January 2021

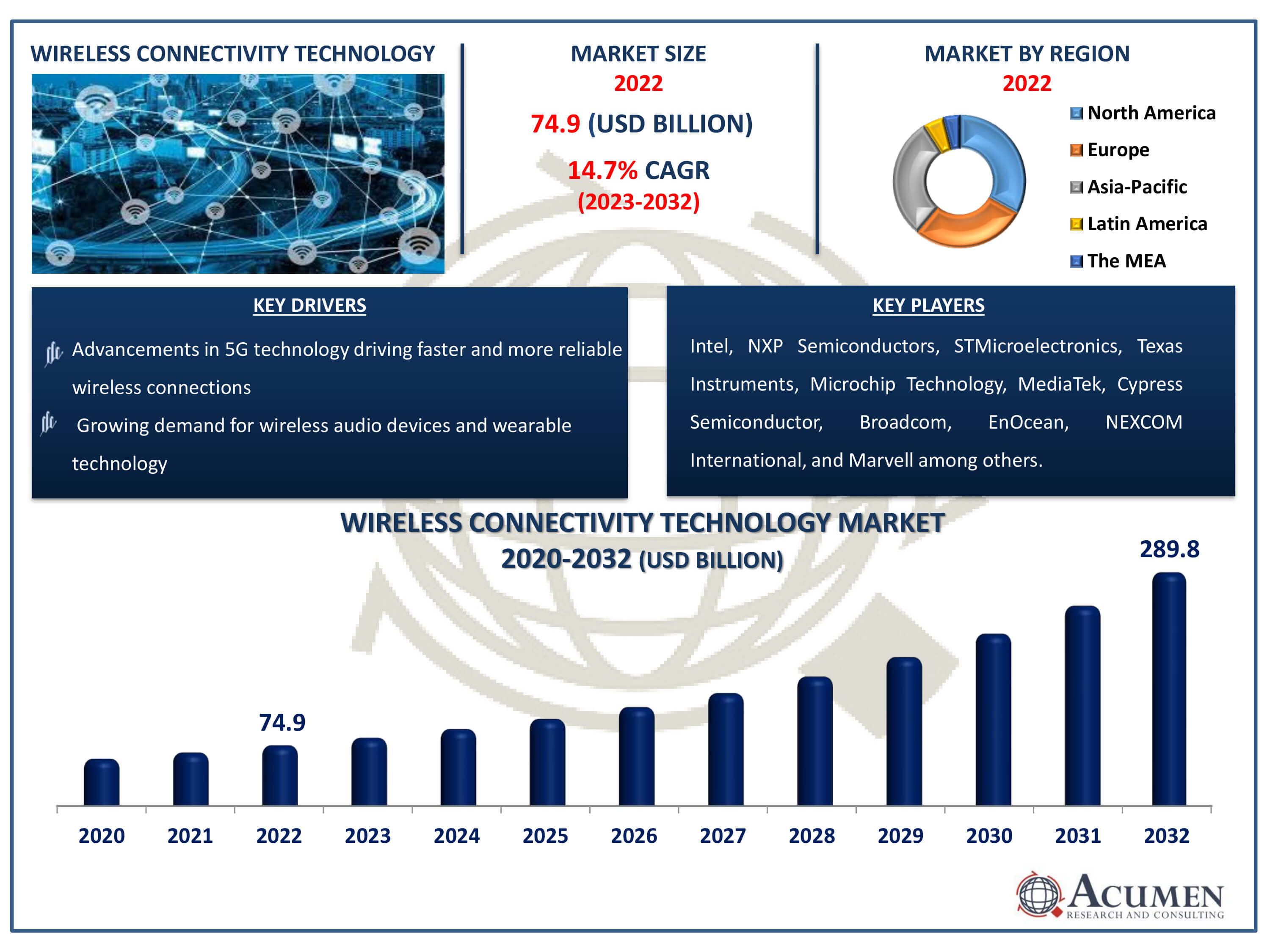

Wireless Connectivity Technology Market Size accounted for USD 74.9 Billion in 2022 and is estimated to achieve a market size of USD 289.8 Billion by 2032 growing at a CAGR of 14.7% from 2023 to 2032.

