April 2023

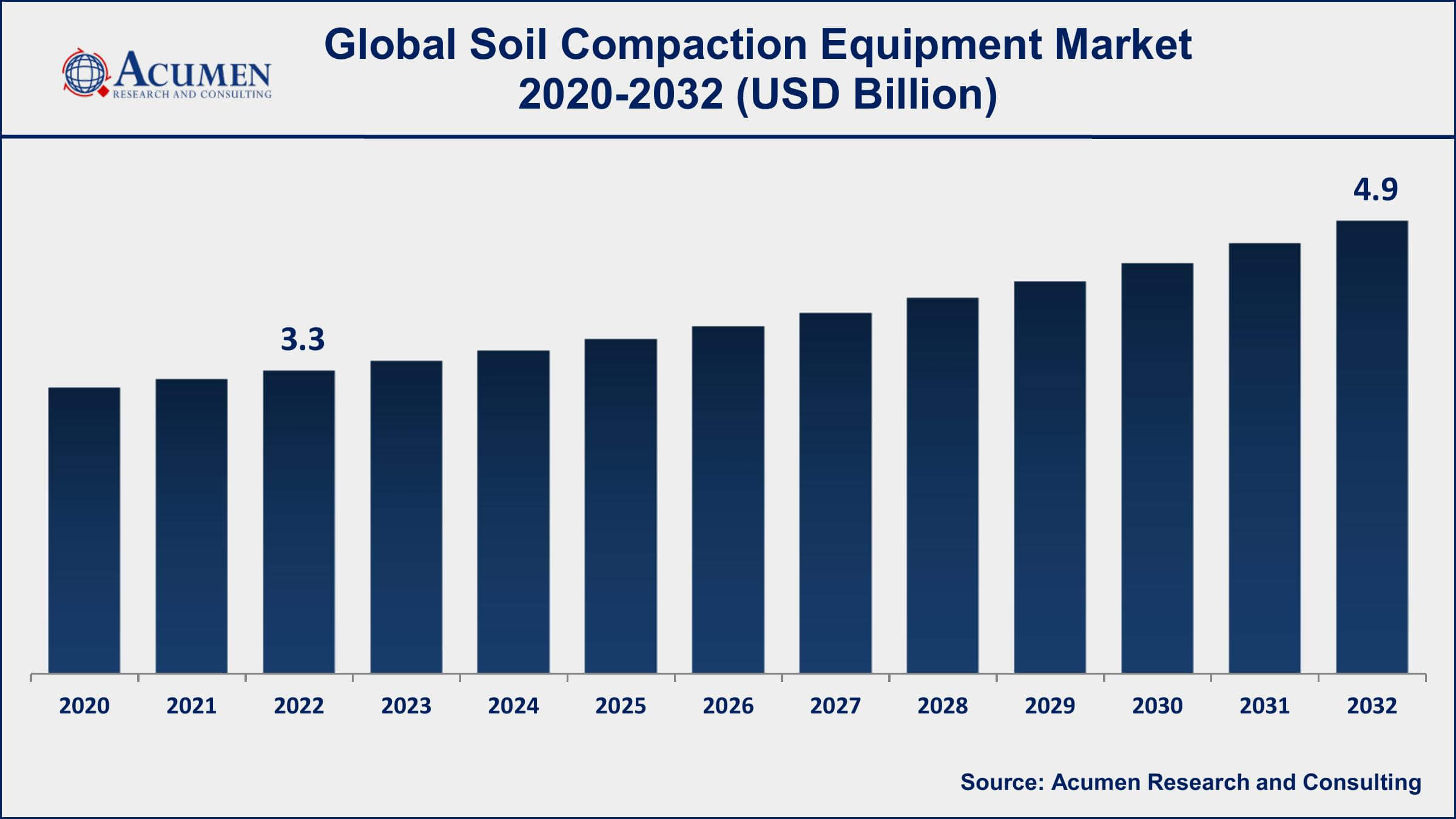

Soil Compaction Equipment Market Size accounted for USD 3.3 Billion in 2022 and is projected to achieve a market size of USD 4.9 Billion by 2032 growing at a CAGR of 4.2% from 2023 to 2032.

The Global Soil Compaction Equipment Market Size accounted for USD 3.3 Billion in 2022 and is projected to achieve a market size of USD 4.9 Billion by 2032 growing at a CAGR of 4.2% from 2023 to 2032.

Soil Compaction Equipment Market Highlights

Soil compaction equipment refers to a range of heavy machinery and tools designed to compress and consolidate soil, making it denser and more stable. This process is crucial in construction, agriculture, and civil engineering projects to ensure the soil can support heavy loads, prevent settling, and improve its overall load-bearing capacity. Soil compaction equipment typically includes rollers, compactors, and vibratory machines that exert pressure on the ground to reduce voids between soil particles, thus increasing its density.

The soil compaction equipment market has been experiencing steady growth over the years, driven by increased infrastructure development, urbanization, and construction activities worldwide. As urban populations grow and cities expand, there is a rising demand for housing, roads, bridges, and other infrastructure projects. This necessitates the use of soil compaction equipment to ensure the stability and longevity of these structures. Additionally, agriculture also relies on soil compaction equipment to optimize crop yields by improving soil structure and drainage. As a result, the market for soil compaction equipment is expected to continue growing, with advancements in technology leading to more efficient and environmentally friendly equipment in the coming years. However, market growth can be influenced by factors such as economic conditions, government infrastructure investments, and environmental regulations.

