July 2023

RISC-V Market (By Processor Core Type: 32-bit, 64-bit, 128-bit; By Application: Data Centers, Smartphones, IoT Devices, Others; By End Use: Computing & Storage, Medical, Consumer Electronics, Industrial, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

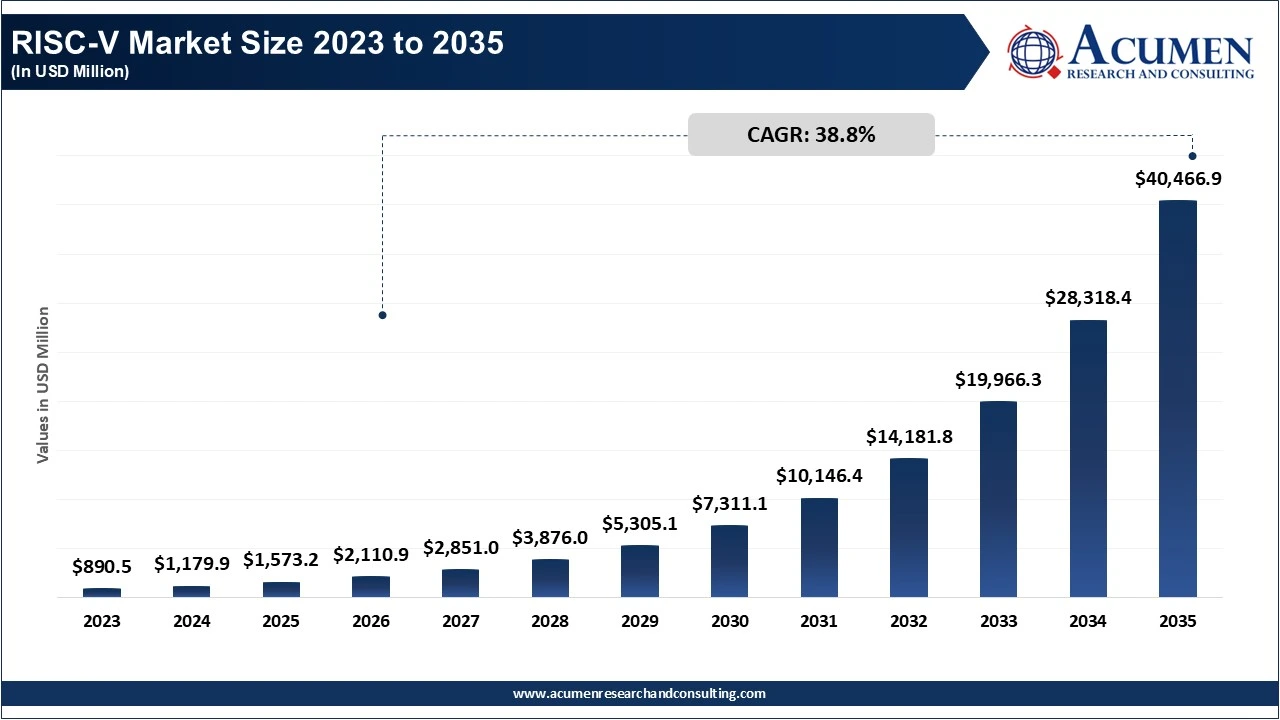

The global RISC-V market size accounted for USD 1,573.2 million in 2025 and is estimated to reach around USD 40,466.9 million by 2035 growing at a CAGR of 38.8% from 2026 to 2035. The growth in demand for customizable and open-source architecture is driving the growth or the RISC-V market. Further, the proliferation of artificial intelligence, IoT, and edge computing applications continues to support the market demand.

Sovereign and customizable open-standard IP semiconductor programs across the US, China, and European Union and an expanding verification ecosystem are augmenting design wins, alleviating time-to-market, and attracting new market entrants. However, software complications from uneven ISA extensions, a shortage of lead EDA talent in mature nodes, and restricted backward compatibility compared to ARM are substantial restraints that could hamper the market adoption.

Price-sensitive requirements in IoT design are aligning with the chip-sovereignty mandates, creating a strategic opportunity for vertically integrated companies in the RISC-V market. In addition, early commercialization of 128-bit processor core type, the expanding tool-chain standardization with the help of the RVA23 Profile, and the advent of ISO 26262 and ISO/SAE 21434 certified IP point to continued scalability in high-performance computing, industrial automation, and automotive sectors. The willingness of investors to invest capital in open-hardware startup organizations, as well as associations that pool patents or connect EDA suppliers with IP vendors, are further diminishing the barriers to entry and boosting convergence toward a more unified hardware and software stack.

