February 2025

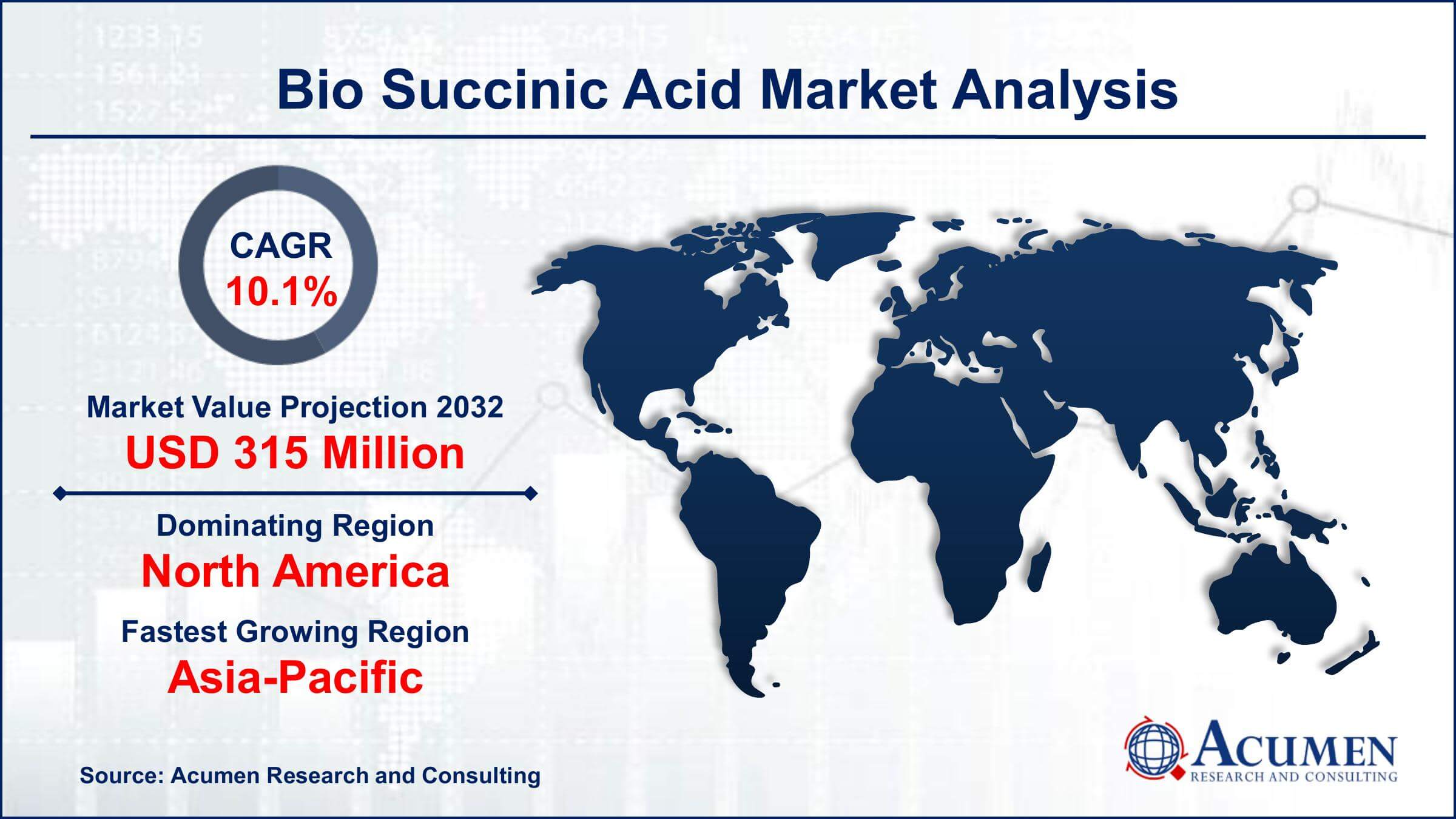

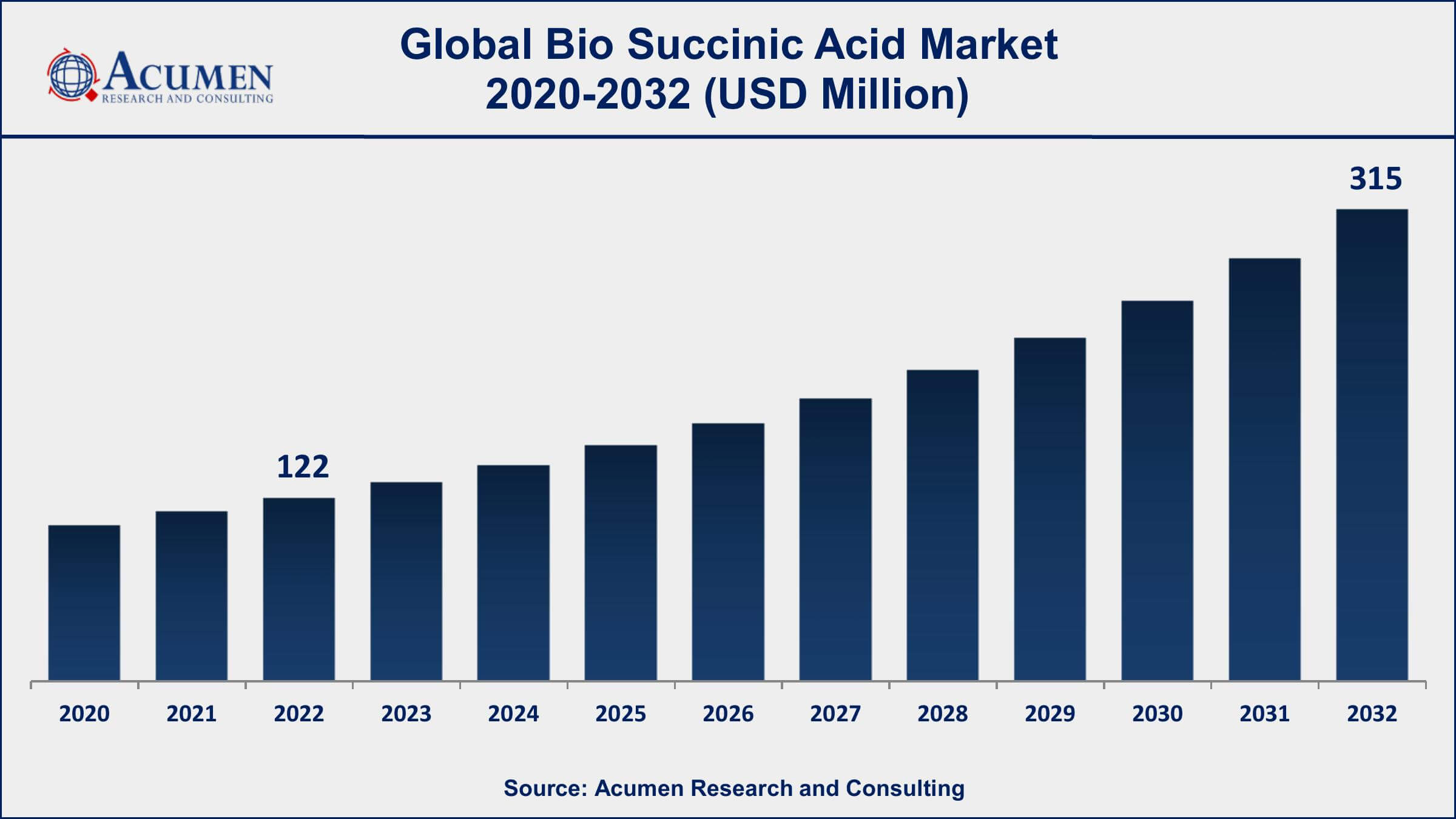

Bio Succinic Acid Market Size accounted for USD 122 Million in 2022 and is projected to achieve a market size of USD 315 Million by 2032 growing at a CAGR of 10.1% from 2023 to 2032.

