October 2024

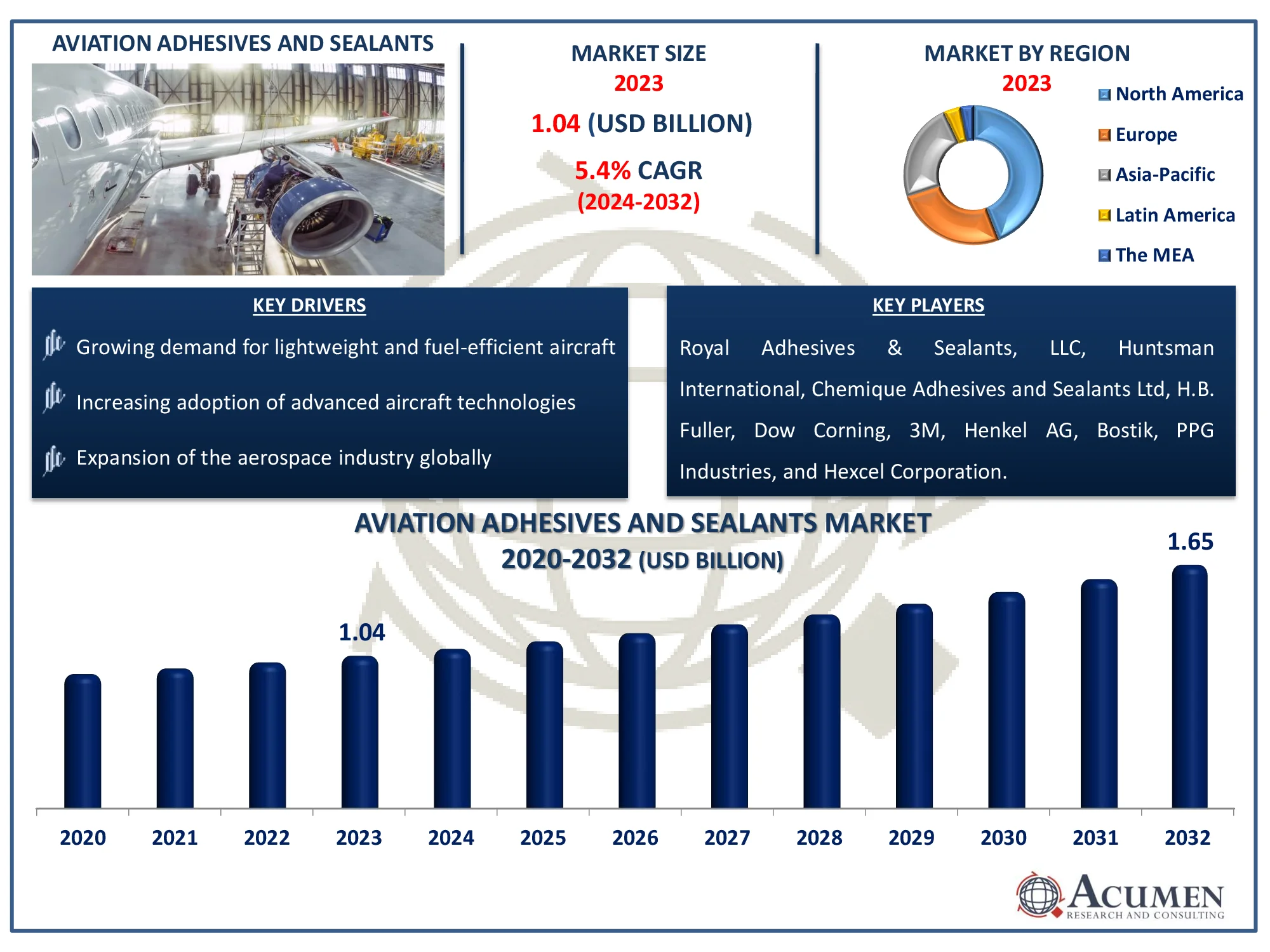

The Global Aviation Adhesives and Sealants Market Size accounted for USD 1.04 Billion in 2023 and is estimated to achieve a market size of USD 1.65 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

The Global Aviation Adhesives and Sealants Market Size accounted for USD 1.04 Billion in 2023 and is estimated to achieve a market size of USD 1.65 Billion by 2032 growing at a CAGR of 5.4% from 2024 to 2032.

