April 2020

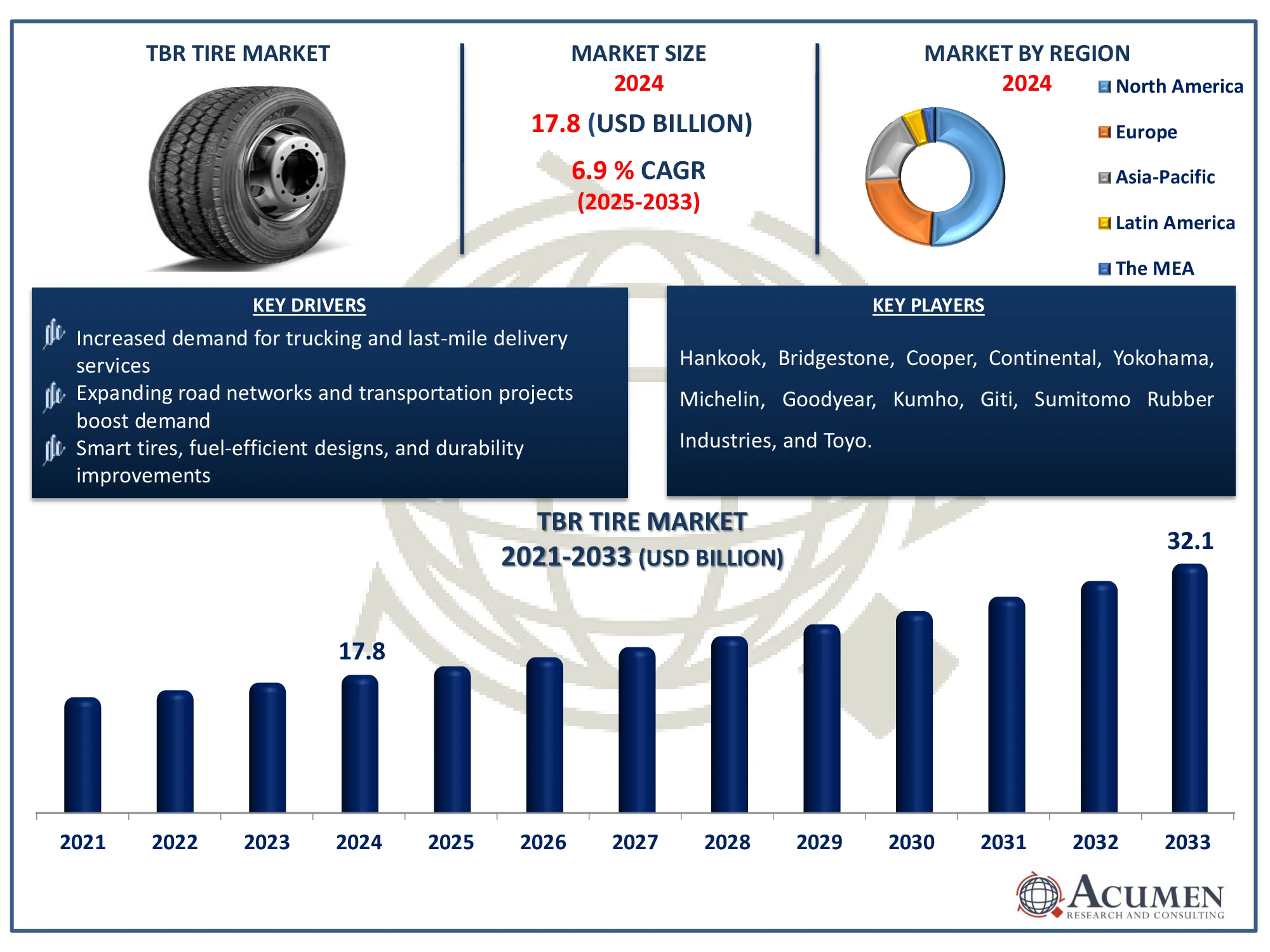

The Global TBR Tire Market Size accounted for USD 17.8 Billion in 2024 and is estimated to achieve a market size of USD 32.1 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

The Global TBR Tire Market Size accounted for USD 17.8 Billion in 2024 and is estimated to achieve a market size of USD 32.1 Billion by 2033 growing at a CAGR of 6.9% from 2025 to 2033.

TBR (truck and bus radial) tires are specifically developed for vehicles longer than 21 feet and weighing more than 10,000 pounds, excluding recreational vehicles. These tires are primarily designed for highway use, providing benefits such as higher driving comfort due to flexible sidewalls, less heat buildup at high speeds, greater resistance to tread degradation, and enhanced fuel efficiency through better energy transmission from the vehicle to the road.

TBR (truck and bus radial) tires are specifically developed for vehicles longer than 21 feet and weighing more than 10,000 pounds, excluding recreational vehicles. These tires are primarily designed for highway use, providing benefits such as higher driving comfort due to flexible sidewalls, less heat buildup at high speeds, greater resistance to tread degradation, and enhanced fuel efficiency through better energy transmission from the vehicle to the road.

