March 2022

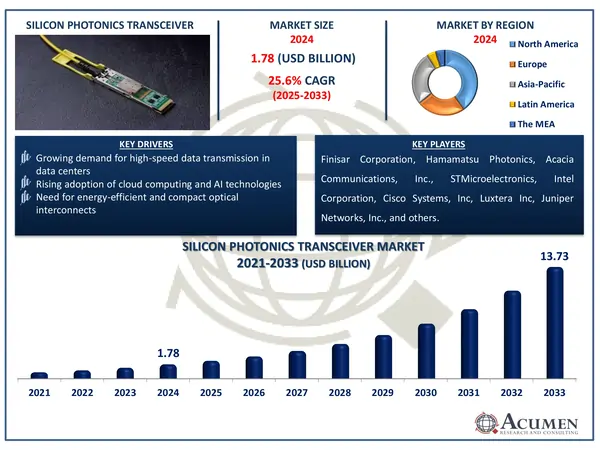

The Global Silicon Photonics Transceiver Market Size accounted for USD 1.78 Billion in 2024 and is estimated to achieve a market size of USD 13.73 Billion by 2033 growing at a CAGR of 25.6% from 2025 to 2033.

The Global Silicon Photonics Transceiver Market Size accounted for USD 1.78 Billion in 2024 and is estimated to achieve a market size of USD 13.73 Billion by 2033 growing at a CAGR of 25.6% from 2025 to 2033.

A silicon photonics transceiver is a high-speed data transmission device that employs silicon-based photonic circuits to transmit data using light rather than standard electrical signals. It incorporates optical component such as modulators, detectors, and waveguides onto a silicon chip, resulting in faster and more energy-efficient communication. These transceivers are widely utilized in data centers, high-performance computing, and telecommunications to accommodate the growing demand for more bandwidth. Silicon photonics is scalable and cost-effective since it makes use of regular CMOS fabrication. Its tiny size and high-speed performance make it an important technology for next-generation optical networks.

Silicon photonics transceivers will play an important role in meeting the growing demand for faster, more energy-efficient data transmission enabled by technologies such as 5G and cloud computing. Their ability to deliver high-speed, low-power solutions will be critical in satisfying future connection demands across a variety of industries, including AI, IoT, and big data analytics.

|

Market |

Silicon Photonics Transceiver Market |

|

Silicon Photonics Transceiver Market Size 2024 |

USD 1.78 Billion |

|

Silicon Photonics Transceiver Market Forecast 2033 |

USD 13.73 Billion |

|

Silicon Photonics Transceiver Market CAGR During 2025 - 2033 |

25.6% |

|

Silicon Photonics Transceiver Market Analysis Period |

2021 - 2033 |

|

Silicon Photonics Transceiver Market Base Year |

2024 |

|

Silicon Photonics Transceiver Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Component, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Finisar Corporation, Intel Corporation, Hamamatsu Photonics, Acacia Communications, Inc., Luxtera Inc, Cisco Systems, Inc, Juniper Networks, Inc., STMicroelectronics, GlobalFoundries, Mellanox Technologies Ltd., and International Business Machines Corporation (IBM). |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The increasing amount of data in telecommunications and data center & high-performance computing is primarily supporting the market growth. The technological advancement in application sectors including military, defense & aerospace, medical & life sciences, and sensing is boosting the demand for silicon photonics transceiver in the market.

The ongoing advancement, research, and development activities, and continued investment by the major players for the innovation in the silicon photonics transceiver sector are further expected to support the growth over the forecast period from 2025 to 2033.

Partnerships & collaborations, and new product development are key strategies for the expansion of market share. For instance, DustPhotonics has launched the QSFP-DD DR4 transceiver module in 2020. The new transceiver module is particularly designed to support high-performance 400 Gbps coherent transmission in a pluggable form factor for high-speed networks and intra-data center interconnect. The new solution is designed to cope up with the increasing bandwidth demands of hyper-scale data centers. The QSFP-DD form factor introduced by supplier enabling next-generation optics provides an 8-lane electrical interface, increasing bandwidth, channel capacity, and port density.

In September 2020, Verizon Media and Inphi have together validated a “seamless upgrade” from 100Gb Ethernet QSFP28 optics, using Inphi’s Colorz silicon photonics platform to 400GbE QSFD-DD over the same production Open Line System. According to both the partners, the demonstration consisted of adding a 400ZR from an Arista 400G switch into a 100GHz DWDM channel without affecting any of the existing 100GbE wavelengths.

