October 2018

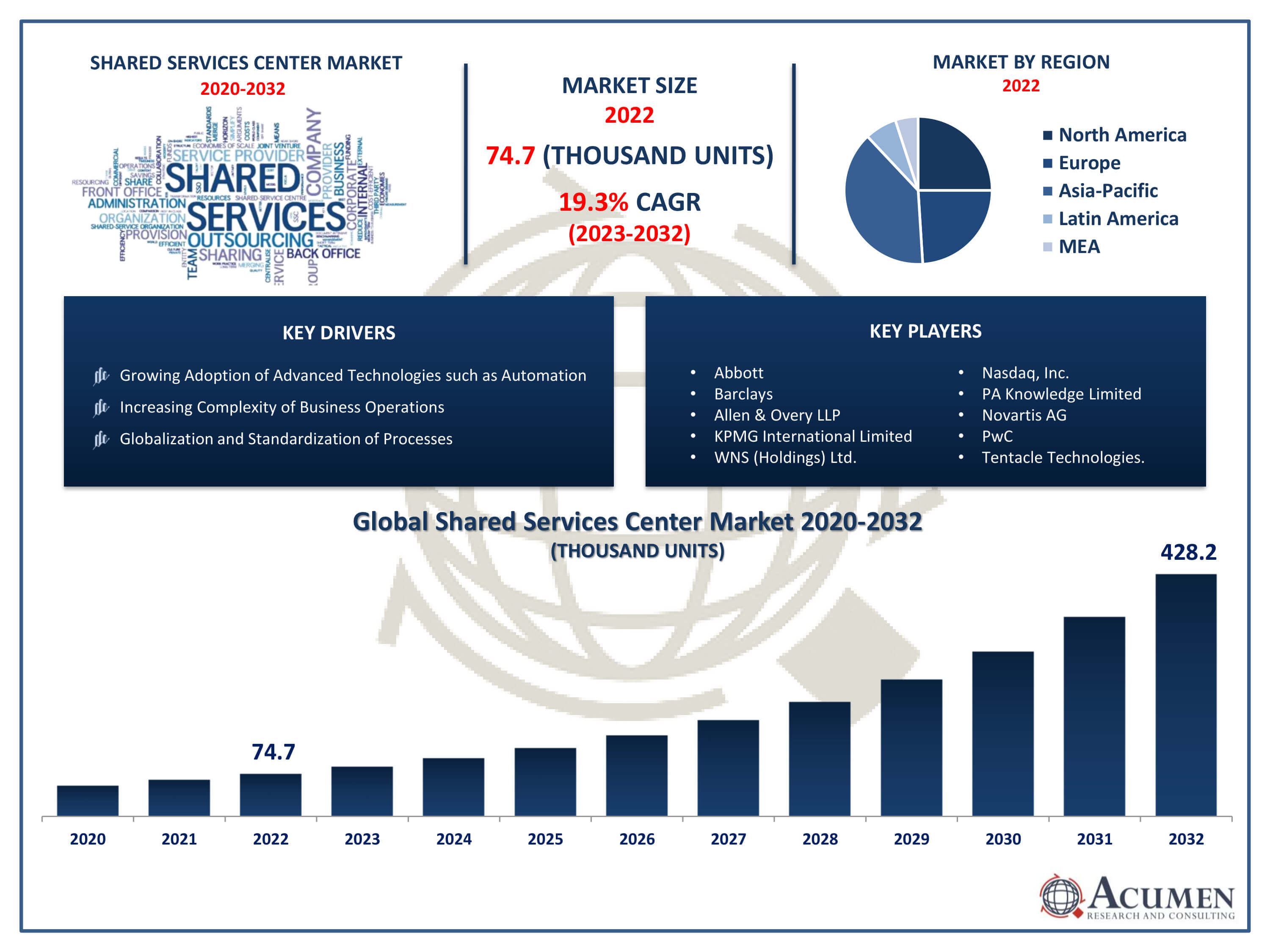

Shared Services Center Market Size accounted for 74.7 Thousand Units in 2022 and is projected to achieve a market size of 428.2 Thousand Units by 2032 growing at a CAGR of 19.3% from 2023 to 2032.

The Shared Services Center Market Size accounted for 74.7 Thousand Units in 2022 and is projected to achieve a market size of 428.2 Thousand Units by 2032 growing at a CAGR of 19.3% from 2023 to 2032.

Shared Services Center Market Highlights

A shared services center (SSC) is a centralized unit within an organization that consolidates and streamlines various support functions, such as finance, human resources, information technology, and customer service. The primary goal of an SSC is to achieve operational efficiency, cost savings, and improved service quality by consolidating these common functions into a single, specialized unit. This model allows organizations to standardize processes, leverage economies of scale, and enhance overall productivity.