The Wireless Connectivity Technology Market Size accounted for USD 74.9 Billion in 2022 and is estimated to achieve a market size of USD 289.8 Billion by 2032 growing at a CAGR of 14.7% from 2023 to 2032.

Wireless Connectivity Technology Market Highlights

The term wireless connectivity technology describes the methods by which gadgets, including computers, cellphones, and Internet of Things (IoT) devices, connect to the internet or interact with one another without requiring actual cable connections. This technology allows for seamless data transmission over short or long distances by utilizing a variety of wireless communication protocols, including NFC, Wi-Fi, Bluetooth, Zigbee, and cellular networks. The wireless connectivity market is expanding quickly due to the growing popularity of wearable, smart homes, and Internet of Things (IoT) devices. The market is expanding as a result of factors such the development in smart city projects, the proliferation of smartphones, and the growing demand for wireless audio devices. Furthermore, the market is expanding because to the developments in 5G technology and low-power wireless networks, which offer improved efficiency and connectivity for a range of sectors.

Global Wireless Connectivity Technology Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Wireless Connectivity Technology Market Report Coverage

| Market | Wireless Connectivity Technology Market |

| Wireless Connectivity Technology Market Size 2022 | USD 74.9 Billion |

| Wireless Connectivity Technology Market Forecast 2032 | USD 289.8 Billion |

| Wireless Connectivity Technology Market CAGR During 2023 - 2032 | 14.7% |

| Wireless Connectivity Technology Market Analysis Period | 2020 - 2032 |

| Wireless Connectivity Technology Market Base Year |

2022 |

| Wireless Connectivity Technology Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Connectivity Technology, By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Intel, Qualcomm, NXP Semiconductors, STMicroelectronics, Texas Instruments, Microchip Technology, MediaTek, Cypress Semiconductor, Broadcom, EnOcean, NEXCOM International, Skyworks Solutions, Murata Manufacturing, Marvell, Quantenna, Renesas Electronics Corporation, and NORDIC Semiconductor. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Wireless Connectivity Technology Market Insights

Rapid technological advancements in the electronics sector, high internet penetration, and the increasing focus of sensor manufacturers on improving wireless sensing technology are major factors expected to drive the growth of the global market. Additionally, the high demand for advanced wireless devices across various industry verticals is another factor expected to augment market growth. Governments are investing heavily in the development of the healthcare sector, leading to increased demand for wireless medical equipment. With the rising number of patients in hospitals suffering from various diseases, the use of wireless technology to transfer information offers greater accuracy, eliminates manual tasks, and allows real-time access to information.

Major players are focusing on business development to increase profit share, employing approaches such as merger and acquisition activities to expand customer bases and enhance product portfolios, further augmenting global market growth. For instance, in 2019, Qualcomm acquired TDK, a Japanese company focused on producing parts for telecommunications equipment, aiming to bolster its lineup of products for 5G smartphones, thereby increasing its business presence and profit ratio.

Moreover, players are investing heavily in new product development and engaging in high R&D activities to offer innovative product offerings, which is expected to support market growth. Introducing new products is aimed at expanding the customer base and increasing revenue. For example, in 2019, Omron, a provider of advanced industrial automation solutions, launched the E2E NEXT proximity sensor series featuring exceptionally long sensing distances and IoT functionality, expected to attract new customers and enhance the product portfolio.

However, factors such as the unavailability of advanced infrastructure to support the adoption of advanced devices and rising security concerns are expected to hamper global wireless connectivity market growth. Additionally, the lack of uniform communication standards presents another challenge to market growth. High investments in the development of 5G technology and the emergence of cross-domain working applications are expected to create new opportunities for players operating in the target market over the wireless connectivity technology industry forecast period. Furthermore, an inclination towards emerging economies is expected to further support revenue traction in the target market.

