September 2023

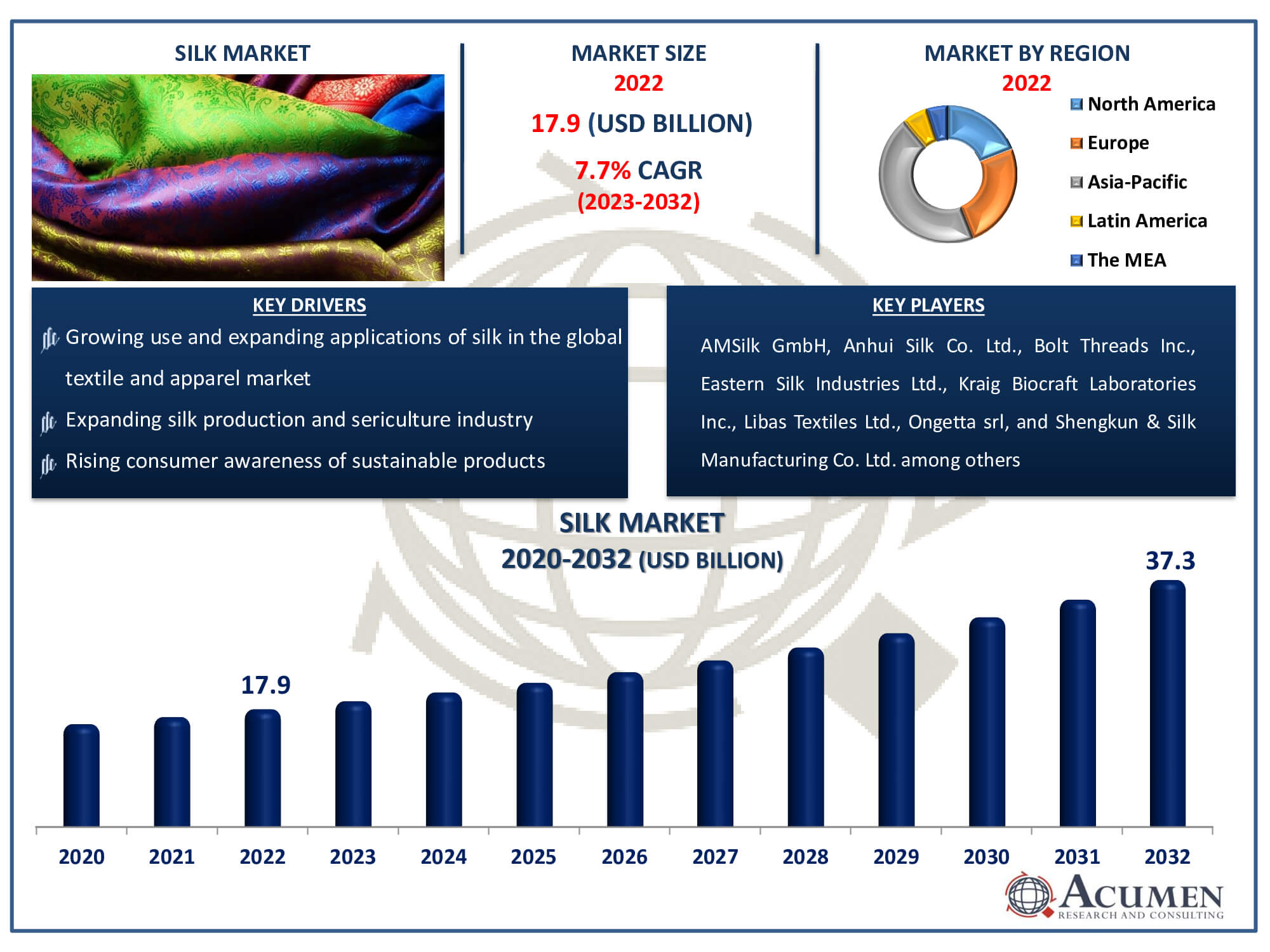

Silk Market Size accounted for USD 17.9 Billion in 2022 and is estimated to achieve a market size of USD 37.3 Billion by 2032 growing at a CAGR of 7.7% from 2023 to 2032.

The Silk Market Size accounted for USD 17.9 Billion in 2022 and is estimated to achieve a market size of USD 37.3 Billion by 2032 growing at a CAGR of 7.7% from 2023 to 2032.

Silk Market Highlights

Silk is a unique form of cloth that is smooth, silky, and lustrous. Silk is a type of natural thread produced by some insects, such as silkworms. They generate it to form protective cocoons. People harvest these cocoons, remove the silk strands, and weave them into garment textiles. The majority of silk manufacture originated in China. China produces the most silk in the world and exports it to other countries. India is the second-largest producer of silk. Mulberry silk, Tussar silk, and Eri silk are the several varieties of silk. Silk is widely utilized in a variety of garments, including gowns, bridal dresses, neckties, and scarves. It is also seen in home furnishings such as wall hangings, cushions, upholstery, and curtains. Silk structures have also been effectively employed in medical treatments to aid in wound healing and the formation of tissues like as bone, cartilage, tendon, and ligaments.

