March 2023

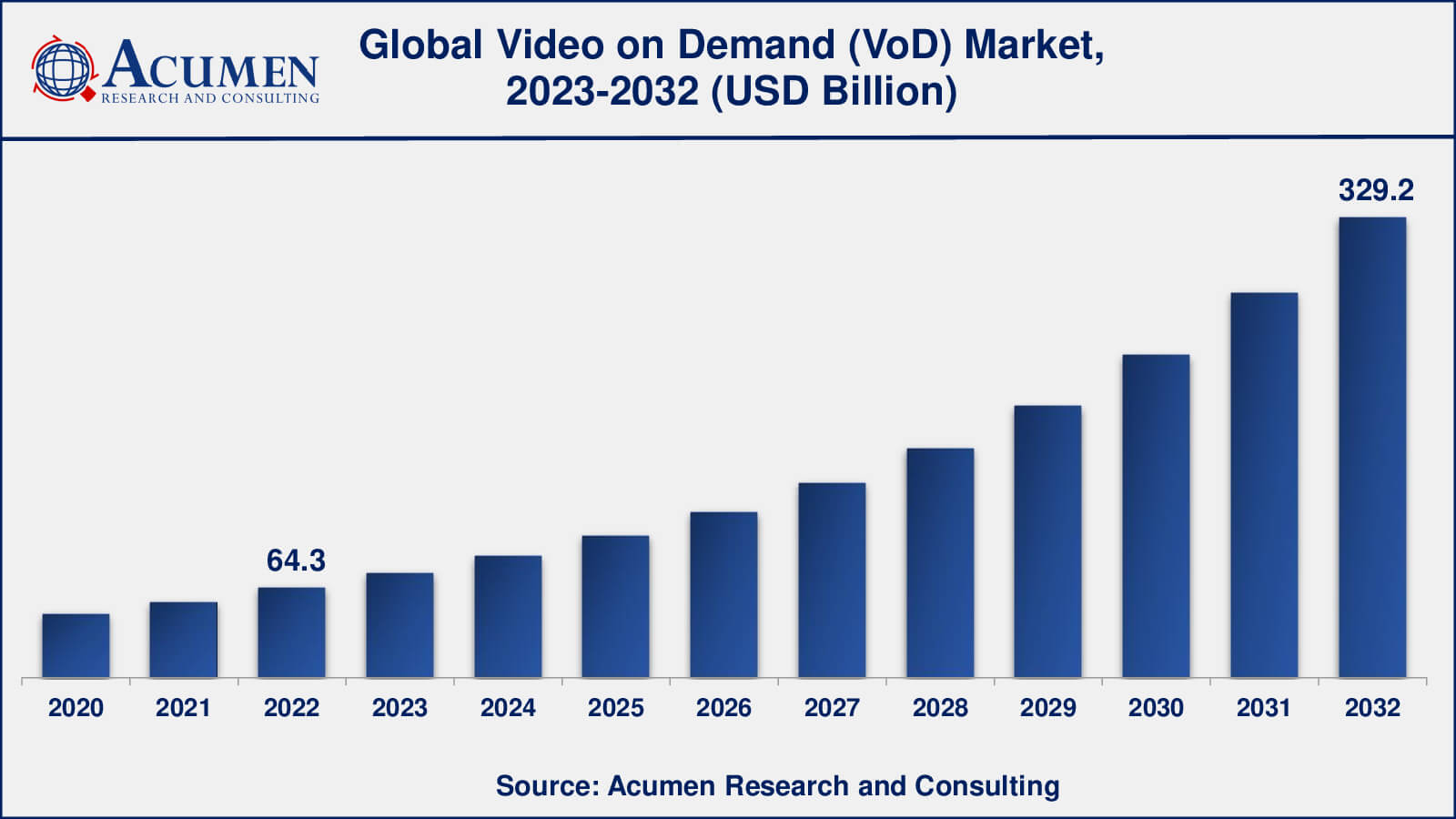

Video on Demand Market Size accounted for USD 64.3 Billion in 2022 and is estimated to achieve a market size of USD 329.2 Billion by 2032 growing at a CAGR of 17.9% from 2023 to 2032.

The Global Video on Demand (VoD) Market Size accounted for USD 64.3 Billion in 2022 and is estimated to achieve a market size of USD 329.2 Billion by 2032 growing at a CAGR of 17.9% from 2023 to 2032.

