February 2020

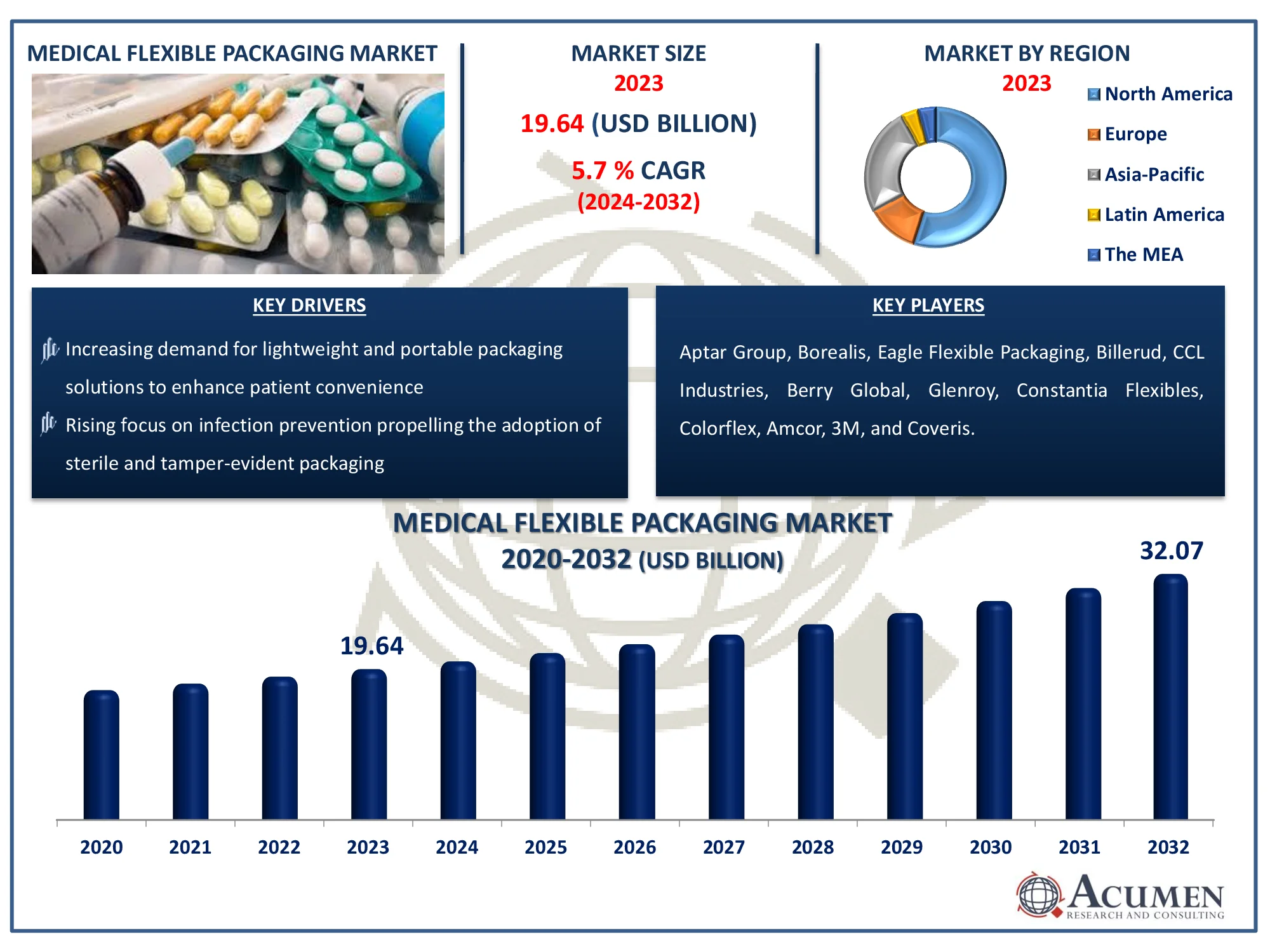

The Medical Flexible Packaging Market is set to grow from USD 19.64 Billion in 2023 to USD 32.07 Billion by 2032, driven by a CAGR of 5.7%. Explore key trends and market insights.

The Global Medical Flexible Packaging Market Size accounted for USD 19.64 Billion in 2023 and is estimated to achieve a market size of USD 32.07 Billion by 2032 growing at a CAGR of 5.7% from 2024 to 2032.

Medical Flexible Packaging Market Highlights

For many powders and solid dose items (pills), flexible formats have been used for decades. Indeed, the first headache powders were sold in paper/plastic laminate sachets, which are still widely available today. The first aspirins were sold in aluminum foil strip packaging. This foil material is still used exclusively for blister packaging lidding today, usually in conjunction with a rigid plastic 'blister. Some formats, however, now use foil on foil, which has the advantage of being less prone to damage. Medical devices, ranging from simple syringes to highly sophisticated dosing mechanisms, are also packaged in flexible bags or foil packs to protect them and maintain a sterile or moisture-free environment. Flexible packaging has numerous advantages for medical and pharmaceutical products. It not only protects and extends the shelf-life of products, but it also uses less energy to manufacture, lowers shipping costs, and sends fewer materials to landfills.

