July 2022

Global Advanced Shopping Technology Market Segmentation: By Technology - Beacons, Virtual reality, Smart shelves, Retail apps, Social showrooming (2014-2024)

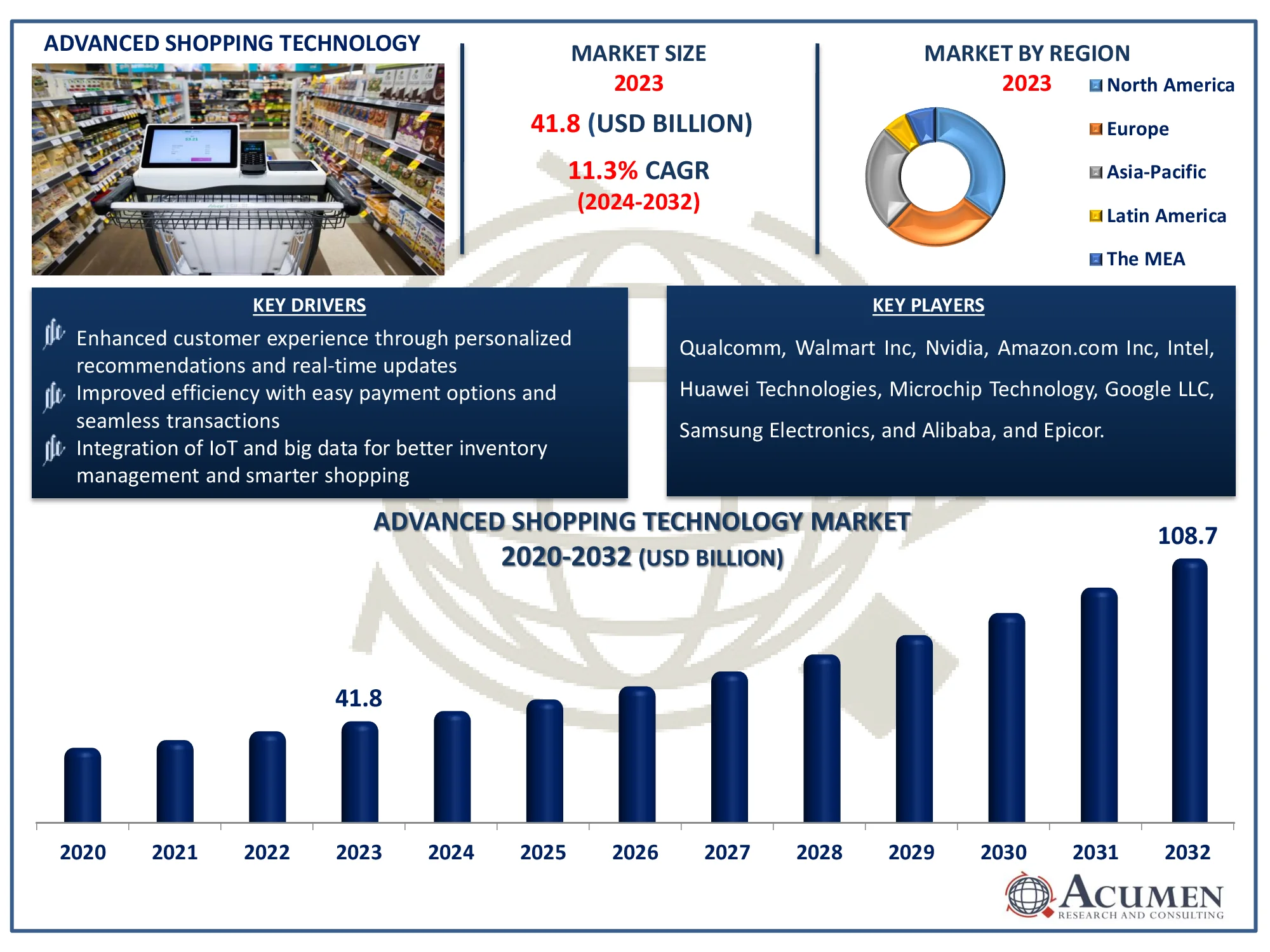

The Global Advanced Shopping Technology Market Size accounted for USD 41.8 Billion in 2023 and is estimated to achieve a market size of USD 108.7 Billion by 2032 growing at a CAGR of 11.3% from 2024 to 2032.

