January 2020

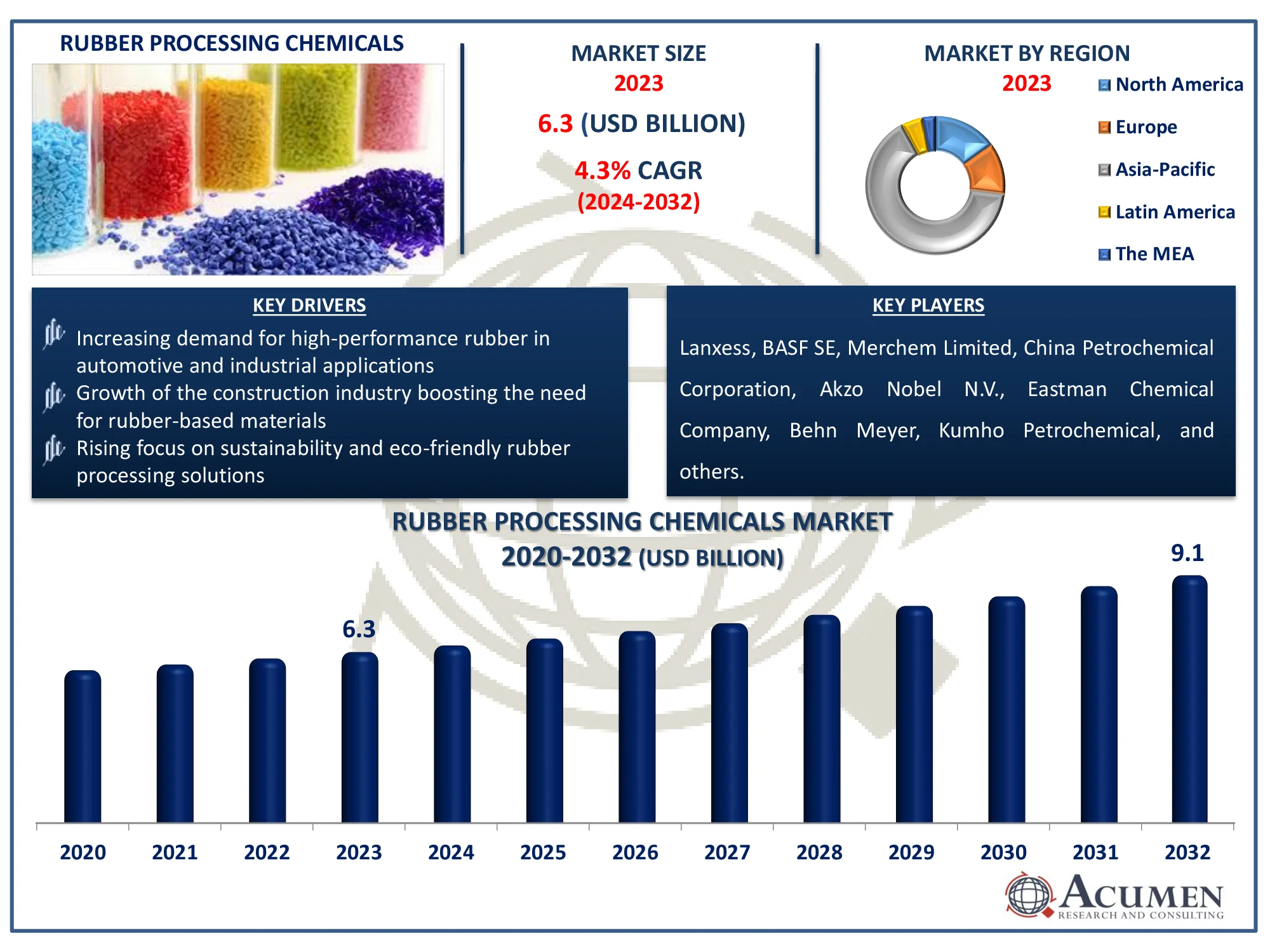

The Global Rubber Processing Chemicals Market Size accounted for USD 6.3 Billion in 2023 and is estimated to achieve a market size of USD 9.1 Billion by 2032 growing at a CAGR of 4.3% from 2024 to 2032.

The Global Rubber Processing Chemicals Market Size accounted for USD 6.3 Billion in 2023 and is estimated to achieve a market size of USD 9.1 Billion by 2032 growing at a CAGR of 4.3% from 2024 to 2032.