TBR tires primarily serve two markets: the trucking industry and public transit services. They offer enhanced structural strength, increased cornering force for improved maneuverability, and shorter stopping distances thanks to a larger tread contact patch. Additionally, TBR tires help to reduce accident-related expenses and losses. Furthermore, they provide substantial benefits in terms of wear resistance, durability, reduced rolling resistance, and improved driving comfort, resulting in lower total operating costs.

|

Market |

TBR Tire Market |

|

TBR Tire Market Size 2024 |

USD 17.8 Billion |

|

TBR Tire Market Forecast 2033 |

USD 32.1 Billion |

|

TBR Tire Market CAGR During 2025 - 2033 |

6.9% |

|

TBR Tire Market Analysis Period |

2021 - 2033 |

|

TBR Tire Market Base Year |

2024 |

|

TBR Tire Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Tire Axle, By Application, By End-Use Industry, By Sales Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Hankook, Bridgestone, Cooper, Yokohama, Michelin, Sumitomo Rubber Industries, Continental, Goodyear, Kumho, Giti, and Toyo. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

TBR tires offer various safety advantages over other types of tires and are extremely durable. They provide stronger structural strength, increased cornering power for greater maneuverability, and shorter stopping distances thanks to a bigger tread contact patch. Notably, TBR tires help to reduce accident-related expenditures and losses.

However, the greater initial cost of TBR tires compared to traditional bias-ply truck and bus tires remains a significant hurdle, deterring some fleet operators from investing in them and limiting market expansion. Nonetheless, improvements in performance, such as increased durability, decreased rolling resistance, and lower maintenance costs, are likely to drive truck and bus radial (TBR) tire market growth during the projection period.

Furthermore, the increasing use of TBR tires in technologically upgraded trucks, notably in the construction industry, is expected to drive significant growth in the coming years. According to the Bureau of Labor Statistics, the construction business is expected to grow by 4.7 percent between 2023 and 2033, outpacing the overall industry growth rate of 4.0 percent. The expansion of the construction industry will increase demand for heavy-duty trucks and equipment, creating a greater requirement for long-lasting TBR tires. The expansion of e-commerce and the increasing penetration of TBR tires in developed economies are also projected to have a significant impact on truck and bus radial (TBR) tire market growth throughout the projection period.

TBR Tire Market Segmentation

TBR Tire Market SegmentationThe worldwide market for TBR tire is split based on tire axle, application, end-use industry, sales channel, and geography.

According to truck and bus radial tire industry analysis, drive tire perform critical function in delivering traction, stability, and load-bearing capability. These tires are engineered to handle high torque and stress, making them necessary for commercial trucks that operate in a variety of terrains and weather situations. With rising demand for freight transportation and long-haul trucking, the drive tire segment maintains its position in market and technological innovation. Steer tires are essential for vehicle handling and stability; they are mounted on the front axle to guarantee precise steering and even wear. Trailer tires, which are usually used on non-powered axles, can withstand enormous weights while maintaining longevity. All-position tires are versatile and can be utilized on any axle, providing balanced performance and cost efficiency.

According to TBR tire industry analysis, in recent years, the truck segment has taken the lead due to the high need for freight transportation, logistics, and long-haul trucking. Trucks require durable and high-performance tires to carry huge loads, long distances, and changing road conditions, resulting in a steady demand for TBR tires. With the growth of e-commerce, infrastructure projects, and cross-border trade, the truck segment remains the market leader in this area. The bus market also plays an important role, with TBR tires developed for passenger comfort, safety, and durability. The expanding necessity for public transportation and intercity travel fuels consistent demand for bus tires, especially in urban and developing regions.

According to truck & bus radial tire industry analysis, trucking is witnessing significant expansion in the market as a result of its widespread use in freight transportation, logistics, and supply chain operations. With the growing demand for long-haul trucking, construction material transport, and last-mile delivery, there is a continued need for durable and high-performance TBR tires. This sector's reliance on heavy-duty vehicles for economic activity ensures that it maintains its market leadership. Public transportation services increase demand for TBR tires in buses, ensuring passenger safety and operational efficiency. Commercial cars are primarily used in cities for logistics and delivery services.

According to TBR tire market forecast, aftermarket segment is expected to increase significantly because to the frequent replacement needs of commercial vehicles that experience heavy wear and tear. Fleet owners and independent truck operators are constantly looking for long-lasting and cost-effective tire replacements, which drives significant demand in this market. The OEM (original equipment manufacturer) segment focuses on new vehicle production, providing TBR tires directly to truck and bus manufacturers. While it maintains a consistent market share, its growth is limited when compared to the aftermarket, as tire replacements are more common than new vehicle purchases.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

