July 2023

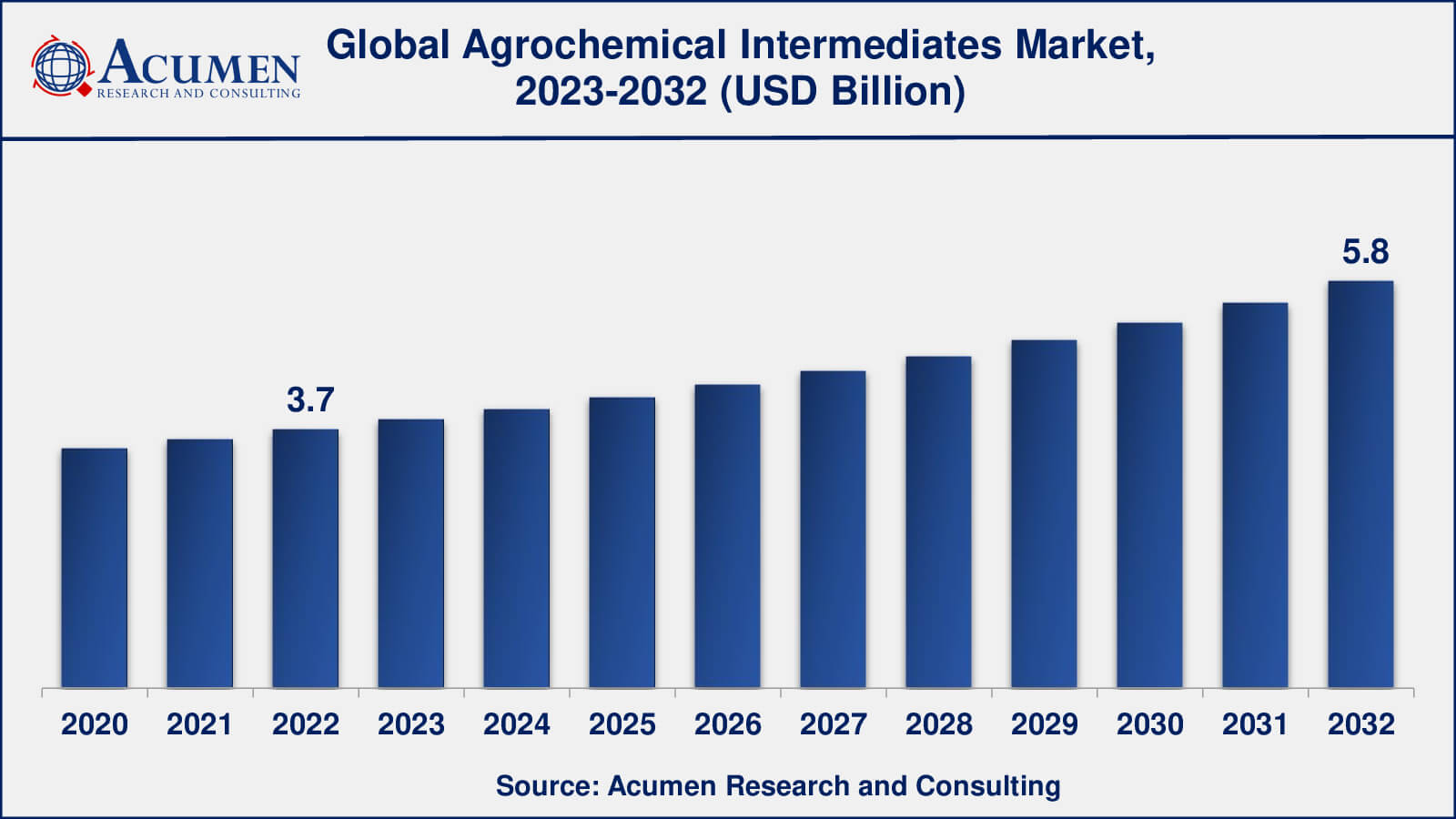

Agrochemical Intermediates Market Size accounted for USD 3.7 Billion in 2022 and is estimated to achieve a market size of USD 5.8 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

The Global Agrochemical Intermediates Market Size accounted for USD 3.7 Billion in 2022 and is estimated to achieve a market size of USD 5.8 Billion by 2032 growing at a CAGR of 4.7% from 2023 to 2032.