Rubber, a widely used polymer, is primarily classified into natural and synthetic rubber. Natural rubber is composed solely of isoprene monomers and is derived as coagulated latex from various trees found in tropical and wild regions. In contrast, synthetic rubber is produced by combining styrene and butadiene, two key by-products of petroleum refining. Approximately 70% of the global rubber consumption is synthetic. Synthetic rubber manufacturers utilize diverse chemical formulations to meet the specific needs of various end-use industries. Rubber is processed with a variety of chemicals to create essential products like automobile tires and rubber mats. These chemicals enhance rubber's resistance to oxidation, heat, ozone, sunlight, and mechanical stress while improving the vulcanization process. Rubber processing chemicals encompass a wide range of products, including accelerators, anti-degradants, and processing aids, among others.

|

Market |

Rubber Processing Chemicals Market |

|

Rubber Processing Chemicals Market Size 2023 |

USD 6.3 Billion |

|

Rubber Processing Chemicals Market Forecast 2032 |

USD 9.1 Billion |

|

Rubber Processing Chemicals Market CAGR During 2024 - 2032 |

4.3% |

|

Rubber Processing Chemicals Market Analysis Period |

2020 - 2032 |

|

Rubber Processing Chemicals Market Base Year |

2023 |

|

Rubber Processing Chemicals Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Lanxess, BASF SE, Merchem Limited, China Petrochemical Corporation, Akzo Nobel N.V., Eastman Chemical Company, Behn Meyer, Kumho Petrochemical, Solvay, R.T. Vanderbilt Holding Company, Inc., Arkema, and Paul & Company |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The expanding worldwide population, together with greater consumer spending power and purchasing capacity, has greatly raised the need for rubber processing chemicals in the automotive industry. For example, America's Plastic Makers estimates that rubber processing chemicals are widely used in the automotive sector, particularly in the manufacture of tires and other rubber components, accounting for $69 of the chemistry value in an average automobile, highlighting the importance of rubber processing chemicals in this industry. These compounds have an important role in improving the characteristics of rubber, particularly in the manufacture of automotive tires.

As a result, the rising automobile industry is likely to fuel the worldwide rubber processing chemicals market. According to the India Brand Equity Foundation, the automobile sector has attracted a cumulative equity FDI infusion of about US$ 36.268 billion between April 2000 and March 2024, further driving the growth of the rubber processing chemicals industry as demand for high-quality rubber components increases.

Furthermore, developments in automobile tire manufacturing technology are a crucial driver of market growth. For instance, in April 2022, Sailun Tire Group debuted a new mixing technique called 'Eco Point3'. The method would allow for continuous and homogeneous mixing of rubber compounding components under liquid phase conditions. The technique enhances tire resistance and efficiency while also boosting traction and longevity. These compounds not only improve the qualities of rubber, but also the manufacturing process for raw materials utilized in other applications, such as door mat production. However, during the projection period, stronger environmental laws and government policies may pose obstacles to market expansion.

The worldwide market for rubber processing chemicals is split based on type, application, and geography.

According to the rubber processing chemicals industry analysis, anti-degradants type dominates the market in 2023. According to Interstate Technology and Regulatory Council (ITRC), Tire anti-degradants are used to extend the life of tires by preventing the cracking and breakdown of rubber as it reacts with ozone over time. 6 p-Phenylenediamine (6PPD) is currently the most prevalent chemical used for this purpose and is known to produce 6PPD-quinone (6PPD-q) through interaction with ozone. This growing focus on enhancing tire durability and performance is expected to drive the demand for anti-degradants in industry.

According to the rubber processing chemicals market forecast, non-tire category dominates because rubber is widely used in industries other than tires. Automotive parts, industrial gear, footwear, and consumer items all demand specialist rubber compounds that are more durable, flexible, and resistant. Rubber processing chemicals are critical for increasing the performance and longevity of these goods. The non-tire segment dominates the market because of the increased need for high-quality rubber in a variety of sectors.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