Report Scope

| Area of Focus | Details |

| RISC-V Market Size 2025 | USD 1,573.2 Million |

| RISC-V Market Forecast 2035 | USD 40,466.9 Million |

| RISC-V Market CAGR During 2026 – 2035 | 38.8% |

| Segments Covered | By Processor Core Type, By Application, By End Use, and By Geography |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alibaba Group Holding Limited (T-Head Semiconductor), Apex Semiconductor (Shenzhen) Co., Ltd., Andes Technology Corporation, SiFive, Inc., Codasip s.r.o, StarFive Technology Co., Ltd., Huawei Technology Co., Ltd., MipSoC Ltd., Rivos Inc., and Bluespec Inc. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The Asia-Pacific region contributes the largest share by geography in the RISC-V market, driven by an integrated semiconductor manufacturing base, a dense cluster of consumer-electronics and OEM firms, and aggressive policy support for domestic chip design. Key leading nations in the region include China, Taiwan, South Korea, Japan, and India. Driven both by startup innovation and large-scale industrial adoption, China is leading the efforts of reducing dependence on foreign ISAs through indigenously designed RISC-V SoCs used in IoT devices, edge-AI hardware, and embedded systems.

| Region | Market Share (%) | Key Highlights |

| North America | 26% | A major trend in North America is the surge in RISC-V adoption for AI accelerators and data-center hardware, driven by CHIPS Act funding and strong participation from major tech companies such as Google, Intel, and Nvidia. |

| Europe | 19% | Europe is trending toward RISC-V for technological sovereignty, with initiatives like the European Processor Initiative (EPI), SiPearl’s Rhea processor, and the DARE platform accelerating region-wide efforts to reduce reliance on foreign instruction sets. |

| Asia-Pacific | 44% | Dominant as the market is driven by an integrated semiconductor manufacturing base, a dense cluster of consumer-electronics and OEM firms, and aggressive policy support for domestic chip design. |

| MEA | 6% | In MEA, the key trend is growing government-backed investment in semiconductor research and sovereign digital infrastructure, prompting early exploration of RISC-V for secure IoT deployments and smart-city systems. |

| Latin America | 4% | Latin America is seeing rising academic and startup engagement around RISC-V, as universities and emerging fabless companies adopt open-source architectures to lower development costs and build local semiconductor capability. |

This, in turn, facilitates an ideal environment in the region for fast production and deployment of the chips, from IP design to the complete fabrication of SoC, due to the robust foundry infrastructure and supply-chain integration. This is all supported by the broader trend of national strategic policies encouraging local semiconductor ecosystems. For example, several Asian countries have been ramping up efforts toward achieving supply-chain sovereignty and digital transformation, which bolsters demand for open-architecture processors like RISC-V. The manufacturing strength, demand for electronics, and supportive policy place the Asia-Pacific region as the key driver of RISC-V adoption across the world.

The worldwide market for RISC-V is split based on processor core type, application, end use, and geography.

