April 2021

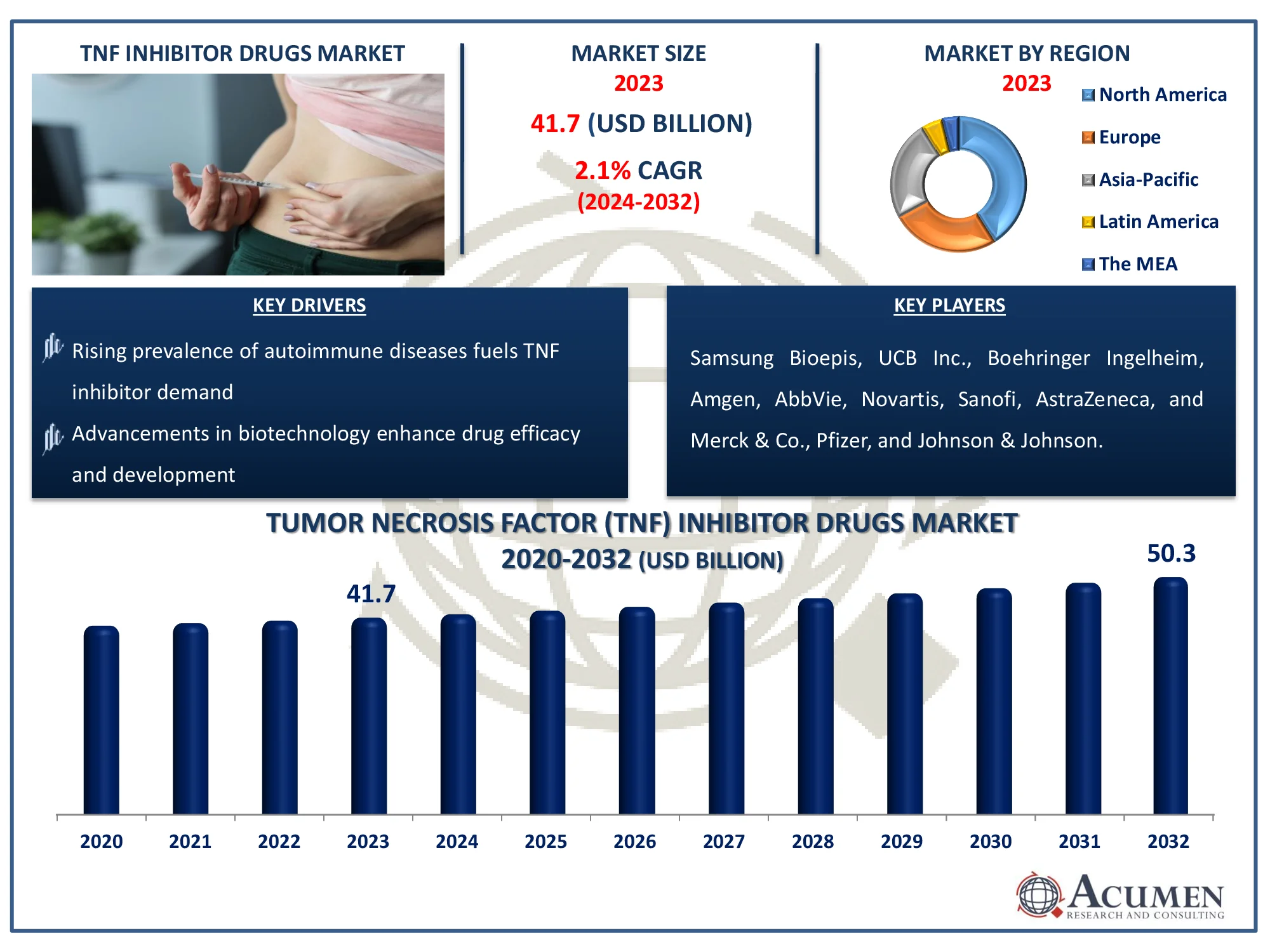

The Global Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Size accounted for USD 41.7 Billion in 2023 and is estimated to achieve a market size of USD 50.3 Billion by 2032 growing at a CAGR of 2.1% from 2024 to 2032.

The Global Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Size accounted for USD 41.7 Billion in 2023 and is estimated to achieve a market size of USD 50.3 Billion by 2032 growing at a CAGR of 2.1% from 2024 to 2032.