Video on Demand (VoD) Market Highlights

Video on Demand (VoD) is an advanced media distribution system through which users can access videos with a flexible watching schedule. VOD is a technology used in delivering video content. Nowadays, broadcasting has become a common form of media distribution in the form of over-the-air programming. VOD includes TV shows and movies that users can view immediately, and it is available for both free and paid programs. In recent years, the video-on-demand market has gained popularity due to the increase in the use of over-the-top (OTT) services. Several OTT platforms, such as Netflix and Amazon Prime, allow viewers to watch videos according to their preferences. The increasing technological advancements and rising network speeds are advantageous for video-on-demand providers, enabling them to create and offer high-definition content at a high streaming rate. These are essential factors contributing to the growth of the market in the upcoming years.

Global Video on Demand (VoD) Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Video on Demand (VoD) Market Report Coverage

| Market | Video on Demand Market |

| Video on Demand Market Size 2022 | USD 64.3 Billion |

| Video on Demand Market Forecast 2032 | USD 329.2 Billion |

| Video on Demand Market CAGR During 2023 - 2032 | 17.9% |

| Video on Demand Market Analysis Period | 2020 - 2032 |

| Video on Demand Market Base Year | 2022 |

| Video on Demand Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Business Model, By Solution, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Alphabet, Amazon.com, Inc., Apple, Inc., AT&T, Canalplay, Google, Home Box Office, Inc., Hulu LLC, maxdome GmbH, Netflix, Inc., Telefonaktiebolaget LM Ericsson (Ericsson Television), Verizon Communication, LLC, YouTube. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Video on Demand (VoD) Market Insights

The enhanced customer viewing experience, along with flexibility and ease of use, is a primary factor driving market growth. The widespread usage of mobile devices, coupled with increasing internet access, offers seamless customer experiences, supporting market expansion. The proliferation of mobile computing devices allows multiple users in the same place to watch distinct programs on various devices simultaneously, further bolstering the market value. Additionally, the rising preference for online streaming IPTV over traditional TV, along with an increasing number of mergers with local producers and film studios across regions for the subscription VoD model, is projected to create potential opportunities during the forecast period from 2020 to 2027. The growing use of analytics and AI to discern audience preferences and reactions is also expected to create potential opportunities over this period.

The video-on-demand market has grown significantly in recent years, owing to increased demand for streaming services. Consumers increasingly favor VoD platforms because of the flexibility and convenience they provide, allowing users to access material at their leisure. OTT services including Netflix, Amazon Prime Video, Disney+, and Hulu have emerged as key participants in the VoD business. These platforms feature a massive library of material, including films, TV series, and original projects, and they have a global user base. Major VoD platforms are increasing their presence in overseas areas in order to appeal to a worldwide clientele. This has led to the growing popularity of video-on-demand industry services throughout the world. The COVID-19 pandemic significantly impacted the video-on-demand industry, leading to a surge in demand as people turned to streaming services for entertainment during lockdowns and restrictions.

On the other hand, the risk associated with video content piracy and the disparity in opinions between producers and aggregators over the licensed business model are factors likely to restrict growth to some extent over the estimated period.

Video on Demand (VoD) Market Segmentation

The worldwide market for video on demand (VoD) is split based on business model, solution, application, and geography.

