June 2020

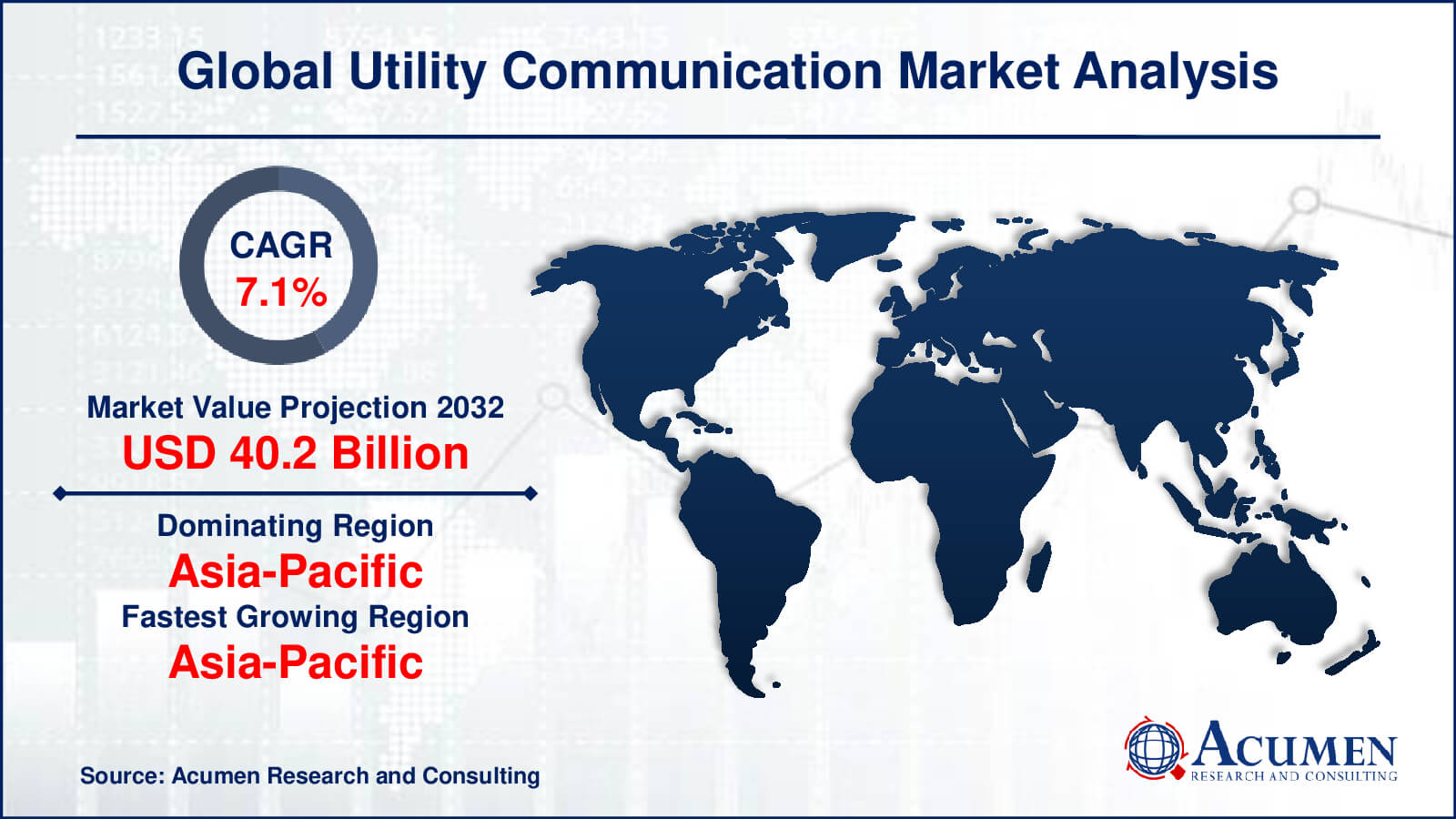

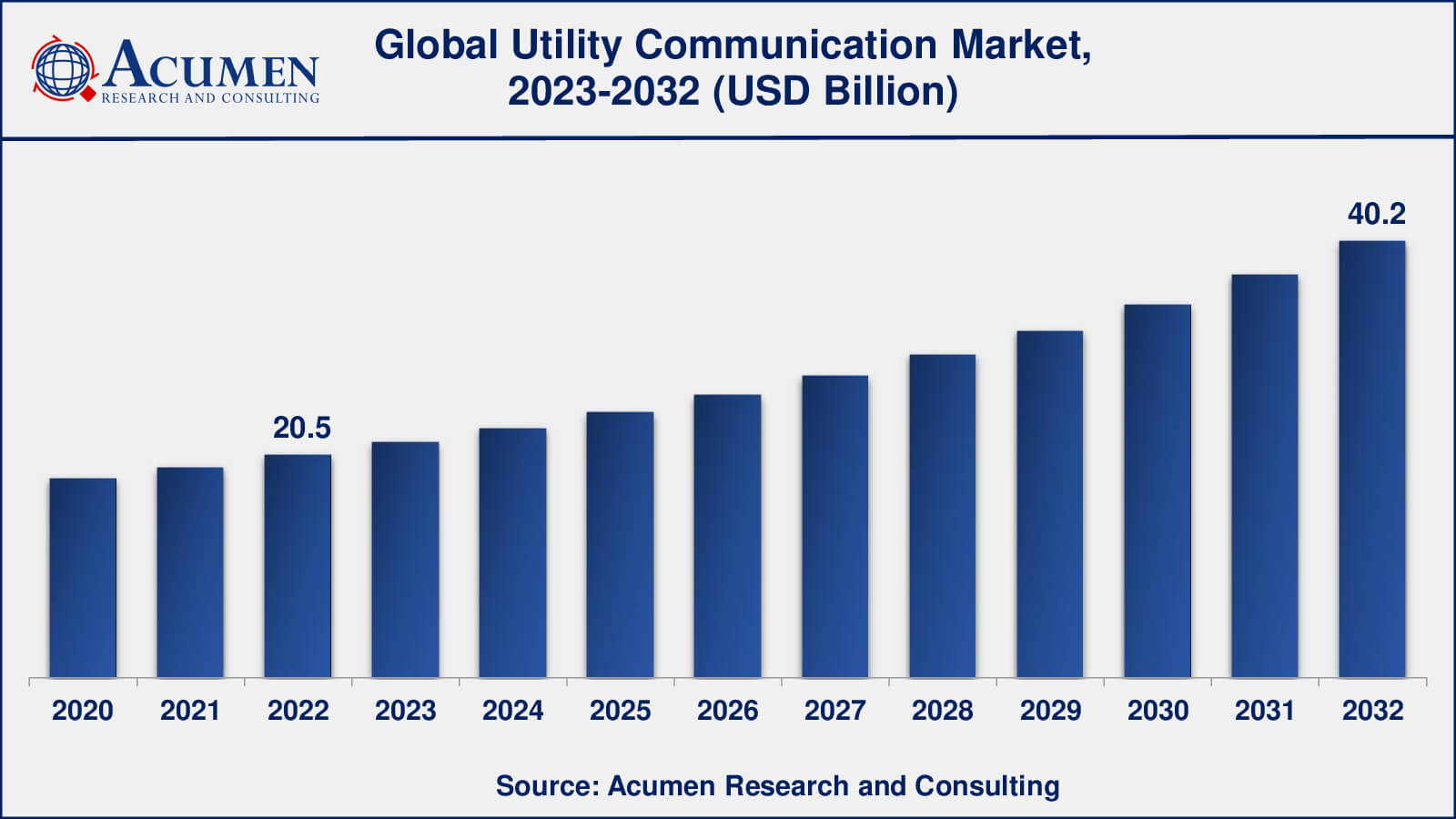

Utility Communication Market Size accounted for USD 20.5 Billion in 2022 and is estimated to achieve a market size of USD 40.2 Billion by 2032 growing at a CAGR of 7.1% from 2023 to 2032.

The Global Utility Communication Market Size accounted for USD 20.5 Billion in 2022 and is estimated to achieve a market size of USD 40.2 Billion by 2032 growing at a CAGR of 7.1% from 2023 to 2032.

