September 2024

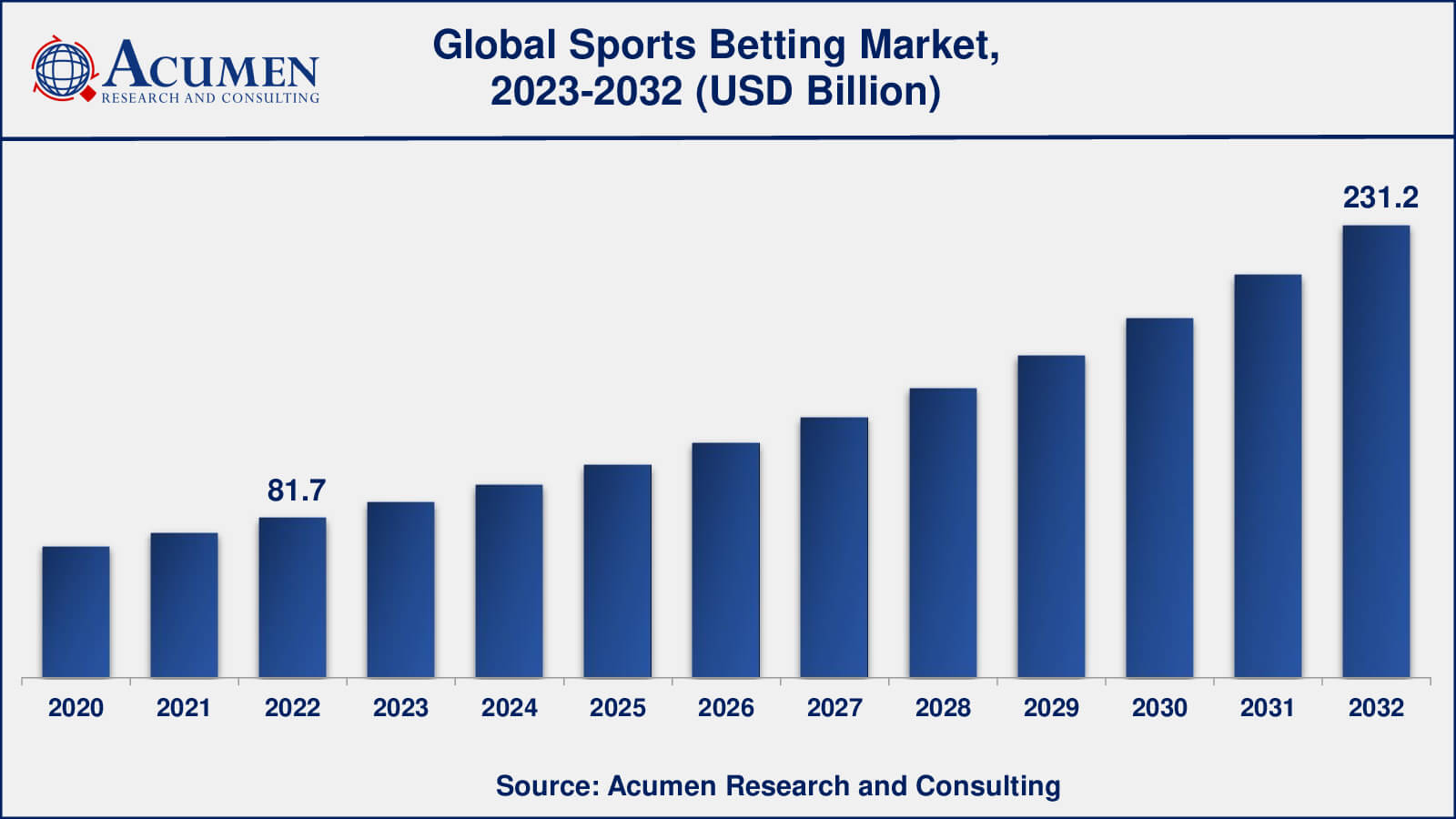

Sports Betting Market size accounted for USD 81.7 Billion in 2020 and is expected to reach USD 231.2 Billion by 2028 with a considerable CAGR of 11.1% during the forecast period of 2023 to 2032.

The global Sports Betting Market size accounted for USD 81.7 Billion in 2022 and is expected to reach USD 231.2 Billion by 2032 with a considerable CAGR of 11.1% during the forecast period of 2023 to 2032.

