May 2022

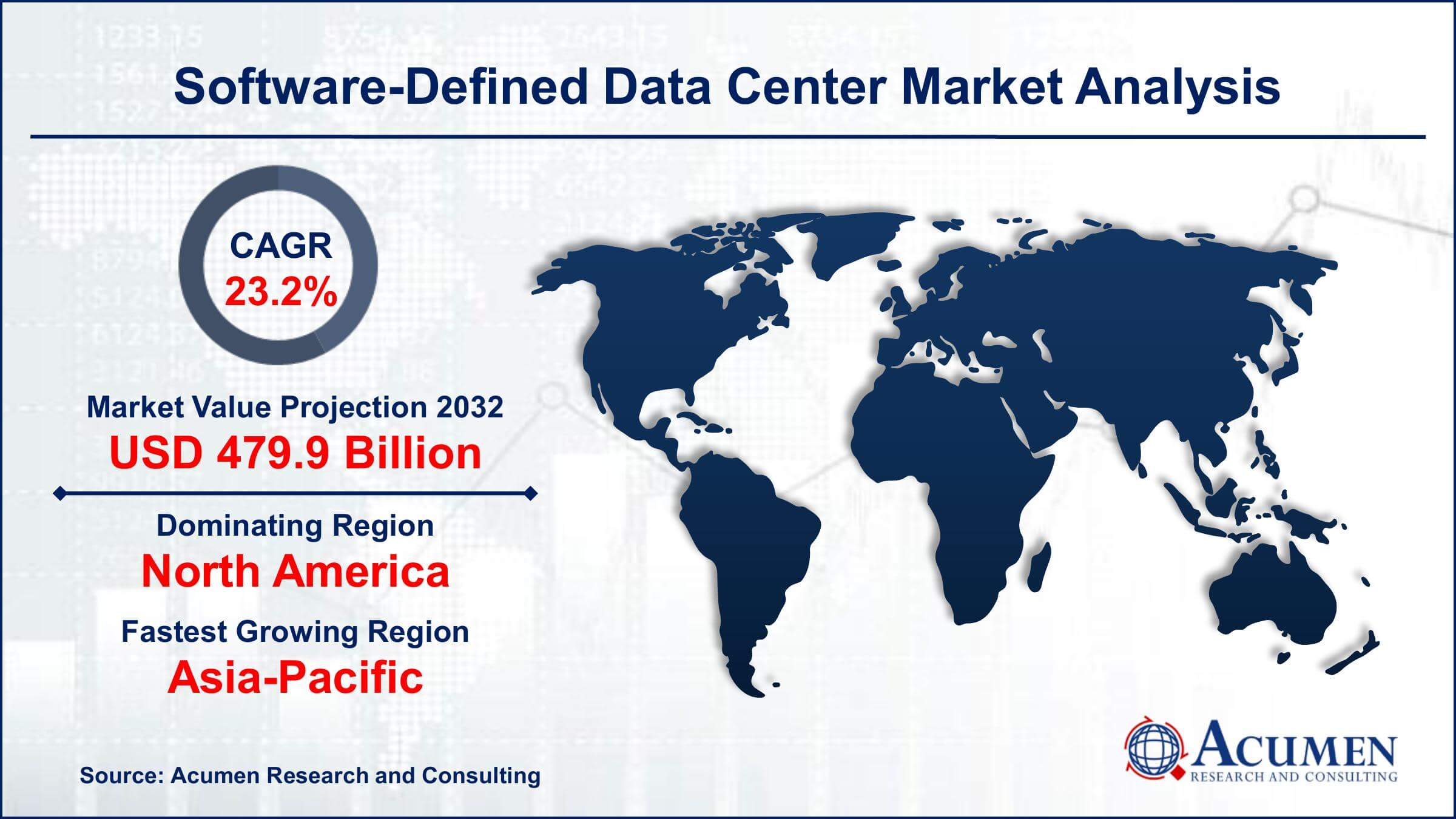

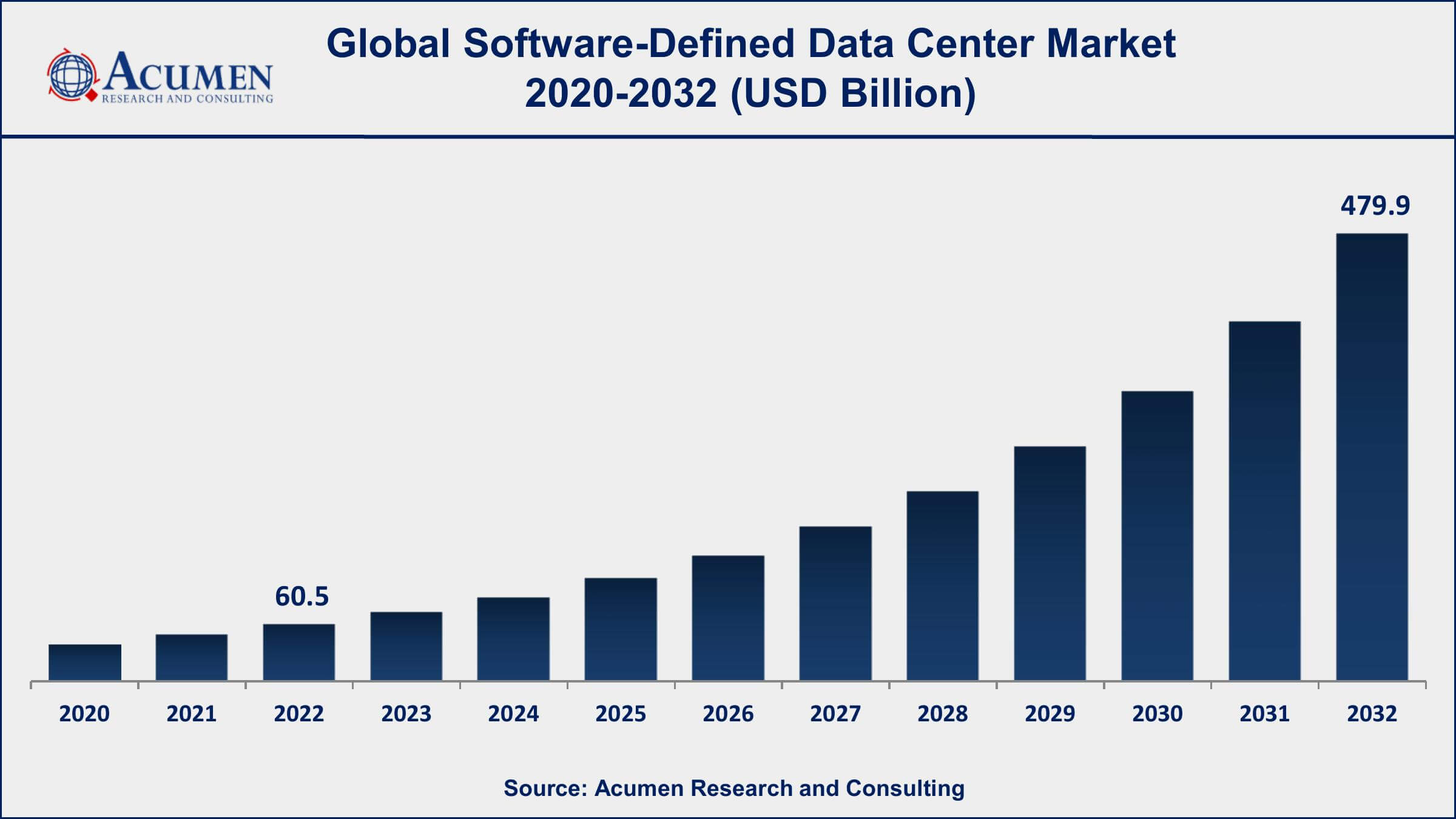

Software-Defined Data Center Market Size accounted for USD 60.5 Billion in 2022 and is projected to achieve a market size of USD 479.9 Billion by 2032 growing at a CAGR of 23.2% from 2023 to 2032.

The Software-Defined Data Center (SDDC) Market Size accounted for USD 60.5 Billion in 2022 and is projected to achieve a market size of USD 479.9 Billion by 2032 growing at a CAGR of 23.2% from 2023 to 2032.

Software-Defined Data Center Market Report Key Highlights

A software-defined data center (SDDC) is a data center architecture that virtualizes and abstracts all of the underlying hardware resources (such as storage, networking, and computing) and manages them through software. The SDDC approach enables greater flexibility, scalability, and automation, making it easier to manage and optimize data center resources. This is achieved by utilizing software-defined networking (SDN), software-defined storage (SDS), and software-defined computing (SDC) to abstract hardware resources and pools them into logical resources that can be managed and provisioned through software.

The SDDC market size is expected to grow significantly in the coming years. The increasing adoption of cloud computing and the need for scalable, flexible, and efficient data centers are the major factors driving the growth of the SDDC market. Additionally, the growing demand for automation and the need for better management and optimization of data center resources are also driving market growth. The SDDC market is also seeing significant growth due to the increasing adoption of artificial intelligence (AI) and machine learning (ML) technologies. AI and ML require massive amounts of data to be processed and analyzed in real time, which requires highly scalable and efficient data center infrastructures. The SDDC approach provides the necessary flexibility, scalability, and automation to enable these technologies to function efficiently, which is driving the demand for SDDC solutions in the market.

