December 2023

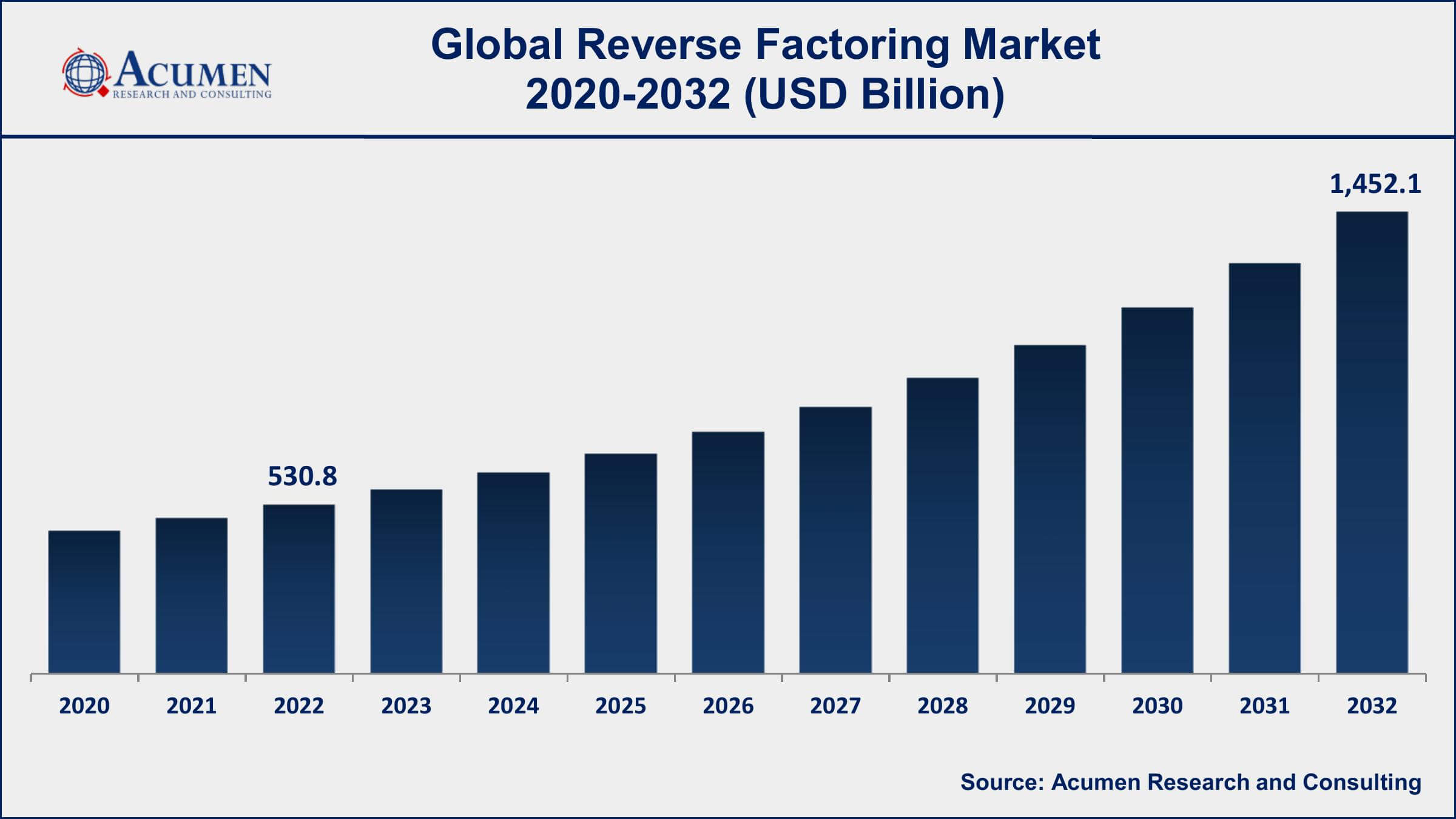

Reverse Factoring Market Size accounted for USD 530.8 Billion in 2022 and is projected to achieve a market size of USD 1,452.1 Billion by 2032 growing at a CAGR of 10.8% from 2023 to 2032.