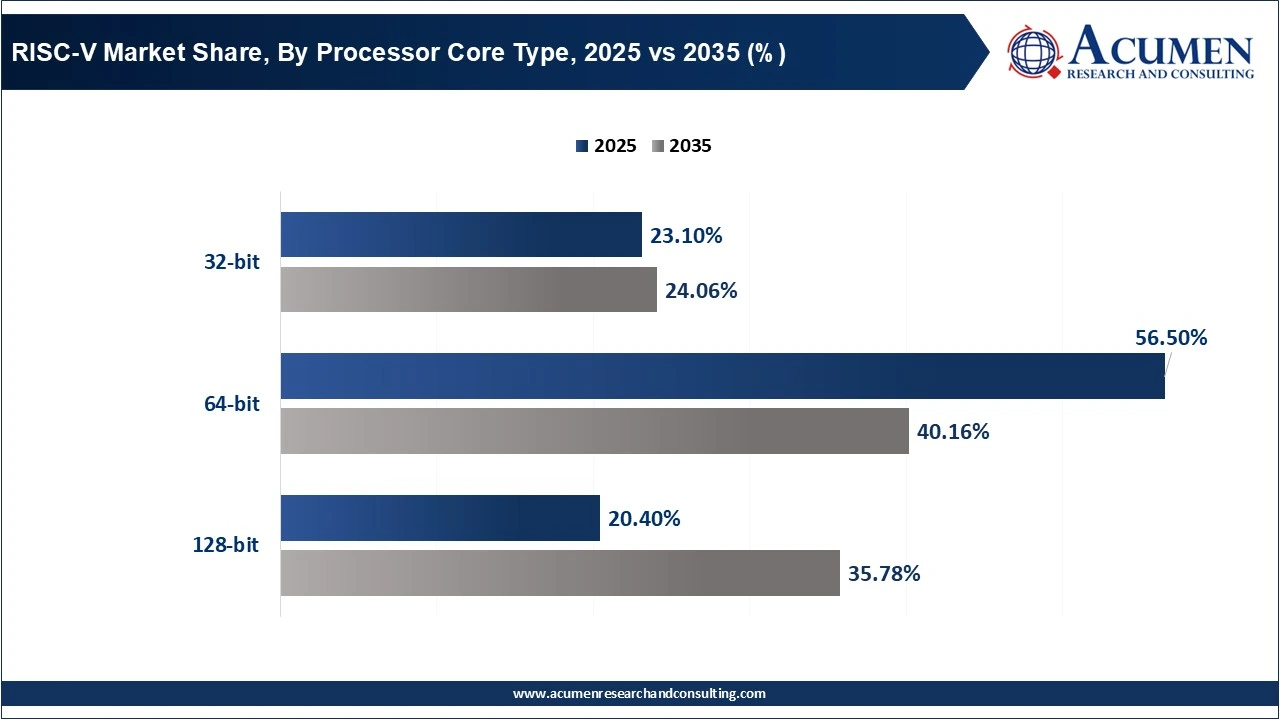

According to the RISC-V industry analysis, 64-bit processor core type dominated the market. Chip makers are drawn to 64-bit architectures because all the major Linux platforms, ChromeOS firmware stacks, and cloud-native container environments already run efficiently on them, enabling product teams to target high-volume markets with limited redesign. In the next few years, improved development tools and the next generation of high-performance plans such as SiFive's P870-D, which can scale up to 256 cores, will be able to provide hyperscale operators with the capability to test RISC-V server clusters at petascale-class throughput.

| Processor Core Type | Market Share (%) | Key Highlights |

| 32-bit | 23% | Witnessing accelerating penetration into ultra-low-power, resource-constrained embedded applications. |

| 64-bit | 57% | Dominant as these processors have become the default choice for performance-centric deployments, driving their dominance across both enterprise and consumer market segments. |

| 128-bit | 20% | Expected to grow exponentially as modern compute workloads increasingly demand higher addressable memory, stronger throughput, and broader data-path capabilities. |

The IoT devices segment dominates the RISC-V sector, as the architecture is exceptionally well-aligned with the requirements of low-power, cost-sensitive, and highly customized embedded applications. In reality, most IoT endpoints-smart sensors, wearables, home automation modules, industrial nodes, and other microcontroller-based systems-require only lightweight processors capable of fine-tuning for dedicated tasks without the addition of unnecessary silicon area. RISC-V's modular, open ISA makes it possible for companies to integrate the instructions required for their application, which reduces power consumption, die size, and overall cost.

| Application | Market Share (%) | Key Highlights |

| Data Centers | 20% | Data centers are increasingly exploring RISC-V for customizable, power-efficient accelerators and server-class cores to reduce reliance on proprietary architectures. |

| Smartphones | 23% | Smartphone OEMs are adopting RISC-V in subsystems like sensor hubs and AI co-processors to lower licensing costs and enable differentiated, energy-efficient features. |

| IoT Devices | 30% | Dominant as the architecture is exceptionally well-aligned with the needs of low-power, cost-sensitive, highly customized embedded applications. |

| Others | 27% | Others include automotive, industrial, and robotics. These sectors are trending toward RISC-V for domain-specific compute designs that support safety certification and long product lifecycles. |

