October 2022

Advanced Packaging Market (By Packaging Type: Flip-Chip, Fan-Out WLP, Embedded-Die, Fan-In WLP, 5D/3D, Others; By Application: Consumer Electronics, Automotive, Industrial, Healthcare, Aerospace & Defense, Others) - Global Industry Analysis, Size, Share, Trends and Forecast 2026 to 2035

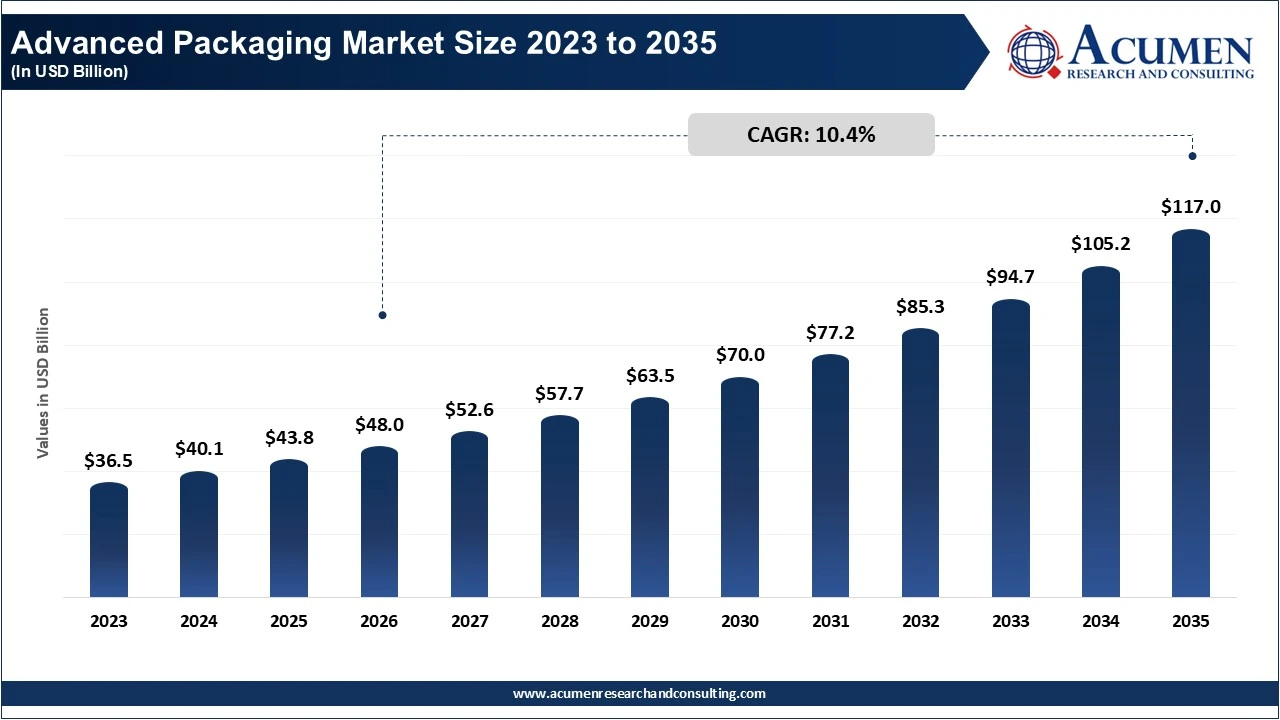

The global advanced packaging market size accounted for USD 43.81 billion in 2025 and is estimated to exceed around USD 116.96 billion by 2035, growing at a CAGR of 10.4% from 2026 to 2035. Advanced packaging refers to novel semiconductor packaging technologies that improve chip performance, reduce size, and increase power efficiency. Unlike traditional packaging, it enables higher-density integration of numerous chips (chiplets) in a single package, resulting in faster data transfer and reduced latency. It is critical to the development of next-generation applications such as artificial intelligence, 5G, and high-performance computing. To fulfill the increased demand for miniaturization and performance, innovative packaging techniques like as 2.5D/3D packaging, wafer-level packaging, and fan-out packaging are frequently used.