The Reverse Factoring Market Size accounted for USD 530.8 Billion in 2022 and is projected to achieve a market size of USD 1,452.1 Billion by 2032 growing at a CAGR of 10.8% from 2023 to 2032.

Reverse Factoring Market Highlights

Reverse factoring, also known as supply chain finance, is a financial arrangement in which a large corporation collaborates with a financial institution to help its suppliers obtain financing at a lower interest rate than they would typically be able to secure. In this arrangement, the financial institution pays the suppliers on behalf of the large corporation, often at an earlier date than the payment due date. In return, the suppliers offer a discount on the invoiced amount. This benefits both the large corporation, as it ensures a stable supply chain by strengthening supplier relationships, and the suppliers, who gain access to affordable financing, improving their cash flow and liquidity positions. Reverse factoring is especially beneficial for small and medium-sized enterprises (SMEs) that may face challenges in obtaining affordable financing through traditional means.

The market for reverse factoring has been experiencing significant growth in recent years due to its potential to optimize working capital management for businesses. Companies are increasingly recognizing the importance of efficient supply chain management and are turning to reverse factoring as a strategic tool. With globalization and the complexity of modern supply chains, the demand for stable financing solutions is on the rise. Furthermore, financial institutions are becoming more adept at structuring innovative and tailored reverse factoring programs, making it an attractive option for both large corporations and their suppliers. The trend is further fueled by advancements in financial technology, which have streamlined the process, making it easier for businesses to implement and manage reverse factoring programs. As businesses continue to prioritize liquidity and operational efficiency, the market for reverse factoring is expected to show sustained growth in the coming years.

Global Reverse Factoring Market Trends

Market Drivers

Market Restraints

Market Opportunities

Reverse Factoring Market Report Coverage

| Market | Reverse Factoring Market |

| Reverse Factoring Market Size 2022 | USD 530.8 Billion |

| Reverse Factoring Market Forecast 2032 | USD 1,452.1 Billion |

| Reverse Factoring Market CAGR During 2023 - 2032 | 10.8% |

| Reverse Factoring Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Category, By Financial Institution, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Accion International, Barclays Plc, PrimeRevenue, Inc., Banco Bilbao Vizcaya Argentaria, S.A., Trade Finance Global, Deutsche Factoring Bank, Credit Suisse Group AG, JP Morgan Chase & Co., Drip Capital Inc., HSBC Group, Viva Capital Funding, LLC, Mitsubishi UFJ Financial Group, Inc., and TRADEWIND GMBH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

In reverse factoring, a large corporation partners with a financial institution to help its suppliers obtain financing at lower interest rates and better terms than they might otherwise secure. The financial institution pays the suppliers on behalf of the corporation, often before the payment due date, in exchange for a discount on the invoiced amount. This benefits both the corporation, as it ensures a stable supply chain by supporting its suppliers, and the suppliers, who gain access to affordable financing. Unlike traditional factoring where small businesses sell their invoices at a discount to a third party, reverse factoring involves the collaboration of all parties in the supply chain, creating a mutually beneficial financial arrangement. Reverse factoring finds applications across various industries and sectors. One of its primary applications is in supporting small and medium-sized enterprises (SMEs) that may struggle to secure cost-effective financing through traditional channels. By providing timely and affordable funding, reverse factoring helps SMEs manage their cash flow effectively, enabling them to invest in their operations, fulfill orders, and grow their businesses.

The reverse factoring market has been experiencing substantial growth in recent years, driven by the increasing recognition of its benefits across various industries. One of the key drivers of this growth is the growing complexity of global supply chains. As businesses expand globally, their supply chains become intricate and involve numerous suppliers, often located in different parts of the world. Reverse factoring helps in streamlining these complex supply chains by ensuring that suppliers receive timely payments, thereby enhancing the overall efficiency of the supply chain management process. This has led many large corporations to adopt reverse factoring as a strategic tool to maintain strong supplier relationships and ensure the smooth flow of goods and services. Furthermore, the rise of financial technology (FinTech) has significantly contributed to the growth of the reverse factoring market. FinTech companies have developed innovative platforms and solutions that make it easier for corporations to implement and manage reverse factoring programs. The seamless integration of technology into reverse factoring has attracted more companies to explore this financing option, further propelling market growth.