Utility Communication Market Highlights

Utility communication is the interchange of information and data within the framework of utility services such as electricity, water, gas, or telephones. It entails data transfer between the utility provider and the users, as well as data transmission between different components of the utility infrastructure itself. This communication can take place via a variety of channels, including wired or wireless networks, specific communication protocols, and advanced metering and monitoring systems.

Improved operational efficiency is one of the primary advantages of utility communication. Providers may optimize their operations, discover and respond to issues more quickly, and prevent or minimize service interruptions by providing real-time monitoring and management of utility networks. Utility companies, for example, may use modern communication systems to remotely monitor the state of their infrastructure, identify possible defects or leaks, and take proactive actions to remedy them before they become serious issues. This has the potential to result in considerable cost savings and enhanced service dependability for both the utility company and the consumers.

Furthermore, utility communication is critical for integrating renewable energy sources and encouraging sustainability. As renewable energy generation becomes increasingly popular, such as solar or wind power, robust communication systems are required to handle the varying supply and demand dynamics. Utility communication promotes the effective integration of renewable energy into the grid by providing real-time communication between renewable energy producers, grid operators, and consumers. This encourages the shift to a more ecologically friendly and sustainable energy system.

Global Utility Communication Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Utility Communication Market Report Coverage

| Market | Utility Communication Market |

| Utility Communication Market Size 2022 | USD 20.5 Billion |

| Utility Communication Market Forecast 2032 | USD 40.2 Billion |

| Utility Communication Market CAGR During 2023 - 2032 | 7.1% |

| Utility Communication Market Analysis Period | 2020 - 2032 |

| Utility Communication Market Base Year | 2022 |

| Utility Communication Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Utility, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | ABB, Black & Veatch Holding, FUJITSU, General Electric, Itron, Motorola Solutions, Nokia, Schneider Electric, Sensus (Xylem), Siemens, and Telefonaktiebolaget LM Ericsson. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Utility Communication Market Insights

The utility communication industry is shaped by numerous main aspects that affect its growth and development. The growing demand for smart grid infrastructure is an important factor. Utilities are embracing smart grid technologies that rely largely on strong communication infrastructure in order to improve the efficiency and reliability of their services. These technologies allow for real-time monitoring, management, and optimization of utility networks, resulting in higher operational efficiency and less downtime. Another motivator is the increased emphasis on energy efficiency and sustainability. Utility communication is critical in allowing energy management, demand response programmes, and renewable energy integration. With a global focus on lowering carbon emissions and shifting to greener energy sources, utility providers are employing communication technology to better manage the variable supply and demand dynamics associated with renewable energy output.

Communication technology advancements can contribute to market dynamics. The fast advancement of wireless networks, Internet of Things (IoT) connections, and communication protocols improves utility communication capabilities. These developments allow for the easy flow of data, remote monitoring, and control of utility infrastructure. These technologies enable the implementation of advanced metering and monitoring systems, allowing utilities to collect real-time data and obtain useful insights for effective resource management.

However, the utilities communication sector faces a number of obstacles and constraints. High initial investment expenses might be a major impediment. Implementing utility communication systems necessitates significant upfront expenditures in infrastructure, metres, sensors, and communication networks. These expenses can be prohibitive, especially for smaller utility providers. Technical problems and interoperability issues may provide commercial hurdles. It might be difficult to integrate various systems and technologies inside utility communication networks. To guarantee smooth data transmission and the protection of sensitive information, compatibility, interoperability, and data security become key issues. Overcoming these problems necessitates standardization initiatives, stakeholder participation, and rigorous cybersecurity measures.

Despite these obstacles, the utilities communication sector offers several potential. The increasing deployment of smart metering infrastructure represents a significant potential. Smart metres, enabled by utility communication networks, provide extensive information about energy use to utilities and consumers, allowing for improved resource management and cost optimization.