| Area of Focus | Details |

| Advanced Packaging Market Size 2026 | USD 47.97 Billion |

| Advanced Packaging Market Forecast 2035 | USD 116.96 Billion |

| Advanced Packaging Market CAGR During 2026 - 2035 | 10.4% |

| Segments Covered | By Type, By End-User, and By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amkor Technology Inc., SEMICON, Samsung Electronics, JCET Group, ASMPT SMT Solutions, Taiwan Semiconductor Manufacturing Company (TSMC), IPC International, Inc., Advanced Semiconductor Engineering (ASE), Prodrive Technologies B.V., and Yole Group. |

| Report Coverage | Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

As smartphones, wearables, and other portable devices become more advanced, there is a growing desire for chips that are smaller, faster, and more energy efficient. Silicon Box announced a USD 2 billion investment in a Singapore-based advanced semiconductor manufacturing foundry in July 2023, while TSMC announced plans to invest NTD 90 billion in a cutting-edge chip packaging plant in Taiwan. These significant expenditures in improved chip packaging are projected to propel market growth during the forecast period.

Next-generation technologies like artificial intelligence, 5G, and the internet of things necessitate fast data processing and minimal latency. Advanced packaging addresses these criteria by utilizing high-bandwidth interconnects and multi-die integration to greatly improve system-level performance. According to the Press Information Bureau (PIB), India has made significant headway in its 5G rollout, with coverage reaching 99.6% of districts. The country's internet subscriber base has risen to 97.15 crore, with wireless users accounting for 92.78 crore. A record 4.69 lakh 5G BTSs have been deployed nationally, connecting millions, and 25 crore mobile customers now use 5G services, indicating a huge increase in digital connectivity. Because of increased demand for high-performance semiconductor components, the rapid expansion of 5G adoption is likely to drive growth in the advanced packaging industry.

However, creating and deploying new packaging technologies requires costly equipment, complex production processes, and significant R&D expenditure, which can be prohibitively expensive for smaller businesses.

Autonomous and electric vehicles require advanced computing power and real-time data processing. For example, the Global Semiconductor Alliance (GSA) notes that the rise of self-driving cars is driving up demand for high-performance AI circuits capable of real-time data processing, sensor fusion, and advanced decision making. These sophisticated chips rely on advanced packaging technologies to meet rigorous performance, power, and space requirements, driving growth in the advanced packaging industry.

The worldwide market for advanced packaging is split based on treatment, end-user, and geography.

The flip-chip packaging dominates the market due to its greater electrical performance, increased I/O density, and small form factor. It enables direct connection of the die to the substrate via solder bumps, which reduces signal loss and increases speed. This approach improves heat management and reliability, making it suitable for high-performance computers and mobile devices. Its broad use in AI, 5G, and data centers reinforces its market supremacy.

Advanced Packaging Market Share, By Packaging Type, 2025 (%)

| Packaging Type | Market Share, 2025 (%) |

| Flip-Chip | 37% |

| Fan-Out WLP | 28% |

| Embedded-Die | 4% |

| Fan-In WLP | 18% |

| 2.5D/3D | 10% |

| Others | 3% |

The consumer electronics category leads due to rising demand for smaller, quicker, and more efficient gadgets. Smartphones, tablets, and wearables demand innovative packaging techniques to ensure excellent performance and downsizing. This segment drives advancements in packaging technologies such as system-in-package and fan-out wafer-level packaging. Rapid technological adoption and rising customer expectations help to sustain its market dominance.

Advanced Packaging Market Share, By Application, 2025 (%)

