February 2023

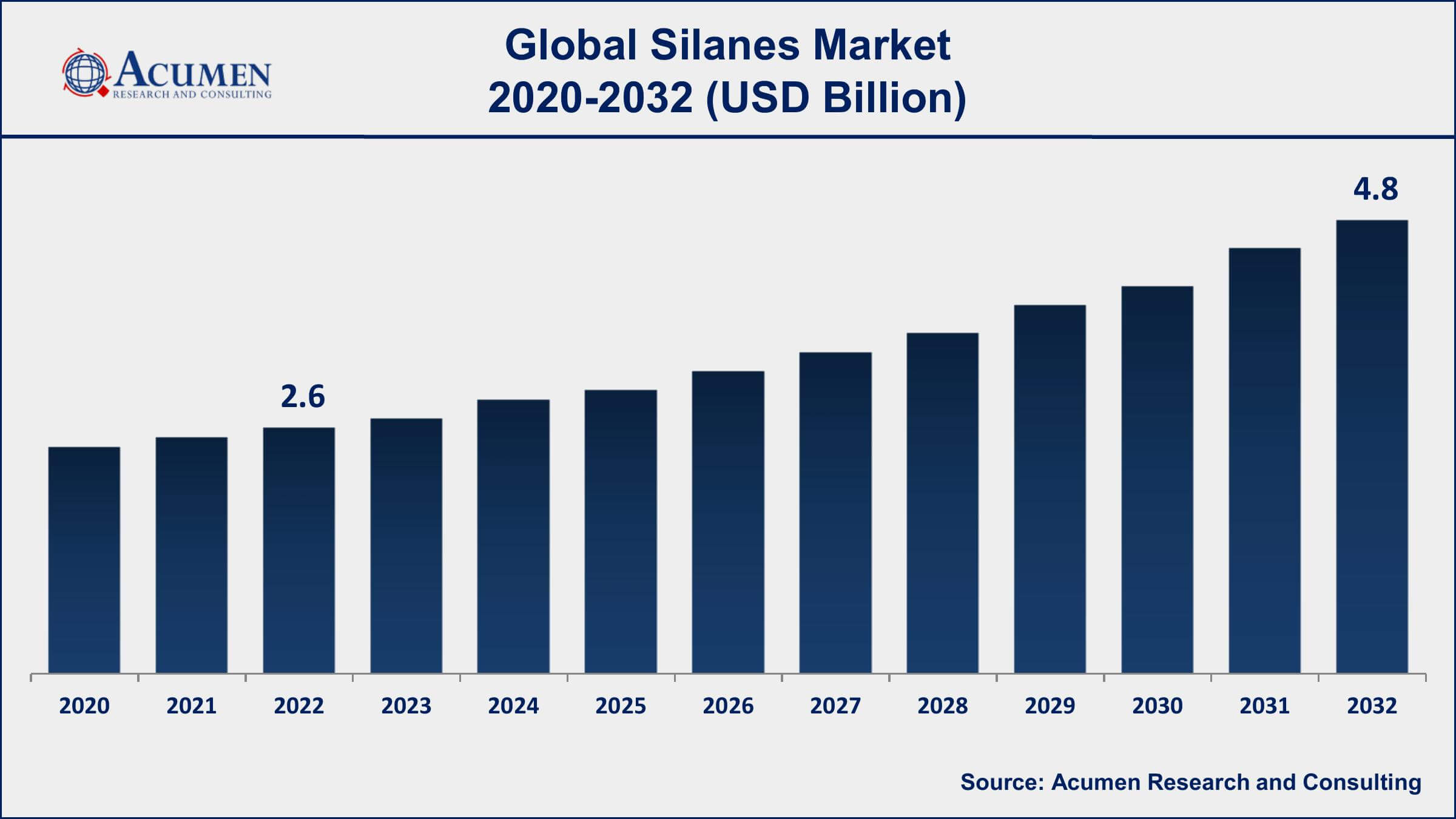

Silanes market, which reached a value of USD 2.6 Billion in 2022, is anticipated to expand to USD 4.8 Billion by 2032, with a projected Compound Annual Growth Rate (CAGR) of 5.8% from 2023 to 2032.

The Global Silanes Market Size accounted for USD 2.6 Billion in 2022 and is projected to achieve a market size of USD 4.8 Billion by 2032 growing at a CAGR of 5.8% from 2023 to 2032.

Silanes Market Key Highlights

Silanes are a group of chemical compounds that contain one or more silicon atoms and organic groups attached to them. These compounds are used in a wide range of applications, including adhesives, sealants, coatings, and resins. Silanes are known for their ability to improve the adhesion and durability of materials, as well as their water-repelling and anti-corrosive properties.