Global Software-Defined Data Center Market Trends

Market Drivers

Market Restraints

Market Opportunities

Software-Defined Data Center Market Report Coverage

| Market | Software-Defined Data Center Market |

| Software-Defined Data Center Market Size 2022 | USD 60.5 Billion |

| Software-Defined Data Center Market Forecast 2032 | USD 479.9 Billion |

| Software-Defined Data Center Market CAGR During 2023 - 2032 | 23.2% |

| Software-Defined Data Center Market Analysis Period | 2020 - 2032 |

| Software-Defined Data Center Market Base Year | 2022 |

| Software-Defined Data Center Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Type, By Deployment, By Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | VMware Inc., Cisco Systems Inc., Hewlett Packard Enterprise (HPE), Dell Technologies Inc., Microsoft Corporation, IBM Corporation, Nutanix Inc., Red Hat Inc., Oracle Corporation, and Citrix Systems Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Software-defined data center (SDDC) also called virtual data center (VDC) is a term related to marketing that aims at the extension of the concept of virtualization like pooling, abstraction, and automation of all resources of data-center, and services to achieve ITaaS (IT as a service). A system where all the elements of infrastructure such as storage, networking, security, and CPU are virtualized and deployed as a service is called a software-defined data center. SDDC is cast away to combiners and data-center builders other than towards tenants, as ITaaS represents an output of SDDC. To tenants, software awareness in infrastructure is invisible. Data storage resources are software-based where all other resources including networking, security, and storage are combined in a software-defined data center. A user portal is provided by SDDC which uses web-sever and is responsible for the delivery of data. It helps its customers to get access to information using the cloud and virtualization. Also, it is responsible for providing advanced data management which is, in turn, responsible for creating a backup of the data.

All those providing increased security at less price, scalability, improved data center agility, and management of operation of the data center are responsible for the growth of SDDC. Organizations involved in retail, telecom, IT, and healthcare have faced abrupt growth in big data and hence it has become important for them to adopt SDDC. Hence, the market of SDDC is expected to reach a new level in the field of automated data centers involving SDDC. The key challenge in this is data security. Various verticals such as IT and telecom, healthcare, government, and retail have adopted SDDCs. Other industry segments such as media, entertainment, education transportation, and utilities are supporting the implementation of SDDCs. The government and BFSI sector is thought to be the one who will lead the market of SDDCs because of their abrupt increase in big data and increased demand for all software-related services and data storage.

Software-Defined Data Center Market Segmentation

The global software-defined data center market segmentation is based on component, type, deployment, industry, and geography.

Software-Defined Data Center Market By Component

According to our software-defined data center industry analysis, the solution segment held the largest market share in 2022. SDDC solutions offer a more efficient and cost-effective way of managing this data growth compared to traditional data center architectures. With the explosion of data generated by businesses and individuals, the need for scalable and flexible data center solutions is becoming more critical. Moreover, the growing popularity of edge computing and IoT devices is also contributing to the expansion of the SDDC market. As the number of connected devices and endpoints continues to increase, SDDC solutions are becoming an essential infrastructure component for managing and processing data from these devices.