Global Medical Flexible Packaging Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Medical Flexible Packaging Market Report Coverage

| Market | Medical Flexible Packaging Market |

| Medical Flexible Packaging Market Size 2022 |

USD 19.64 Billion |

| Medical Flexible Packaging Market Forecast 2032 | USD 32.07 Billion |

| Medical Flexible Packaging Market CAGR During 2023 - 2032 | 5.7% |

| Medical Flexible Packaging Market Analysis Period | 2020 - 2032 |

| Medical Flexible Packaging Market Base Year |

2023 |

| Medical Flexible Packaging Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Material, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Aptar Group, Eagle Flexible Packaging, Borealis, Billerud, Glenroy, CCL Industries, Berry Global, Constantia Flexibles, Colorflex, Amcor, 3M, and Coveris. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Medical Flexible Packaging Market Insights

Medical flexible packaging provides numerous advantages, including product protection, ease of shipment and less space utilization during storage and shipment, lowering warehousing and shipment costs. This improves the manufacturers' overall cost efficiency. Medical flexible packaging eliminates the possibility of contamination. The water-resistant medical flexible packaging has a smooth finish that prevents particles from contaminating the packaging.

Furthermore, the expansion of the global pharmaceutical market is likely to increase medical product expenditure, which will have a direct impact on the medical flexible packaging market. To protect the interests of end-users, hygiene is paramount in medical flexible packaging. Sterilization has become critical in order to keep medical products clean and extend their shelf life. This is expected to increase demand for medical flexible packaging in the market.

Rising population, increasing disposable income and expenditure on healthcare facilities are likely to impact the growth of medical flexible packaging positively. For instance, according to the National Library of Medicine, the estimated cost of chronic disease is expected to reach $47 trillion worldwide by 2030. The healthcare industry is rapidly expanding because health care is a significant component of a country's economic growth and an indicator of social safety net facilities. Because of the rise in chronic illnesses, the healthcare industry is expected to grow. For instance, in 2020, an estimated 523 million people worldwide were affected by some kind of cardiovascular disease (CVD), with roughly 19 million deaths. Furthermore, the improvement and availability of healthcare facilities around the world are likely to drive market demand for medical flexible packaging.

COVID-19 impact on Medical Flexible Packaging Market

The COVID 19 pandemic will present challenges for businesses all over the world. As the number of infections rises, so will the demand for medical products. Manufacturers of basic medical supplies to combat the infection are likely to benefit from the epidemic. Many of these items are low-margin disposables, such as standard examination medical supplies, masks, wipes, gloves, and personal protective equipment (PPE). Reduced production capacity is likely to constrain supply as a result of supply chain disruptions. This is expected to increase market demand for medical flexible packaging that is both convenient and safe to use.

Medical Flexible Packaging Market Segmentation

The worldwide market for medical flexible packaging is split based on product, material, end-use, and geography.

Medical Flexible Packaging Market By Product

According to medical flexible packaging industry analysis, by product, the pouches and bags segment is expected to take a commanding lead in the global market, accounting for the largest share. Pouches and bags are used to package a variety of medical products. Amcor is a major manufacturer and supplier of pouches and bags in the healthcare industry. Over the forecast period, the segment is expected to be driven by the development of special pouches and bags with high-barrier packaging.

Medical Flexible Packaging Market By Material

Based on material, the plastics segment is expected to take the lead in the global market, accounting for a sizable market share in the global medical flexible packaging market. Plastics provide more options and have higher tensile strength than metals, which is expected to drive segment growth over the forecast period. Extrusion technology innovation, as well as the presence of a large number of manufacturing facilities, have increased demand for plastics and paved the way for new product development in medical packaging. Polyethylene, polyethylene terephthalate, polypropylene, and polyvinyl chloride are the most commonly used plastics. In other types of packaging, plastic is frequently used to retain the structure of packaging and make it waterproof by adding a thin layer of plastic film. Oil price fluctuations affect the costs of plastics, which in turn affect the prices of plastic medical flexible packaging.

Medical Flexible Packaging Market By End-use

The pharmaceutical manufacturing segment has dominated the global industry in the past and is expected to do so again during the medical flexible packaging market forecast period. The preference of manufacturers to have an in-house packing facility is driving packaging material consumption in this end-use segment. However, demand is expected to fall as manufacturers outsource their packaging activities in order to save money.