Furthermore, the increased integration of renewable energy creates potential for communication technology providers. Utility communication is critical in managing the dynamic nature of renewable energy output, allowing for optimal grid integration. Communication systems that can properly handle renewable energy sources' variable supply and demand are in great demand. Furthermore, the growing volume of data created by utility communication systems opens up new possibilities in sophisticated analytics and data management. Utilities need systems that can analyze and extract important insights from data in order to optimize operations, improve decision-making processes, and boost overall efficiency.

Utility Communication Market Segmentation

The worldwide market for utility communication is split based on utility, technology, application, end-use, and geography.

Utility Communication Market Utilities

According to utility communication industry analysis, the public sector, which includes government-owned or state-operated utility providers, has a large presence in the utility communication market. Historically, public utilities, particularly in regulated markets, have been in charge of supplying vital services such as electricity, water, gas, and telephones. They may have well-developed communication infrastructure and networks to support their activities. Typically, public utilities are concerned with serving the public interest and providing dependable, accessible, and cheap utility services.

The private sector is also important in the utility communication industry, particularly in more liberalised and competitive market structures. The market is dominated by private utility corporations, independent power producers, renewable energy developers, and telecommunications service providers. To encourage breakthroughs in utility communication infrastructure, private enterprises frequently provide novel technology, experience, and capital expenditures. They may work in collaboration with public utilities or independently to create and administer communication networks tailored to their offerings.