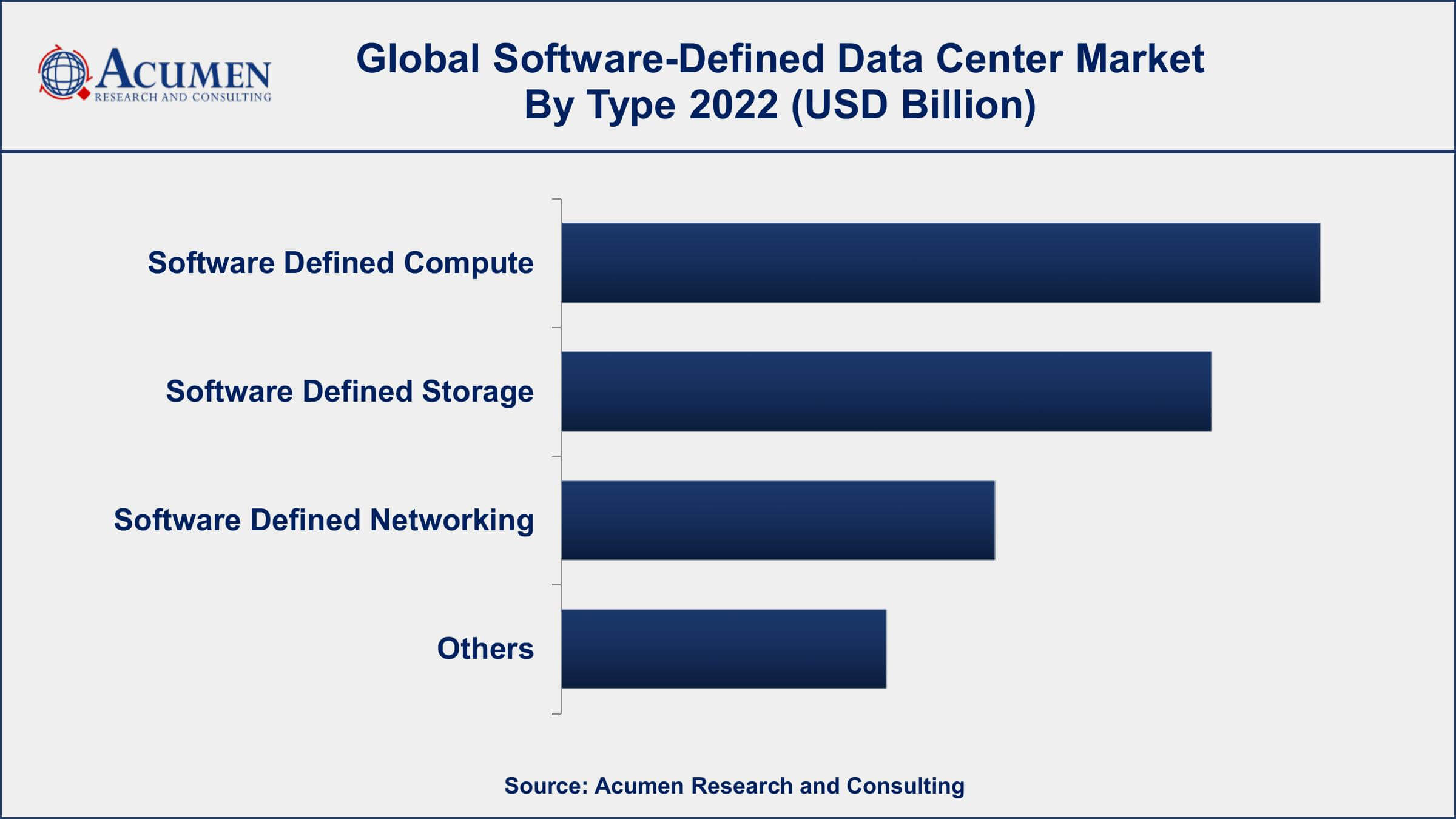

Software-Defined Data Center Market By Type

In terms of type, the software-defined compute segment is leading the market in 2022. is a critical component of the software-defined data center (SDDC) market. This segment refers to the use of virtualization technologies to abstract and pool compute resources such as processors, memory, and storage. The software-defined compute segment is expected to experience significant growth in the coming years due to several factors. One factor driving the growth of the software-defined compute segment is the increasing demand for more flexible and scalable data center solutions. Traditional data centers rely on physical hardware and fixed configurations, which can limit their ability to adapt to changing business needs. In contrast, software-defined compute solutions enable businesses to dynamically allocate compute resources on demand, reducing costs and increasing flexibility.

Software-Defined Data Center Market By Deployment

According to the software-defined data center market forecast, the public segment is expected to experience significant growth in the coming years. One factor driving the growth of the public deployment segment is the increasing adoption of cloud computing. Cloud computing has become an essential infrastructure component for businesses of all sizes, as it enables organizations to rapidly deploy and scale their applications and services. Public cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) offer a range of SDDC solutions that can be deployed on their cloud infrastructure, making it easier for businesses to adopt SDDC technologies.

Software-Defined Data Center Market By Industry

In terms of the industry, the IT & telecom segment dominates the software-defined data center market in 2022. One factor driving the growth of the IT & telecom segment is the increasing demand for more flexible and scalable data center solutions. IT and telecom companies operate some of the largest data centers in the world, and they are under constant pressure to optimize their infrastructure to reduce costs and increase efficiency. SDDC solutions enable these companies to abstract and pool their infrastructure resources, making it easier to manage and scale their data centers.

