November 2024

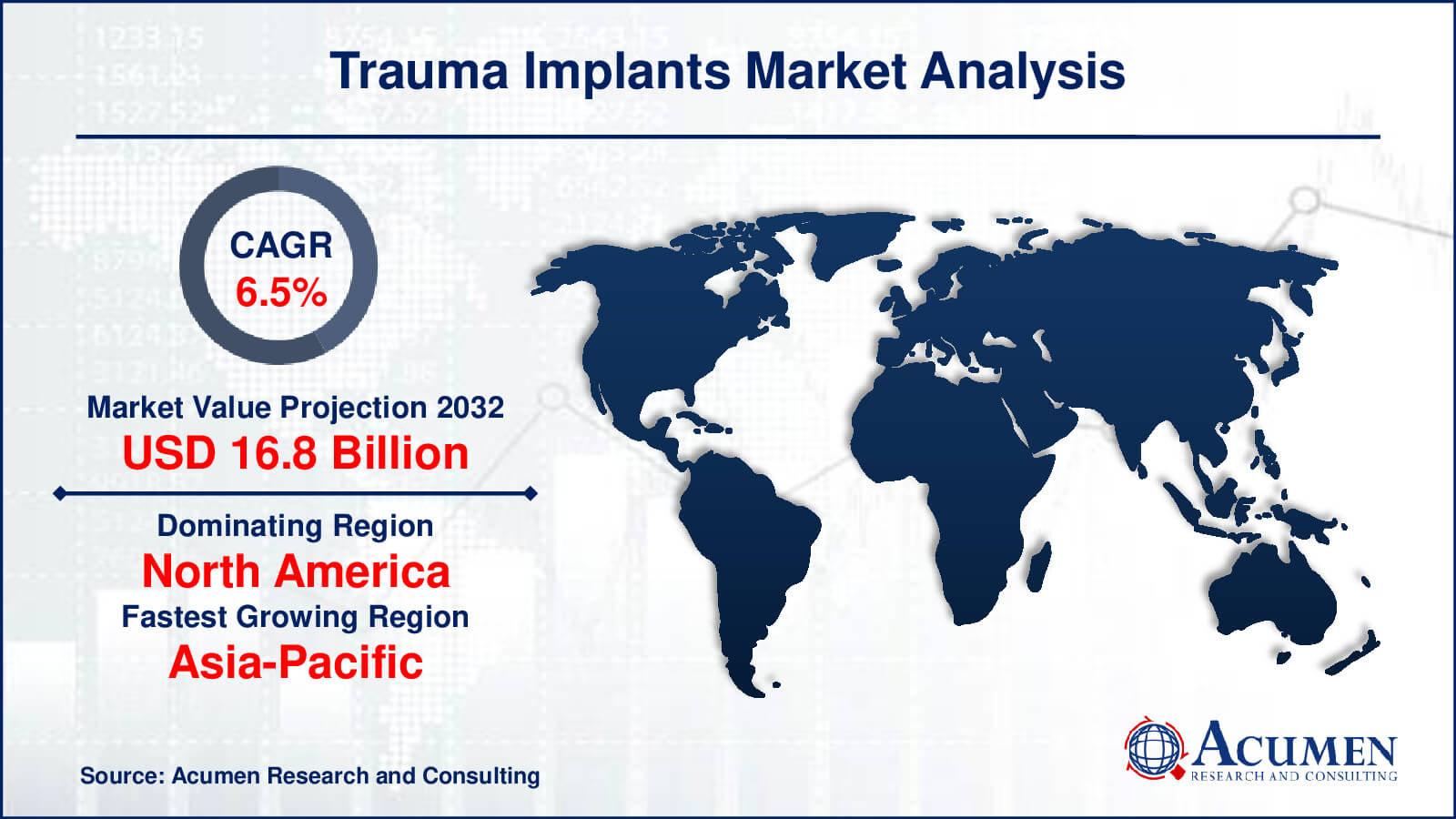

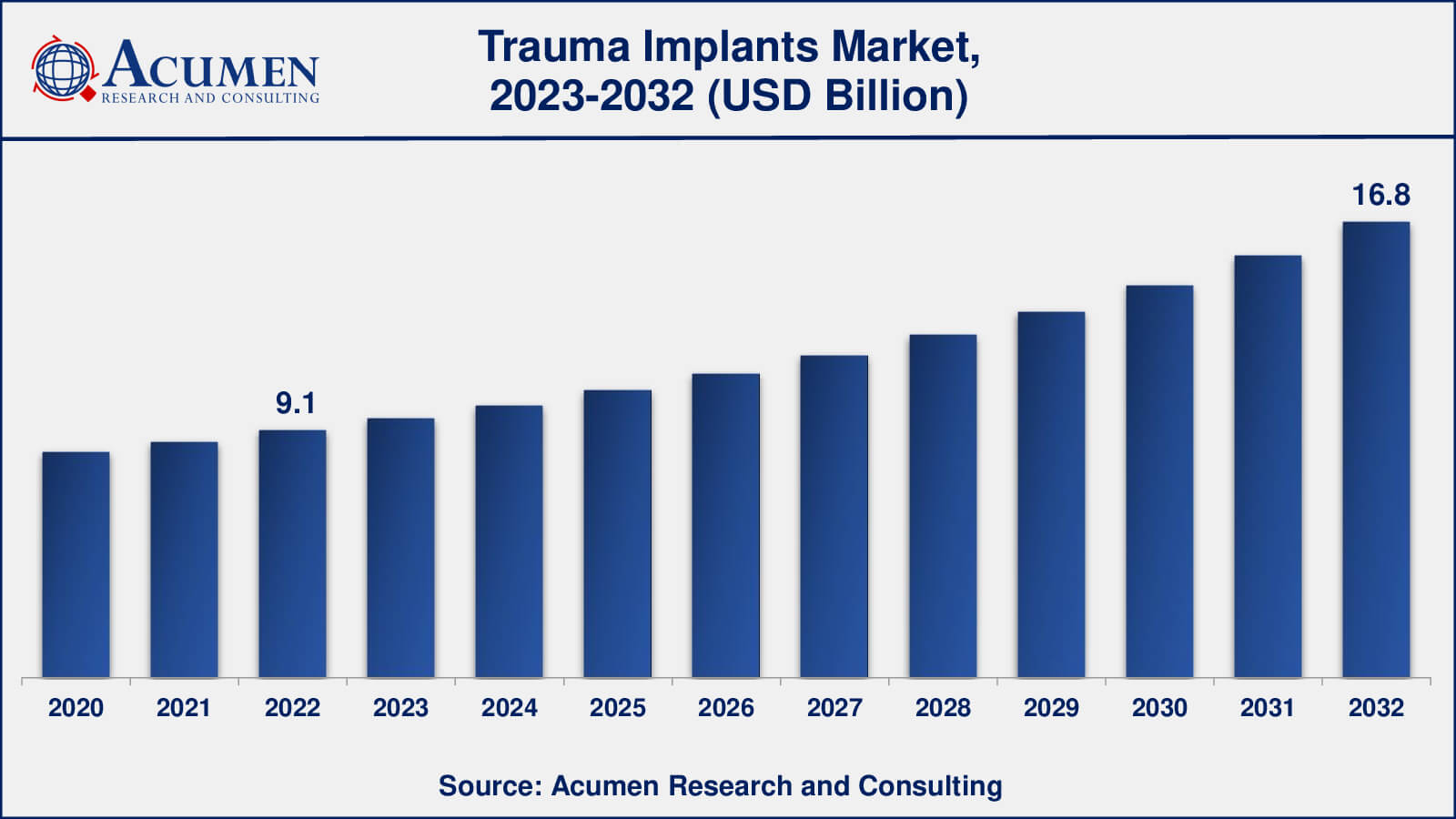

Trauma Implants Market Size accounted for USD 9.1 Billion in 2022 and is estimated to achieve a market size of USD 16.8 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

The Global Trauma Implants Market Size accounted for USD 9.1 Billion in 2022 and is estimated to achieve a market size of USD 16.8 Billion by 2032 growing at a CAGR of 6.5% from 2023 to 2032.

Trauma Implants Market Highlights

Trauma implants are manufactured or produced from various metals and substances, including internal trauma fixation devices, craniomaxillofacial fixation devices, and implantable trauma stimulators. These implants are surgically placed inside the body and function as a bone structure replacement or reinforcement for damaged structures. Trauma implants play a vital role in introducing new products. There are different types of trauma implants, such as reconstructive joint replacement, spinal implants, dental implants, orthobiologics, and trauma and craniomaxillofacial implants, all of which serve various medical purposes.

