October 2022

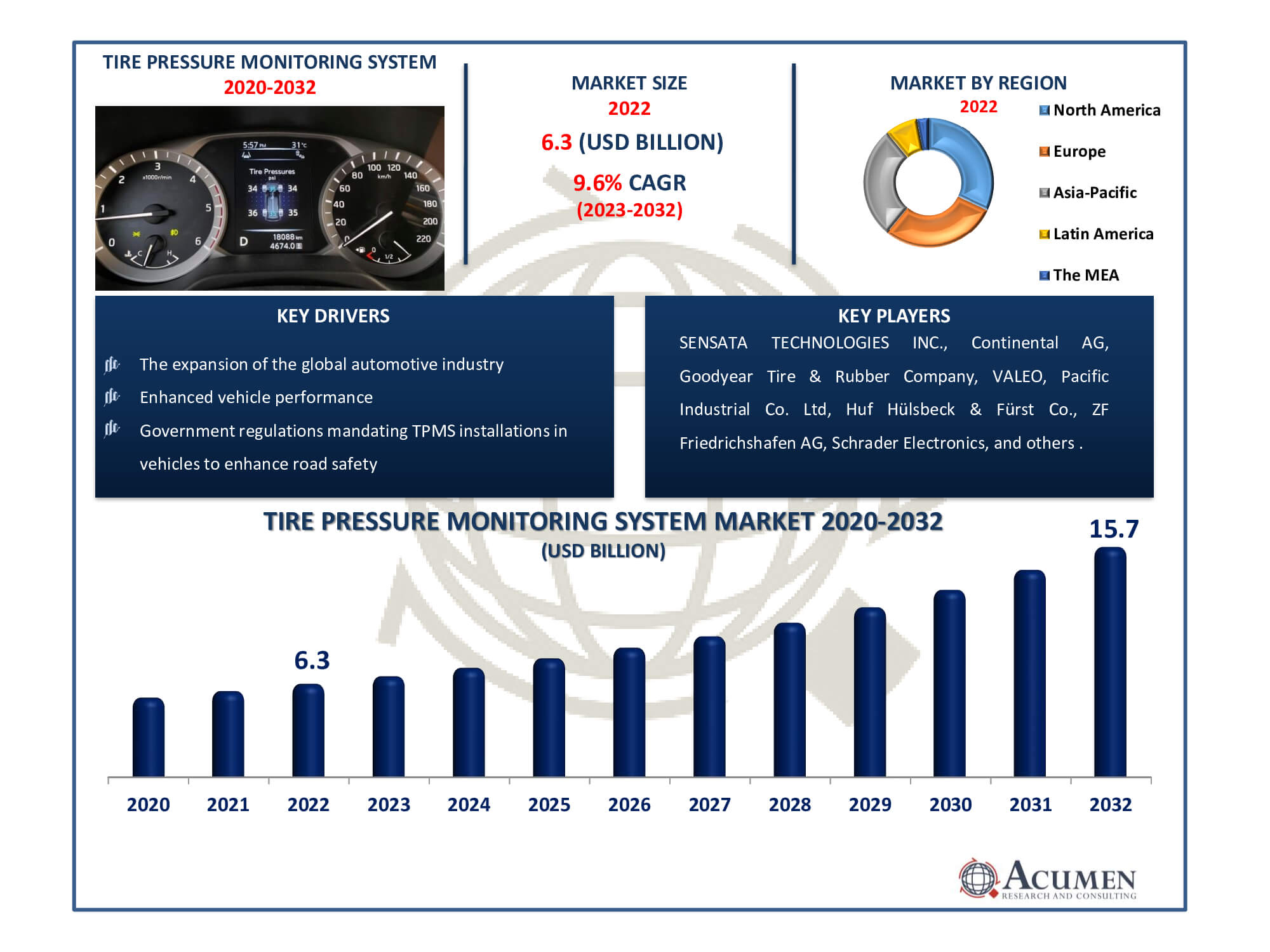

Tire Pressure Monitoring System Market Size accounted for USD 6.3 Billion in 2022 and is estimated to achieve a market size of USD 15.7 Billion by 2032 growing at a CAGR of 9.6% from 2023 to 2032.

The Tire Pressure Monitoring System Market Size accounted for USD 6.3 Billion in 2022 and is estimated to achieve a market size of USD 15.7 Billion by 2032 growing at a CAGR of 9.6% from 2023 to 2032.

Tire Pressure Monitoring System Market Highlights

A tire pressure monitoring system (TPMS) is an electronic system that tracks the air pressure in a vehicle's tires and alerts the driver to potentially unsafe conditions. It conveys this information through various means, such as a pressure gauge, a pictogram display, or a straightforward low-pressure warning light on the vehicle's dashboard. The primary focus of the TPMS market is on improving vehicle safety, tire lifespan, and fuel efficiency. TPMS is critical in preventing accidents caused by underinflated tire and encourages environmentally friendly driving practices. As governments require TPMS in new vehicles and drivers become more cautious, the TPMS business expands, creating opportunities for automotive suppliers, sensor makers, and data analytics firms.

