April 2025

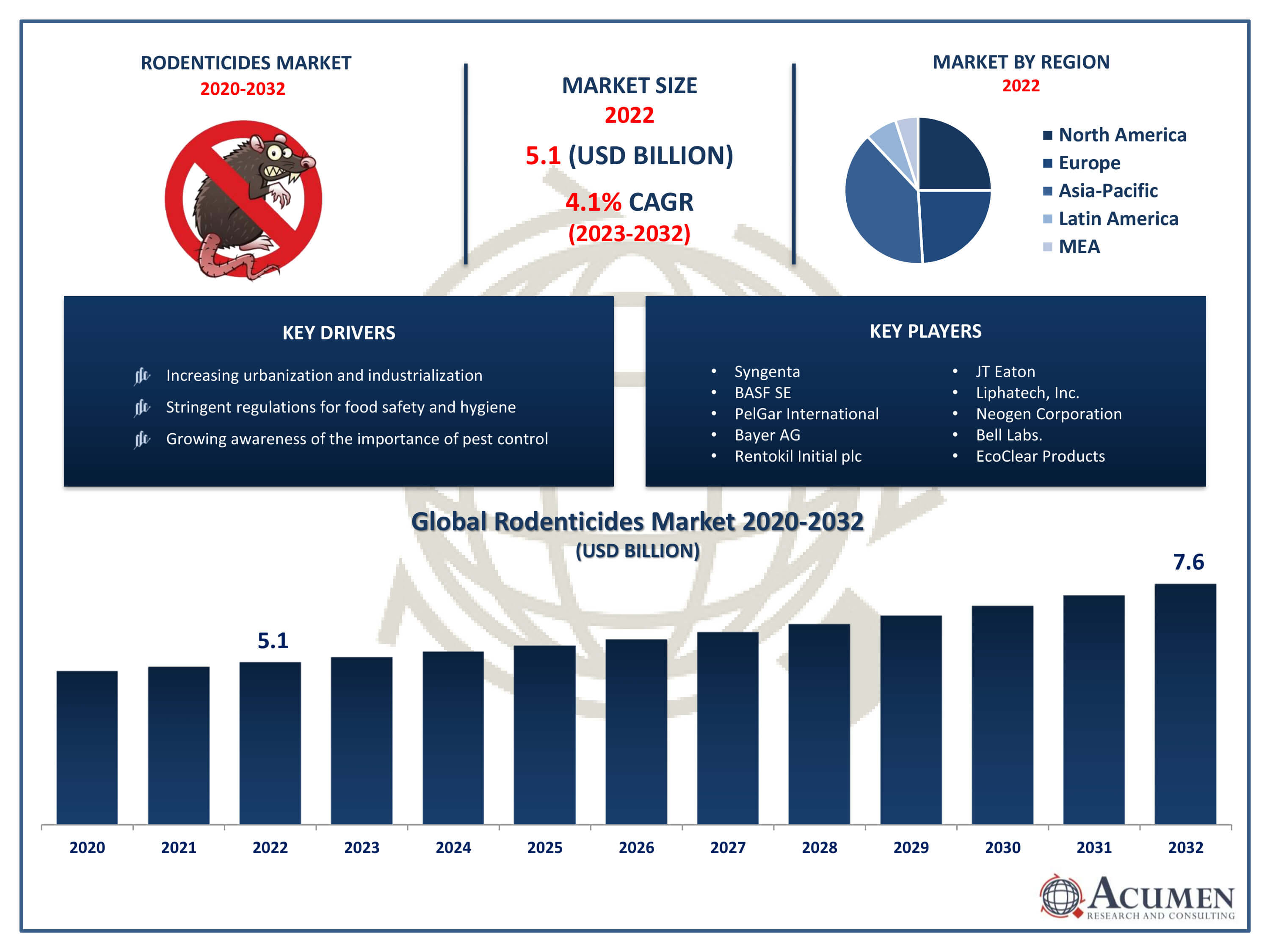

Rodenticides Market Size accounted for USD 5.1 Billion in 2022 and is projected to achieve a market size of USD 7.6 Billion by 2032 growing at a CAGR of 4.1% from 2023 to 2032.

The Rodenticides Market Size accounted for USD 5.1 Billion in 2022 and is projected to achieve a market size of USD 7.6 Billion by 2032 growing at a CAGR of 4.1% from 2023 to 2032.