Adhesives, often known as glues, are substances that form a strong bind between two surfaces and securely hold it. Sealants, on the other hand, serve as fillers for gaps or joints in materials, limiting fluid passage. The aviation sector is experiencing an increase in demand for high-performance adhesives and sealants, which are commonly utilized in composite materials for both interior and exterior applications.

According to the American Coating Association, adhesives and sealants used in construction, transportation, industrial, electronic, consumer, and a variety of other applications are innovative materials based on cutting-edge synthetic polymer technologies. They've existed for thousands of years. Manufacturers in the aerospace industry are increasingly focusing on epoxies and polyurethane technology, particularly in weight-saving designs, as graphite composites continue to replace aluminum components. The transition from aluminum to graphite composites raises the demand for high-performance adhesives, fueling innovation and industry expansion.

|

Market |

Aviation Adhesives and Sealants Market |

|

Aviation Adhesives and Sealants Market Size 2023 |

USD 1.04 Billion |

|

Aviation Adhesives and Sealants Market Forecast 2032 |

USD 1.65 Billion |

|

Aviation Adhesives and Sealants Market CAGR During 2024 - 2032 |

5.4% |

|

Aviation Adhesives and Sealants Market Analysis Period |

2020 - 2032 |

|

Aviation Adhesives and Sealants Market Base Year |

2023 |

|

Aviation Adhesives and Sealants Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Technology, By Resin, By Product, By End-User, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Royal Adhesives & Sealants, LLC, Huntsman International, Chemique Adhesives and Sealants Ltd, H.B. Fuller, Dow Corning, 3M, Henkel AG, Bostik, PPG Industries, and Hexcel Corporation. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

These materials are highly prized in aerospace because to their qualities like as creep resistance, tensile strength, durability, elasticity, and weather resistance. The boom in aircraft construction to meet expanding air travel demand, combined with falling jet fuel prices, is driving the increasing demand for aviation adhesives and sealants in general, commercial, and military applications. According to the India Brand Equity Foundation (IBEF), the Union Budget 2024-25 includes incentives to encourage MRO activities in aviation, such as extending export and re-import periods for repairs and establishing a 5% standard IGST on aircraft parts. Furthermore, India will require more than 2200 aircraft by 2042.

Furthermore, advances in research and development, together with numerous government incentive programs, are likely to improve aircraft production, moving the market forward. The global expansion of the aircraft sector is driving the growth of the aviation adhesives and sealants market. According to the Aerospace Industries Association, the US aerospace and military industry will generate over $955 billion in sales in 2023, up 7.1 percent over the previous year.

The development of eco-friendly, high-performance adhesives presents an opportunity for the aircraft adhesives and sealants business. According to Phys.org, a team of bioengineers at the University of California, Berkeley, has developed a novel sustainable adhesive polymer, which will help progress the development of environmentally friendly, high-performing adhesives. This innovation is projected to boost growth in the aircraft adhesives and sealants market, as the sector embraces more sustainable and efficient bonding technologies.

Aviation Adhesives and Sealants Market Segmentation

Aviation Adhesives and Sealants Market SegmentationThe worldwide market for aviation adhesives and sealants is split based on technology, resin, product, end-user, and geography.

According to the aviation adhesives and sealants industry analysis, solvent-based adhesives are gaining popularity because of their high bonding strength, endurance, and resilience to harsh temperatures and chemicals, making them excellent for aerospace applications. These adhesives provide excellent adherence to metals and composites, assuring structural integrity in aircraft manufacture and maintenance. Water-based adhesives, while environmentally friendly and low in VOC emissions, are largely employed in interior aircraft applications due to their poorer resistance to extreme environmental conditions as compared to solvent-based alternatives.