The market growth of silanes has been significant in recent years, and it is expected to continue to grow in the coming years. The primary driver of this growth is the increasing demand for silanes in the construction industry, particularly in the Asia-Pacific region. The rising demand for high-performance materials, coupled with the growing construction industry in countries like China and India, has led to an increase in the demand for silanes. Additionally, the automotive industry is another major consumer of silanes, using them in coatings, adhesives, and sealants to improve the performance and durability of their products.

Global Silanes Market Trends

Market Drivers

Market Restraints

Market Opportunities

Silanes Market Report Coverage

| Market | Silanes Market |

| Silanes Market Size 2022 | USD 2.6 Billion |

| Silanes Market Forecast 2032 | USD 4.8 Billion |

| Silanes Market CAGR During 2023 - 2032 | 5.8% |

| Silanes Market Analysis Period | 2020 - 2032 |

| Silanes Market Base Year | 2022 |

| Silanes Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Evonik Industries AG, Wacker Chemie AG, Dow Inc., Shin-Etsu Chemical Co. Ltd., Gelest Inc., Momentive Performance Materials Inc., China National Bluestar (Group) Co. Ltd., Air Liquide S.A., Elkem ASA, H.C. Starck GmbH, Jiangsu Chenguang Silane Co. Ltd., and Nanjing Shuguang Chemical Group Co. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Silane is known as an organic compound that contains multiple or single silicon carbon (Si-C) bonded atoms. The silicon-based monomeric chemical comprises four key substituents as well as at least one carbon-silicon bond structure (CH3-Si-). The excellent anticorrosion properties of silanes make it a widely preferred and excellent material for protective coatings in a broad range of applications such as microbiological corrosion protection, erosion/corrosion protection coatings making weatherable automotive paints, and many more. Rising demand for silanes from the automobile industry is anticipated to act as a key growth driver for the global silane market. Silanes are widely used in several end-use applications such as fiber treatment, rubber & plastics, paint & coatings, adhesives & sealants, and others.

The rising demand for silanes, especially from consumers for improved fuel efficiency, road safety, and less environmental impact creating vehicles is projected to bolster the demand for silanes over the coming years. Increasing demand for green tires, as well as growing automobile sales along with rising water-based coating formulation as well as increasing focus on fuel efficiency among consumers with regulation compliance, are some of the crucially prime factors accelerating the global silanes market growth.

Silanes Market Segmentation

The global silane market segmentation is based on type, application, and geography.