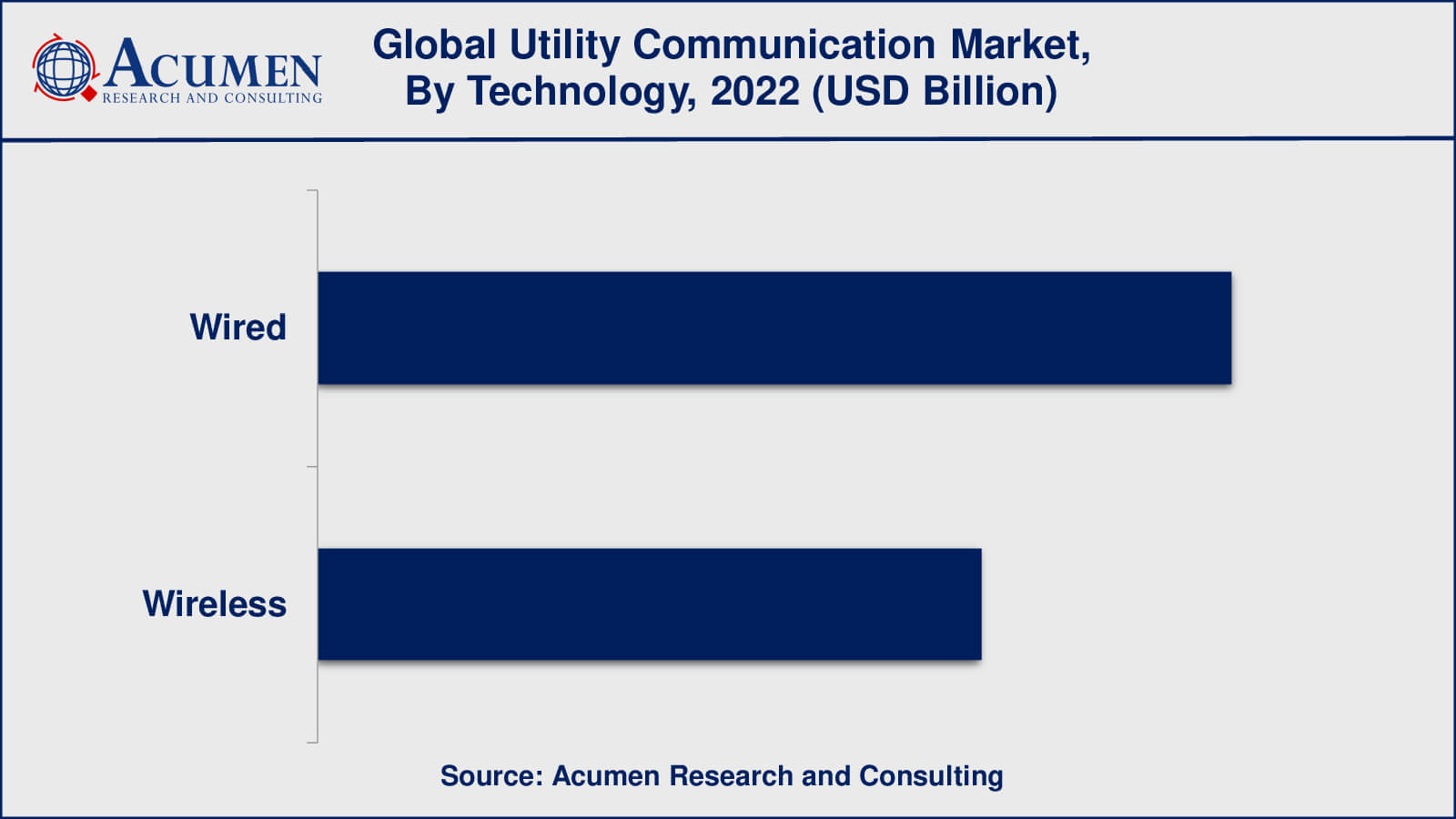

Utility Communication Market Technologies

According to our projections, the wired technologies sub-segment accounted for the lion's share of the overall utilities communication market and will continue to do so in the years 2023-2032. Historically, wired technologies such as fibre optics, Ethernet, and powerline communication (PLC) have played an important part in utility communication infrastructure. These technologies provide dependable and high-bandwidth connectivity, making them ideal for applications requiring secure and uninterrupted data transfer.

However, with improvements in wireless networks and the Internet of Things (IoT), wireless technologies have gained relevance in the utilities communication industry. In certain utility communication applications, wireless technologies provide flexibility, scalability, and cost-effectiveness.

Utility Communication Market Applications

According to utility communication market forecast, the transmission & distribution application dominates the utility communication market. This application relates to the communication methods and technologies used in the transmission and distribution of utilities such as electricity, water, and gas. It includes the communication infrastructure that is used to monitor, regulate, and optimise the flow of these services throughout the grid or network. Because of factors like as grid monitoring and control, grid automation, outage management, and grid optimisation and planning, the transmission and distribution application dominates the utility communication industry.

While transmission and distribution dominate the utility communication business, other applications play important roles as well. Communication systems, for example, are critical in the oil and gas industry for monitoring and regulating pipeline infrastructure, assuring safe and efficient transit of petroleum products. Communication solutions are also used in utility applications such as metering, consumer interaction, and renewable energy integration.