Members of a European consortium are advancing silicon photonics technology, having demonstrated a fully packaged transceiver module with a data transfer rate of 100 Gb/s in 2020. The effort was led by the COSMICC project (CMOS Solutions for Mid-board Integrated Transceivers with Breakthrough Connectivity at Ultra-Low Cost). According to the COSMICC team, the newly developed optical hardware is designed to address the communications industry's growing demand for high-speed data modules. The COSMICC transceiver multiplexes two wavelengths at 50 Gb/s each and is initially targeted at applications in data centers and supercomputers across various sectors

The worldwide market for silicon photonics transceiver is split based on component, type, data range, application, and geography.

According to silicon photonics transceiver industry analysis, the laser generates the optical signal, which is critical for high-speed data transfer. The photodetector transforms incoming optical impulses back to electrical signals, allowing for data processing. The modulator modulates light to encode data, ensuring high bandwidth and efficient signal transmission. Together, these component enable faster, more reliable connection in data centers and telephony.

According to types, short-distance transmission is critical for high-speed data transfer within data centers, allowing for faster connection between servers while maintaining low latency and energy efficiency. Long-distance transmission, on the other hand, benefits telecom networks and hyperscale data centers by providing consistent, high-bandwidth connectivity over long distances. Both types play an important role in satisfying the expanding data demands of cloud computing and 5G.

As per the data range, receivers with less than 100G and 100G data rates are critical for aging systems and cost-sensitive applications that require moderate bandwidth. Higher data ranges, such as 200G, 400G, and 800G+, are becoming increasingly crucial in modern data centers, cloud computing, and AI workloads that require ultra-fast, high-capacity transmission. These high-speed transceivers enable network infrastructure innovation and scalability. All of the data ranges work together to achieve broad market acceptance and future-ready connectivity.

According to silicon photonics transceiver market forecast, the industry is quickly expanding, propelled by rising demand for high-performance computing (HPC) and data center applications. Silicon photonics technology provides quicker data transmission rates and increased bandwidth, which are critical for dealing with the large amounts of data created by these industries. This technique is also useful in telecommunications applications, allowing for more efficient and scalable communication networks. As these industries expands, the demand for sophisticated optical transceivers increases, propelling silicon photonics to the forefront of innovation.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

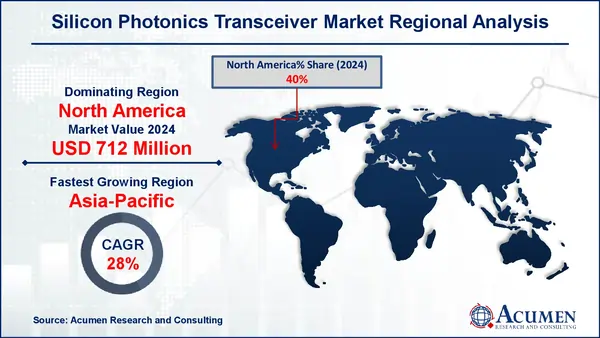

In terms of regional segments, North America dominates the silicon photonics transceiver market due to its concentration of large technology businesses and advanced data center infrastructure. Furthermore, large expenditures in R&D stimulate innovation in silicon photonics technology. For example, in August 2022, DustPhotonics Ltd. and MaxLinear collaborated to present a silicon photonics chipset with lasers powered directly by a digital signal processor (DSP), eliminating the need for separate driver chips. The combination between MaxLinear's Keystone DSP and DustPhotonics' Carmel Silicon Photonics chip lays the path for the development of low-cost optical transceivers for data transfer. This discovery enables the development of 400Gb/s transceivers with power consumption of less than 7W.

In 2024, Asia-Pacific is projected to lead the market in terms of growth rate. The rapid technological advancement in the emerging economies of the region including China and India is supporting the regional market value. The ongoing development and expansion in the data center & high-performance computing are supporting the regional market value. The regional expansion of major players in order to take advantage of available opportunities is further boosting the market growth. Furthermore, the region collectively including its major economy is anticipated to experience the fastest growth with major CAGR (28%) during the forecast period from 2025 to 2033.

Some of the top silicon photonics transceiver companies offered in our report include Finisar Corporation, Intel Corporation, Hamamatsu Photonics, Acacia Communications, Inc., Luxtera Inc, Cisco Systems, Inc, Juniper Networks, Inc., STMicroelectronics, GlobalFoundries, Mellanox Technologies Ltd., and International Business Machines Corporation (IBM).

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2022

September 2022

July 2020

January 2025