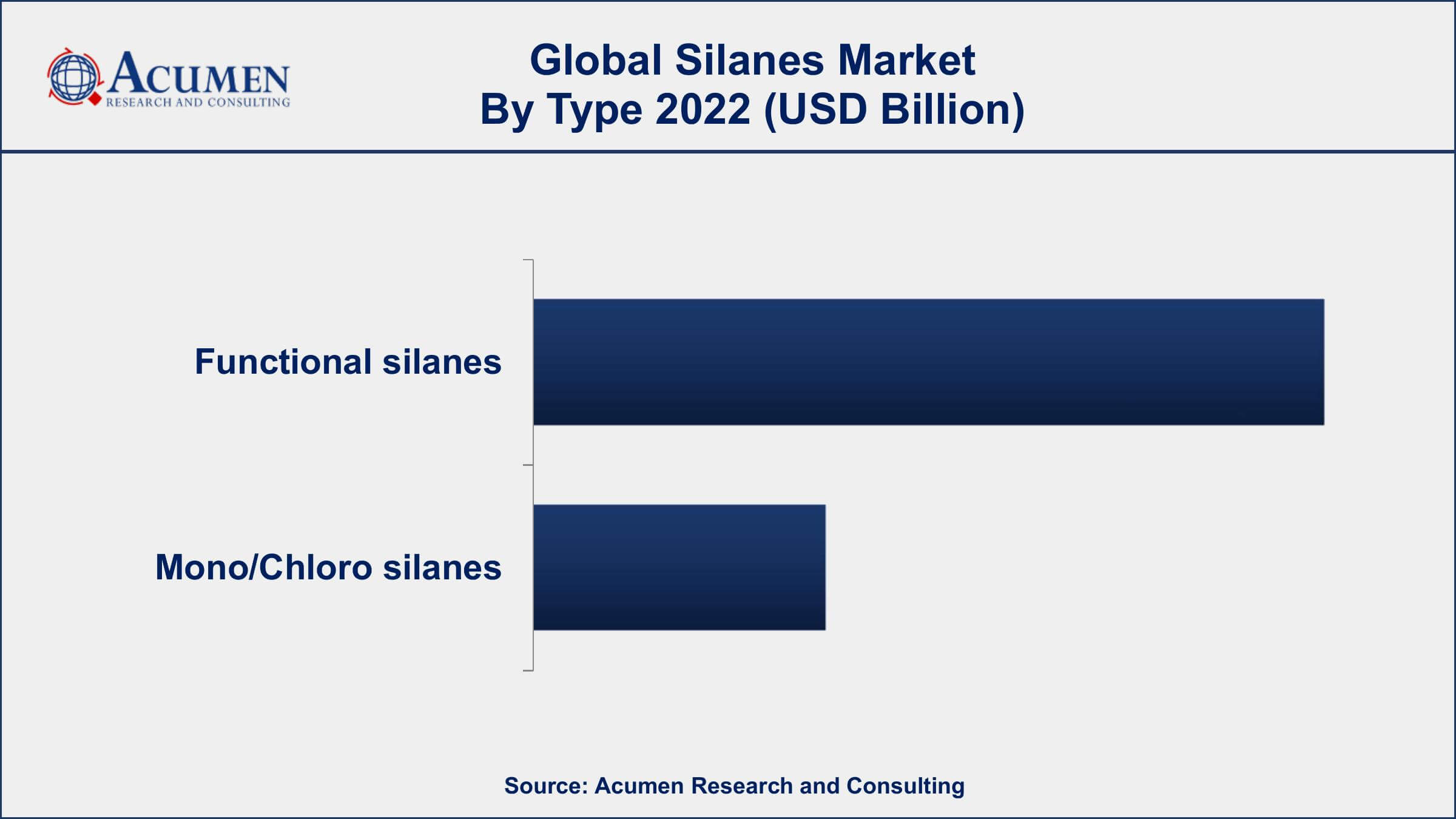

Silanes Market By Type

In terms of types, the functional silane segment has seen significant growth in the silane market in recent years. Functional silanes are a type of silane that have organic functional groups attached to the silicon atom, which allows them to be used in a wide range of applications. These silanes are known for their ability to improve the properties of materials, such as adhesion, durability, and moisture resistance. The functional silane segment has been growing rapidly in the silane market in recent years, and it is expected to continue to grow in the coming years. The growth of this segment is primarily driven by the increasing demand for high-performance materials in various industries, including construction, automotive, and electronics. In the construction industry, functional silanes are used in concrete, masonry, and other building materials to improve their strength, adhesion, and durability.

Silanes Market By Application

According to the silanes market forecast, the rubber & plastics segment is expected to witness significant growth in the coming years. The silanes are widely used as coupling agents, adhesion promoters, and crosslinking agents in rubber and plastic applications. Silanes are known to improve the mechanical properties of rubber and plastic products, such as strength, flexibility, and durability, and also enhance their resistance to heat, moisture, and chemicals. The rubber and plastics segment has been growing steadily in the silane market, and it is expected to continue to grow in the coming years. The growth of this segment is driven by the increasing demand for high-performance rubber and plastic products in various industries, including automotive, construction, and electronics. In the automotive industry, silanes are used as coupling agents in tire manufacturing to improve the adhesion between rubber and other materials, such as steel and textiles.

Silanes Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Silanes Market Regional Analysis

The Asia-Pacific region is dominating the silanes market due to several factors, including the increasing demand for silanes from various industries, the growing construction and automotive sectors, and the presence of a large number of silane manufacturers in the region. One of the key drivers of the silane market in the Asia-Pacific region is the increasing demand for high-performance materials from various industries such as automotive, construction, and electronics. The region is home to several emerging economies, such as China and India, which are witnessing rapid industrialization and urbanization, leading to a growing demand for high-quality and durable products. This has resulted in an increase in the demand for silanes in the region. Moreover, the construction and automotive sectors are also driving the growth of the silane market in the region.

Silanes Market Player

Some of the top silanes market companies offered in the professional report include Evonik Industries AG, Wacker Chemie AG, Dow Inc., Shin-Etsu Chemical Co. Ltd., Gelest Inc., Momentive Performance Materials Inc., China National Bluestar (Group) Co. Ltd., Air Liquide S.A., Elkem ASA, H.C. Starck GmbH, Jiangsu Chenguang Silane Co. Ltd., and Nanjing Shuguang Chemical Group Co. Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2023

September 2024

June 2024

July 2022