Reverse Factoring Market Segmentation

The global Reverse Factoring Market segmentation is based on category, financial institution, end-use, and geography.

Reverse Factoring Market By Category

According to the reverse factoring industry analysis, the domestic segment accounted for the largest market share in 2022. One of the primary factors driving the growth of the domestic reverse factoring market is the increasing focus on supporting small and medium-sized enterprises (SMEs). In many countries, SMEs form the backbone of the economy, contributing significantly to employment and economic growth. Reverse factoring provides these smaller entities with a lifeline, enabling them to optimize their cash flow and operate without the financial constraints that often plague businesses of their size. As governments and financial institutions in various nations recognize the vital role SMEs play, they are actively promoting domestic reverse factoring programs to empower these businesses, thereby fueling market growth. Moreover, the rise of e-commerce and digital platforms has revolutionized domestic trade dynamics.

Reverse Factoring Market By Financial Institution

In terms of financial institutions, the banks segment is expected to witness significant growth in the coming years. Banks are increasingly recognizing the potential of reverse factoring to create mutually beneficial relationships between large corporations and their suppliers. One of the key drivers of this growth is the inherent stability and reliability that banks bring to the table. Their financial expertise and robust infrastructures provide a secure environment for managing the complexities of reverse factoring transactions. As businesses, especially large corporations, seek seamless and secure financial solutions, banks have become the go-to entities to implement these intricate financing arrangements, fostering trust and confidence in the market. Additionally, the growth in the banking segment is propelled by technological advancements. Banks have been quick to leverage cutting-edge technologies, such as blockchain and artificial intelligence, to enhance the efficiency and transparency of reverse factoring processes.

Reverse Factoring Market By End-use

According to the reverse factoring market forecast, the healthcare segment is expected to witness significant growth in the coming years. One of the primary factors fueling this growth is the increasing need for healthcare providers to optimize their working capital. Hospitals, clinics, and healthcare facilities often face delayed payments from insurance companies and government agencies, leading to cash flow constraints. Reverse factoring solutions have emerged as a lifeline, enabling healthcare providers to ensure a steady cash flow by allowing them to receive early payments from financial institutions. This liquidity support is crucial for maintaining the quality of patient care, investing in advanced medical technologies, and managing day-to-day operational expenses. As the healthcare industry becomes more aware of the benefits of reverse factoring, an increasing number of providers are adopting these financial strategies, contributing significantly to market growth. Moreover, pharmaceutical companies and medical equipment suppliers are also embracing reverse factoring to strengthen their relationships with healthcare providers.

Reverse Factoring Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Reverse Factoring Market Regional Analysis

Europe has emerged as a dominating region in the reverse factoring market due to a combination of factors that have created a conducive environment for its widespread adoption. One of the key reasons is the region's strong emphasis on small and medium-sized enterprises (SMEs). Europe is home to a large number of SMEs, and these businesses often face challenges in accessing affordable financing. Reverse factoring has provided a viable solution, enabling SMEs to optimize their working capital by ensuring timely payments from larger corporations. European governments and financial institutions have been proactive in promoting these programs, recognizing the vital role SMEs play in the region's economy. This support has encouraged the widespread adoption of reverse factoring among businesses of all sizes, contributing significantly to the market's growth in Europe. Additionally, the well-established and interconnected business networks within European countries have facilitated the seamless implementation of reverse factoring programs. The region's complex supply chains, spanning multiple countries and involving numerous suppliers, demand efficient financial solutions. Reverse factoring streamlines these intricate networks by providing a standardized and reliable method of managing payments, thereby enhancing the overall efficiency of supply chain operations. Moreover, the robust regulatory framework in Europe ensures a secure environment for financial transactions, building trust among businesses and financial institutions.

Reverse Factoring Market Player

Some of the top reverse factoring market companies offered in the professional report include Accion International, Barclays Plc, PrimeRevenue, Inc., Banco Bilbao Vizcaya Argentaria, S.A., Trade Finance Global, Deutsche Factoring Bank, Credit Suisse Group AG, JP Morgan Chase & Co., Drip Capital Inc., HSBC Group, Viva Capital Funding, LLC, Mitsubishi UFJ Financial Group, Inc., and TRADEWIND GMBH.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

December 2023

May 2025

September 2023

December 2022