Sports Betting Market Highlights

A sport betting is a type of gambling that entails predicting the results of sporting events and wagering on those predictions. Bettors analyze different aspects such as team performance, player statistics, injuries, and historical data to make informed choices about which team or person is likely to win or perform well in a particular game or match. They then place bets with bookies or betting platforms, putting their money at stake in the goal of profiting if their predictions are correct. Sports betting is a popular and ubiquitous practice that provides an extra element of excitement to sporting events for many fans, but it also contains inherent dangers because to the unpredictability of athletic outcomes.

The sports betting industry has experienced a meteoric rise in the last few decades, opening up new opportunities for entrepreneurs to invest and prosper in the lucrative betting world. With the emergence of new sports betting trends, cutting-edge technologies are reimagining how sportsbooks operate and strategize. Clearly, the sports betting industry is thriving, with technological advancements having the most significant impact on its trajectory.

Sports Betting Market Dynamics

Market Growth Drivers

Market Restraints

Market Opportunities

Sports Betting Market Report Coverage

| Market | Sports Betting Market |

| Sports Betting Market Size 2022 | USD 81.7 Billion |

| Sports Betting Market Forecast 2032 | USD 231.2 Billion |

| Sports Betting Market CAGR During 2023 - 2032 | 11.1% |

| Sports Betting Market Analysis Period | 2020 - 2032 |

| Sports Betting Market Base Year | 2022 |

| Sports Betting Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Platform, By Betting Type, By Sports Type, By Age Group, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 888 Holdings Plc, Bet365, Betsson AB, Churchill Downs Incorporated, Entain plc, Flutter Entertainment Plc, IGT, Kindred Group Plc, Sportech Plc, William Hill Plc, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Pre-Covid:

The COVID-19 pandemic had a detrimental impact on the sports betting industry, resulting in the cancellation or postponement of numerous sporting events worldwide. Notably, events like Euro 2020 and the 2020 Tokyo Olympics were rescheduled to 2021. Despite these negative effects of COVID-19, some positive aspects emerged within the sports betting industry.

Post Covid:

The sports betting market demonstrated extraordinary resilience and recovery following the COVID-19 outbreak. Despite facing temporary hurdles at the peak of the pandemic, the industry rebounded effectively, experiencing a revival in customer interest and betting activity.

A notable indicator of this resurgence is the significant increase in betting volumes observed during major sporting events. Events such as the UEFA European Championship, the Tokyo Olympics, and the resumption of numerous domestic leagues witnessed a surge in wagering, signaling renewed interest among gamblers.

Moreover, the pandemic accelerated the shift to online platforms, a trend that has persisted post-COVID. The user-friendly interfaces, convenience, and accessibility of online sports betting have attracted both experienced and novice gamblers. This transition has been accompanied by the introduction of new features and enhanced security measures, all contributing to a more enjoyable and secures betting experience.

Sports Betting Market Insights

The global sports betting market is primarily driven by factors such as the increasing number of sports events and leagues, as well as the growing digital infrastructure. Trends in the global sports betting market include the surging penetration of connected devices and the evolving regulatory scenarios within the broader gambling industry. Additionally, the growing demand for sports betting among millennials and the elderly population has propelled market growth worldwide. Young adults are either participating in sports betting for the first time or transitioning from illegal to legal sports betting, given its rising popularity. Currently, more than 60% of modern sports gamblers are under the age of 40, with millennials accounting for 46% and Generation Z accounting for 15%. These younger generations naturally turn to online media to place their wagers.

In recent years, sports betting has become more convenient, allowing individuals to bet on a variety of sports from the comfort of their homes or while traveling, leading to increased betting activity worldwide. However, strict betting regulations and the proliferation of illegal betting practices pose significant challenges to sports betting market value. It was estimated in 2014 that over 80% of sports bets were illegal. Moreover, estimates suggest that illegal wagers on football games in America alone range between $60 and $80 billion annually.

Furthermore, the emergence of 5G networks and the growing utilization of AI and blockchain technologies in the sports betting market are anticipated to create various growth opportunities in the coming years. Artificial intelligence can also enhance the personalization of betting experiences, offering consumers real-time sports news and comprehensive analytics based on their past betting behaviors. Conversely, the fundamental principles of blockchain technology provide significant potential for instilling confidence in online gaming. The utilization of blockchain technology results in a permanent record of verifiable, immutable transaction history, benefiting all parties involved.