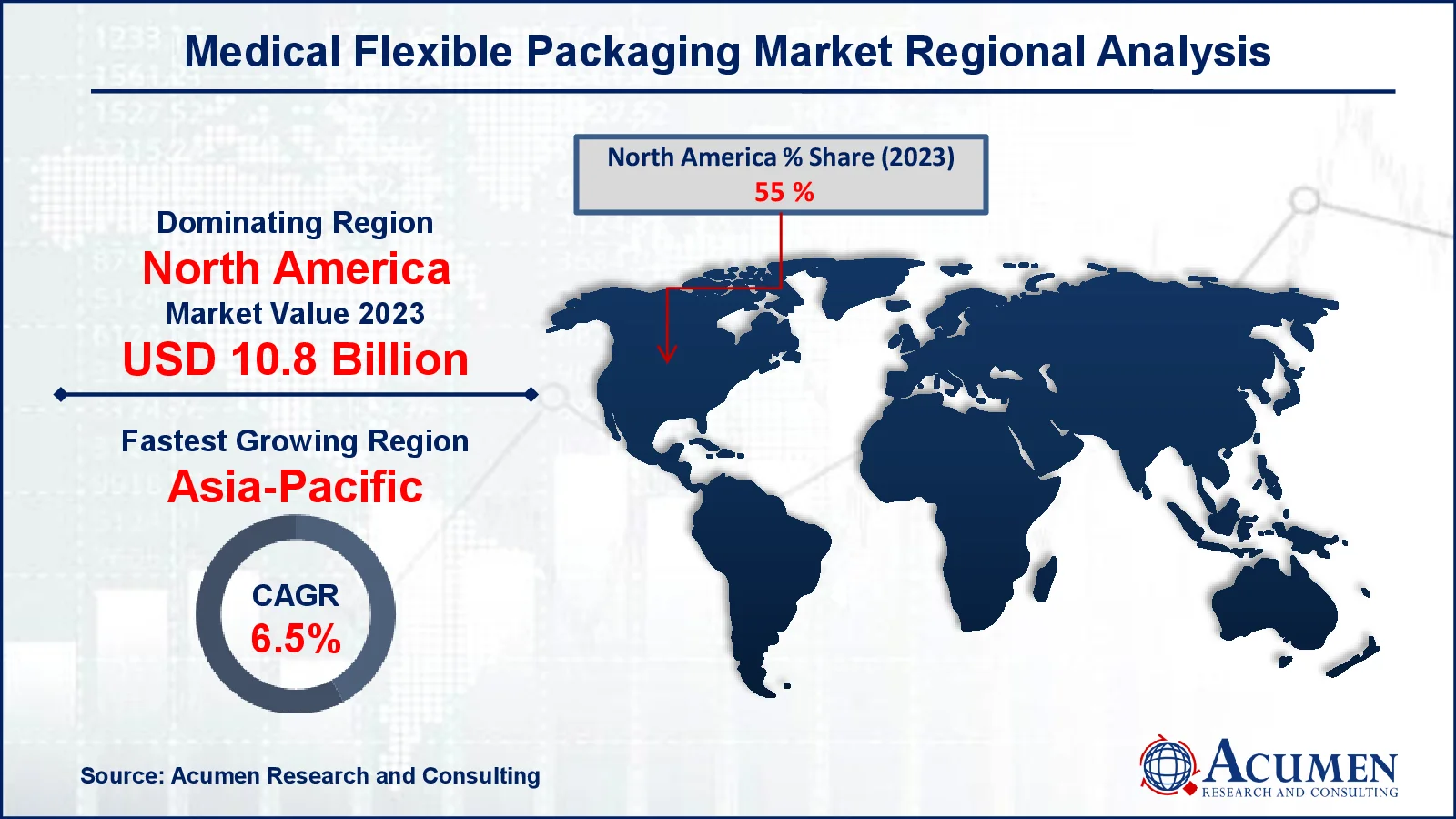

Medical Flexible Packaging Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Medical Flexible Packaging Market Regional Analysis

North America's pharmaceutical and medical device makers are likely to lead the worldwide medical flexible packaging market. The region accounts for a sizable portion of medical product exports. The Asia Pacific region is expected to grow rapidly due to the expansion of the medical industry.

The economic outlook and government aid are likely to have an impact on healthcare facility spending in the region, which is expected to fuel consumption. The growing population, the rise in chronic illnesses and the presence of a large number of manufacturers in the region all contribute to an increase in demand for medical flexible packaging, which is expected to benefit the medical industry.

Medical Flexible Packaging Market Players

Some of the top medical flexible packaging companies offered in our report includes Aptar Group, Eagle Flexible Packaging, Borealis, Billerud, Glenroy, CCL Industries, Berry Global, Constantia Flexibles, Colorflex, Amcor, 3M, and Coveris.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2020

April 2020

April 2025

April 2025