Rodenticides Market Highlights

Rodenticides are chemical substances designed to control and eliminate rodent populations, including rats and mice. These compounds are used to address issues related to rodent infestations in various settings, such as agricultural fields, residential areas, and industrial facilities. Rodenticides work by targeting the rodents' central nervous system or causing internal bleeding, leading to their death. While they play a crucial role in pest control, the use of rodenticides requires careful consideration due to potential environmental and health risks. For instance, according to the World Health Organization (WHO), accidental poisoning caused 106,683 deaths and the loss of 6.3 million years of healthy life globally.

Rodenticides are chemical substances designed to control and eliminate rodent populations, including rats and mice. These compounds are used to address issues related to rodent infestations in various settings, such as agricultural fields, residential areas, and industrial facilities. Rodenticides work by targeting the rodents' central nervous system or causing internal bleeding, leading to their death. While they play a crucial role in pest control, the use of rodenticides requires careful consideration due to potential environmental and health risks. For instance, according to the World Health Organization (WHO), accidental poisoning caused 106,683 deaths and the loss of 6.3 million years of healthy life globally.

The market for rodenticides has experienced steady growth over the years, driven by factors such as increasing urbanization, globalization of trade, and a growing awareness of the importance of effective pest control. As urban areas expand and industrial activities rise, the demand for rodenticides has risen to protect crops, infrastructure, and public health. Additionally, stringent regulations and guidelines regarding food safety and hygiene in various industries contribute to the demand for rodenticides to maintain a pest-free environment. The market has seen innovations in formulations and delivery systems, enhancing the efficiency and safety of rodent control products. However, it is essential for the industry to balance the need for effective pest control with environmental and human health considerations, promoting the development of sustainable and responsible rodenticide solutions.

Global Rodenticides Market Trends

Market Drivers

Market Restraints

Market Opportunities

Rodenticides Market Report Coverage

| Market | Rodenticides Market |

| Rodenticides Market Size 2022 | USD 5.1 Billion |

| Rodenticides Market Forecast 2032 | USD 7.6 Billion |

| Rodenticides Market CAGR During 2023 - 2032 | 4.1% |

| Rodenticides Market Analysis Period | 2020 - 2032 |

| Rodenticides Market Base Year |

2022 |

| Rodenticides Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Form, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Syngenta, BASF SE, PelGar International, Bayer AG, Rentokil Initial plc, JT Eaton, Liphatech, Inc., Neogen Corporation, Bell Labs., EcoClear Products, Impex Europa S.L., and Terralink Horticulture Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Rodenticides are chemical substances specifically formulated to control and manage rodent populations, primarily rats and mice, due to the potential threats they pose to agriculture, public health, and various industries. These compounds are designed to be toxic to rodents, leading to their elimination and control. Rodenticides work through different mechanisms, including anticoagulant effects that cause internal bleeding or neurotoxic effects that target the rodents' central nervous system, resulting in death. These chemicals are available in various formulations, such as baits, pellets, and powders, making them versatile and adaptable for different applications. The applications of rodenticides span across diverse sectors. In agriculture, rodenticides are employed to protect crops from rodent damage, preventing significant losses in yield. In urban and residential settings, these substances are used to control infestations that can compromise hygiene and pose health risks. Industrial facilities, warehouses, and storage areas also utilize rodenticides to safeguard products and equipment. Further, rising concern over rodents population that is threat for human health is also contributing for the market share. According to health statistics, rodents such as mice and rats are known carriers of 70 deadly diseases Rodents were the main culprits in the Black Plaque that killed thousands during the Middle Ages.

A significant challenge facing the rodenticides market revolves around the health implications associated with both intentional and unintentional use. For instance, the American Association of Poison Control Centers (AAPCC) reports that rodenticides have been linked to 75,514 cases, including 66,362 unintentional incidents and 1,598 intentional ones, resulting in 29 fatalities. Moreover, insufficient dissemination of information regarding the safe application of these chemicals further exacerbates concerns within the rodenticide industry. Despite the prevalent risk of rodenticide poisoning across Africa, only 17.2% of the continent's 58 nations have established Poison Information Centers (PICs), highlighting a critical gap in public health infrastructure.