The market growth of shared services centers has been significant in recent years, driven by a growing recognition of the benefits they offer. Organizations across various industries are increasingly adopting SSCs as a strategic approach to optimize their business processes and enhance competitiveness. Factors contributing to this growth include the need for cost reduction, increased efficiency, and the rising complexity of business operations. Additionally, advancements in technology, such as automation and digital transformation, play a crucial role in enabling SSCs to deliver services more efficiently. As businesses continue to focus on agility and cost-effectiveness, the shared services center market is expected to expand further, with ongoing developments in technology and a continued emphasis on operational excellence.

Global Shared Services Center Market Trends

Market Drivers

Market Restraints

Market Opportunities

Shared Services Center Market Report Coverage

| Market | Shared Services Center Market |

| Shared Services Center Market Size 2022 | 74.7 Thousand Units |

| Shared Services Center Market Forecast 2032 | 428.2 Thousand Units |

| Shared Services Center Market CAGR During 2023 - 2032 | 19.3% |

| Shared Services Center Market Analysis Period | 2020 - 2032 |

| Shared Services Center Market Base Year |

2022 |

| Shared Services Center Market Forecast Data | 2023 - 2032 |

| Segments Covered | By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Abbott, Barclays, Allen & Overy LLP, KPMG International Limited, Ernst & Young Global Limited, WNS (Holdings) Ltd., Nasdaq, Inc., PA Knowledge Limited, Novartis AG, Western Union Financial Services, Inc., PwC, and Tentacle Technologies. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Shared Services Center Market Dynamics

A shared services center (SSC) is a centralized unit within an organization that consolidates and manages common business support functions to achieve operational efficiency and cost savings. These shared services typically include areas such as finance, human resources, information technology, procurement, and customer service. The primary objective of an SSC is to streamline processes, standardize operations, and centralize resources, allowing the organization to benefit from economies of scale. By centralizing these functions, the SSC can eliminate redundancy, optimize resources, and provide specialized expertise, ultimately leading to improved service quality and reduced operational costs. The applications of shared services centers span across various business functions. In finance, an SSC can centralize accounting, invoicing, and payroll processes, ensuring accuracy and compliance. In human resources, it can handle activities like recruitment, employee onboarding, and benefits administration. Information technology functions such as helpdesk support, software development, and system maintenance can also be consolidated within an SSC.

The shared services center (SSC) market has witnessed robust growth in recent years, driven by a confluence of factors contributing to the increasing adoption of this business model. Organizations across various industries are recognizing the potential of SSCs in achieving operational excellence, cost savings, and enhanced service delivery. The focus on cost efficiency, a key driver, has led companies to consolidate support functions such as finance, human resources, and IT, allowing them to leverage economies of scale and standardize processes. As businesses continue to navigate economic uncertainties, the demand for shared services centers as a strategic tool for cost reduction and operational optimization is expected to remain strong.

Moreover, technological advancements play a pivotal role in shaping the growth trajectory of the SSC market. Automation, artificial intelligence, and digital transformation are enabling SSCs to enhance efficiency, reduce errors, and provide more agile and responsive services. This increased reliance on technology not only improves the quality of services but also positions SSCs as drivers of innovation within organizations. As the business landscape continues to evolve, with a heightened focus on flexibility and resilience, the shared services center market is poised for sustained growth, offering businesses a strategic solution for navigating the complexities of the modern business environment.

Shared Services Center Market Segmentation

The global Shared Services Center Market segmentation is based on end-use, and geography.

Shared Services Center Market By End-Use

In terms of end-uses, the pharmaceutical and clinical segment accounted for the significant market share in 2022. As pharmaceutical companies and clinical research organizations grapple with increasing demands for efficiency, compliance, and data management, the adoption of shared services centers has become a strategic imperative. The consolidation of back-office functions, such as finance, regulatory affairs, and clinical trial management, within SSCs allows these organizations to standardize processes, streamline operations, and reduce costs while ensuring compliance with rigorous industry regulations. The growth in the pharmaceutical and clinical segments of the SSC market is also fueled by the need for agility and innovation in drug development and healthcare delivery. Shared services enable pharmaceutical companies to focus more resources on research and development, accelerate clinical trial timelines, and navigate the complex regulatory landscape efficiently.

Moreover, the manufacturing segment has experienced significant growth in the adoption of shared services centers (SSCs) as organizations within this industry increasingly recognize the benefits of centralized support functions. Shared services in manufacturing typically encompass a range of processes, including finance, procurement, supply chain management, and IT services. The sector's emphasis on operational efficiency, cost reduction, and improved competitiveness has driven many manufacturing companies to leverage SSCs as a strategic approach to streamline their back-office operations.