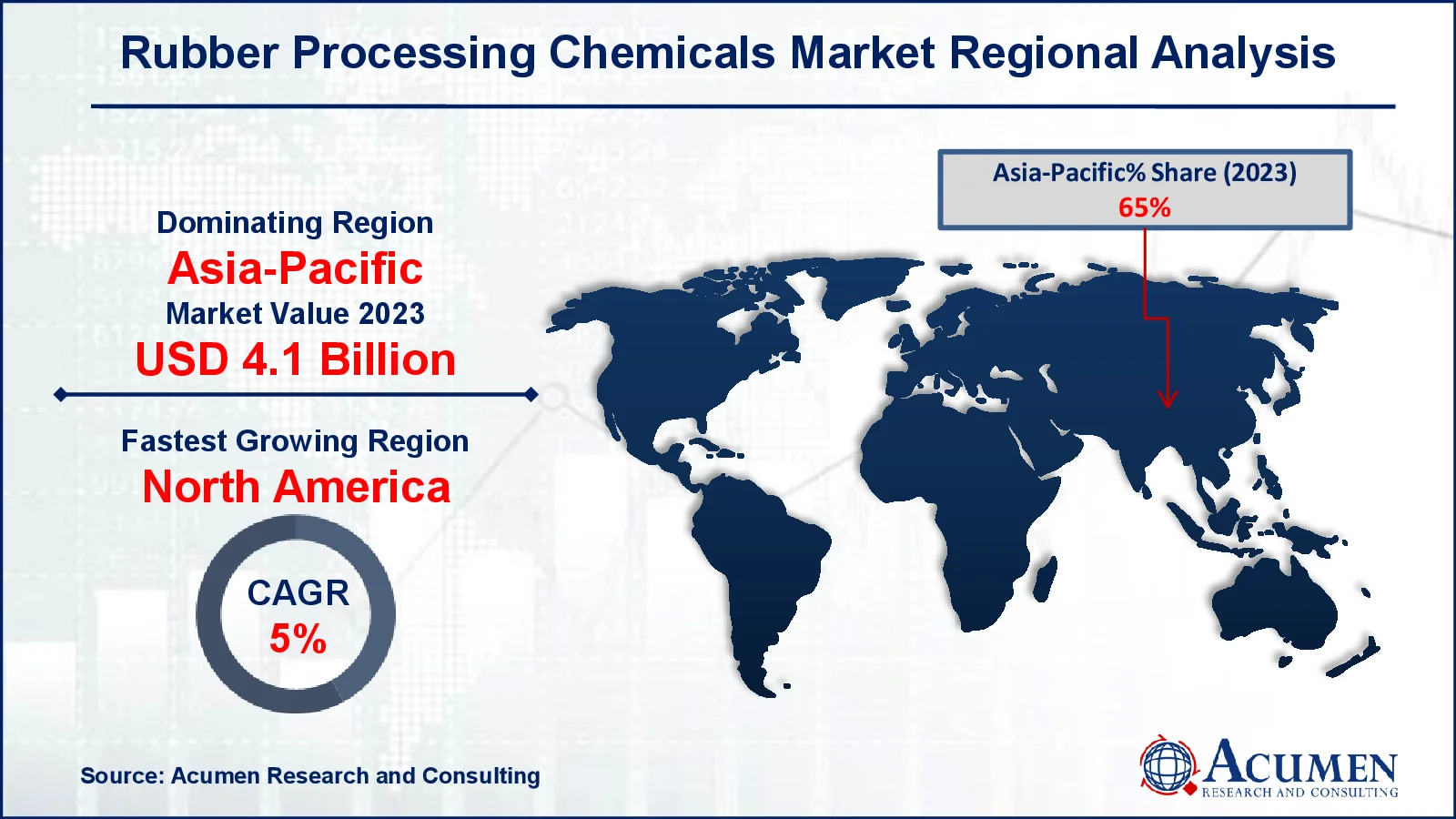

For several reasons, the demand in Asia-Pacific is analyzed to be the major driving factor for the growth of global market. China is anticipated to account for the largest share and lead the overall demand owing to the increasing industrial production over the last few years. For instance, according to the National Bureau of Statistics of China, in 2023, the value added of industrial companies over the required size increased by 4.6% over the previous year. The markets in other developing countries such as Brazil, Russia, Poland, Indonesia, New Zealand, Argentina and India among others are also anticipated to grow rapidly throughout the forecast period.

North America's established automotive and construction industries are driving considerable expansion in the rubber processing chemicals market. According to the Associated General Contractors of America, construction is a significant contributor to the US economy. There were about 919,000 construction establishments in the United States in the first quarter of 2023. The industry employs 8.0 million people and builds approximately $2.1 trillion in structures each year. Rising demand for high-performance tires, along with tight environmental requirements, is driving the development of sophisticated RPCs in the region.

Some of the top rubber processing chemicals companies offered in our report include Lanxess, BASF SE, Merchem Limited, China Petrochemical Corporation, Akzo Nobel N.V., Eastman Chemical Company, Behn Meyer, Kumho Petrochemical, Solvay, R.T. Vanderbilt Holding Company, Inc., Arkema, and Paul & Company.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2020

November 2022

August 2022

November 2024