March 2021

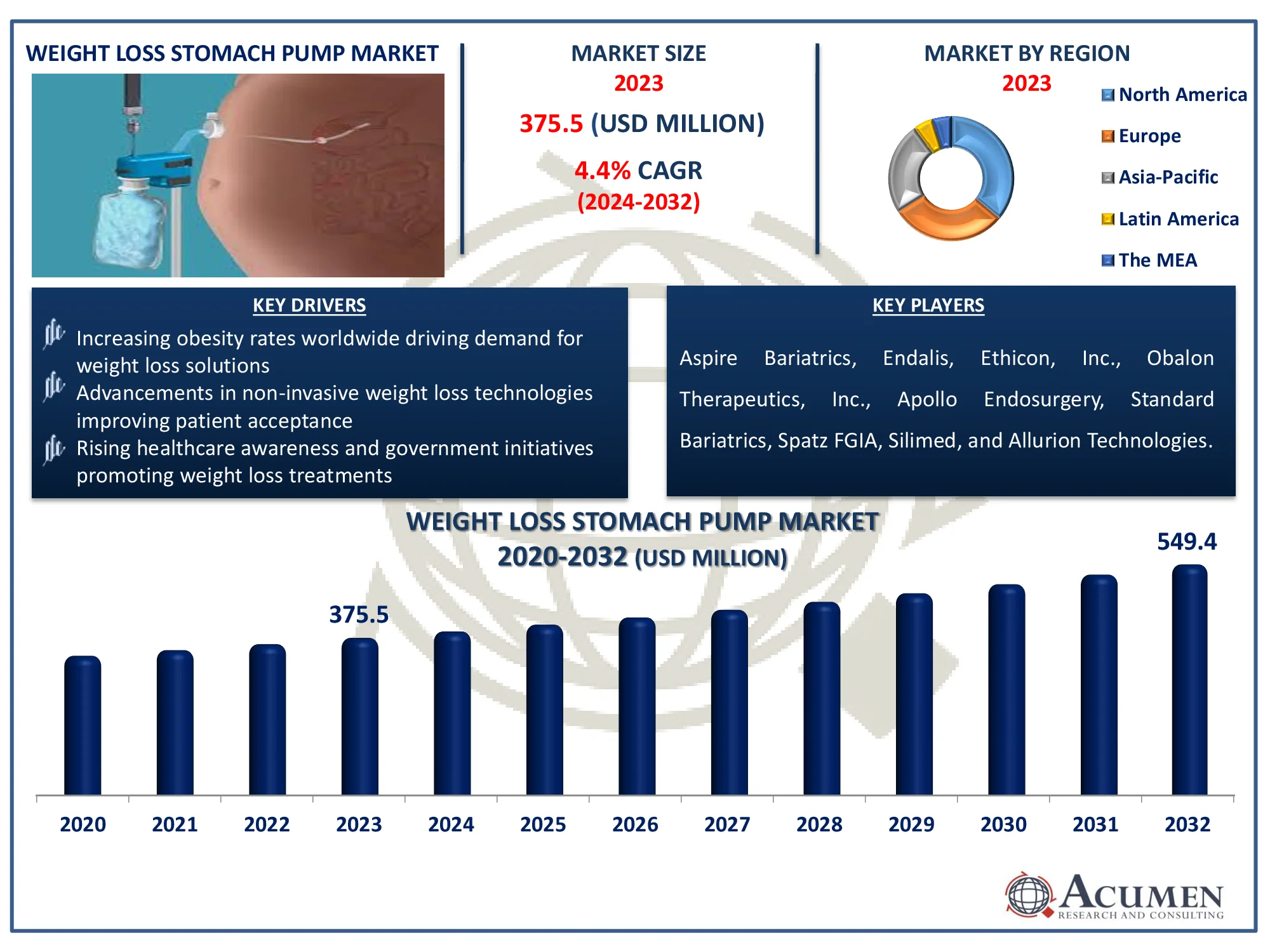

The Global Weight Loss Stomach Pump Market Size accounted for USD 375.5 Million in 2023 and is estimated to achieve a market size of USD 549.4 Million by 2032 growing at a CAGR of 4.4% from 2024 to 2032.

The Global Weight Loss Stomach Pump Market Size accounted for USD 375.5 Million in 2023 and is estimated to achieve a market size of USD 549.4 Million by 2032 growing at a CAGR of 4.4% from 2024 to 2032.

