January 2024

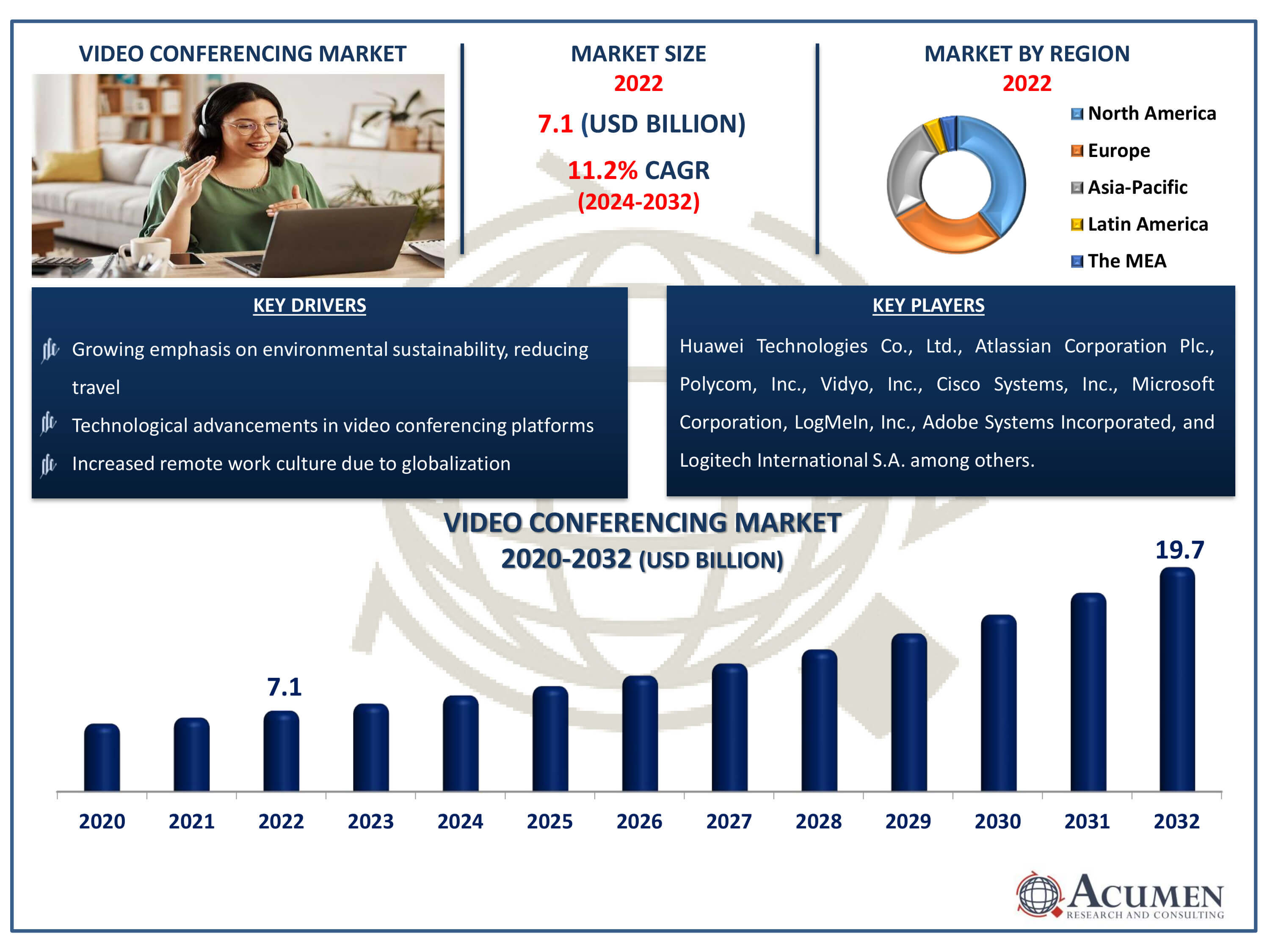

Video Conferencing Market Size accounted for USD 7.1 Billion in 2022 and is estimated to achieve a market size of USD 19.7 Billion by 2032 growing at a CAGR of 11.2% Billion from 2024 to 2032.