| Application | Market Share, 2025 (%) |

| Consumer Electronics | 52% |

| Automotive | 18% |

| Industrial | 9% |

| Healthcare | 8% |

| Aerospace & Defense | 7% |

| Others | 6% |

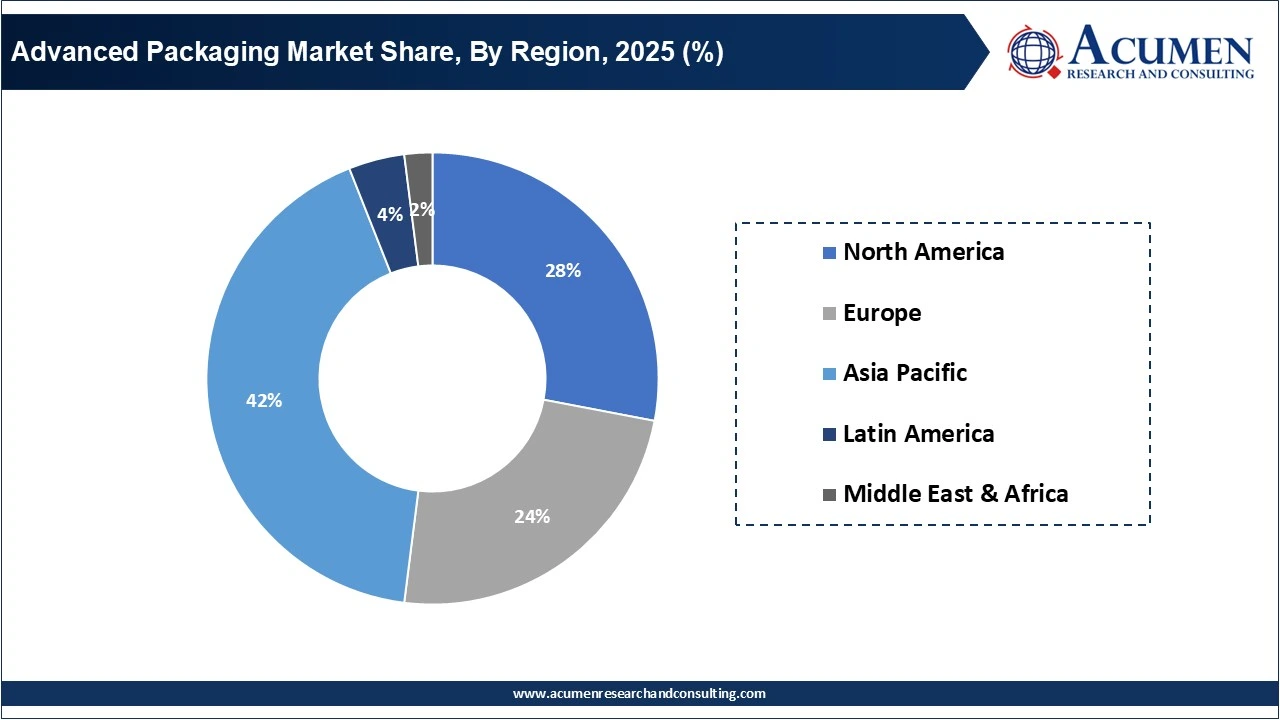

In terms of regional segments, the Asia-Pacific region dominates the advanced packaging industry, owing to a strong semiconductor manufacturing ecosystem in countries such as Taiwan, South Korea, and China. For example, in March 2024, TSMC announced intentions to establish sophisticated semiconductor packaging facilities in Japan. This approach is supported by strong government subsidies and increased investment in Japan's semiconductor industry, establishing the country as a major player in the worldwide market. The presence of major foundries and OSAT (Outsourced Semiconductor Assembly and Test) providers in the region, together with strong demand for consumer electronics and government assistance, continues to accelerate industry expansion.

Meanwhile, North America is experiencing rapid growth in sophisticated packaging, owing to increased investments in semiconductor R&D and domestic chip manufacture. For example, in October 2024, TSMC and Amkor announced a collaboration to establish advanced packaging and testing facilities in Peoria, Arizona. This program will use TSMC's InFO and CoWoS technologies to facilitate semiconductor production for AI and HPC applications. The site's proximity to TSMC's Phoenix fabs will shorten manufacturing times and strengthen the US semiconductor ecosystem. According to the Council on Foreign Relations, the "CHIPS Act" formally known as the CHIPS and Science Act of 2022, is a US federal law designed to enhance domestic semiconductor manufacturing and research and development (R&D), which is driving rapid progress in packaging technologies throughout the region.

Advanced Packaging Market Size, By Region (USD Billion)

| Region | 2025 | 2026 | 2035 |

| North America | $12.57 | $13.43 | $35.56 |

| Europe | $10.51 | $11.51 | $27.02 |

| Asia-Pacific | $18.40 | $20.15 | $47.37 |

| Latin America | $1.75 | $1.92 | $4.56 |

| MEA | $0.88 | $0.96 | $2.46 |

By Packaging Type

By Application

By Region

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2022

April 2025

January 2025

December 2023