February 2020

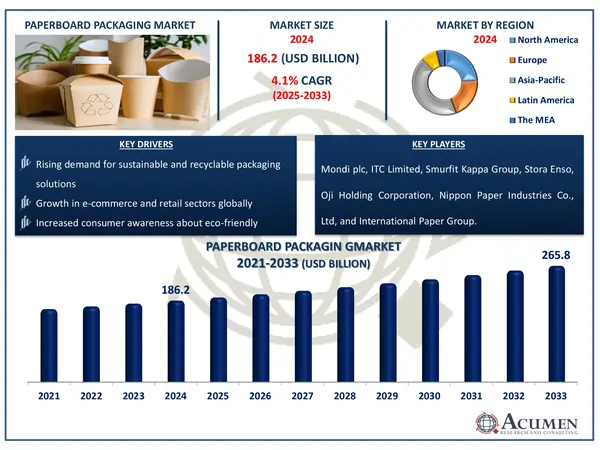

The Global Paperboard Packaging Market Size accounted for USD 186.2 Billion in 2024 and is estimated to achieve a market size of USD 265.8 Billion by 2033 growing at a CAGR of 4.1% from 2025 to 2033.

The Global Paperboard Packaging Market Size accounted for USD 186.2 Billion in 2024 and is estimated to achieve a market size of USD 265.8 Billion by 2033 growing at a CAGR of 4.1% from 2025 to 2033.

Paperboard packaging is a lightweight, thick paper-based material used to make boxes and cartons. It has great printability, making it suitable for branding and product information. Paperboard is commonly used in packaging for food, cosmetics, pharmaceuticals, and consumer electronics. It is recyclable and frequently produced from renewable materials, making it an environmentally responsible option. Its versatility and cost-effectiveness make it a popular choice across numerous industries.

Paperboard Packaging Council states about its four different parts that are solid bleached sulfate (SBS), coated unbleached kraft (CUK), coated recycled paperboard, and non-bending chipboard, each contain its different properties and strengths.

|

Market |

Paperboard Packaging Market |

|

Paperboard Packaging Market Size 2024 |

USD 186.2 Billion |

|

Paperboard Packaging Market Forecast 2033 |

USD 265.8 Billion |

|

Paperboard Packaging Market CAGR During 2025 - 2033 |

4.1% |

|

Paperboard Packaging Market Analysis Period |

2021 - 2033 |

|

Paperboard Packaging Market Base Year |

2024 |

|

Paperboard Packaging Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Raw Material, By Product, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Mondi plc, ITC Limited, Smurfit Kappa Group, Stora Enso, Oji Holding Corporation, Nippon Paper Industries Co., Ltd, International Paper Group, South African Pulp & Paper Industries, and Svenska Cellulosa Aktiebolaget. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The rising personal care and cosmetics sector is generating demand for more practical and appealing packaging options, which is helping to expand the paperboard packaging business. According to our analysis, the worldwide beauty and personal care products market was valued at USD 527.2 billion in 2023 and is expected to reach USD 855.2 billion by 2032, rising at a 5.7% CAGR between 2024 and 2032. Similarly, the cosmetic and personal care packaging equipment market, which was valued at USD 4.6 billion in 2023, is predicted to reach USD 7.4 billion by 2032, representing a 5.5% CAGR. The increased demand for packaging machines in the cosmetics and personal care segment promotes the expansion of the paperboard packaging business.

Furthermore, growing consumer awareness of eco-friendly packaging solutions is driving market expansion, since paperboard is a sustainable alternative. The National Institutes of Health (NIH) promotes the importance of sustainable packaging, emphasizing the vital role that packaging materials play in assuring product safety and utility in industries such as food and drinks, cosmetics, pharmaceuticals, and others. Paper and paperboard stand out as feasible, environmentally friendly alternatives, strengthening the market's shift toward sustainable solutions.

However, the market faces hurdles due to stiff competition from plastic and flexible packaging options. Despite this, advances in coating technologies aimed at improving durability and shelf life are increasing the use of paperboard packaging. For example, in August 2023, Graphic Packaging International, Inc., a major paperboard plant in the United States, introduced PaceSetter Rainier, a new coated recycled paperboard (CRB). This product combines the properties of solid bleached sulfate (SBS) with recycled content, providing better brightness, whiteness, and surface smoothness, hence increasing its competitiveness against regular SBS materials.

The worldwide market for paperboard packaging is split based on raw material, product, application, and geography.

According to paperboard packaging industry analysis, recycled waste paper segment enjoys a prominent position as a raw material due to its cost-effectiveness and environmental benefits. It considerably minimizes the requirement for virgin pulp, hence conserving natural resources like forests and water. Furthermore, increased consumer awareness and governmental demands on sustainability have fueled the demand for environmentally friendly packaging solutions. Manufacturers are increasingly adopting recycled paper to satisfy both economic and environmental goals.

Based on product, boxboard products are expected to witness significant growth in paperboard packaging market due to their strong protective qualities. They are widely used in packaging for food, cosmetics, and consumer goods, offering both structural integrity and appealing aesthetics. The shift towards sustainable and recyclable materials further boosts demand for boxboard as an eco-friendly alternative.

According to paperboard packaging market forecast, food and beverage industry leads the market. Growing use of packaged foods drives the paperboard packaging sector. Furthermore, prominent players focus on innovation in paper-based packaging solutions to maintain segment dominance in the business. For example, in June 2024, Saica Group announced the introduction of a new paper-based product aimed at multipack items in the confectionery, biscuit, and chocolate industries. This expansion of new paper-based products aimed at the food and beverage industry will preserve segment leadership in market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

In terms of regional segments, the Asia-Pacific region leads the worldwide paperboard packaging market, with countries such as India, China, South Korea, and Malaysia experiencing significant increases in packaged food consumption. This trend contributes greatly to the expansion of the paperboard packaging sector. For example, the Indian Council for Research on International Economic Relations reports a significant increase in ultra-processed food consumption in India, with retail sales expected to reach 3,633,458 units by 2025. Furthermore, the processed food sector in India has achieved a compound annual growth rate (CAGR) of 15.32% in retail sales value and 7.16% in retail sales volume over the same time. This anticipated increase in ultra-processed food sales is expected to fuel further demand for paperboard packaging, particularly because of its lightweight, eco-friendly, and print-compatible properties appropriate for large-scale distribution.

Meanwhile, North America's paperboard packaging industry is expected to rise at a 4.6% CAGR. In October 2024, Avery Dennison launched its first line of INGEDE12-certified paper label solutions, which include enhanced adhesive technologies to promote recyclability and output quality for cardboard and paper production. Compliance with the package and Packaging Waste Regulation (PPWR) rules, which demand particular, recycling design standards for all package components, is becoming increasingly crucial. The paperboard packaging market in North America is predicted to grow further due to the existence of key industry players and the continued expansion of the e-commerce sector.

Some of the top paperboard packaging companies offered in our report include Mondi plc, ITC Limited, Smurfit Kappa Group, Stora Enso, Oji Holding Corporation, Nippon Paper Industries Co., Ltd, International Paper Group, South African Pulp & Paper Industries, and Svenska Cellulosa Aktiebolaget.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2020

September 2023

April 2020

April 2025