Software-Defined Data Center Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

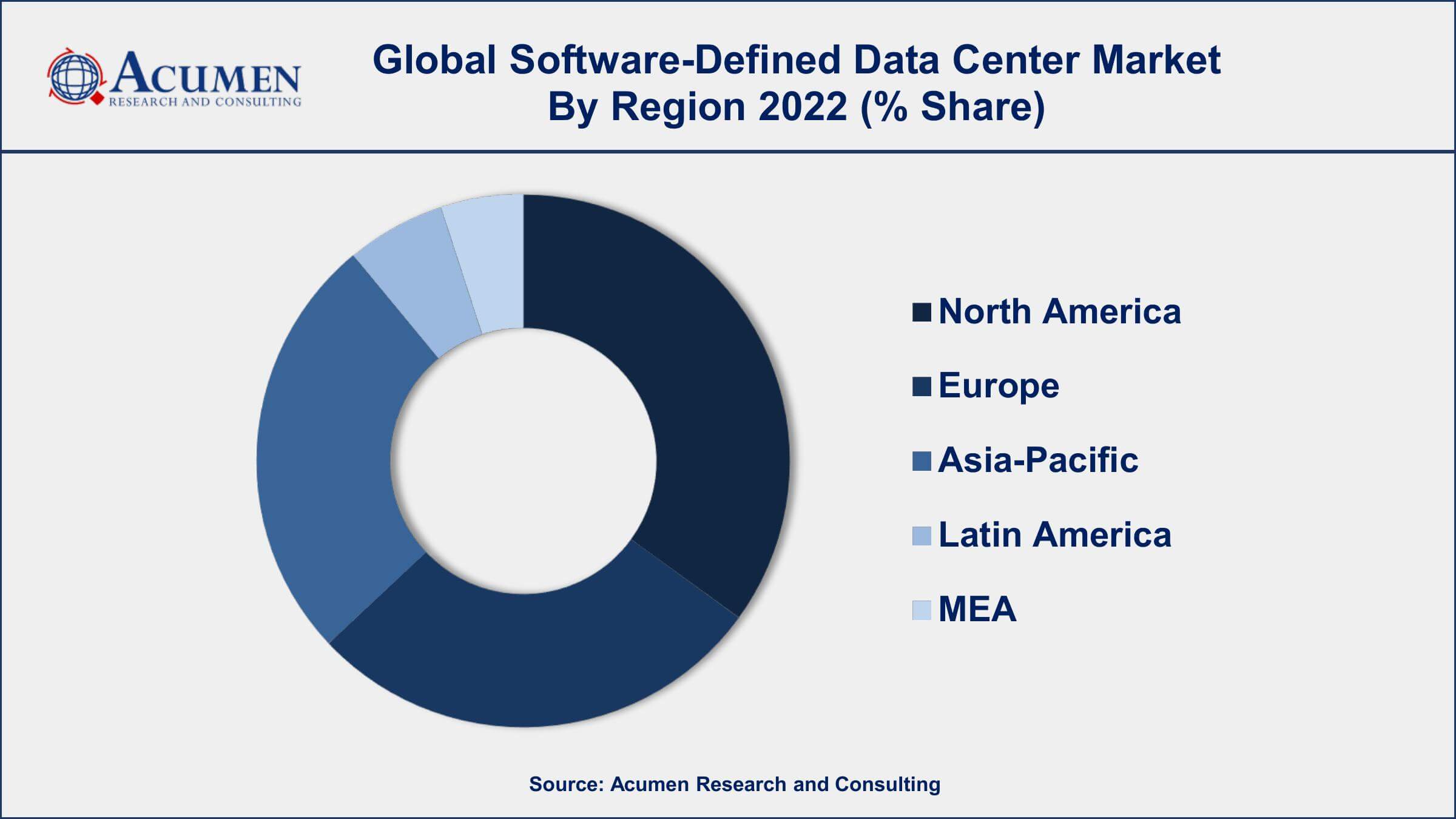

Software-Defined Data Center Market Regional Analysis

North America dominates the software-defined data center (SDDC) market due to several factors. One of the primary reasons for North America's dominance is the high level of technology adoption in the region. The United States is home to some of the largest technology companies in the world, and many of these companies have been early adopters of SDDC solutions. As a result, there is a high level of awareness and demand for SDDC solutions in North America. Another factor contributing to North America's dominance in the SDDC market is the region's robust cloud computing infrastructure. North America is home to some of the largest public cloud providers in the world, such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These cloud providers offer a range of SDDC solutions that can be deployed on their infrastructure, making it easier for businesses in North America to adopt SDDC technologies.

Software-Defined Data Center Market Player

Some of the top software-defined data center market companies offered in the professional report includes VMware Inc., Cisco Systems Inc., Hewlett Packard Enterprise (HPE), Dell Technologies Inc., Microsoft Corporation, IBM Corporation, Nutanix Inc., Red Hat Inc., Oracle Corporation, and Citrix Systems Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

May 2022

September 2024

August 2020

September 2024