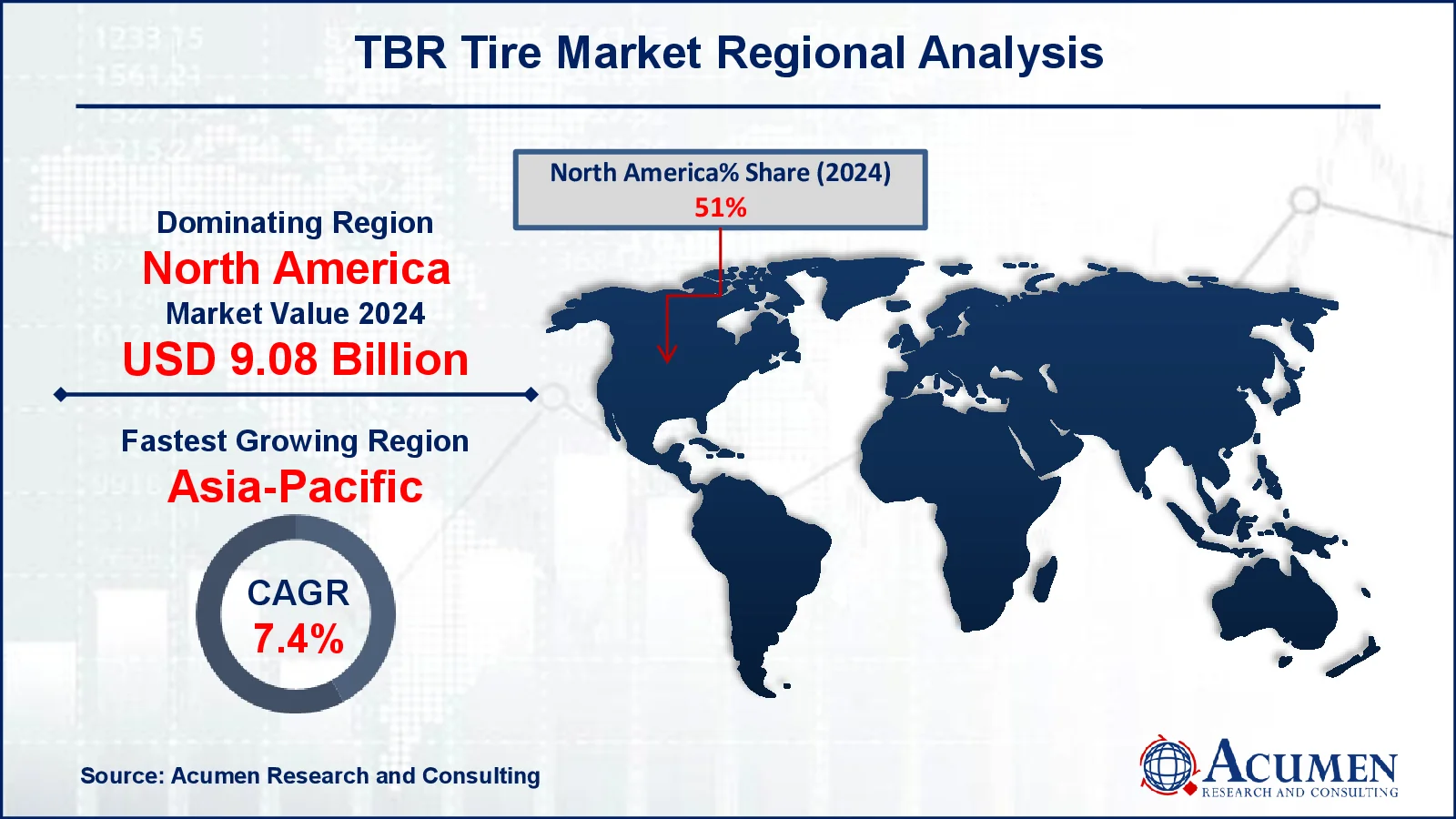

TBR Tire Market Regional Analysis

TBR Tire Market Regional AnalysisIn terms of regional segments, North America dominates the truck and bus radial (TBR) tire market, owing to its well-developed trucking industry, wide freight network, and high demand for long-haul and heavy-duty trucks. According to the US Department of the Treasury, the US construction sector will rise in 2023 and beyond, driven by rising demand for data centers, energy infrastructure, and EV charging stations, as well as government efforts such as the Infrastructure Investment and Jobs Act (IIJA). Furthermore, tight fuel efficiency and safety laws are hastening the adoption of sophisticated TBR tires, cementing the region's supremacy.

Asia-Pacific's truck and bus radial tire market is rising rapidly, owing to increased industrialization, expanded logistics networks, and large-scale infrastructure projects. As per Green Finance & Development Center, investments in green energy construction, including hydropower, increased from USD 5.6 billion in 2022 to USD 8.1 billion in 2023. Rail projects worth USD 4.2 billion are underway in Africa, Latin America, and East Asia, including the Kinshasa urban railway in the Democratic Republic of Congo. Meanwhile, China continues to invest heavily in road building around the world, with projects worth USD 7.5 billion, including a USD 1.6 billion toll road in Cambodia. The rise in global construction and infrastructure projects continues to fuel demand for heavy-duty trucks and machines, pushing development in the truck and bus radial tire market.

Some of the top TBR tire companies offered in our report include Hankook, Bridgestone, Cooper, Yokohama, Michelin, Sumitomo Rubber Industries, Continental, Goodyear, Kumho, Giti, and Toyo.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2020

August 2020

August 2020

May 2022