According to the aviation adhesives and sealants industry analysis, epoxy resin dominates owing of its great strength, durability, and resilience to extreme environmental conditions such as temperature changes, moisture, and chemicals. This makes it an excellent alternative for bonding crucial components such as aircraft frames, fuselages, and engines, where dependability and performance are essential. Furthermore, epoxy-based adhesives have great shear and tensile strength, ensuring that parts remain securely bonded despite the enormous forces encountered during flight. Epoxy resins are gaining popularity as sophisticated composites become more common in modern airplanes.

According to the aviation adhesives and sealants industry forecast, adhesives serve a significant function in bonding aircraft components such as wings, fuselage, and engines, assuring structural integrity and durability. The increasing demand for lightweight, high-performance materials in aircraft design drives up the use of adhesives, particularly those with high bonding strength and tolerance to harsh environments. As aviation technology advances, the demand for better adhesive formulations to support new materials, such as composites, increases. Sealants, while important for preserving aerodynamic efficiency and preventing leaks, are more specialized for sealing joints and gaps in aircraft.

According to the aviation adhesives and sealants market forecast, commercial aviation sector is dominant due to the significant need for aircraft manufacture, maintenance, and repair. As commercial airlines grow their fleets and renovate existing aircraft, high-performance adhesives and sealants become increasingly important in assuring safety, longevity, and fuel efficiency. Furthermore, commercial aviation necessitates modern materials that can survive extreme circumstances, resulting in greater use of specialist adhesives for components like as engines, wings, and fuselages.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