Global Silk Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Silk Market Report Coverage

| Market | Silk Market |

| Silk Market Size 2022 | USD 17.9 Billion |

| Silk Market Forecast 2032 |

USD 37.3 Billion |

| Silk Market CAGR During 2023 - 2032 | 7.7% |

| Silk Market Analysis Period | 2020 - 2032 |

| Silk Market Base Year |

2022 |

| Silk Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AMSilk GmbH, Anhui Silk Co. Ltd., Bolt Threads Inc., Eastern Silk Industries Ltd., Kraig Biocraft Laboratories Inc., Libas Textiles Ltd., Ongetta srl, Shengkun Silk Manufacturing Co. Ltd., Wensli Group Co. Ltd., Jiangsu Sutong Cocoon And Silk Co., and Zhejiang Jiaxin Silk Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Silk Market Insights

Silk is the principal product of the textile industry. Silk is used in a variety of apparel designs, including gowns, bridal dresses, neckties, and scarves. Raw silk is used to make apparel items such as shirts, suits, ties, and coats. On the other hand, hand-spun mulberry silk is used to make comforters and sleeping bags. China is the major producer of silk. For example, in 2005, China produced 680,000 tons of silk cocoons, yielding 130,000 tons of silk. From 2000 to 2005, China's silk output climbed by an average of 14.2 percent every year. Furthermore, in 2022, the total value of textile and clothing shipments in the United States was $65.8 billion. For example, the United States is the world's third largest exporter of textile-related items. In 2021, the aggregate value of fiber, textile, and garment exports hit $34 billion. Overall, the rising use and expanding applications of silk in the global textile and apparel industry are projected to drive the silk market forward in the approaching years.

One major constraint in the silk business is that silk production is more expensive than other materials. Silk production entails numerous labor-intensive stages, such as caring for silkworms, gathering cocoons, and extracting silk strands. These stages need expert labor and extensive resources, which raises production costs. Furthermore, there are few sites with the ideal environment for silk cultivation, and silk harvests are quickly destroyed by pests and diseases, adding to overall costs. As a result, the high cost might stifle market expansion and provide hurdles for smaller industry firms. For example, in India, the cost of Charkha raw silk has risen by 65.87% in the last year. The price for the April-June 2022 quarter was ?4,603.93 per kg, up from ?2,775.12 per kg in the same quarter of 2021.

Silk acts as a natural insulator, maintaining a comfortable mix of coolness and warmth. Silk apparel is appropriate for all seasons, including summer and winter. During the winter months, use silk as a layer under a sweater to keep warm without feeling heavy. For example, silk can absorb up to 30% of its weight in water without becoming moist. It efficiently absorbs perspiration while allowing the skin to breathe. Overall, silk promotes improved health. Overall, silk's health advantages imply that its use is expected to rise, creating an opportunity in the next year. The adoption of technical breakthroughs has the potential to boost the global silk market. ReshaMandi, an agro-tech firm based in Karnataka, for example, uses technology to help silk growers boost their total revenue and improve the quality of their silk. In May 2021, the firm launched innovative 'AI & IoT-led ecosystem solutions,' which benefited 5,500 silk producers and increased their income by 30%.

Silk Market Segmentation

The worldwide market for silk is segmented into type, application, and region

Silk Market By Type

According to the silk market analysis, based on types, the mulberry silk sub-category is predicted to expand the fastest over the analysis period. This is owing to the excellent quality of mulberry silk, which is accomplished by raising silkworms in a way that improves their nutritional characteristics for humans. Mulberry silk, known as one of the softest natural silks, nurtures the skin while also being antimicrobial and hypoallergenic. Mulberry silk, for example, works well for treating skin disorders such as atopic dermatitis. Mulberry silk is in high demand worldwide owing to its unique characteristics.

Silk Market By Application

Based on application, the textile sub-category dominated the worldwide silk market. Textiles are the principal industry for silk because of its remarkable properties such as lightweight, luxurious feel, and robust durability. Silk is also used extensively in several manufacturing processes.For example, medical sutures, apparel, silk comforters, and parachutes all contributed to the textile sub-segment's sustained expansion over the analyzed period. Its many applications include bridal dresses, gowns, blouses, scarves, and neckties, as well as a variety of domestic goods such as cushions, wall hangings, draperies, and upholstery.