The weight loss stomach pump is an external device that drains stomach contents into the toilet, thereby controlling calorie absorption and minimizing weight gain. This device consists of a small tube inserted into the stomach and extending to the exterior of the body. It offers an easier option for weight loss than organized diets, weight loss devices, or surgical procedures. Patients who want to lower their calorie intake should speak with dieticians, healthcare specialists, or fitness trainers. Clinical studies have shown that patients typically lose 46 pounds in the first year and 50 pounds in the second year.

|

Market |

Weight Loss Stomach Pump Market |

|

Weight Loss Stomach Pump Market Size 2023 |

USD 375.5 Million |

|

Weight Loss Stomach Pump Market Forecast 2032 |

USD 549.4 Million |

|

Weight Loss Stomach Pump Market CAGR During 2024 - 2032 |

4.4% |

|

Weight Loss Stomach Pump Market Analysis Period |

2020 - 2032 |

|

Weight Loss Stomach Pump Market Base Year |

2023 |

|

Weight Loss Stomach Pump Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Disease Type, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Aspire Bariatrics, Ethicon, Inc., Obalon Therapeutics, Inc., Endalis, Apollo Endosurgery, Standard Bariatrics, Spatz FGIA, Silimed, and Allurion Technologies. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The weight loss stomach pump market is expected to expand significantly due to the growing number of patients undergoing gastric bypass surgery and the rising rates of obesity. According to the World Obesity Federation, 79% of adults with overweight and obesity are projected to reside in low- and middle-income countries (LMICs) by 2035. The number of adults living with obesity is anticipated to increase from 0.81 billion in 2020 to 1.53 billion by 2035.

Additionally, the market is expected to experience a strong compound annual growth rate (CAGR) driven by the pumps' ability to reduce body weight with minimal invasiveness. These pumps are commonly used by patients with bulimia nervosa (an eating disorder) aged 22 and older. Moreover, the U.S. Food and Drug Administration has approved Zepbound (tirzepatide) injection for chronic weight management in adults with obesity (BMI of 30 kg/m² or greater) or overweight (BMI of 27 kg/m² or greater), who also have at least one weight-related condition, such as high blood pressure, type 2 diabetes, or high cholesterol. This approval, along with other government initiatives promoting weight loss treatments, is expected to further boost the market for weight loss stomach pumps in the forecasted years.

The global rise in non-surgical therapies, the increasing prevalence of obesity and bulimia, and changes in lifestyle choices will all contribute to the growth of the weight reduction stomach pump industry. For example, the National Institute of Health reports that the most recent survey revealed a 3.4% global rise, with 34.9 million surgical and nonsurgical aesthetic procedures performed by plastic surgeons in 2023. Over 15.8 million surgical treatments and over 19.1 million nonsurgical procedures were carried out worldwide. However, the potential negative effects of surgery pose hurdles that may restrict market expansion.

Weight Loss Stomach Pump Market Segmentation

Weight Loss Stomach Pump Market SegmentationThe worldwide market for weight loss stomach pump is split based on disease type, end-user, and geography.

According to the weight loss stomach pump industry analysis, obesity is the dominant disease type in industry due to the growing prevalence of obesity and its associated health risks. According to the Centers for Disease Control and Prevention (CDC), between August 2021 and August 2023, the prevalence of obesity among U.S. adults reached 40.3%. (Washington, DC – September 12, 2024) – By 2023, obesity rates for adults in the United States were at or above 35% in 23 states, reflecting a decades-long upward trend in obesity prevalence. The demand for surgical weight loss solutions, including stomach pumps, is driven by the need for effective interventions in managing severe obesity.

According to the weight loss stomach pump market forecast, hospitals, as key end users, are seeing significant growth in market as sophisticated bariatric treatment solutions become more frequently accepted. With an increasing number of obese patients globally, hospitals are introducing stomach pump systems into complete weight management programs. The availability of qualified healthcare staff and specialized facilities in hospitals broadens their options for these procedures. Furthermore, growing awareness of minimally invasive therapies increases the demand for stomach pumps in medical settings further enhance segment’s growth.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Weight Loss Stomach Pump Market Regional Analysis