The Global Bio Succinic Acid Market Size accounted for USD 122 Million in 2022 and is projected to achieve a market size of USD 315 Million by 2032 growing at a CAGR of 10.1% from 2023 to 2032.

Bio Succinic Acid Market Highlights

Bio succinic acid, also known as biobased succinic acid, is a naturally occurring organic acid that can be produced through fermentation processes using renewable resources such as sugar, starch, or lignocellulosic biomass. It is a key platform chemical with a wide range of applications in various industries, including bioplastics, chemicals, pharmaceuticals, and food. One of its significant advantages is its potential to replace petroleum-based succinic acid, reducing the environmental footprint and dependence on fossil fuels.

The market for bio succinic acid has been experiencing substantial growth in recent years due to increasing awareness of sustainability and environmental concerns. With a shift towards greener and more sustainable alternatives, bio succinic acid has gained traction as a bio-based platform chemical. The demand is driven by its use in the production of biodegradable plastics, resins, and coatings, as well as its applications in the manufacture of pharmaceuticals and chemicals. As industries continue to seek environmentally friendly solutions, the bio succinic acid market is expected to witness further growth, with advancements in biotechnological processes and increasing investment in renewable feedstock sources contributing to its expansion.

Global Bio Succinic Acid Market Trends

Market Drivers

Market Restraints

Market Opportunities

Bio Succinic Acid Market Report Coverage

| Market | Bio Succinic Acid Market |

| Bio Succinic Acid Market Size 2022 | USD 122 Million |

| Bio Succinic Acid Market Forecast 2032 | USD 315 Million |

| Bio Succinic Acid Market CAGR During 2023 - 2032 | 10.1% |

| Bio Succinic Acid Market Analysis Period | 2020 - 2032 |

| Bio Succinic Acid Market Base Year |

2022 |

| Bio Succinic Acid Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Roquette Frères, Myriant Corporation, BioAmber Inc. (Now called LCY Biosciences), BASF SE, Corbion, Succinity GmbH (Now Reverdia), Anqing Hexing Chemical Co., Ltd., Mitsubishi Chemical Corporation, Gadiv Petrochemical Industries Ltd., Kawasaki Kasei Chemicals, Jinan Huaming Biological Technology Co., Ltd., and Mitsui Chemicals. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bio succinic acid, also known as biobased succinic acid, is a renewable and sustainable organic compound produced through biotechnological processes, primarily fermentation, using renewable feedstock sources like sugar, starch, or lignocellulosic biomass. This environmentally friendly alternative to petroleum-based succinic acid offers numerous advantages. It serves as a key platform chemical for various industries due to its versatility and eco-friendly nature.

Bio succinic acid finds applications across a wide range of industries. In the bioplastics sector, it serves as a crucial building block for the production of biodegradable polymers and resins, reducing the environmental impact of plastic products. Additionally, it plays a pivotal role in the chemical industry, where it is used in the synthesis of various chemicals, solvents, and coatings, offering a sustainable alternative to traditional petrochemical-based processes. Furthermore, the pharmaceutical industry utilizes bio succinic acid in the production of drugs, excipients, and intermediates.

The bio succinic acid market has been experiencing significant growth over the past few years and is poised for continued expansion in the coming years. One of the primary drivers of this growth is the increasing global emphasis on sustainability and the need for eco-friendly alternatives to petroleum-based chemicals. Bio succinic acid, being derived from renewable feedstocks through fermentation processes, aligns well with these sustainability goals. As a result, industries such as bioplastics, chemicals, and pharmaceuticals are increasingly incorporating bio succinic acid into their production processes to reduce their carbon footprint and environmental impact.