The rodenticides market has witnessed significant growth in recent years, driven by several key factors. One of the primary drivers is the escalating global urbanization and industrialization, which has created favorable conditions for rodent infestations. As urban areas expand, the demand for effective pest control solutions, including rodenticides, has increased to protect crops, infrastructure, and public health. Additionally, the globalization of trade has amplified the need for stringent pest control measures to prevent the spread of pests across borders, further boosting the rodenticides market. Moreover, a growing awareness of the importance of pest control in various sectors, such as agriculture, food processing, and healthcare, has contributed to the market's expansion. Stringent regulations and standards related to food safety and hygiene have prompted industries to invest in robust rodent control measures, driving the adoption of rodenticides.

Rodenticides Market Segmentation

The global market for rodenticides segmentation is based on product, form, application, and geography.

Rodenticides Market By Product

According to the rodenticides industry analysis, the anticoagulant segment accounted for the largest market share in 2022. Anticoagulant rodenticides work by inhibiting the blood clotting process in rodents, leading to internal bleeding and subsequent death. This mechanism of action has proven effective against rodent populations and has contributed to the increased adoption of anticoagulant-based rodenticides in various applications. One of the key drivers behind the growth of the anticoagulant segment is the development of second-generation anticoagulants that address concerns related to resistance in rodents. These advanced formulations provide a more potent and longer-lasting effect, overcoming challenges associated with certain rodent species developing resistance to traditional rodenticides. Additionally, the anticoagulant segment has gained popularity due to its lower risk of secondary poisoning in non-target species, making it a safer choice for pest control.

Rodenticides Market By Form

In terms of forms, the blocks segment is expected to witness significant growth in the coming years. Rodenticide blocks are formulated with attractive baits and toxicants, providing a ready-to-use solution for pest management. The block format ensures prolonged exposure to the active ingredients, increasing the likelihood of rodents consuming a lethal dose. This convenience factor has made blocks a preferred choice for both professional pest control services and individual consumers seeking efficient and user-friendly solutions for rodent infestations. Furthermore, the blocks segment has seen innovation in formulations, including the development of bait blocks with multiple active ingredients to combat potential resistance issues. The ability to secure these blocks in bait stations or strategic locations enhances safety by minimizing the risk of accidental exposure to non-target species.

Rodenticides Market By Application

According to the rodenticides market forecast, the household segment is expected to witness significant growth in the coming years. Rodenticides tailored for household use come in various formulations, including baits, traps, and blocks, providing consumers with diverse options to combat rodent issues effectively. The convenience of off-the-shelf rodenticide products that are specifically designed for household applications has contributed significantly to the segment's expansion. The growth in the household segment can also be attributed to the rising urbanization and the associated increase in rodent-related challenges in residential areas. As urban spaces expand, rodents find ample shelter and food sources, leading to heightened incidences of infestations. Homeowners are increasingly turning to rodenticides as a quick and effective solution to safeguard their homes and belongings. Additionally, advancements in rodenticide formulations, such as those designed to be pet-friendly and environmentally conscious, have further fueled the adoption of rodenticides in households.

Rodenticides Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Rodenticides Market Regional Analysis