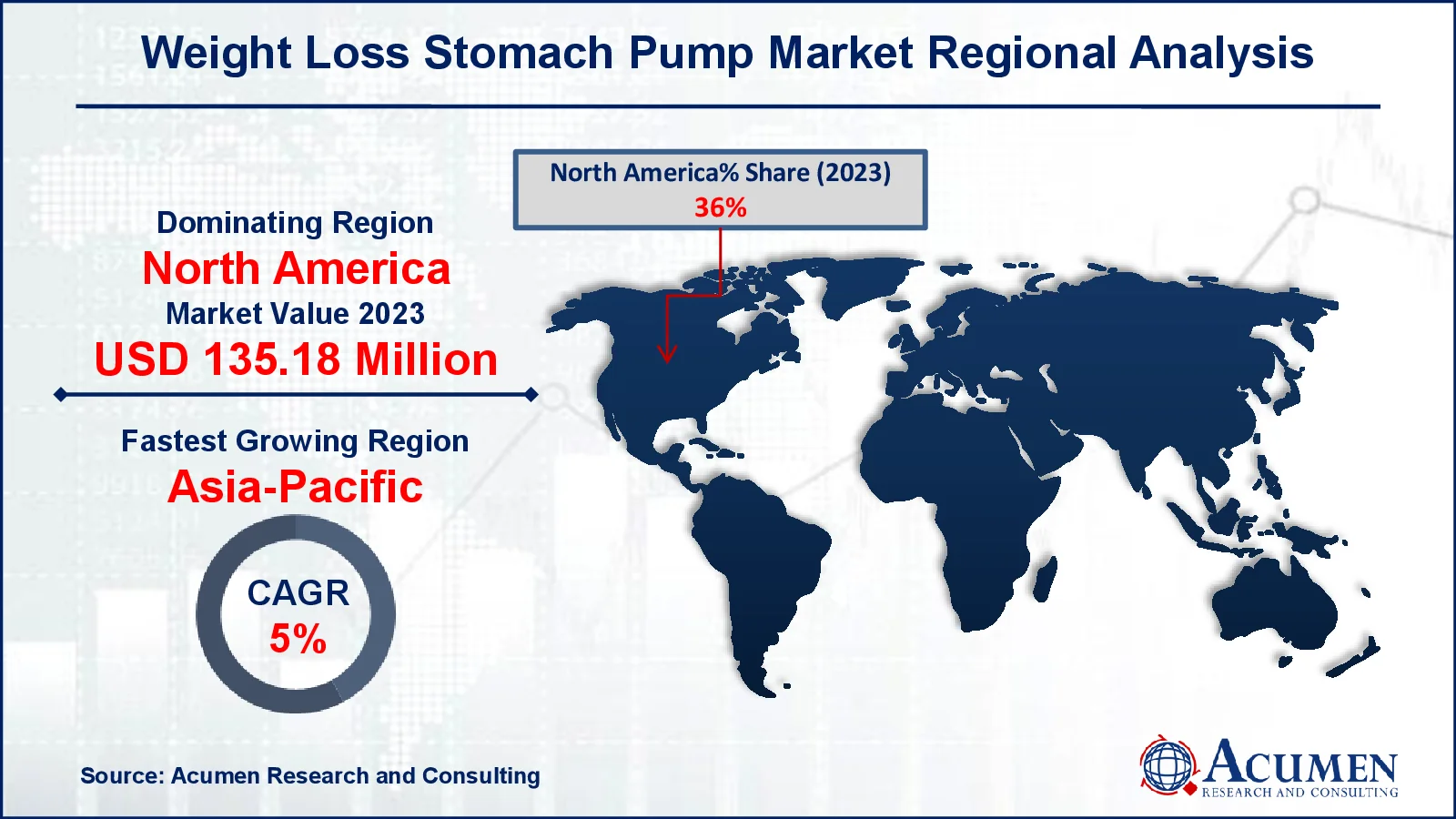

Weight Loss Stomach Pump Market Regional AnalysisFor several reasons, North America dominates the market for weight loss stomach pumps due to technological advancements in the region. Countries such as Canada and the United States have successfully implemented weight loss stomach pumps in their healthcare systems, which is projected to increase the market for weight loss stomach pumps over the forecast period. Furthermore, the availability of favorable government initiatives, enhanced healthcare infrastructure, and the implementation of weight loss stomach pumps in existing healthcare organizations will drive market expansion. For instance, in the United States, the Centers for Disease Control and Prevention's High Obesity Program (HOP) promote policy, system, and environmental improvements to address health disparities in diet, physical activity, and obesity. The CDC pays 16 land grant colleges to implement the High Obesity Program (HOP). HOP works mostly in rural communities, where at least 40% of adults are obese. Obesity affects over one in every five children and adolescents in the United States, as well as more than two out of every five adults. Obesity costs the US healthcare system over $173 billion annually. Furthermore, constantly improved reimbursement development would fuel market growth.

Europe was regarded as the second largest market for weight loss stomach pumps because of improved weight loss therapy in the healthcare system, combined with implementation. Furthermore, the Government of the United Kingdom estimates that 64.0% of persons aged 18 and older in England will be overweight or obese between 2022 and 2023. Overall, this growing obesity in the European region drives industrial growth.

Some of the top weight loss stomach pump companies offered in our report include Aspire Bariatrics, Ethicon, Inc., Obalon Therapeutics, Inc., Endalis, Apollo Endosurgery, Standard Bariatrics, Spatz FGIA, Silimed, and Allurion Technologies.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2021

February 2025

January 2025

October 2022