The market's growth is also fueled by regulatory initiatives aimed at reducing greenhouse gas emissions and promoting the use of bio-based chemicals. Governments in various regions are implementing policies that incentivize the adoption of renewable chemicals like bio succinic acid. Additionally, technological advancements in fermentation processes and the development of cost-effective production methods are making bio succinic acid more competitive with its petroleum-based counterparts.

Bio Succinic Acid Market Segmentation

The global bio succinic acids market segmentation is based on application, end-use, and geography.

Bio Succinic Acid Market By Application

In terms of applications, the 1,4-Butanediol (BDO) segment accounted for the largest market share in 2022. BDO is a valuable chemical compound used as a precursor in the production of various high-demand products such as engineering plastics, polyurethanes, and elastomers. The growth of the BDO segment is closely tied to the expanding market for sustainable and bio-based chemicals, as BDO derived from bio succinic acid offers a greener alternative to its petroleum-based counterpart. One of the key drivers of the BDO segment's growth is the increasing awareness of environmental sustainability. As industries seek to reduce their carbon footprint and dependence on fossil fuels, bio-based BDO produced from bio succinic acid has gained traction as a viable option. Furthermore, stringent environmental regulations and mandates in various regions are pushing companies to adopt eco-friendly alternatives, thereby boosting the demand for bio-based BDO. The versatility of BDO, which finds applications in diverse industries including automotive, textiles, and consumer goods, further contributes to its growth prospects within the bio succinic acid market.

Bio Succinic Acid Market By End-use

According to the bio succinic acid market forecast, the industrial segment is expected to witness significant growth in the coming years. Bio succinic acid, a bio-based platform chemical, has gained significant attention and adoption in various industrial applications. One of the primary drivers of this growth is the increasing emphasis on sustainability and the need for eco-friendly alternatives to petroleum-based chemicals in industrial processes. Bio succinic acid aligns well with these goals as it can be derived from renewable resources and offers a more environmentally friendly option. The industrial segment encompasses a wide range of applications, including the production of chemicals, plastics, coatings, and more. Bio succinic acid serves as a valuable feedstock for the manufacture of various industrial chemicals and materials, particularly those used in the production of biodegradable plastics and resins. With the growing demand for sustainable and biodegradable products across industries, the use of bio succinic acid has gained momentum. Additionally, the ongoing development of new and innovative applications for bio succinic acid in industrial processes, such as in the production of bio-based solvents and specialty chemicals, is further fueling its growth within this segment.

Bio Succinic Acid Market Regional Outlook

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

Bio Succinic Acid Market Regional Analysis

Geographically, North America has emerged as a dominant region in the bio succinic acid market for several key reasons. First and foremost, North America is home to a robust bio-based chemicals industry with a strong focus on sustainability and environmental responsibility. The region has a well-established infrastructure for the production and utilization of bio succinic acid, driven by the increasing demand for eco-friendly alternatives to petroleum-based chemicals. The United States and Canada, in particular, have witnessed significant investments in biotechnology and renewable feedstock sources, positioning them as leaders in the production of bio succinic acid. Furthermore, North America benefits from a supportive regulatory environment and government incentives that encourage the adoption of bio-based chemicals. Federal and state-level policies promote the use of renewable resources and sustainable practices, providing a favorable ecosystem for the growth of the bio succinic acid market. In addition, the region's strong emphasis on research and development has led to technological advancements in the production of bio succinic acid, making it more cost-effective and competitive with traditional, petroleum-derived succinic acid.

Bio Succinic Acid Market Player

Some of the top bio succinic acid market companies offered in the professional report include Roquette Frères, Myriant Corporation, BioAmber Inc. (Now called LCY Biosciences), BASF SE, Corbion, Succinity GmbH (Now Reverdia), Anqing Hexing Chemical Co., Ltd., Mitsubishi Chemical Corporation, Gadiv Petrochemical Industries Ltd., Kawasaki Kasei Chemicals, Jinan Huaming Biological Technology Co., Ltd., and Mitsui Chemicals.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

February 2025

July 2024

October 2024

June 2024