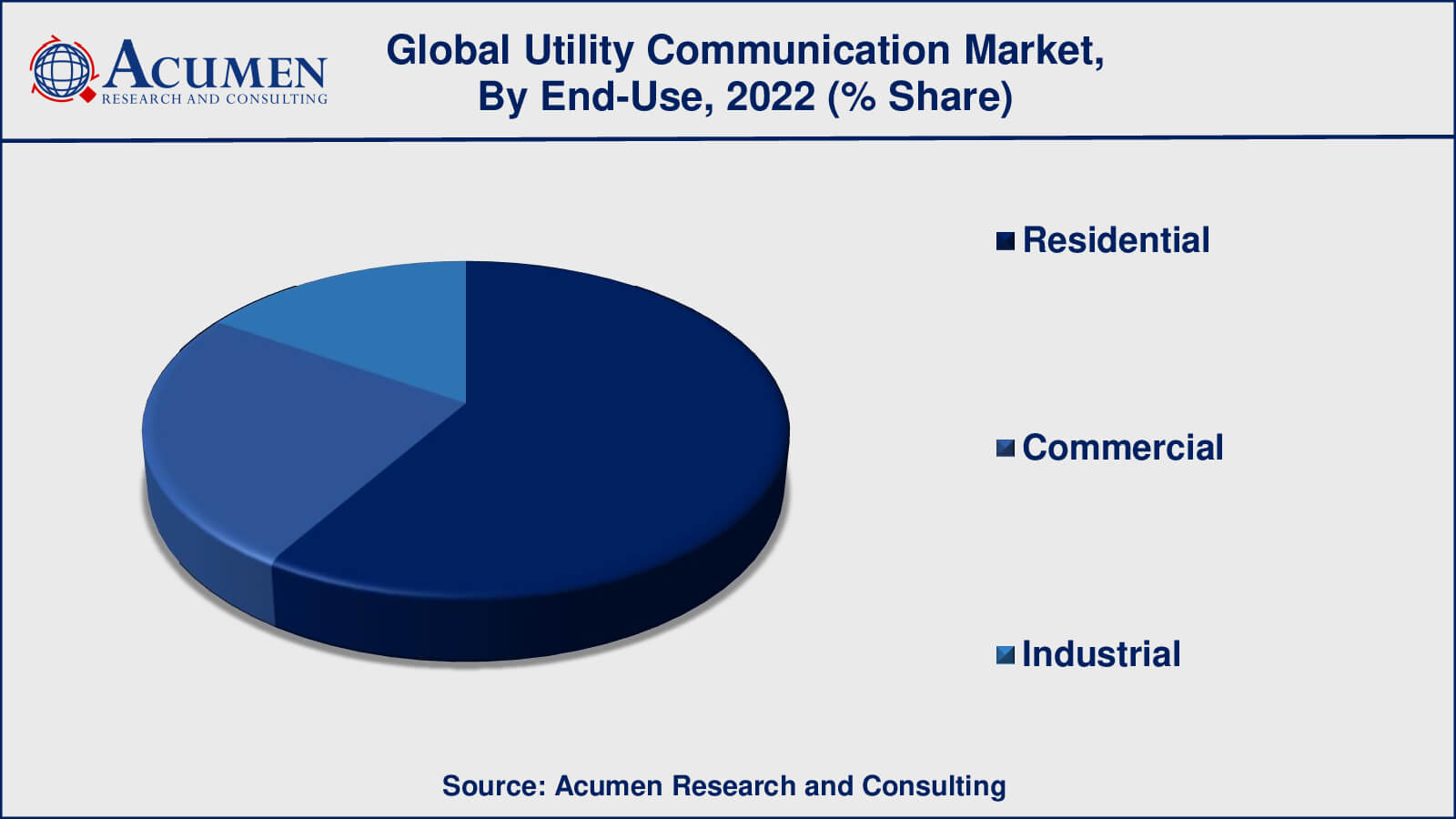

Utility Communication Market End-Uses

As per the utility communication market forecast, the residential segment has been identified as the dominant force in the utility communication market, indicating that residential consumers, which include individual households and small-scale consumers, have the most influence on the demand and adoption of utility communication solutions. Residential end-users have a large influence on the market dynamics for utility communication. While residential sector dominance in the utilities communication market is probable, market dynamics might vary based on factors such as regional demography, regulatory frameworks, and technology improvements. These variables may have an impact on the residential segment's dominance in comparison to other sectors, such as commercial or industrial.

Utility Communication Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Utility Communication Market Regional Analysis

According to your analysis, the Asia-Pacific region is the industry leader in terms of utility communication market share. For starters, the Asia-Pacific region's fast economic expansion has resulted in increasing energy consumption and a larger demand for efficient utility services. The expansion of industry, urbanization, and population development in countries such as China and India have created a major demand for improved utility communication infrastructure to meet the rising energy demands.

Second, Asian countries have initiated efforts and regulations targeted at modernizing their utility sectors and increasing energy efficiency. These programmes frequently include investments in smart grid infrastructure and utility communication technology to increase grid stability, optimize energy use, and make renewable energy sources more accessible.

Furthermore, the Asia-Pacific area has been at the forefront of technology advances like as smart grid technologies, IoT integration, and sophisticated metering infrastructure. With the use of these technologies, utility communication has become more efficient, allowing for real-time data monitoring, remote control capabilities, and better demand-side management.

Utility Communication Market Players

Some of the top utility communication companies offered in our report include ABB, Black & Veatch Holding, FUJITSU, General Electric, Itron, Motorola Solutions, Nokia, Schneider Electric, Sensus (Xylem), Siemens, and Telefonaktiebolaget LM Ericsson.

Utility Communication Industry Recent Developments

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

June 2020

October 2023

June 2024

October 2025