Global Soil Compaction Equipment Market Trends

Market Drivers

Market Restraints

Market Opportunities

Soil Compaction Equipment Market Report Coverage

| Market | Soil Compaction Equipment Market |

| Soil Compaction Equipment Market Size 2022 | USD 3.3 Billion |

| Soil Compaction Equipment Market Forecast 2032 | USD 4.9 Billion |

| Soil Compaction Equipment Market CAGR During 2023 - 2032 | 4.2% |

| Soil Compaction Equipment Market Analysis Period | 2020 - 2032 |

| Soil Compaction Equipment Market Base Year |

2022 |

| Soil Compaction Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Caterpillar Inc., Volvo Construction Equipment, JCB (J.C. Bamford Excavators Ltd.), Dynapac (Fayat Group), Bomag GmbH, Wacker Neuson SE, Ammann Group, Case Construction Equipment (CNH Industrial), Hamm AG (Wirtgen Group), XCMG Group, SANY Group, and Hitachi Construction Machinery Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Soil compaction equipment is a category of heavy machinery and tools specifically designed for the purpose of increasing the density and stability of soil. It achieves this by exerting pressure or force on the ground, reducing the voids between soil particles, and thereby making the soil more compact and solid. This compaction process is essential in various industries, including construction, agriculture, and civil engineering, as it ensures that the soil can bear heavy loads, resist settling, and improve its load-bearing capacity.

In construction, soil compaction equipment plays a crucial role in preparing the ground for building foundations, roads, bridges, and other structures. Compacted soil provides a stable and secure base, preventing the shifting or sinking of structures over time. In agriculture, soil compaction equipment is used to enhance crop yields by improving soil structure and drainage. Compact soil allows plant roots to access nutrients and water more efficiently, leading to healthier and more productive crops. Additionally, in civil engineering projects such as embankments, dams, and retaining walls, soil compaction equipment ensures the soil's integrity and stability, reducing the risk of erosion and structural failure.

The soil compaction equipment market has been witnessing significant growth in recent years and is expected to continue its upward trajectory. This growth is primarily driven by several key factors. First and foremost, the global construction industry is expanding at a rapid pace, fueled by urbanization and infrastructure development projects. As cities grow and demand for new roads, bridges, buildings, and other infrastructure increases, the need for soil compaction equipment to ensure stable foundations and long-lasting structures becomes paramount. Additionally, the agricultural sector continues to adopt modern farming techniques, driving the demand for soil compaction equipment to improve soil structure and optimize crop yields. Technological advancements in soil compaction equipment are another major driver of market growth.

Soil Compaction Equipment Market Segmentation

The global Soil Compaction Equipment Market segmentation is based on type, application, and geography.

Soil Compaction Equipment Market By Type

In terms of types, the smooth-wheeled rollers segment accounted for the largest market share in 2022. Smooth-wheeled rollers, also known as asphalt rollers or vibratory rollers, are widely used in road construction and maintenance, as well as in various other applications like landfills and airport runways. One of the primary drivers of growth in this segment is the increasing demand for road infrastructure, especially in rapidly developing countries. Governments and private contractors are investing heavily in expanding road networks to accommodate growing urbanization and transportation needs, thus driving the demand for smooth-wheeled rollers. Furthermore, technological advancements have significantly enhanced the efficiency and capabilities of smooth-wheeled rollers. These innovations include the integration of GPS and telematics systems for precise compaction control, as well as the development of hybrid and electric models that are more environmentally friendly and cost-effective to operate.

Soil Compaction Equipment Market By Application

According to the soil compaction equipment market forecast, the building and construction segment is expected to witness significant growth in the coming years. The demand for soil compaction equipment in this sector arises from the need to create stable and solid foundations for various structures, including residential buildings, commercial complexes, industrial facilities, and infrastructure projects such as bridges and highways. As urbanization continues to surge worldwide, there is a growing demand for new construction and renovation activities, fueling the need for soil compaction equipment. In urban environments, where space is often limited, the efficient use of land and the ability to construct buildings on a solid, compacted surface are paramount, further boosting the demand for these machines. Moreover, technological advancements in soil compaction equipment have made it more appealing to construction companies. Modern equipment comes equipped with features like GPS and telematics systems, which enhance precision in compaction processes and enable real-time monitoring of the compaction effort. This not only improves the quality of construction but also helps reduce construction time and costs, making soil compaction equipment an integral part of construction projects.

Soil Compaction Equipment Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Soil Compaction Equipment Market Regional Analysis

Asia-Pacific has emerged as the dominating region in the soil compaction equipment market due to several key factors that collectively contribute to its prominence in this industry. First and foremost, rapid urbanization and industrialization in Asia-Pacific have led to a surge in infrastructure development and construction projects. Countries like China, India, and Southeast Asian nations are witnessing unprecedented growth in urban areas, resulting in a significant demand for new roads, bridges, residential buildings, and commercial spaces. Soil compaction equipment is essential for ensuring the structural integrity of these projects, and the sheer scale of construction activities in the region has driven the need for a substantial amount of compaction equipment. Additionally, government initiatives and investments in infrastructure development are substantial in Asia-Pacific. Many countries in the region have launched ambitious infrastructure programs to support economic growth and urbanization. These initiatives involve massive budgets allocated to transportation networks, energy infrastructure, and public facilities, all of which require soil compaction equipment for successful execution. Furthermore, the adoption of advanced construction technologies and the integration of smart compaction systems have also propelled the growth of the soil compaction equipment market in the region, making it a hub for both production and consumption of these machines.

Soil Compaction Equipment Market Player

Some of the top soil compaction equipment market companies offered in the professional report include Caterpillar Inc., Volvo Construction Equipment, JCB (J.C. Bamford Excavators Ltd.), Dynapac (Fayat Group), Bomag GmbH, Wacker Neuson SE, Ammann Group, Case Construction Equipment (CNH Industrial), Hamm AG (Wirtgen Group), XCMG Group, SANY Group, and Hitachi Construction Machinery Co., Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2023

December 2020

August 2022

April 2020