, because of advancements in road transportation systems and highway improvements around the world, this trend is expected to continue in the coming years.

Retail Logistics Market Regional Outlook

North America

Europe

Latin America

Asia-Pacific

The Middle East & Africa (MEA)

Asia-Pacific region gathered maximum market share in 2021 due to the presence of a large consumer base

According to our retail logistics market regional outlook, the Asia-Pacific region is expected to dominate the market in 2021. This is attributed to the region's growing consumer base, increased adoption of e-commerce channels by individuals, and rising smartphone and internet penetration. Furthermore, in recent years, the e-commerce industry has seen tremendous growth in countries such as China, India, and Japan due to a variety of factors such as growing urbanization and rising disposable income, as well as changing customer consumption patterns.

Retail Logistics Market Players

Some of the top retail logistics companies offered in the professional report include APL Logistics Ltd, C.H. Robinson Worldwide, A.P. Moller – Maersk, Inc., DSV, DHL International GmbH, FedEx, Nippon Express, Kuehne + Nagel International, United Parcel Service, Schneider, and XPO Logistics, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2024

August 2020

February 2022

October 2024