Agrochemical Intermediates Market Highlights

Agrochemical intermediates are chemical compounds used as raw materials or building blocks in the production of agrochemicals, which are chemicals used in agriculture to increase crop yields and protect crops from pests and diseases. Agrochemical intermediates are extensively used to produce pesticides such as fungicides, herbicides, and insecticides. General examples of agrochemical intermediates are 2-Chloro-6-(Trichloromethyl) Pyridine, 4-Fluorotoluene Diethyl Phosphorochloridothionate, 2-Chloro-5-Chloro Methyl Pyridine, and 2-Chloropropionic Acid. Commonly used agrochemical intermediates among end users are alkylamines, amines, aldehydes, and acids.

Global Agrochemical Intermediates Market Dynamics

Market Drivers

Market Restraints

Market Opportunities

Agrochemical Intermediates Market Report Coverage

| Market | Agrochemical Intermediates Market |

| Agrochemical Intermediates Market Size 2022 | USD 3.7 Billion |

| Agrochemical Intermediates Market Forecast 2032 | USD 5.8 Billion |

| Agrochemical Intermediates Market CAGR During 2023 - 2032 | 4.7% |

| Agrochemical Intermediates Market Analysis Period | 2020 - 2032 |

| Agrochemical Intermediates Market Base Year | 2022 |

| Agrochemical Intermediates Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Eastman Chemical Company, RohnerChem, Arkema, DPx Fine Chemicals Austria GmbH & Co KG, Kuraray Co., Ltd, Sugai Chemical Industry Co., Ltd, BASF SE, Evonik Industries, Air Water Inc., Astec LifeSciences Ltd., WeylChem Group, Mitsubishi Corporation and Sudarshan Chemical Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Agrochemical Intermediates Market Insights

The agrochemical intermediates market is a growing industry driven by rising agrochemical demand, particularly in developing countries where agriculture is a major driver of economic growth. Rising population and subsidies allocated by the government in emerging economies for surging agricultural mechanisms are driving the growth of this market. However, factors such as a lack of consumer awareness, ecological concerns, and high prices are restraining the growth of this market. Favorable government policies and technological advancements are expected to propel the growth of this market.

Agrochemical Intermediates Market Segmentation

The worldwide market for agrochemical intermediates is split based on type, application, sales channel, and geography.