Global Tire Pressure Monitoring System Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Tire Pressure Monitoring System Market Report Coverage

| Market | Tire Pressure Monitoring System Market |

| Tire Pressure Monitoring System Market Size 2022 | USD 6.3 Billion |

| Tire Pressure Monitoring System Market Forecast 2032 | USD 9.4 Billion |

| Tire Pressure Monitoring System Market CAGR During 2023 - 2032 | 9.6% |

| Tire Pressure Monitoring System Market Analysis Period | 2020 - 2032 |

| Base Year |

2022 |

| Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Vehicle Type, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | SENSATA TECHNOLOGIES INC., Continental AG, Goodyear Tire & Rubber Company, VALEO, Pacific Industrial Co. Ltd, Huf Hülsbeck & Fürst Co., ZF Friedrichshafen AG, Schrader Electronics, NIRA Dynamics AB, Renesas Electronics Corporation Ltd., Delphi Automotive LLP, Hampton Automotive Technology Co. Ltd, and ORANGE ELECTRONIC CO LTD. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Tire Pressure Monitoring System Market Insights

The imposition of strict safety norms in developed economies, along with technological advancements that enable real-time updates, is driving market growth. The rapidly growing automotive sector, coupled with rising disposable incomes in developing economies, is boosting demand. Furthermore, the increasing health and safety awareness among consumers and the installation of various advanced driver assistance systems (ADAS) are further accelerating the market's value. Moreover, increasing research and development activities that enhance TPMS to facilitate fuel efficiency are projected to create potential opportunities over the estimated period from 2023 to 2032.

The high initial cost of installing and integrating these systems into vehicles is a constraint in the tire pressure monitoring system (TPMS) industry. While TPMS improves safety and fuel efficiency, the costs of manufacturing and installing these systems can raise the overall cost of vehicles, thereby limiting adoption, particularly in price-sensitive countries.

The growing trend towards autonomous vehicles and smart transportation systems provides an opportunity in the TPMS market. Because real-time tire pressure data is critical for autonomous vehicle operation, TPMS can play a critical role in guaranteeing the safety and optimal performance of autonomous vehicles. As the development and deployment of autonomous vehicles continues, the demand for improved TPMS systems is likely to climb, offering TPMS producers with a considerable market potential.

Tire Pressure Monitoring System Market Segmentation

The worldwide market for tire pressure monitoring system is split based on technology, vehicle type, sales channel, and geography.

Tire Pressure Monitoring System Technologies

According to the tire pressure monitoring system market the largest section was direct TPMS in 2022. Direct TPMS uses pressure sensors embedded in each tire to monitor and transmit real-time tire pressure data to the vehicle's onboard computer. This technology detects pressure changes with high accuracy and speed, ensuring perfect tire pressure monitoring.

Direct TPMS is popular because it quickly alerts drivers to tire pressure issues, improving road safety and tire longevity. It is used in current automobiles because of its capacity to offer precise data. It has become the leading technology in the TPMS market due to its direct approach to monitoring, meeting safety regulations and consumer needs for precise tire pressure management.

Tire Pressure Monitoring System Vehicle Types

According to the TPMS industry analysis, the increasing demand for passenger vehicles across the globe is primarily driving the market value. The rising consumer awareness about health and safety products is driving the market value. Additionally, the increasing purchasing power of people in emerging economies and the rising adoption of technologically advanced products is further supporting the market value. Along with these, the market is also projected to maintain its dominance over the estimated period from 2023 to 2032. The light commercial vehicle category, which includes vans, pickups, and compact trucks, is expected to the second largest segment. Because light commercial cars are often utilised for both personal and business purposes, they account for a sizable portion of the tire pressure monitoring system (TPMS) market. Many companies rely on these vehicles for transportation, distribution, and logistics, highlighting the importance of TPMS in ensuring safe and effective operations.

Tire Pressure Monitoring System Sales Channels

The largest section in the tire pressure monitoring system (TPMS) market is original equipment manufacturers (OEMs). This category leads due to automakers increasingly using TPMS as a regular feature during the manufacturing process. OEMs are incorporating TPMS into new vehicles to meet safety laws and market desires for greater safety features. OEM-fitted TPMS is quickly becoming the norm, ensuring that every new vehicle sold includes this technology. As a result, the OEM segment dominates the TPMS market, owing to obligatory TPMS installation in several regions. Consumers purchasing new vehicles can expect TPMS as a standard feature, contributing to this segment's substantial market presence.