Wireless Connectivity Technology Market Segmentation

The worldwide market for wireless connectivity technology is split based on connectivity technology, type, application, and geography.

Wireless Connectivity Technology Market by Connectivity Technology

According to wireless connectivity technology industry analysis, currently, Wi-Fi is the market leader. Wi-Fi is essential for a wide range of consumer gadgets and industrial applications because it provides flexible and fast wireless internet access. Its supremacy is demonstrated by the broad use of it in public spaces, workplaces, homes, and IoT deployments. Wi-Fi technology is always changing; improvements like Wi-Fi 6 and Wi-Fi 6E provide better efficiency, capacity, and performance. Furthermore, the desire for seamless connectivity and the widespread use of smart gadgets fuel Wi-Fi's wireless connectivity market domination. Its leadership in the industry is fueled by its interoperability, dependability, and compatibility with a broad variety of devices, which consolidate its position as the top option for wireless connectivity solutions.

Wireless Connectivity Technology Market by Types

The cellular M2M sector is dominating the wireless connectivity market. Cellular networks are utilized by cellular M2M, or machine-to-machine communication, to provide data transmission and remote communication between devices. The swift proliferation of IoT deployments across many industries, such as automotive, healthcare, manufacturing, and utilities, is driving this segment's supremacy. Large-scale installations and mission-critical applications can benefit from cellular M2M's extensive coverage, scalability, and reliability. Cellular M2M's dominance in the market is further cemented by the promise of even faster speeds, lower latency, and larger capacity offered by cellular technology developments like the move to 5G. Its supremacy is fueled by its capacity to facilitate a wide variety of IoT applications and offer seamless connectivity over large geographic areas.

Wireless Connectivity Technology Market by Applications

Consumer electronics emerges as the largest and most significant segment in the market for wireless connectivity technologies. The widespread incorporation of wireless connectivity in smartphones, tablets, smart TVs, gaming consoles, and other consumer electronics is the reason for this domination. Customers need seamless wireless connectivity for a variety of applications, from streaming video to smart home management, due to the unwavering demand for connected and smart products. Furthermore, the consumer electronics industry's lightning-fast rate of innovation and product introductions propels the uptake of cutting-edge wireless technologies like Wi-Fi, Bluetooth, and NFC. With its significant market share and influence, the customer Electronics category continues to lead the industry as customer tastes shift towards networked and Internet of Things (IoT) enabled gadgets.

Wireless Connectivity Technology Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Wireless Connectivity Technology Market Regional Analysis