Sports Betting Market Segmentation

The global market for sports betting is segmented based on platform, betting type, sports type, age group, and region.

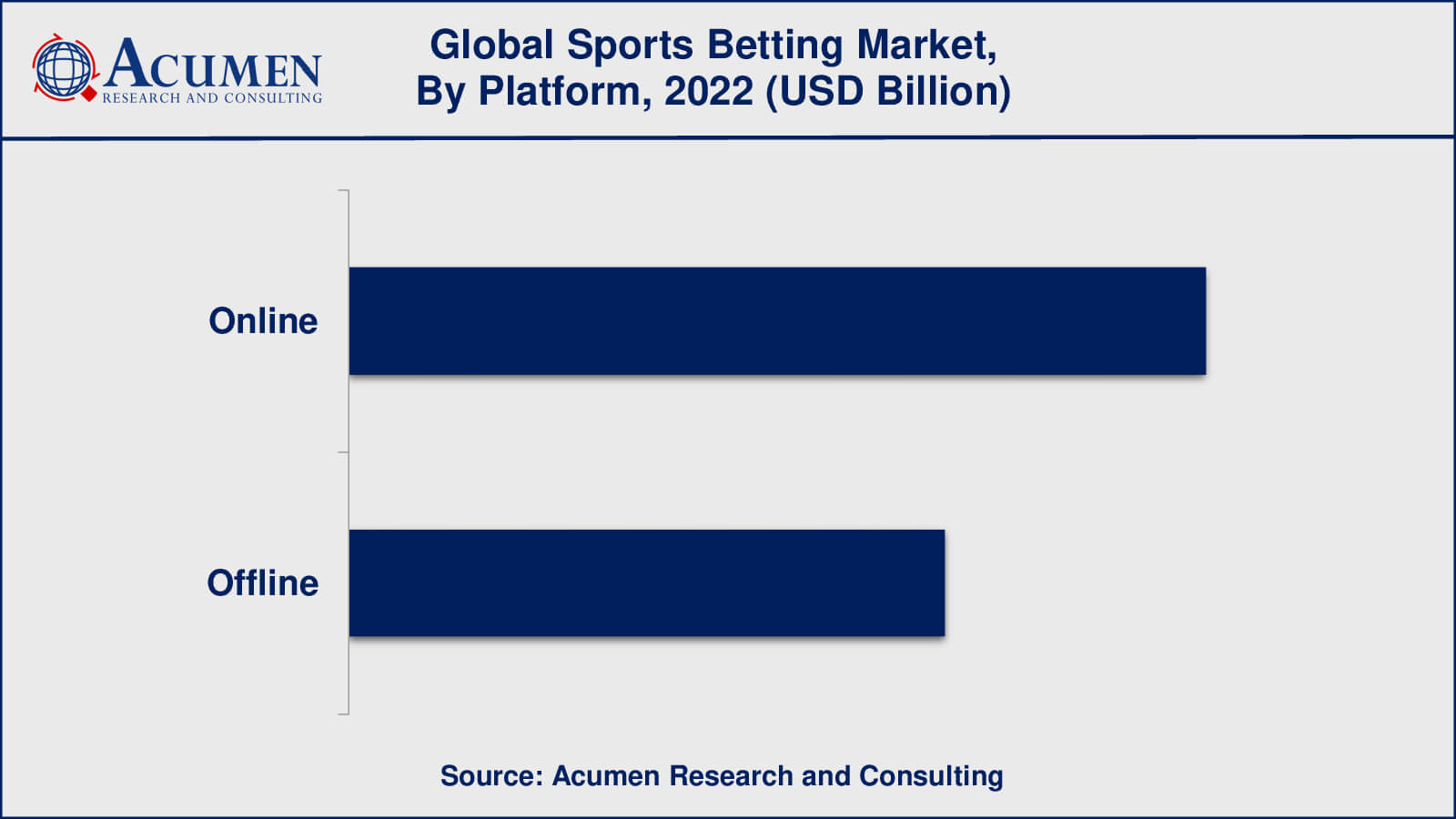

Sports Betting Platforms

Among platform types, the online segment captured the largest share in 2022. As per our sports betting industry analysis, this can be attributed to the convenience offered by online betting. The majority of online sports betting take place during major sporting events such as the FIFA World Cup and European Championships. Additionally, online betting is prominent in sports like horse racing and tennis. Many online sports betting organizations also sponsor various teams as part of their marketing campaigns and strategic expansions.