Global Trauma Implants Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Trauma Implants Market Report Coverage

| Market | Trauma Implants Market |

| Trauma Implants Market Size 2022 | USD 9.1 Billion |

| Trauma Implants Market Forecast 2032 | USD 16.8 Billion |

| Trauma Implants Market CAGR During 2023 - 2032 | 6.5% |

| Trauma Implants Market Analysis Period | 2020 - 2032 |

| Trauma Implants Market Base Year | 2022 |

| Trauma Implants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product, By Material Type, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Acumed LLC, Aesculap, Inc. – a B. Braun company, Conformis, DePuy Synthes Companies, Orthofix Medical Inc., Smith & Nephew, Stryker, Wright Medical Group N.V., and Zimmer Biomet. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Trauma Implants Market Insights

The growth of the trauma implant market is primarily driven by several factors, including the increasing number of bone replacement surgeries, stringent government regulations regarding biologics, a rise in chronic diseases worldwide, an aging population, and technological advancements in trauma implants. Additionally, increased investment in research and development for new bone joints and pharmaceutical devices by key players, along with a growing base of patients with various diseases worldwide, is expected to boost market growth.

According to the National Center for Biotechnology Information (NCBI), the number of products launched increased from 29 in 2003 to 56 in 2013. The World Health Organization (WHO) and The International Agency for Research on Cancer (IARC) project that around 19.3 million new bone implant cases will be diagnosed annually by 2025.

Moreover, changing consumer lifestyles in developed countries, a growing number of hospitals and clinic centers, a thriving pharmaceutical and medical industry, and increased availability of various implant material types and technological advancements present opportunities for manufacturers in the global market over the forecast period. However, challenges such as the high cost of research and development, stringent government regulations for product approval, and the need for skilled professionals may hinder the growth of the global trauma implants market in the coming years.

Trauma Implants Market Segmentation

The worldwide market for trauma implants is split based on type, product, material type, end-user, and geography.

Trauma Implants Types

Based on the type segment, the internal trauma fixation devices segment dominated the trauma implants market. In 2022, the internal trauma fixation devices segment accounted for approximately 35% of the global trauma implants market share. This dominance can be attributed to the increasing demand for replacement surgeries, a rise in the prevalence of osteoporosis and osteoarthritis, and continuous developments in orthopedics. Additionally, regular sales of internal trauma fixation devices, compared to other product types, are expected to contribute to the segment's growth over the forecast period.