Silk Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

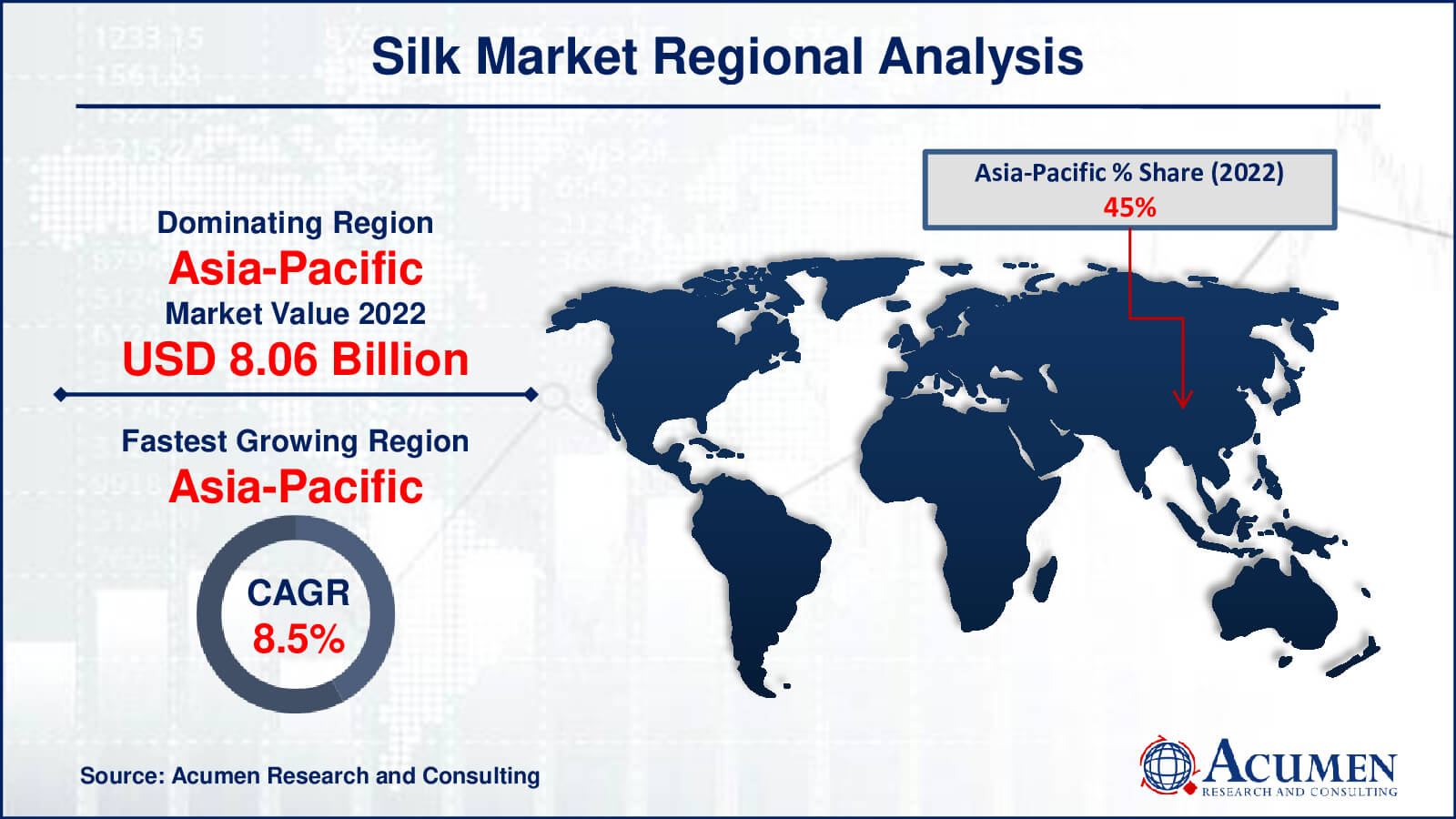

Silk Market Regional Analysis

Based on regional analysis, the silk industry's market is divided into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. Asia-Pacific dominated the global silk market and is predicted to be the fastest-growing subsegment in the future years. The competition in the Asia-Pacific market is fierce, with top businesses utilizing a variety of techniques to gain a major market share in the area. India, Thailand, China, and Uzbekistan are key contributors to the Asia-Pacific silk market. For example, in December 2021, India alone produced 26,587 metric tons (MT) of silk, with mulberry silk accounting for the majority. The primary silk-producing states in India include Andhra Pradesh, Bihar, Assam, Gujarat, and Karnataka, among others.

Silk Market Players

Some of the top silk companies offered in our report includes AMSilk GmbH, Anhui Silk Co. Ltd., Bolt Threads Inc., Eastern Silk Industries Ltd., Kraig Biocraft Laboratories Inc., Libas Textiles Ltd., Ongetta srl, Shengkun Silk Manufacturing Co. Ltd., Wensli Group Co. Ltd., Jiangsu Sutong Cocoon And Silk Co., and Zhejiang Jiaxin Silk Co., Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2023

July 2020

December 2021

May 2021