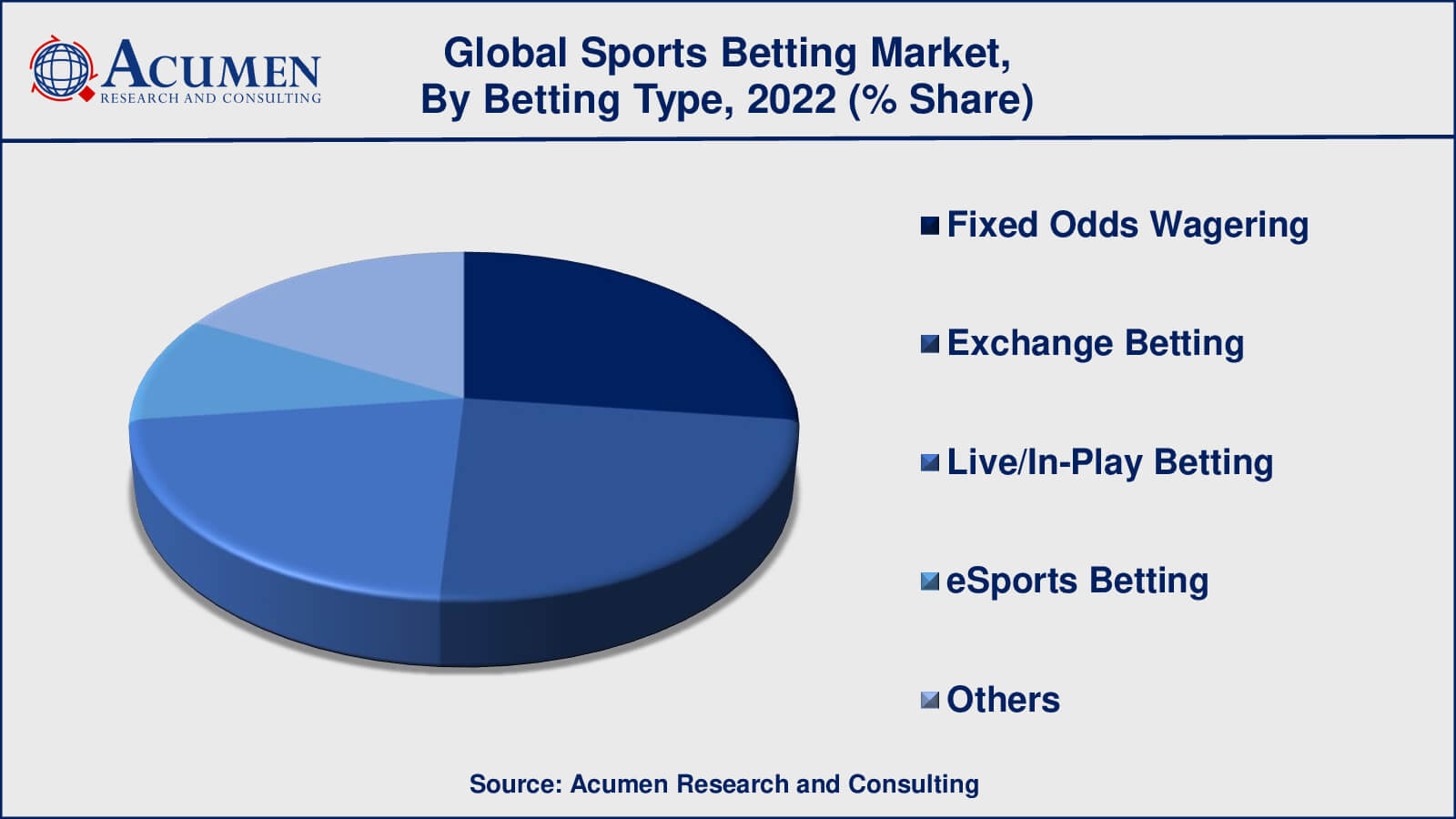

Sports Betting Types

By betting type, fixed odds wagering accounted for the largest sports gambling market share in 2022. This dominance can be attributed to the familiarity of individuals who engage in sports betting on events such as baseball, football, hockey, horse racing, and basketball with this betting format. Fixed odds wagering involves placing a bet on an event with a predetermined payout, regardless of any subsequent changes in the odds. This stability in potential payouts tends to attract more substantial wagers compared to other betting formats.