Video on Demand (VoD) Business Models

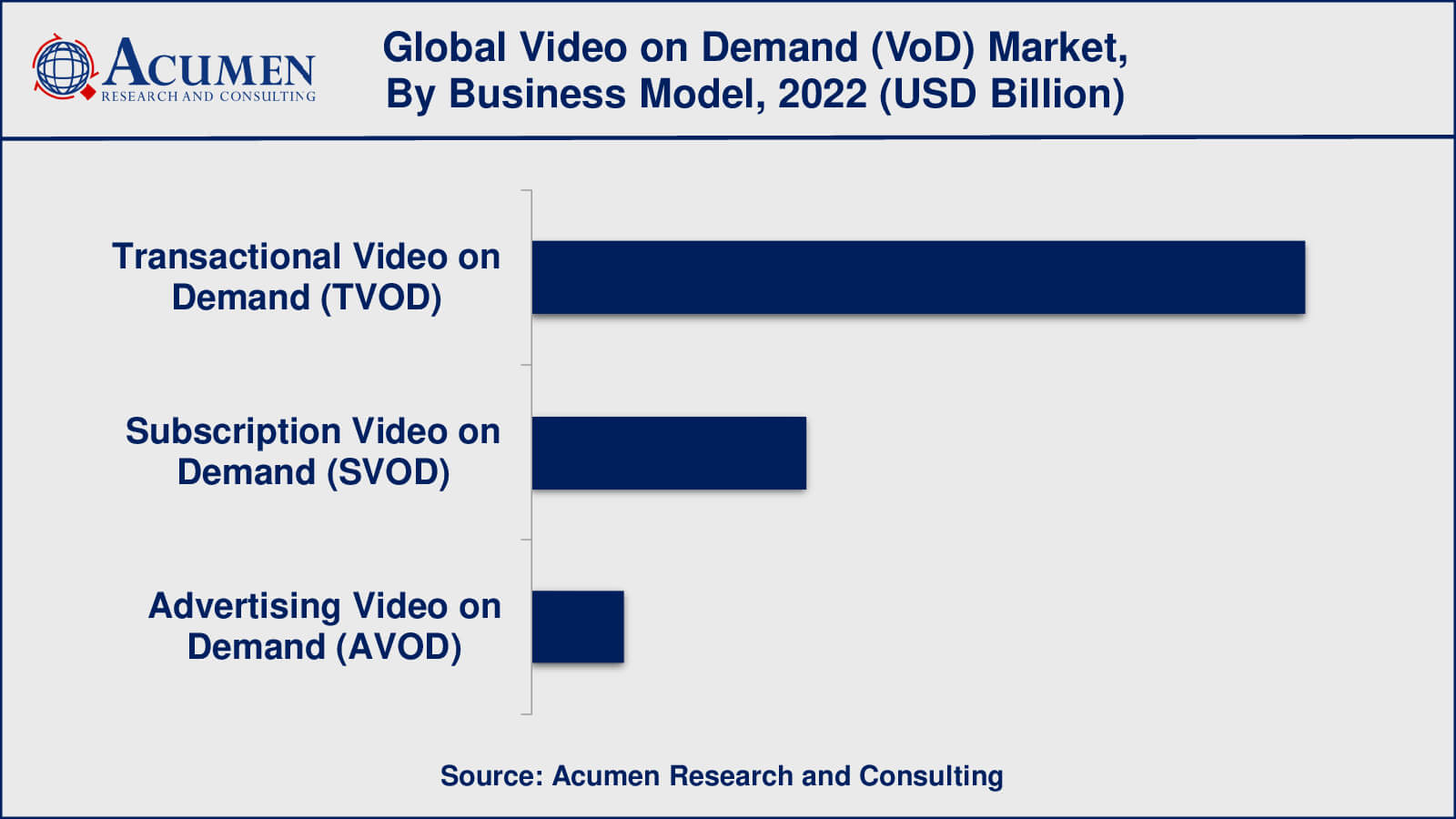

Based on business model segmentation, the video-on-demand (VoD) market includes transactional video on demand, subscription VOD, and advertising VOD. According to Video on Demand (VoD) industry analysis, subscription video on demand (TVOD) has held the largest portion within the business model segment in the past years. The subscription segment is one of the most popular business models. In this model, users pay a price for a subscription to access video streaming services, which can vary in duration, such as 1 month, 6 months, or 1 year, and have different prices according to the plans offered. This business model provides a wide variety of entertainment, including movies, pay TV programming, drama series, and other series. The subscription subsegment has seen the highest Compound Annual Growth Rate (CAGR) during the forecast period.

Video on Demand (VoD) Solutions

Within the Solution segment, the video on demand market is segmented into pay TV, over the top services, and internet protocol television (IPTV). By solution, internet protocol television or IPTV is leading the market with a major share (X%) and is also projected to maintain its dominance over the forecast period. The advantages associated with IPTV, such as the ability to watch TV by surfing the internet, access on-demand videos and interactive TV, and secure and reliable ways to subscribe to videos and other services, are supporting its growth in the market.

Video on Demand (VoD) Applications

Based on the application, the video-on-demand (VoD) market is divided into Media & entertainment, educational & training, health & fitness, live events & sports, and other applications. The entertainment subsegment held the largest video-on-demand VoD market share in recent years and is expected to continue growing over the forecast period. This subsegment generated the maximum income in the video of demand VOD market due to the increasing number of films, drama series, and online commercials. These factors are key contributors to the growth of the VOD market in the upcoming years.

