November 2022

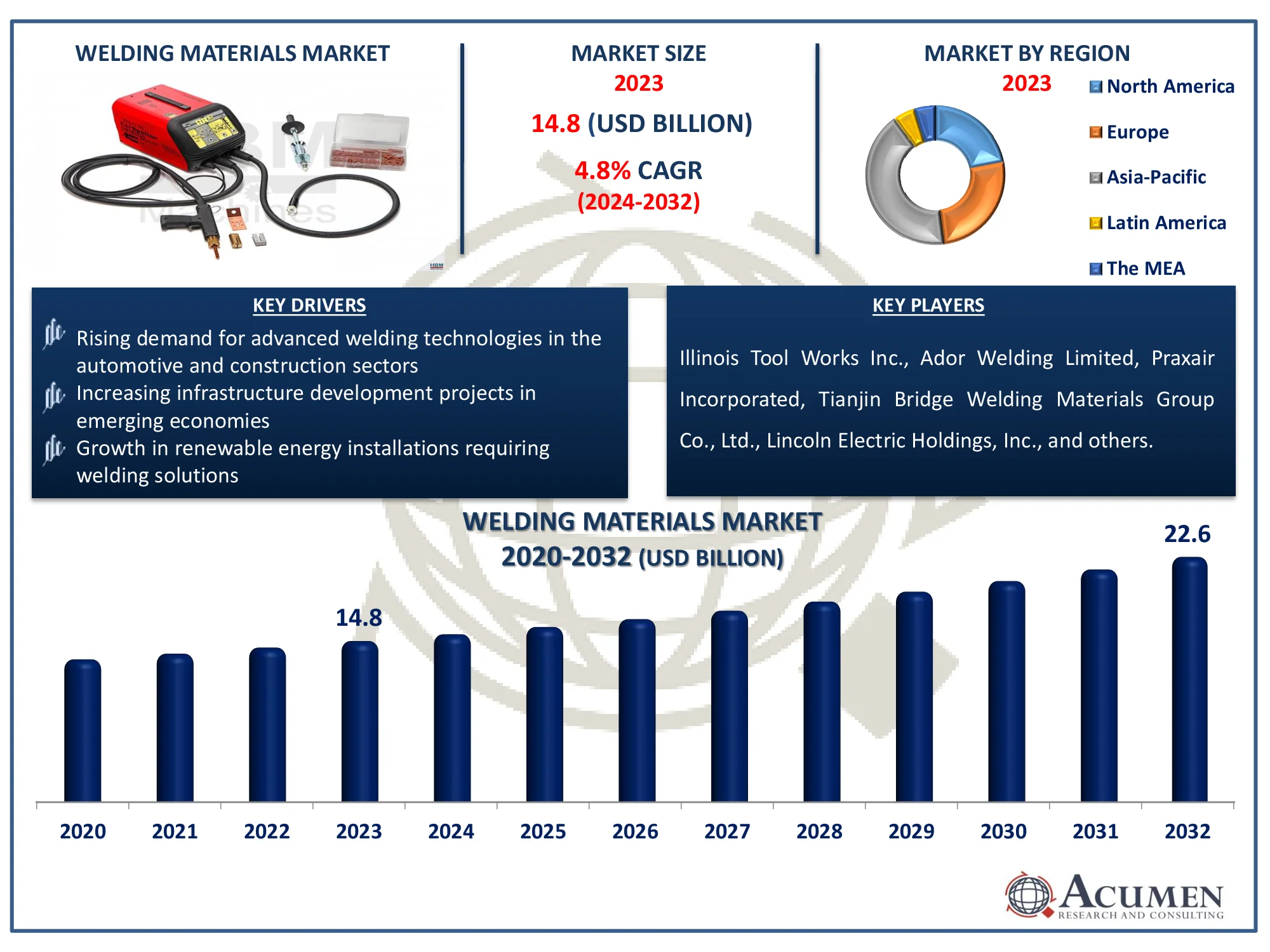

The Global Welding Materials Market Size accounted for USD 14.8 Billion in 2023 and is estimated to achieve a market size of USD 22.6 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

The Global Welding Materials Market Size accounted for USD 14.8 Billion in 2023 and is estimated to achieve a market size of USD 22.6 Billion by 2032 growing at a CAGR of 4.8% from 2024 to 2032.