The idea behind fixed odds is simple: the odds provided at the moment of placing the wager stay consistent, guaranteeing that the possible profits are known ahead of time. This attracts to gamblers who want certainty and clarity in their prospective profits. Fixed odds betting are especially common during important athletic events, when people feel more at ease betting on outcomes with predictable payments.

Sports Betting Sport Types

As per the sports betting market forecast, the football sport is expected to dominate the market and is poised to continue this trend throughout the forecast period from 2023 to 2032. The football segment within the global online sports betting industry exhibits a substantial betting volume and is witnessing a growing number of bets, owing to the expanding global popularity of both sports betting and football as a sport. The upward trajectory is particularly notable in European countries such as Italy and Spain, where football enjoys significant popularity, contributing to the segment's robust growth.

Sports Betting Age Group

Millennials, those born between the early 1980s and the mid-1990s, have made their impact on the sports betting business. Their expertise with online platforms and mobile applications, as digital natives, has easily blended with the online sports betting experience. Their familiarity with technology complements the ease of mobile betting, providing them with a flexible and exciting method to play.

Millennials, who have a proclivity for early technology adoption, have rapidly adopted data analytics, live streaming, and other technological advancements that supplement their sports betting activities. Because of their social tendencies, they have included interactive elements that allow users to exchange thoughts, tactics, and bets with their peers. As a result, there is a tremendous growth in mobile sports betting market among millennials.

Sports Betting Market Regional Segmentation

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Sports Betting Market Regional Overview

The High Trend of Football Betting in the European Countries Propels the Sports Gambling Market Regional Growth

The European sports betting market accounted for the largest market share in 2022. The rising trend of consumer betting, especially in the football segment, in countries such as the United Kingdom, Germany, Italy, and Spain, drives growth in the EU sports betting market. Additionally, the ease of regulations and safety laws in the region further supports the growth of Europe. Online sports betting is most commonly used during major sporting events like the FIFA World Cup and European Championships, leading to tremendous expansion in Europe's online sports betting sector, particularly spurred by the 2018 FIFA World Cup.

Meanwhile, the Asia-Pacific region is expected to register the fastest growth during the forecast period from 2023 to 2032. Online gambling is currently gaining popularity in the Asia-Pacific region due to its provision of real-time gambling experiences, cashless transactions, budget flexibility, and accessibility from any electronic device. Furthermore, the growing number of wagers placed on sports events such as cricket, football, hockey, and basketball also contributes significantly to the anticipated growth in the coming years. Moreover, rapid urbanization is one of the driving factors behind the growth of the APAC sports betting industry.

Sports Betting Market Players

This section of the report pinpoints various key vendors of the market. Some of the prominent sports betting companies offered in the report include 888 Holdings Plc, Bet365, Betsson AB, Churchill Downs Incorporated, Entain plc, Flutter Entertainment Plc, IGT, Kindred Group Plc, Sportech Plc, William Hill Plc, and others.

Companies operating in the market are adopting a series of strategic activities to establish a significant foothold in the competitive landscape. For instance, on November 30, 2021, 888 Holdings Plc announced a partnership with Nuvei Corporation to integrate its Instant Bank Transfer payment solution into Sports Illustrated's newly launched SI Sportsbook. This venture marks the magazine's initial step into the realms of online sports betting and iGaming in the United States.

Similarly, on September 08, 2021, 888 Holdings Plc revealed another partnership, this time with Genius Sports Limited, aimed at furnishing its SI Sportsbook with market-leading official data and trading capabilities. As part of this collaboration, Genius Sports is poised to offer pre-game and in-play content across top-tier U.S. sports properties, including the NBA, NASCAR, NFL, and NCAA."

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2024

April 2025

June 2024

January 2020