The Video Conferencing Market Size accounted for USD 7.1 Billion in 2022 and is estimated to achieve a market size of USD 19.7 Billion by 2032 growing at a CAGR of 11.2% Billion from 2024 to 2032.

Video Conferencing Market Highlights

Video conferencing is a technology that allows individuals or groups to communicate face-to-face via the internet, regardless of their physical location. It enables users to hold meetings, conversations, and presentations in real time via video and audio connections. Participants may see and hear each other through their smartphones, making remote collaboration both simple and efficient. Video conferencing services frequently include tools like screen sharing, chat, and recording to enhance the interactive experience. It is becoming increasingly popular in a variety of industries, including business, education, healthcare, and social events, as it allows for seamless communication and fosters connectedness across distances.

Global Video Conferencing Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Video Conferencing Market Report Coverage

| Market | Video Conferencing Market |

| Video Conferencing Market Size 2022 | USD 7.1 Billion |

| Video Conferencing Market Forecast 2032 |

USD 19.7 Billion |

| Video Conferencing Market CAGR During 2024 - 2032 | 11.2% |

| Video Conferencing Market Analysis Period | 2020 - 2032 |

| Video Conferencing Market Base Year |

2022 |

| Video Conferencing Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Component, By Deployment Mode, By Enterprise Size, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Huawei Technologies Co., Ltd., Atlassian Corporation Plc., Polycom, Inc., Vidyo, Inc., Cisco Systems, Inc., Microsoft Corporation, LogMeIn, Inc., Adobe Systems Incorporated, Logitech International S.A., JOYCE CR, S.R.O., Orange Business Services, and Fuze, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Video Conferencing Market Insights

The increasing demand for communication platforms that are reliable, efficient, and support two-way transmission of audio and video content in various end-use industries is driving the growth of the global video conferencing market. Additionally, the widespread impact of the pandemic has accelerated the adoption of remote work culture across industries, further fueling the demand for video conferencing solutions. For instance, as a safety precaution during the pandemic, Google extended its work-from-home policy until 2021. According to Apptopia, Inc., the Zoom application was downloaded 2.13 million times worldwide on March 23, 2020. Major players are focusing on business expansion through strategic mergers and acquisitions to increase profitability. In 2020, Verizon acquired BlueJeans Network, a video conferencing platform service provider, to expand its product portfolio and enhance profitability. Furthermore, players are investing in product development and introducing innovative solutions to positively impact market growth.

For example, Avaya launched a cloud-based video conferencing and collaboration service in 2019, aimed at increasing its customer base and profitability. Similarly, in 2020, Kaltura, a leading service provider, launched Kaltura Meetings, a reliable, scalable, and secure video conferencing solution, to expand its product portfolio and customer base. Additionally, Zoom, a cloud video conferencing company, introduced new products and features in 2019 to expand its ecosystem. However, challenges such as rising concerns about data theft and the high cost and complexity of solutions may hamper market growth. Additionally, high volatility in the competitive landscape poses a challenge. Rapid advancements in applications with advanced features, along with enhanced safety measures, are expected to create new opportunities for players in the market over the video conferencing industry forecast period.

Video Conferencing Market Segmentation

The worldwide market for video conferencing is split based on component, deployment mode, enterprise size, application, end use, and geography.

Video Conferencing Components

According to video conferencing industry analysis, hardware accounts for the majority of the market. Cameras, microphones, screens, and networking equipment are all necessary components for video conferencing. This dominance stems from the essential role hardware plays in providing smooth audiovisual transmission. Organisations prioritise investing in high-quality hardware to improve the user experience and overall dependability of video conferencing systems. With increased demand for sophisticated features like as high-definition video and noise-cancelling microphones, the hardware industry is steadily expanding. Furthermore, as firms extend their remote work policies and communication requirements, the demand for reliable hardware solutions is projected to accelerate the market's growth trajectory.