Welding materials are nonmetallic substances utilized to join metals and thermoplastics. The joining process involves fusing two materials at elevated temperatures. During welding, the base metal is melted, and filler material is introduced to enhance its strength. Energy sources such as gas flames, lasers, friction, and ultrasound facilitate the welding process. Common raw materials in this technique include plate metal, fittings, castings, formed and expanded metal, sectional metal, hardware, welding wire, and flat metal.

|

Market |

Welding Materials Market |

|

Welding Materials Market Size 2023 |

USD 14.8 Billion |

|

Welding Materials Market Forecast 2032 |

USD 22.6 Billion |

|

Welding Materials Market CAGR During 2024 - 2032 |

4.8% |

|

Welding Materials Market Analysis Period |

2020 - 2032 |

|

Welding Materials Market Base Year |

2023 |

|

Welding Materials Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Technology, By End User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Illinois Tool Works Inc., Ador Welding Limited, Praxair Incorporated, Tianjin Bridge Welding Materials Group Co., Ltd., Lincoln Electric Holdings, Inc., Air Products and Chemicals, Inc., Air Liquide S.A., The Linde Group, Colfax Corporation, and Voestalpine Böhler Welding. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The welding consumables market is primarily driven by increased demand from the constantly increasing automobile industry. According to the IMD Organization, in 2023, China will have the world's largest automotive production sector, with a total output of 30 million vehicles, including global leadership in the manufacture of new energy vehicles (NEVs), producing nearly 9 million units during the year, and accounting for nearly two out of every three NEVs produced worldwide.

Additionally, the global expansion of energy infrastructure and the growing usage of welded steel in residential and commercial construction in rising economies such as China, India, Brazil, the UAE, Argentina, and portions of Africa are driving welding consumables market growth. According to the International Energy Agency, global energy investment is expected to top USD 3 trillion for the first time in 2024, with USD 2 trillion going toward clean energy technology and infrastructure. The switch to renewable energy for electricity generation is also projected to benefit the market. Furthermore, demand from various end-use sectors, such as marine, offshore exploration, shipbuilding, oil and gas, electronics, mining, manufacturing, aviation, and railways, is expected to fuel welding consumables market growth in the years ahead.

Environmental concerns regarding welding material production, combined with government regulations aimed at lowering volatile organic compound (VOC) emissions during the welding process, are projected to slow welding products market growth. However, there are enormous prospects for welding material manufacturers in growing markets. Rapid infrastructure development in nations such as India, China, Singapore, Brazil, Saudi Arabia, and Malaysia presents significant growth opportunities. For example, in October 2022, China Communications Construction Company Limited and PipeChina (formally known as the China Oil and Gas Pipeline Network) inked a strategic cooperation framework agreement in Beijing. This collaboration implies continued expansion and investment in infrastructure projects, which is consistent with the larger trend of increasing infrastructure in places such as China.

Welding Materials Market Segmentation

Welding Materials Market SegmentationThe worldwide market for welding materials is split based on type, technology, end user, and geography.

According to the welding materials industry analysis, electrodes and filler materials are rapidly expanding due to their critical role in increasing weld strength and performance. The growing use of advanced welding processes in industries such as automotive, construction, and energy has created a demand for high-quality electrodes and fillers. These materials are essential for producing perfect welds in difficult situations, such as high-temperature and high-pressure settings. Furthermore, advances in filler material compositions, such as flux-cored and alloy-based versions are spurring innovation and broadening their application across a wide range of end-use sectors.

Arc welding technology dominates the welding materials business due to its versatility, efficiency, and ability to generate strong, long-lasting welds. It is frequently used in industries such as construction, automotive, shipbuilding, and energy due to its capacity to handle a variety of materials and thicknesses. The availability of advanced arc welding processes, such as MIG, TIG, and flux-cored arc welding, broadens its applications. Its cost-effectiveness and versatility make it an excellent alternative for both large-scale industrial applications and smaller, specialised ventures.

According to the welding materials market forecast, the automotive and transportation industries are the greatest consumers of welding materials, driven by the growing need for lightweight, durable, and fuel-efficient cars. Vehicle manufacturing innovations, particularly electric vehicles (EVs), necessitate the use of specific welding materials to ensure that parts are assembled securely, precisely, and safely. As autonomous vehicles and advanced transportation systems become more prevalent, the demand for improved welding processes and materials grows. Furthermore, as emissions and safety rules tighten, car manufacturers rely largely on high-performance welding materials to fulfill changing industry requirements.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