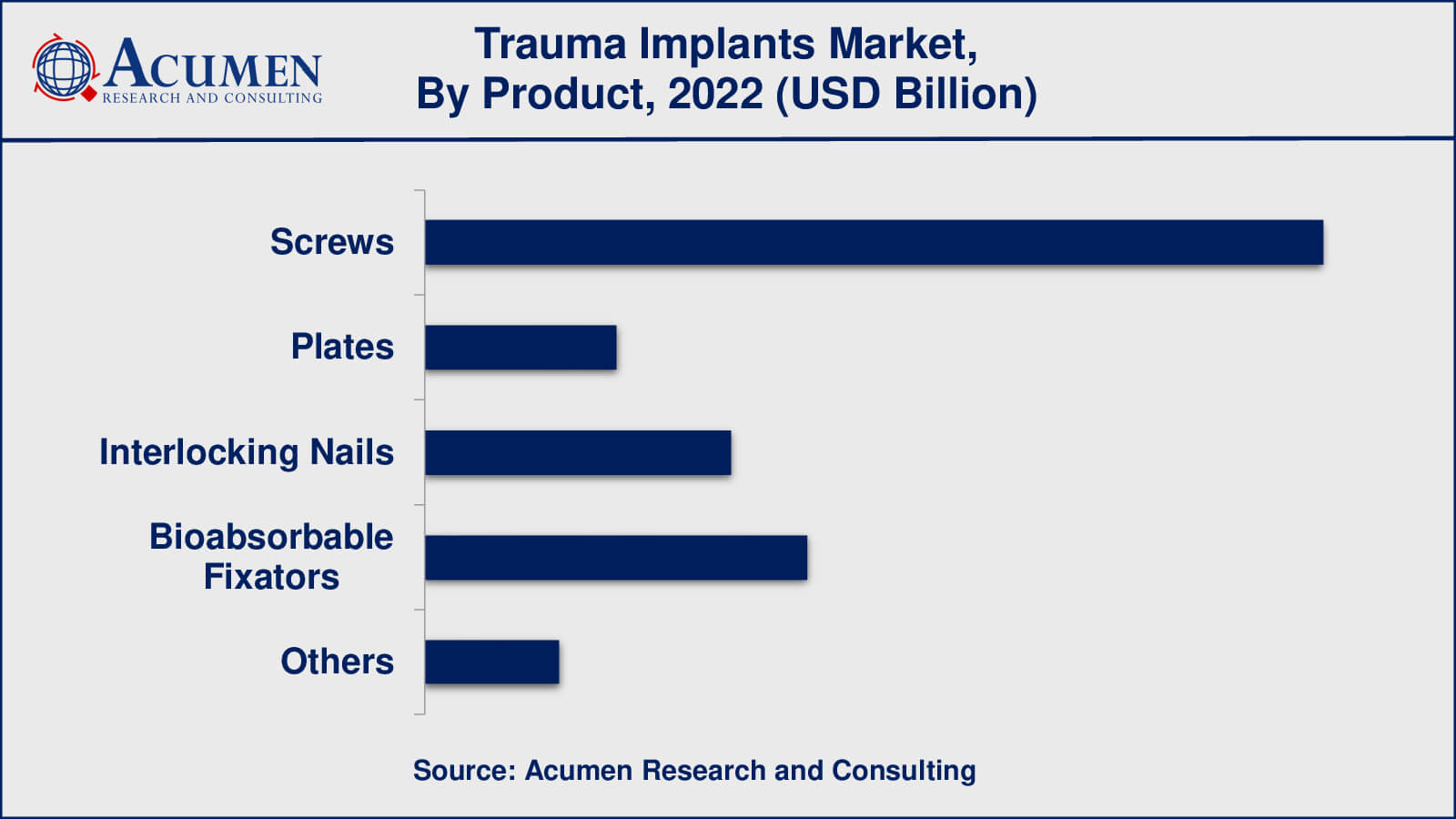

Trauma Implants Products

Within the trauma implants market, the product segment is categorized into screws, plates, interlocking nails, bioabsorbable fixators, and other products. Among these, the Screws category emerged as the leader in terms of revenue share in previous years. Furthermore, following screws, bioabsorbable fixators are expected to hold the second-largest share of the market. This segment is used to keep fractured bones stable and in proper alignment, and this benefit is expected to be a driving factor for its growth in the future.

Trauma Implants Material Types

In terms of material types, the trauma implants market includes metal, polymer, plastic, and other materials. In recent years, the metal segment has emerged as the dominant material type in the trauma implants market, accounting for approximately 46% of the market share in the past year. Furthermore, this segment is experiencing significant growth, with the highest compound annual growth rate (CAGR) projected throughout the forecast period, which spans from 2023 to 2032.

Another prominent material type segment is metal, which holds the second-largest market share after plastics. The metal segment is also expected to exhibit the highest CAGR during the forecast period.