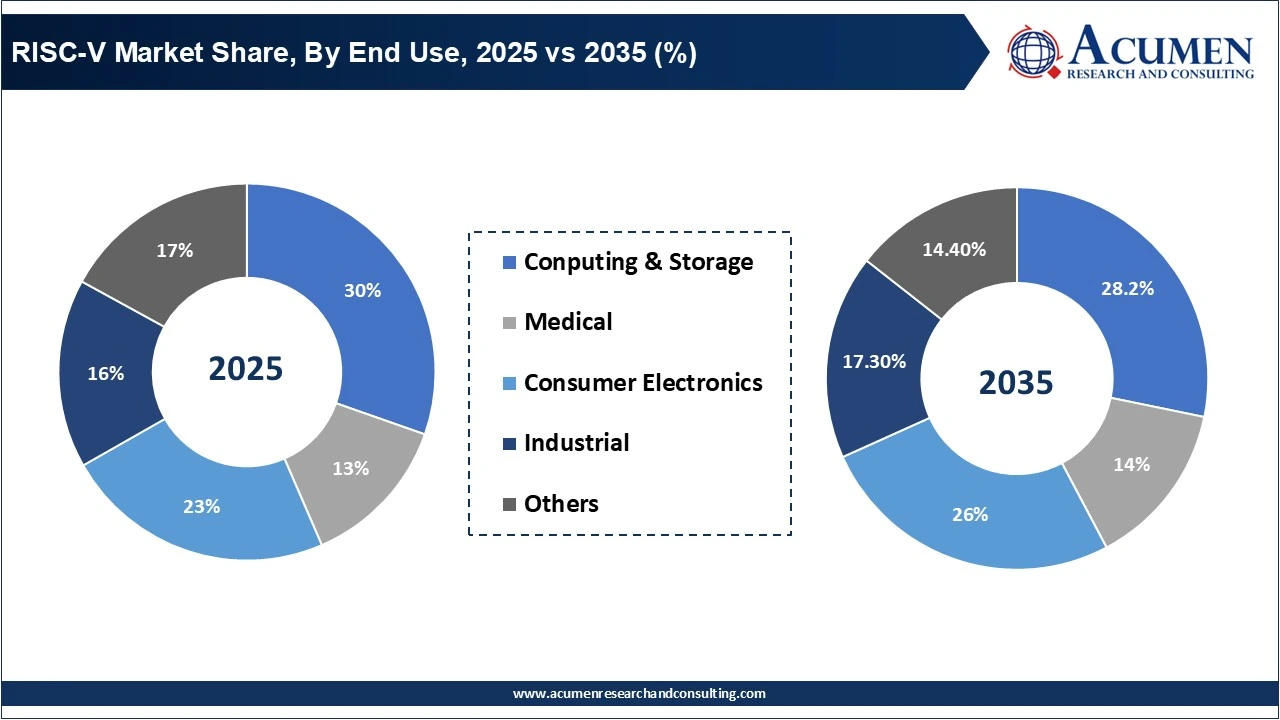

The computing and storage segment is expected to lead in the industry, given that highly scalable, customizable, and energy-efficient architectures are required that would be optimizable for AI acceleration, data processing, and memory-intensive workloads. Open ISA empowers hyperscalers, cloud vendors, and storage solution providers to create domain-specific processors such as SSD controllers, AI inference engines, and confidential-compute modules without bearing hefty licensing fees. This increasing momentum toward disaggregated storage, heterogeneous computing, and integration of edge-cloud fuels demand for flexible 64-bit RISC-V cores capable of running modern workloads. At the same time, leading industry players are upstreaming enhancements in toolchains and kernel optimizations for server-class RISC-V designs, thereby making this segment one of the earliest and most robust adopters of the ecosystem.

| End Use | Market Share (%) | Key Highlights |

| Computing & Storage | 30% | Dominant as as highly scalable, customizable, and energy-efficient architectures are needed that can be optimized for AI acceleration, data processing, and memory-intensive workloads. |

| Medical | 13% | In medical electronics, a rising trend is the use of RISC-V for secure, low-power embedded processors in wearables, diagnostic sensors, and portable patient-monitoring devices. |

| Consumer Electronics | 23% | Consumer electronics are increasingly adopting RISC-V cores in smart appliances, wearables, and multimedia devices to reduce licensing costs and enable highly optimized, differentiated features. |

| Industrial | 16% | Industrial applications are trending toward RISC-V-based controllers and edge modules that offer deterministic performance, long lifecycle support, and customizable instruction sets for factory automation and robotics. |

| Others | 17% | Across remaining sectors, the key trend is the shift toward safety-certified, domain-specific RISC-V platforms that support strict functional-safety requirements and reduce reliance on proprietary architectures. |

By Processor Core Type

By Application

By End Use

By Region

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2023

June 2020

May 2024

April 2025