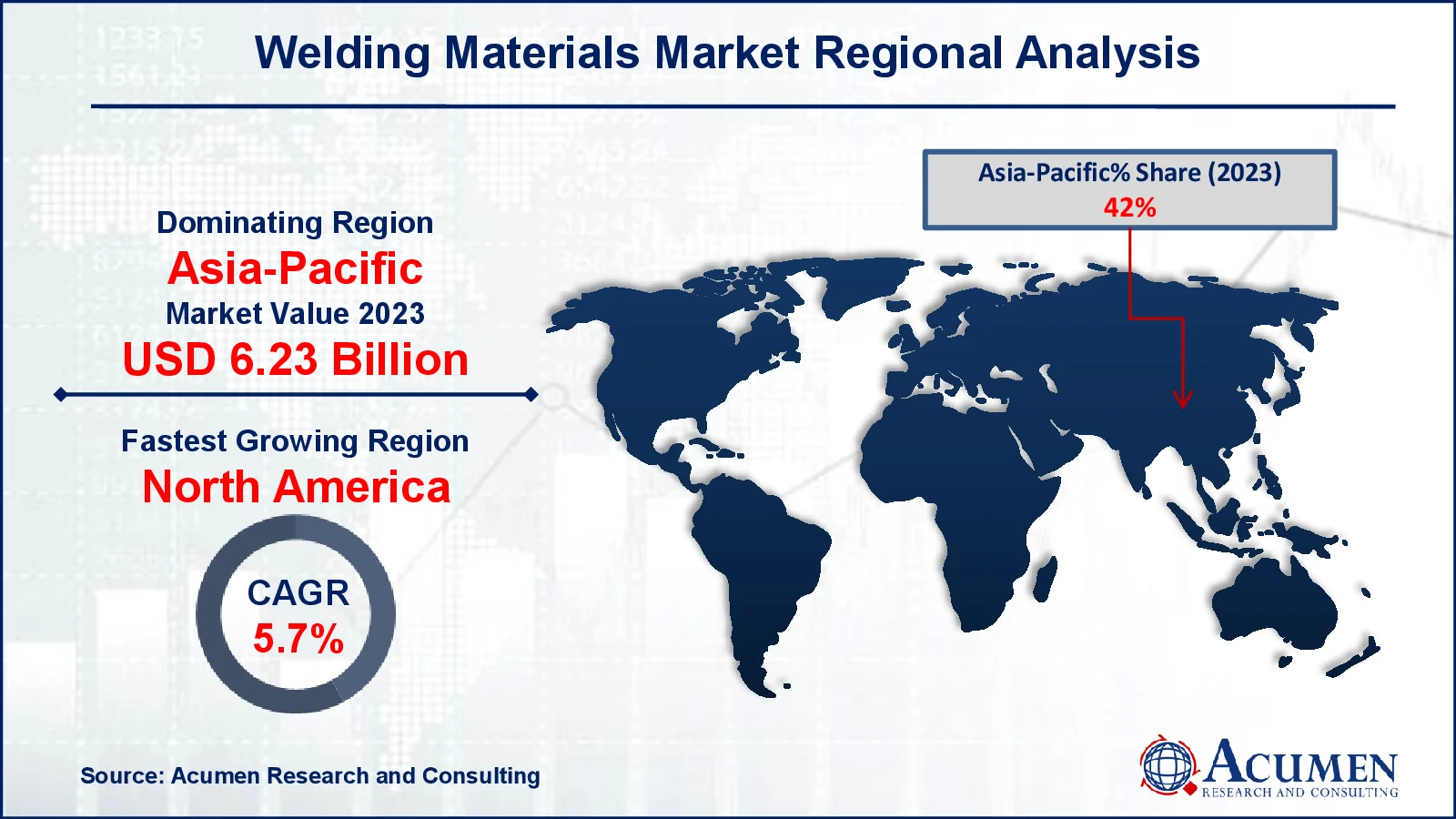

Welding Materials Market Regional Analysis

Welding Materials Market Regional AnalysisFor several reasons, Asia-Pacific is the world's largest welding products market, and it is likely to be the fastest-growing area during the forecast period, thanks to rapidly expanding infrastructure projects in India, China, Malaysia, Singapore, and Indonesia. For example, Invest India asserts that the PM Gati Shakti Master Plan for Expressways will be constructed between 2022 and 2023, allowing for speedier travel. The National Highway network would be expanded by 25,000 kilometers in 2022-203, at a cost of INR 20,000 Crore (USD 2417670).

North American and European markets, on the other hand, are expected to grow more slowly due to the maturity of the transportation and construction industries. Companies in the welding supplies sector are increasingly working together to broaden their global reach and optimize profitability. For example, in August 2023, Lincoln Electric announced a strategic agreement with software firm Authentise to incorporate digital solutions for real-time tracking and quality control in welding processes, which will benefit industrial clients looking to boost production efficiency and transparency. Partnerships with international firms to improve market presence and reputation are also developing as important strategies in the global welding products market.

Some of the top welding materials companies offered in our report include Illinois Tool Works Inc., Ador Welding Limited, Praxair Incorporated, Tianjin Bridge Welding Materials Group Co., Ltd., Lincoln Electric Holdings, Inc., Air Products and Chemicals, Inc., Air Liquide S.A., The Linde Group, Colfax Corporation, and Voestalpine Böhler Welding.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2022

April 2024

June 2018

August 2022