When you visit a store, current technology operates behind the scenes in ways that many customers do not notice. Devices track inventory levels and notify stores when popular items are running low, while retail navigation apps help shoppers find things faster. Innovative technologies are increasingly being used in physical stores. Customers receive push notifications on their phones with the best deals and personalized promotions based on their previous purchases and preferences. Furthermore, modern checkout technologies simplify the payment procedure, increasing ease. These changes contribute to the development of next-generation stores outfitted with cutting-edge shopping technologies, ultimately boosting the overall shopping experience. While internet shopping is convenient, many people prefer the experience of visiting a physical store.

|

Market |

Advanced Shopping Technology Market |

|

Advanced Shopping Technology Market Size 2023 |

USD 41.8 Billion |

|

Advanced Shopping Technology Market Forecast 2032 |

USD 108.7 Billion |

|

Advanced Shopping Technology Market CAGR During 2024 - 2032 |

11.3% |

|

Advanced Shopping Technology Market Analysis Period |

2020 - 2032 |

|

Advanced Shopping Technology Market Base Year |

2023 |

|

Advanced Shopping Technology Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Technology, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Qualcomm, Walmart Inc, Nvidia, Amazon.com Inc, Intel, Huawei Technologies, Microchip Technology, Google LLC, Samsung Electronics, Alibaba, and Epicor. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

To become more flexible, businesses must employ cutting-edge technology such as big data, data analytics, the internet of things (IoT), and cloud computing. Convenient payment options, user-friendly applications, real-time stock availability updates, and time-saving purchasing processes are significant market drivers. In October 2024, India's Unified Payments Interface (UPI) processed ₹23.49 Lakh Crores via 16.58 billion financial transactions, up 45% from 11.40 billion in October 2023. Advanced shopping technologies assist both shops and consumers since they may be adjusted to specific demands using specialized apps. However, there is minimal understanding of the ease of usage and a reluctance choosing to accept this new technology over old purchasing techniques is impeding market growth. Despite this, young people's growing interest in emerging technology is projected to drive market growth in the future years.

The increased interest in combining AI and automation to improve retail operations represents a big opportunity for the advanced shopping technology sector. For example, the Journal of Informatics Education and Research reports that AI improves retail operations in India by optimizing several aspects of the retail environment. Retailers may utilize AI-powered data to develop tailored marketing strategies and improve customer experiences by learning about consumer behavior, preferences, and trends. This technical improvement is projected to boost the expansion of the advanced shopping technology market, providing more efficient retail solution.

Advanced Shopping Technology Market Segmentation

Advanced Shopping Technology Market SegmentationThe worldwide market for advanced shopping technology is split based on technology, application, and geography.

According to the advanced shopping technology industry analysis, retail apps are fast expanding to enhance personalized shopping experiences and streamline the purchasing process. They give businesses with valuable customer insights, allowing for targeted promotions and smooth interaction with e-commerce platforms. Beacons follow soon behind, improving in-store experiences by sending location-based promotions, while smart shelves are gaining traction for better inventory management and consumer engagement. Virtual reality is gaining popularity for immersive product experiences, while social media and showrooming increase visitors and generate consumer demand via social influence.

According to the advanced shopping technology industry analysis, retail is the principal application, driven by the growing use of AI, automation, and digital solutions to improve consumer experiences, optimize inventory management, and simplify checkout operations. Retailers use modern technology like smart shelves, beacons, and retail applications to increase engagement and sales. Commercial advertising follows closely, using data-driven insights to create customized marketing efforts.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Advanced Shopping Technology Market Regional Analysis

Advanced Shopping Technology Market Regional AnalysisFor several reasons, North America dominates the advanced shopping technology industry, owing to well-established retail infrastructure and rapid adoption of cutting-edge technologies. Retail behemoths like Walmart and Amazon are at the vanguard, using AI, IoT, and automation to improve customer experiences and optimize operations. For example, Walmart, North America's largest retail chain, will have over 11,000 brick-and-mortar locations in 2020, as well as almost the same number of online retailers. AI and machine learning (ML) combined with IoT enabled the management of this huge infrastructure. For numerous years, Google Assistant's voice-based search, facial recognition software, and cross-technology solutions have helped the retail business grow and generate more cash. Consumer demand for personalized purchasing and seamless omnichannel experiences drives innovation in this region.

The advanced shopping technology market in Asia-Pacific is growing at an exponential rate, owing to rising e-commerce adoption and increased investments in AI and automation. According to India Brand Equity Foundation, the Indian e-commerce sector is expected to increase from US$ 123 billion in 2024 to US$ 292.3 billion in 2028. Furthermore, India's e-commerce business generated nearly US$ 14 billion in Gross Merchandise Value (GMV) during the 2024 festival season, representing a 12% increase over the prior year. The rise of mobile commerce and digital payment solutions has also accelerated the adoption of innovative shopping technology.

Some of the top advanced shopping technology companies offered in our report include Qualcomm, Walmart Inc, Nvidia, Amazon.com Inc, Intel, Huawei Technologies, Microchip Technology, Google LLC, Samsung Electronics, Alibaba, and Epicor.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2022

December 2022

February 2023

November 2022