Video Conferencing Deployment Modes

For a variety of reasons, the on-premise deployment method dominates the video conferencing industry. Organisations, especially those with rigorous data security and compliance needs, choose on-premise solutions because they provide more control over data management and security processes. Additionally, some businesses, including as government and healthcare, frequently choose on-premise deployments to safeguard data sovereignty and privacy. Furthermore, legacy systems and infrastructure limits may push businesses towards on-premise solutions, particularly if they have already made considerable investments in their IT infrastructure. Despite the rising popularity of cloud-based deployments due to their scalability and flexibility, the on-premise market remains dominant, providing to the unique demands and preferences of diverse companies.

Video Conferencing Enterprise Sizes

There are various reasons why the large company segment dominates the video conferencing industry. To begin, major organizations often have more financial resources and are more likely to invest in complete video conferencing solutions to suit their complicated communication requirements. Furthermore, these businesses frequently operate on a worldwide scale, with scattered teams and locations, demanding reliable video conferencing services for smooth cooperation. Furthermore, major organizations priorities scalability, security, and integration capabilities, all of which are provided by top video conferencing services. Their substantial infrastructure and IT divisions also help with the implementation and administration of modern video conferencing systems. As a result of their increased need and willingness to adopt cutting-edge communication technology, large organizations account for the vast majority of market share.

Video Conferencing Applications

There are several reasons for the enterprise segment's market supremacy in video conferencing. enterprises employ video conferencing for a number of reasons, including remote collaboration, virtual meetings, training sessions, and client presentations. Enterprise adoption is driven by a desire to improve communication efficiency, optimise workflows, and increase collaboration among workers, partners, and clients. Furthermore, the growing popularity of remote work and geographically scattered teams raises the demand for enterprise-grade video conferencing solutions. Enterprises prioritise aspects like security, scalability, and integration, which are frequently supplied by leading video conferencing solutions. Furthermore, corporations have higher funds and resources to invest in modern video conferencing systems, which contributes to their market domination.

Video Conferencing End Uses

The corporate sector has the highest share of the video conferencing industry for various compelling reasons. To begin, organisations rely significantly on video conferencing for internal and external communication, such as team meetings, client presentations, and remote collaborations. With the globalisation of corporate operations, organisations frequently have geographically distributed teams and locations, demanding sophisticated video conferencing solutions to ensure smooth communication and cooperation. Furthermore, the corporate sector prioritises qualities like security, scalability, and integration capabilities, which are critical for managing sensitive business communications. Furthermore, the current spike in remote work trends has boosted demand for corporate video conferencing solutions, as businesses strive to retain productivity and communication among scattered teams. As a result, the corporate segment emerges as the key source of development in the video conferencing market.

Video Conferencing Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Video Conferencing Market Regional Analysis

The North American market is expected to account for a significant revenue share, driven by rising demand from various end-use industries. Additionally, the availability of advanced infrastructure to facilitate the adoption of sophisticated communication solutions further supports the growth of the target market in this region.

In Asia-Pacific, faster growth is anticipated in the near future, primarily due to industries embracing the work-from-home culture. Furthermore, strategic business development activities by major players to increase their business presence are expected to bolster the growth of the target market in this region.

Video Conferencing Market Players

Some of the top video conferencing companies offered in our report includes Huawei Technologies Co., Ltd., Atlassian Corporation Plc., Polycom, Inc., Vidyo, Inc., Cisco Systems, Inc., Microsoft Corporation, LogMeIn, Inc., Adobe Systems Incorporated, Logitech International S.A., JOYCE CR, S.R.O., Orange Business Services, and Fuze, Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2024

July 2022

June 2024

August 2017