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Highlights

TNF inhibitors or factor inhibitors of tumor necrosis are biological medicines extracted from human or animal tissue, most frequently used to prevent inflammating and the development of disease, through a suppression of the inflammatory substance, i.e. the necrosis factor of the tumor, in the body. It is mainly used for the therapy of multiple inflammatory diseases such as rheumatoid arthritis, psoriasis and inflammatory bowel disease. In addition to Adalimumab (Humira), Infliximab (Remicade), Certolizumab (Cimzia), etanercept (Enrel), and more, these TNF inhibitors that are currently approved for the therapy of different inflammatory circumstances.

Global Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Report Coverage

|

Market |

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market |

|

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Size 2023 |

USD 41.7 Billion |

|

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Forecast 2032 |

USD 50.3 Billion |

|

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market CAGR During 2024 - 2032 |

2.1% |

|

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Analysis Period |

2020 - 2032 |

|

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Base Year |

2023 |

|

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Application, By Sales Channel, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Samsung Bioepis, UCB Inc., Johnson & Johnson, Amgen, Boehringer Ingelheim, AbbVie, Novartis, Sanofi, AstraZeneca, and Merck & Co., Pfizer. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Insights

New product launches, promising pipelines, increased autoimmune disease incidences and significantly increased customer awareness of the tumor necrosis factor (TNF) are anticipated to drive development. TNF inhibitors are used to suppress TNF cytokine inflammation and, consequently, to treat autoimmune and inflammatory diseases like rheumatoid arthritis, psoriasis, Crohn's, and cancer, for example. TNF inhibitors are investigating the role of TNF in the therapy of metastatic melanomas and locally developed soft tissue sarcomas.

Biosimilars pose a direct inner danger to the biologics in TNF inhibitors markets. Loss of patent exclusivities in different areas paves the way. Moreover, the tumor necrosis factor (TNF) inhibitor drugs market has intensely rivaled the inhibitors of Interleukin (IL). In many clinical trials, IL inhibitors are shown to have enhanced safety and effectiveness profiles and to show superior outcomes. There has been a substantial paradigm shift in autoimmune disease therapy caused by targeted biodegradable action and the development of bio-similars. However, consumers are more likely to see beneficial impacts on the dynamics of tumor necrosis factor inhibitor drugs market demand for cost efficient drugs with better safety and efficiency profiles.

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Segmentation

The worldwide tumor necrosis factor (TNF) inhibitor drugs market is split based on product, application sales channel, and geography.

TNF Inhibitor Drugs Market By Product

According to tumor necrosis factor (TNF) inhibitor drugs industry analysis, in 2023, humira was in charge of the product area that generated about half of the company's income. Humira made USD 19.9 billion and is still one of the world's most popular pharmaceutical medications. Even if Humira's patent expired in Europe, its exclusivity in the United States remains intact. Although the loss of patent exclusivity will most likely result in lower revenues, Humira is predicted to be the leading TNF inhibitor by 2032. The biological wave poses a substantial threat to biological products, as evidenced by its low cost and comparable results in head-to-head clinical trials. Humira, Enbrel, and Remicade have all been released in various formulations. Erelzi, Inflectra / Remsima, Cyltezo, and other products are among the study's primary findings.

TNF Inhibitor Drugs Market By Application

Autoimmune disease is a major part of the tumor necrosis factor inhibitor drugs market share, although other signs such as cancer are tested in the drugs. In 2023, rheumatoid arthritis resulted the application segment with an general income share of 42%. The segment of rheumatopoietic arthritis is motivated by a elevated therapy speed and product penetration. The most rapidly increasing application sections over the tumor necrosis factor (TNF) inhibitor drugs market forecast period are psoriasis and psoriatic arthritis. Increasing disease prevalence, customer awareness backed by government and private awareness-raising campaigns and positive reimbursement policies drive the psoriasis market.

TNF Inhibitor Drugs Market By Sales Channel

The biggest share of the tumor necrosis factor (TNF) inhibitor drugs market in hospitals in 2023 was motivated mainly by the elevated level of hospital turnover. More than retail pharmacies, most biologics and biomarks are marketed in specialized pharmacies. Specialty pharmacies offer one of the biggest benefits of providing tailored, disease-specific treatment plans for every patient and thereby addressing both economic limitations and achieving better results.