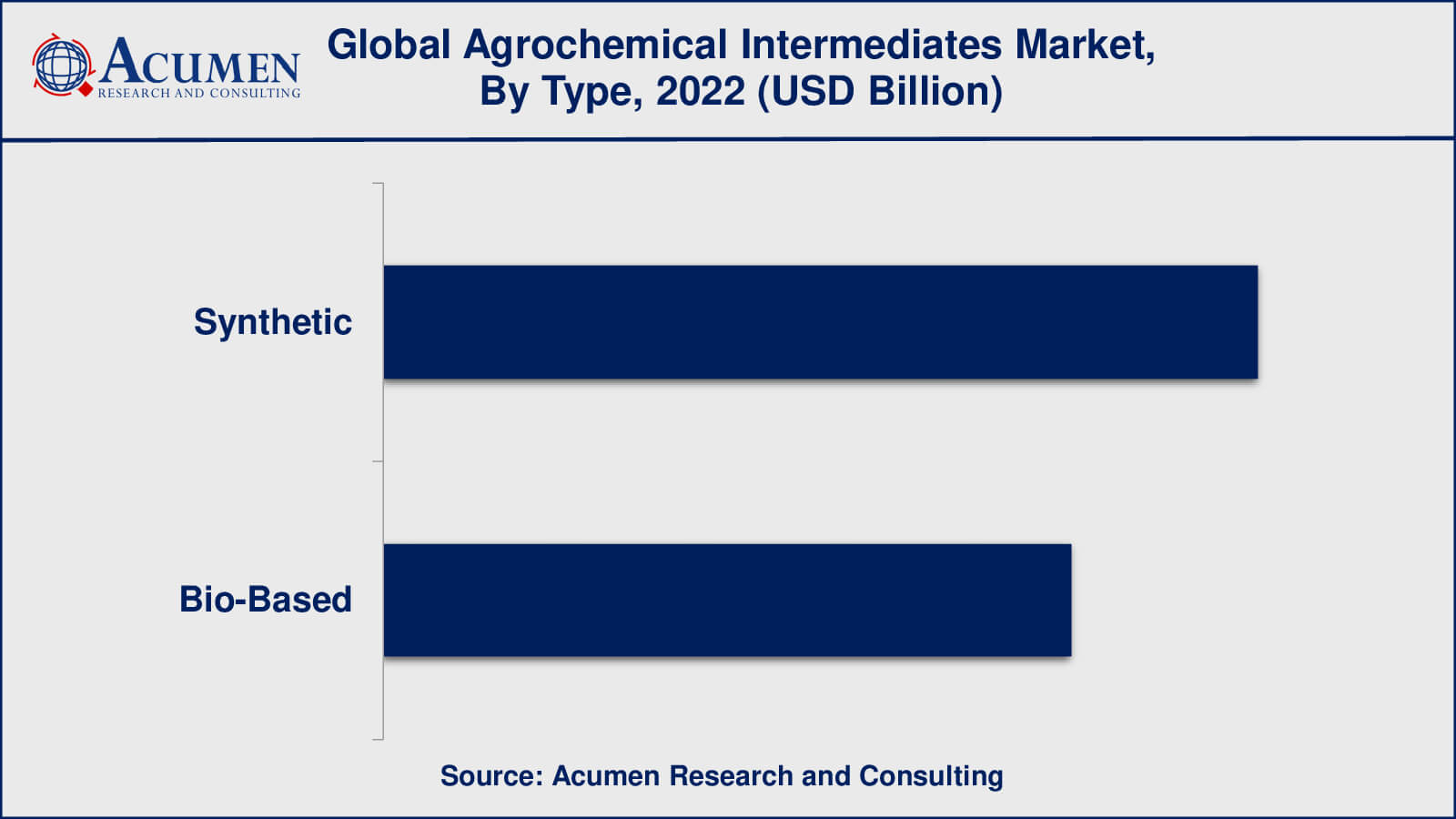

Agrochemical Intermediate Types

According to an agrochemical intermediates industry analysis, synthetic agrochemical intermediates have the largest market share. This is because of their widespread use, availability, and long-standing market presence. However, demand for bio-based agrochemical intermediates is rapidly increasing due to increased consumer awareness of their environmental benefits and consumer preference for sustainable and eco-friendly products. In the coming years, the bio-based agrochemical intermediates segment is expected to grow faster than the synthetic segment.