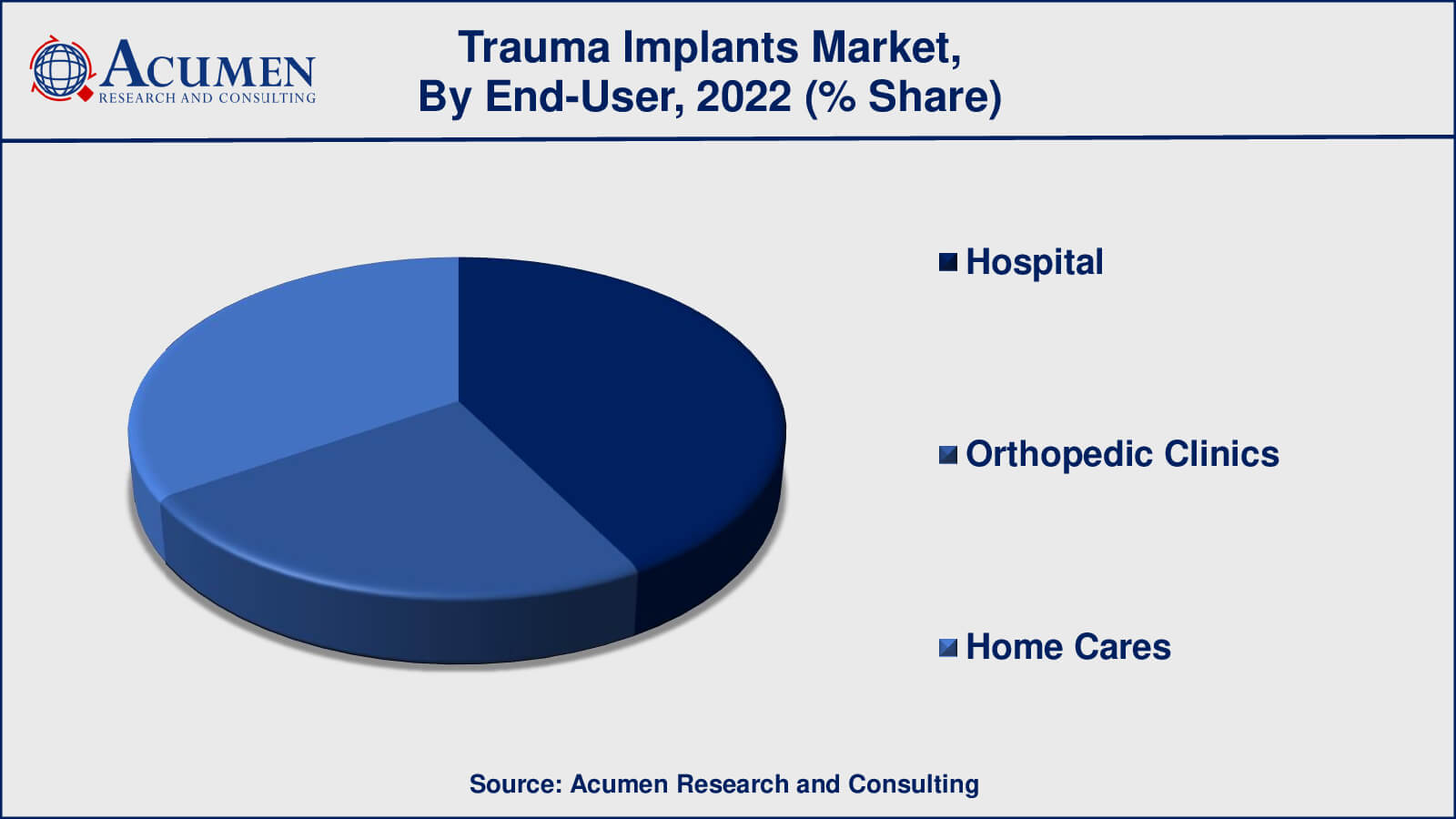

Trauma Implants End-Users

In 2022, the hospital segment accounted for approximately 42% of the global trauma implants market share. This significant share can be attributed to the growing demand for trauma implants across various material types and their use in cataract procedures. Additionally, increased investments in the development of new implants and initiatives for immunization are expected to further boost this segment over the forecast period.

The rise in the number of hospitals, the launch of new treatment options, and supportive government initiatives for trauma implants in hospitals are also expected to drive the demand for trauma implants within the hospital segment during the forecast period.

Trauma Implants Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Trauma Implants Market Regional Analysis

North America accounted for a significant market share in the trauma implants market, and the region is expected to maintain its dominance over the forecast period. This growth is driven by several factors, including the rapid consumption of trauma implants across various material types, the presence of trauma implant companies, favorable reimbursement policies, and increased adoption in cancer research. The North American region also benefits from high levels of research and development in medical devices and pharmaceuticals, the continuous development and launch of new implants and devices, and a well-developed healthcare infrastructure.

Furthermore, the presence of highly skilled surgeons and a growing number of laboratory and research centers in key countries such as the US and Canada are contributing to the growth of trauma implants in North America. Europe follows North America in the trauma implants market.

In contrast, Asia-Pacific is expected to exhibit the highest compound annual growth rate (CAGR) in the global market during the forecast period. This growth can be attributed to the expanding pharmaceutical and medical device industry, increasing innovation and development in trauma implants, and the growth of the outsourcing industry, all of which are expected to enhance the market's growth in the global trauma implants market during the forecast period.

Trauma Implants Market Players

Some of the top Trauma Implants companies offered in our report includes Smith & Nephew, Zimmer Biomet, Conformis, Orthofix Medical Inc., and Acumed LLC, Aesculap, Inc. – a B. Braun company, Wright Medical Group N.V., Stryker, DePuy Synthes Companies.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2024

November 2024

September 2023

October 2024