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Regional Analysis

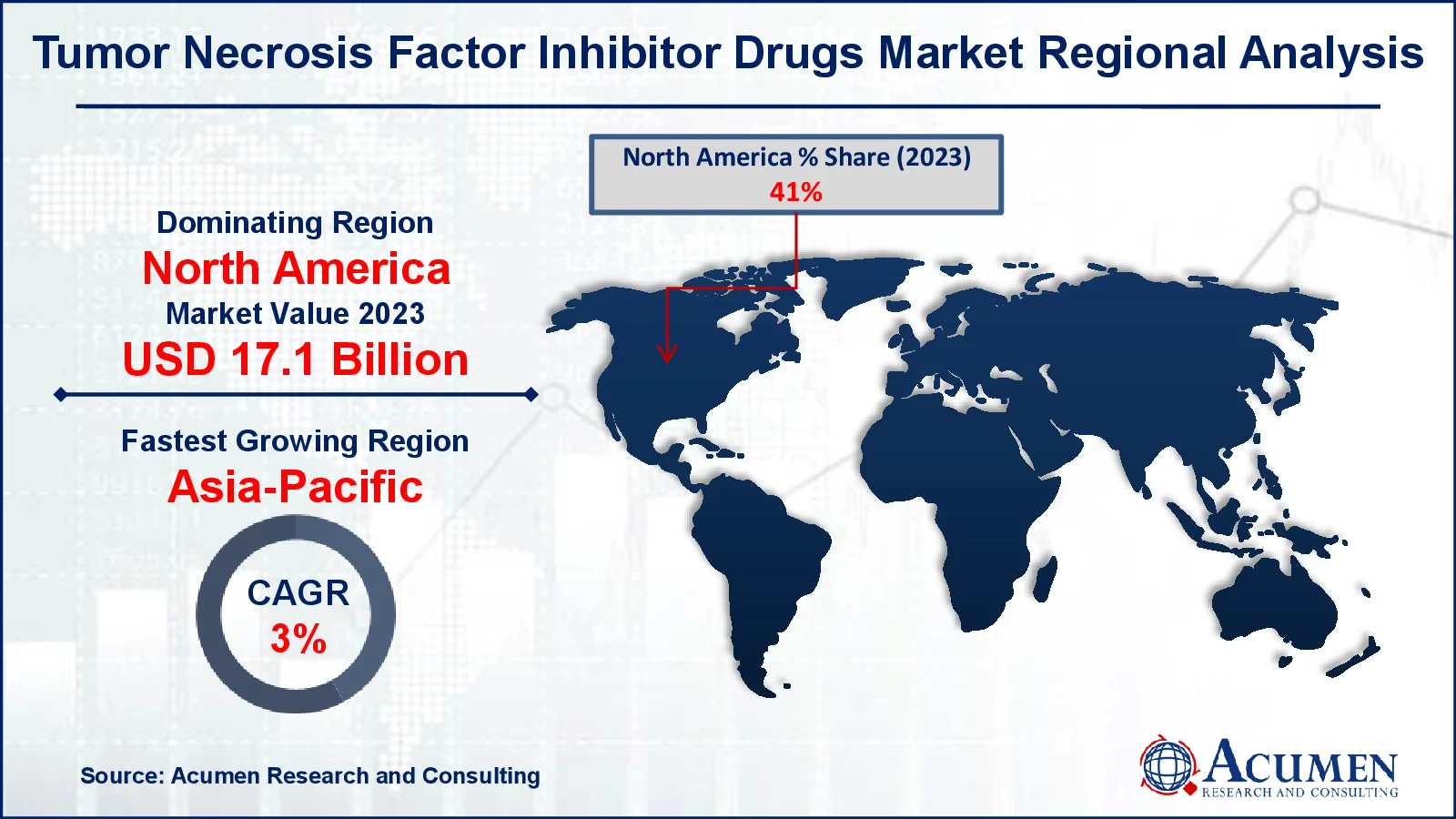

North America resulted the regional landscape in 2023 due to powerful commercial sales of TNF inhibitors in US. The existence of important producers, proactive governmental projects, favorable repayment policies and a big patient pool are among the other variables contributing to development. In the forecast period, Asia-Pacific is expected to be one of the fastest-growing region in the tumor necrosis factor (TNF) inhibitor drugs market. Biosimilar trends are a major driver of national economic growth in the emerging markets, such as China, India and South Korea. Moreover, general economic development, better health infrastructure, higher disposable earnings and increased consumer awareness will probably lead to regional demand in the tumor necrosis factor inhibitor drugs market.

In the same vein, Europe was a significant tumor necrosis factor inhibitor drugs market share of the worldwide economy and was followed by North America as a result of the existence of a big, inflammatory geriatric population.

Tumor Necrosis Factor (TNF) Inhibitor Drugs Market Players

Some of the top tumor necrosis factor (TNF) inhibitor drugs market companies offered in our report includes Samsung Bioepis, UCB Inc., Johnson & Johnson, Amgen, Boehringer Ingelheim, AbbVie, Novartis, Sanofi, AstraZeneca, and Merck & Co., and Pfizer.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

April 2021

December 2017

April 2024

December 2022