Video on Demand (VoD) Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Video on Demand (VoD) Market Regional Analysis

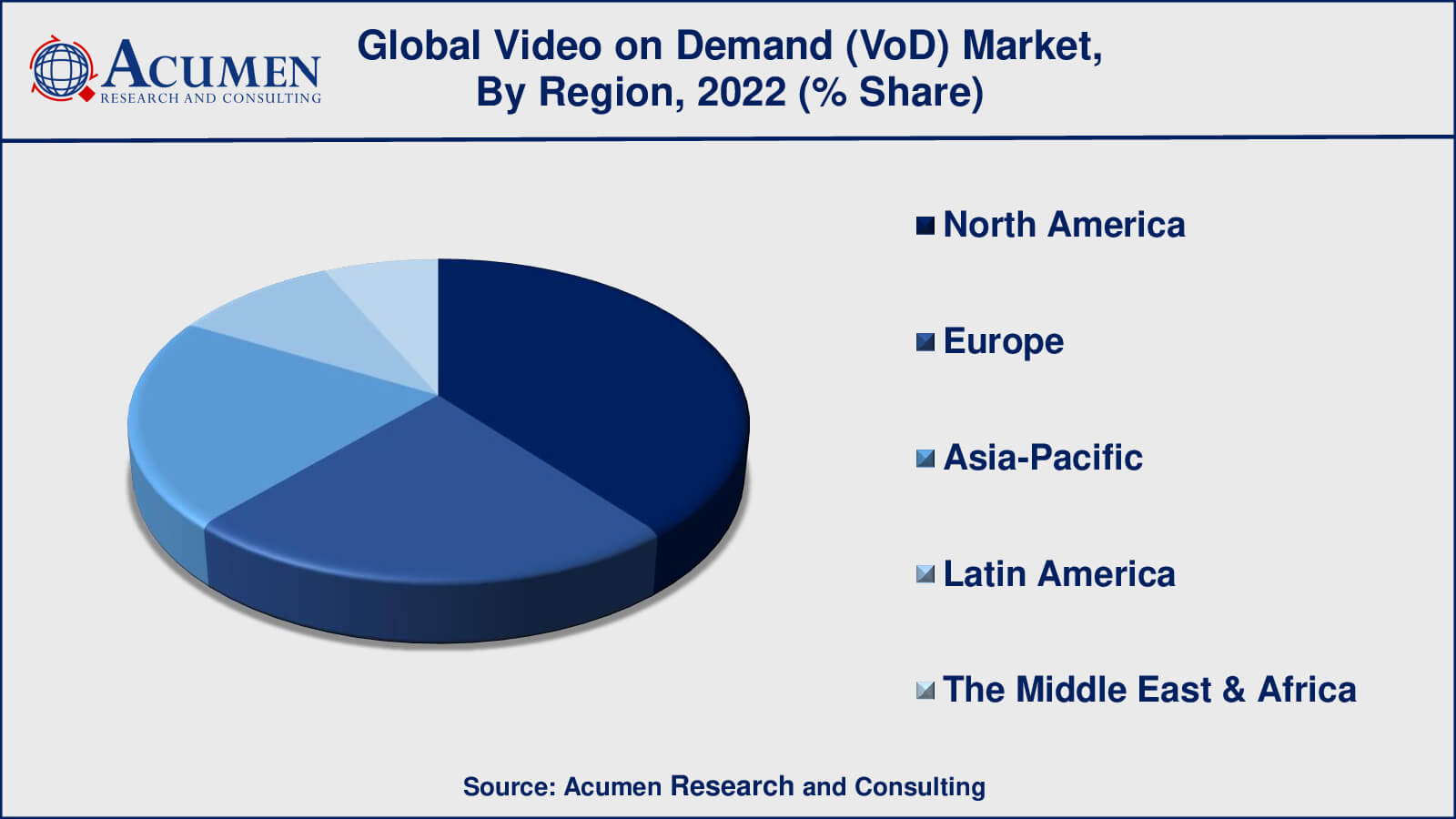

North America held the major share, and the region is also projected to maintain its dominance over the estimated period from 2023 to 2030. The presence of major players in the region, along with technologically advanced infrastructure, supports the regional market value. The high disposable income and extensive usage of entertainment solutions across major economies in the region, including the US and Canada, further contribute to the regional market value. Moreover, Asia Pacific is projected to exhibit significant growth over the forecast period from 2023 to 2030. The increasing disposable income and widespread usage of mobile phones, along with internet connectivity, support its fastest growth over the estimated period.

Video on Demand (VoD) Market Players

Some of the top Video on Demand (VoD) companies offered in our report includes Alphabet, Amazon.com, Inc., Apple, Inc., AT&T, Canalplay, Google, Home Box Office, Inc., Hulu LLC, maxdome GmbH, Netflix, Inc., Telefonaktiebolaget LM Ericsson (Ericsson Television), Verizon Communication, LLC, YouTube.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

January 2025

February 2023

December 2024