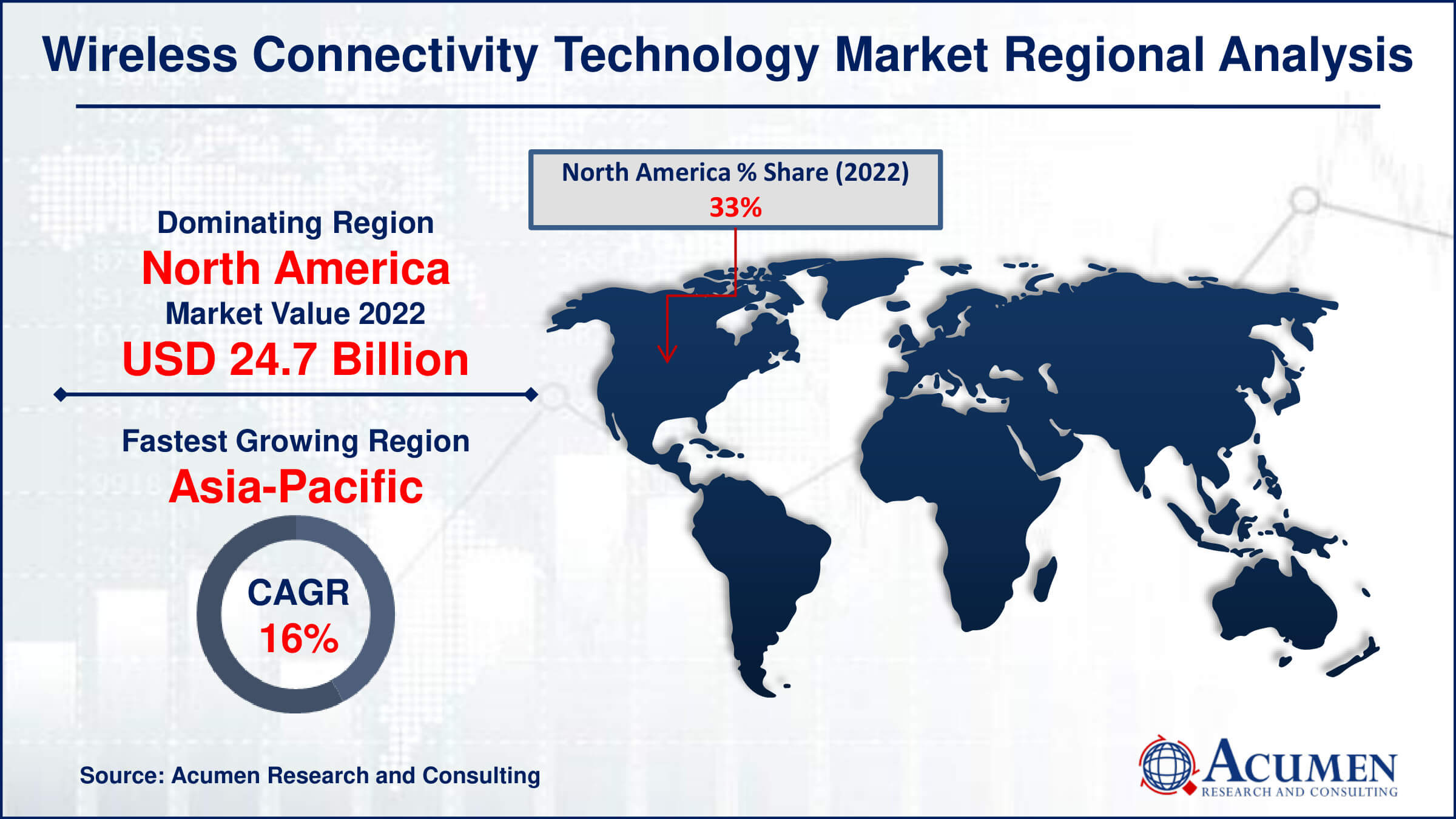

In terms of wireless connectivity technology market analysis, the North American market is expected to account for a significant revenue share due to the availability of advanced infrastructure facilitating the adoption of sophisticated devices. Additionally, the presence of major players operating in the region, along with their proactive approach towards business development, is expected to further bolster the growth of the regional market.

Meanwhile, Asia-Pacific is poised to witness rapid growth in the wireless connectivity technology market forecast period, fueled by the presence of major electronics manufacturers, increasing demand for smart wearable, and the introduction of new product offerings. Moreover, substantial government spending on infrastructure development, coupled with the emergence of small and mid-sized enterprises offering innovative products, is expected to further drive growth in the target market.

Wireless Connectivity Technology Market Players

Some of the top wireless connectivity technology companies offered in our report includes Intel, Qualcomm, NXP Semiconductors, STMicroelectronics, Texas Instruments, Microchip Technology, MediaTek, Cypress Semiconductor, Broadcom, EnOcean, NEXCOM International, Skyworks Solutions, Murata Manufacturing, Marvell, Quantenna, Renesas Electronics Corporation, and NORDIC Semiconductor.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

January 2021

February 2024

July 2021

April 2025