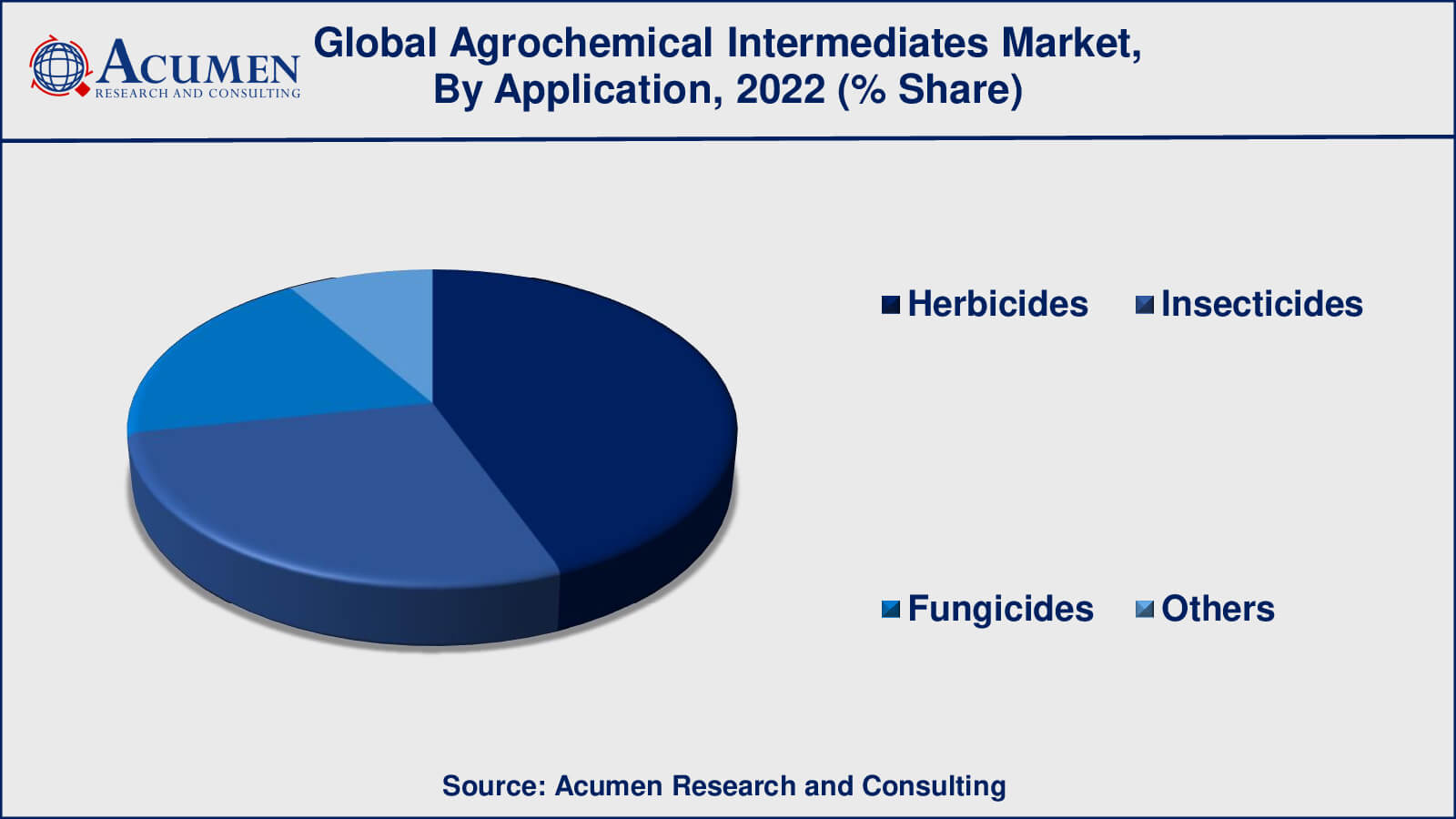

Agrochemical Intermediate Applications

As per the agrochemical intermediates market forecast, herbicides will dominate the agrochemical intermediates market in terms of application due to their high demand for weed control in crops. However, the fungicides and insecticides segments are also important, accounting for a sizable portion of the market.

Because of the growing need for crop protection against insect pests and fungal diseases, the insecticides and fungicides segments are expected to grow faster than the herbicides segment. Furthermore, there is an increasing demand for environmentally friendly and low-impact insecticides and fungicides, which is driving the development of new bio-based agrochemical intermediates in these segments. The "others" segment, which includes molluscicides, rodenticides, and nematicides, is also expected to grow at a moderate rate due to their specific applications in crop protection.

Agrochemical Intermediate Distribution Channels

The use of distributors and wholesalers is common in the agrochemical intermediates market, as they help manufacturers reach a wider customer base and optimize their supply chain. Distributors typically purchase large quantities of agrochemical intermediates directly from manufacturers and then sell them to retailers, wholesalers, and farmers. Wholesalers, on the other hand, purchase and store large quantities of agrochemical intermediates and then sell them to retailers or other end-users in smaller quantities.

Retailers, such as agricultural supply stores and online marketplaces, also play a significant role in the distribution of agrochemical intermediates as they are often the point of contact between end-users and manufacturers. Direct sales, where manufacturers sell agrochemical intermediates directly to farmers, are also common in some regions.

Agrochemical Intermediates Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Agrochemical Intermediates Market Regional Analysis

The Asia-Pacific area is the biggest and fastest-growing market for agrochemical intermediates due to rising population and food demand. The region is also distinguished by a sizable agricultural sector, which drives demand for agrochemical intermediates. Because of their large populations and high agricultural production, China and India are the region's largest markets.

The North American market for agrochemical intermediates is mature and well-established. The region is distinguished by advanced agricultural practices and high per capita agrochemical intermediate consumption. Because of the high demand for agrochemical intermediates in its large agricultural sector, the United States is the region's largest market.

The presence of large-scale agriculture production and advanced farming technologies drives the European market for agrochemical intermediates. The region is also distinguished by stringent regulations governing the use of agrochemical intermediates, which drives the development of environmentally friendly and sustainable products.

Agrochemical Intermediates Market Players

Some of the top agrochemical intermediates companies offered in the professional report include Eastman Chemical Company, RohnerChem, Arkema, DPx Fine Chemicals Austria GmbH & Co KG, Kuraray Co., Ltd, Sugai Chemical Industry Co., Ltd, BASF SE, Evonik Industries, Air Water Inc., Astec LifeSciences Ltd., WeylChem Group, Mitsubishi Corporation and Sudarshan Chemical Industries Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

July 2023

August 2018

April 2025

April 2020