Shared Services Center Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Shared Services Center Market Regional Analysis

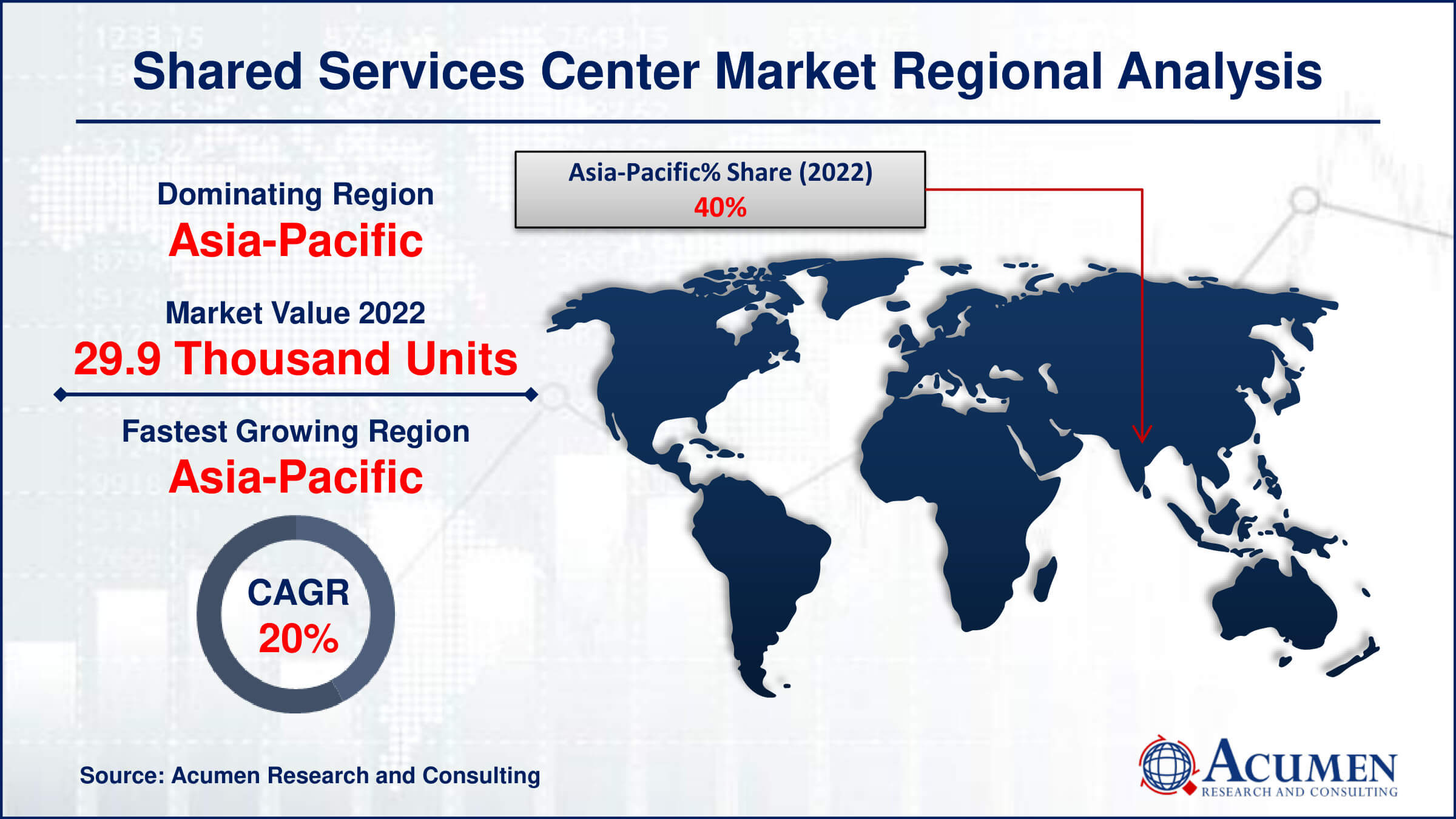

The Asia-Pacific region has emerged as a dominating force in the shared services center (SSC) market, showcasing robust growth and becoming a preferred destination for organizations seeking to establish or expand their shared services operations. One of the key factors contributing to the region's dominance is its large and diverse talent pool, offering a skilled workforce with proficiency in various languages and a strong educational background. Countries like India, the Philippines, and Malaysia have become outsourcing hubs, providing a cost-effective solution for businesses looking to set up shared services centers with access to highly qualified professionals. Additionally, favorable economic conditions and government initiatives have further propelled the growth of the SSC market in the Asia-Pacific region. Many countries in the region offer business-friendly policies, tax incentives, and infrastructure support, encouraging multinational corporations to establish their shared services operations in these locations. The rapid digital transformation in Asia-Pacific has also played a crucial role, enabling SSCs to leverage advanced technologies such as automation, artificial intelligence, and analytics for increased efficiency and innovation. As the demand for operational excellence, cost optimization, and agility continues to drive the global business landscape, the Asia-Pacific region is likely to maintain its dominant position in the shared services center market.

Shared Services Center Market Player

Some of the top shared services center market companies offered in the professional report include Abbott, Barclays, Allen & Overy LLP, KPMG International Limited, Ernst & Young Global Limited, WNS (Holdings) Ltd., Nasdaq, Inc., PA Knowledge Limited, Novartis AG, Western Union Financial Services, Inc., PwC, and Tentacle Technologies.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2018

April 2025

February 2023

June 2024