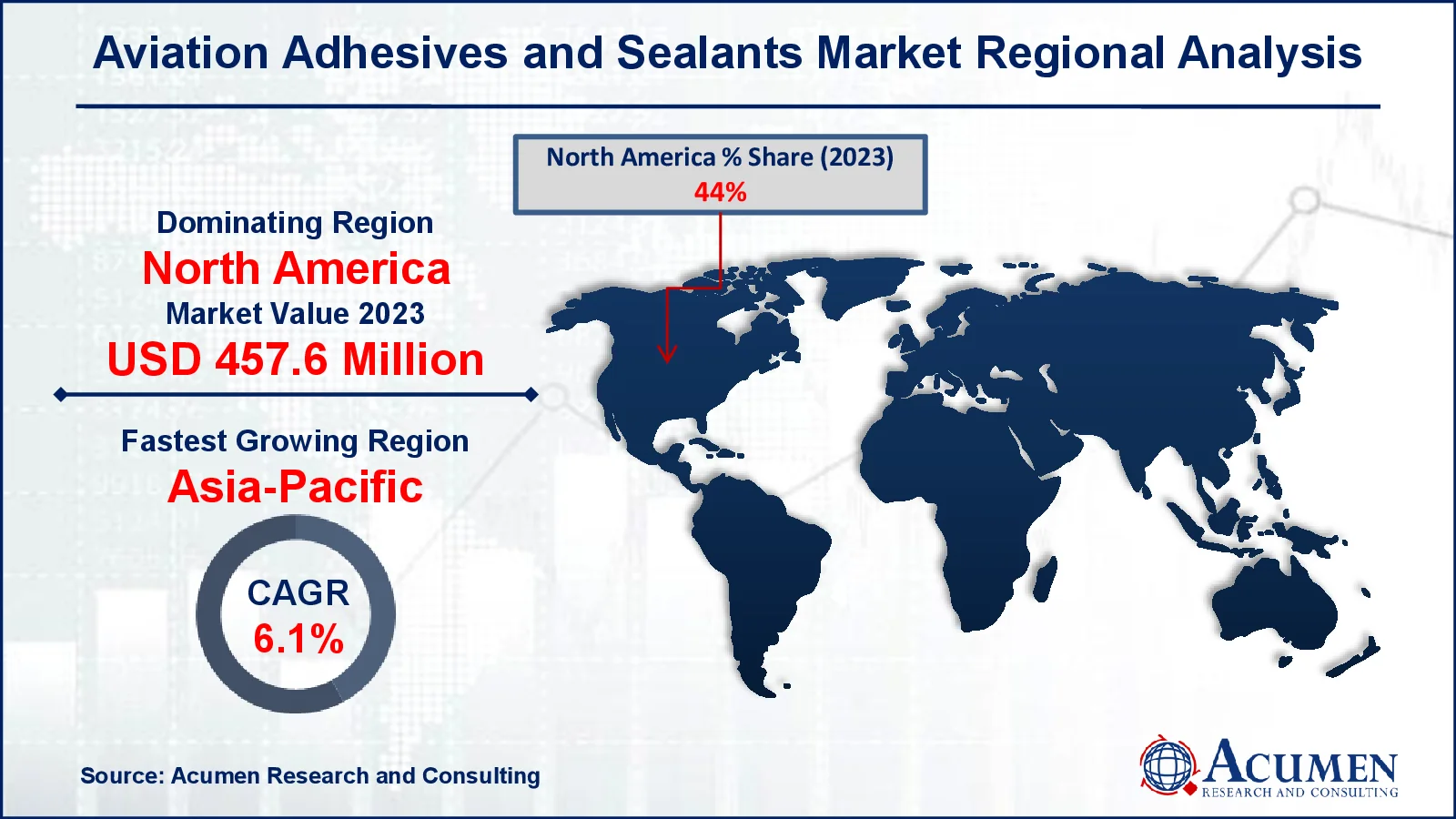

Aviation Adhesives and Sealants Market Regional Analysis

Aviation Adhesives and Sealants Market Regional AnalysisFor several reasons, North America leads the aviation adhesives and sealants market due to its strong aerospace sector presence, which includes major manufacturers like as Boeing and essential MRO (maintenance, repair, and overhaul) service providers. For example, the International Trade Administration reports that Canada continues to be one of the world's top aerospace markets, ranking first in civil flight simulator manufacturing, third in civil engine production, and fourth in civil aircraft production. In 2022, Canada was the only country to rank in the top five for civil flight simulator, engine, and aircraft sub-segments. Canada's aerospace industry generated about C$27 billion (roughly US$20.8 billion) in GDP and nearly 212,000 employments to the Canadian economy, up 14,400 from the previous year. Approximately 88% of Canada's aerospace sector is civil, with 12% being defense-oriented. Montréal is the world's third-largest aerospace hub, after Seattle, Washington, and Toulouse, France, accounting for more than 75% of Canadian aerospace research and development. Furthermore, North America's emphasis on environmentally friendly technology and regulatory criteria for aircraft manufacturing strengthens the market.

In contrast, the Asia-Pacific area is quickly expanding, driven by greater air travel, rising disposable incomes, and the construction of aviation infrastructure in China and India. According to the International Trade Administration, the Civil Aviation Administration of China (CAAC) records show that China will have 248 transport airports by the end of 2021, with seven new airports in operation—Jinzhou Airport in Hubei, Jiujiang Airport in Jiangxi, Heze Airport in Shandong, Wuhu Airport in Anhui, Chengdu Tianfu Airport in Sichuan, Binzhou Airport in Hunan, and Shaoguan Airport in Guangdong. This increase in the number of airports in China may drive up demand for aviation adhesives and sealants, which are essential for aircraft maintenance and construction. In addition, the region's increasing aircraft manufacturing capabilities contributing to the rise of the aviation adhesives market.

Some of the top aviation adhesives and sealants companies offered in our report include Royal Adhesives & Sealants, LLC, Huntsman International, Chemique Adhesives and Sealants Ltd, H.B. Fuller, Dow Corning, 3M, Henkel AG, Bostik, PPG Industries, and Hexcel Corporation.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

October 2024

March 2023

September 2023

August 2020