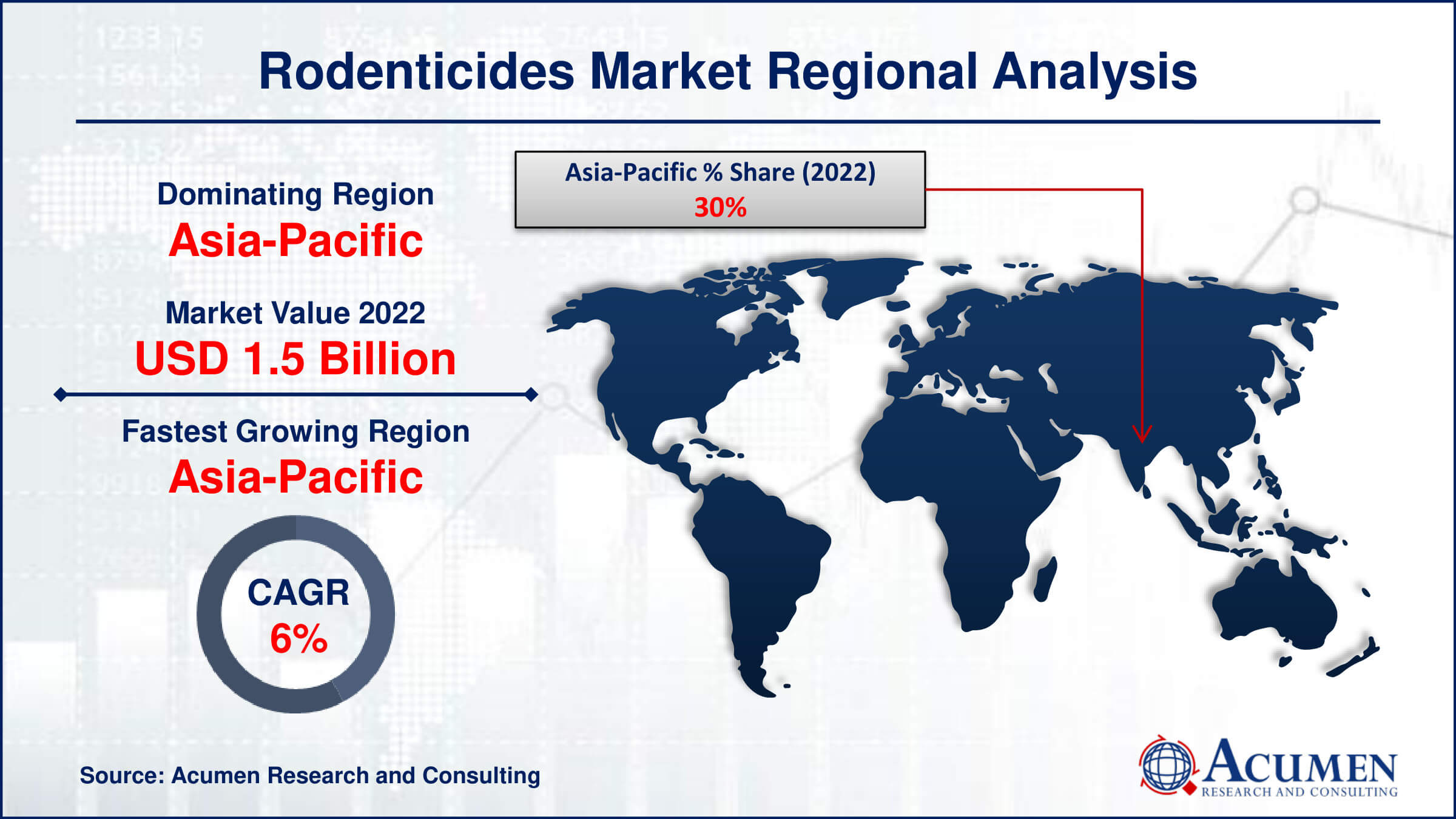

The Asia-Pacific region has emerged as a dominating force in the rodenticides market, fueled by several key factors driving the demand for pest control solutions. Rapid urbanization and industrialization in countries like China and India have led to increased instances of rodent infestations in urban and rural areas alike. As a result, there is a growing emphasis on efficient pest management practices, with rodenticides playing a pivotal role in addressing these challenges. The expansion of agriculture and food processing industries in the region also contributes to the rising need for rodent control measures to protect crops and ensure food safety. Rice field rats are notorious for inflicting significant damage to rice crops, particularly in regions like Malaysia and Indonesia. Studies have shown that these pests can result in average losses ranging from 10% to 20% in rice yields. In areas adjacent to refuge habitats, such as canals, the impact can be even more severe, with chronic losses reaching alarming rates of 30% to 50%. Likewise, the lesser bandicoot rat poses a considerable threat in India, where it has been known to cause annual losses of up to 60% in rice production. Moreover, the Asia-Pacific region experiences diverse climates and ecosystems, creating favorable conditions for the proliferation of rodent populations. This diversity necessitates a variety of rodenticide solutions tailored to different environmental contexts. The rodenticides market in the Asia-Pacific is witnessing innovation in formulations and delivery systems to address these varied needs effectively. Additionally, as regulatory frameworks evolve to meet international standards for food safety and hygiene, the demand for high-quality rodenticides in the region continues to grow.

Rodenticides Market Player

Some of the top rodenticides companies offered in the professional report include Syngenta, BASF SE, PelGar International, Bayer AG, Rentokil Initial plc, JT Eaton, Liphatech, Inc., Neogen Corporation, Bell Labs., EcoClear Products, Impex Europa S.L., and Terralink Horticulture Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2025

February 2020

June 2020

May 2022