Tire Pressure Monitoring System Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Tire Pressure Monitoring System Market Regional Analysis

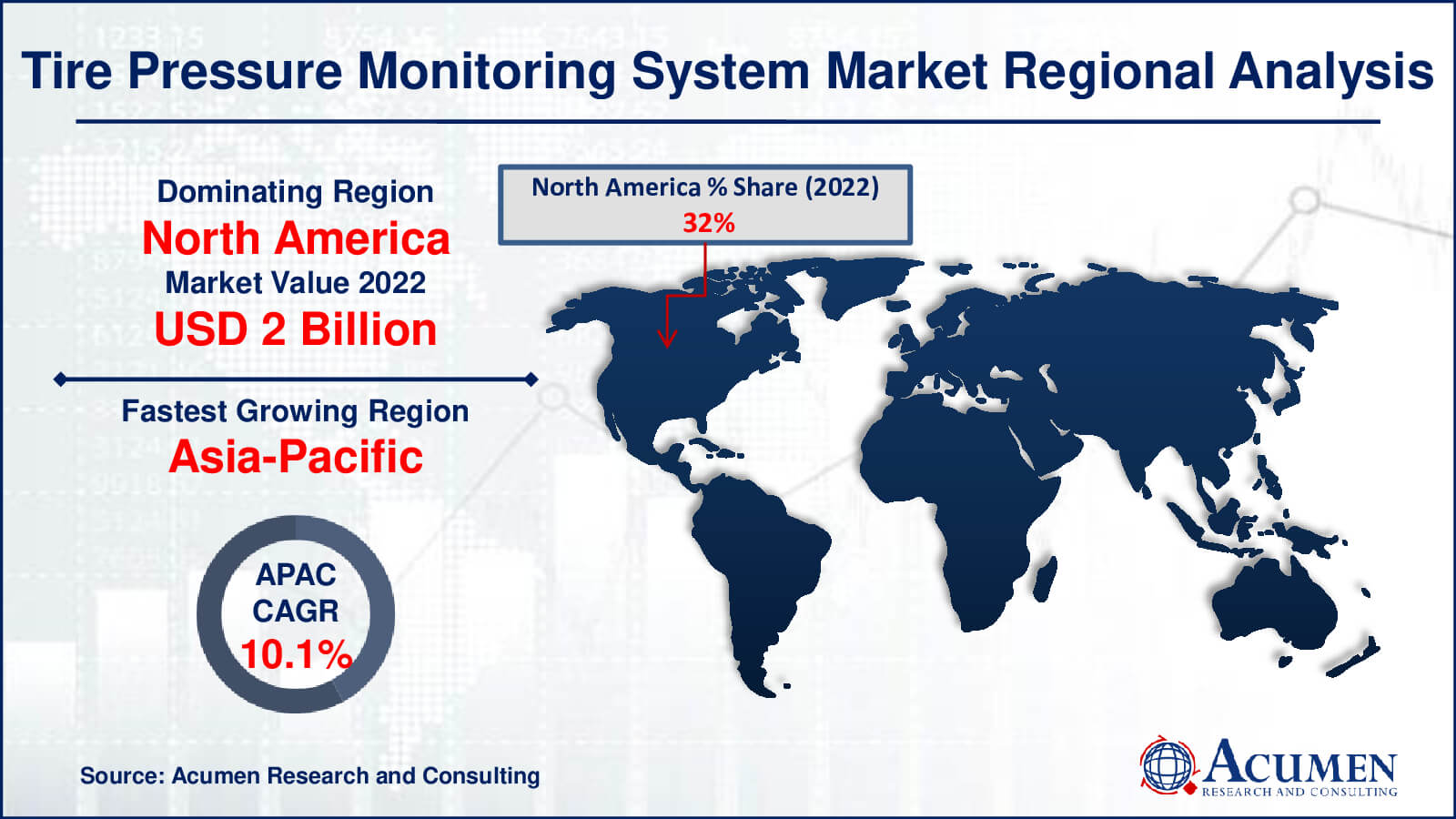

North America continues to be the leading TPMS market. This domination is due to severe safety laws and mandates requiring the installation of TPMS in all new vehicles, assuring road safety and vehicle efficiency. Furthermore, North America is at the forefront of technical breakthroughs, with a greater understanding of the significance of safety precautions. As a result, TPMS adoption remains strong, considerably contributing to market growth.

Europe is the world's second largest TPMS market, with similarities to North America in terms of severe safety requirements and growing awareness of the benefits of TPMS. The strong European automotive sector prioritizes TPMS integration, while customers and manufacturers actively embrace these technologies to improve road safety and vehicle performance.

As the fastest-growing TPMS market, Asia-Pacific takes the lead. The rapid expansion of the automobile sector in emerging economies is essentially driving this rise. Increased disposable money and increased awareness of health and safety have resulted in an increase in demand for TPMS. Furthermore, the installation of advanced driver assistance systems (ADAS) and the growing popularity of passenger vehicles have propelled TPMS adoption dramatically. Countries such as China and India play critical roles in the expansion of the automotive sector, making the Asia-Pacific region a hotbed for automotive TPMS market growth.

Tire Pressure Monitoring System Market Players

Some of the top tire pressure monitoring system companies offered in our report includes SENSATA TECHNOLOGIES INC., Continental AG, Goodyear Tire & Rubber Company, VALEO, Pacific Industrial Co. Ltd, Huf Hülsbeck & Fürst Co., ZF Friedrichshafen AG, Schrader Electronics, NIRA Dynamics AB, Renesas Electronics Corporation Ltd., Delphi Automotive LLP, Hampton Automotive Technology Co. Ltd, and ORANGE ELECTRONIC CO LTD.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2022

February 2023

February 2025

January 2025