November 2020

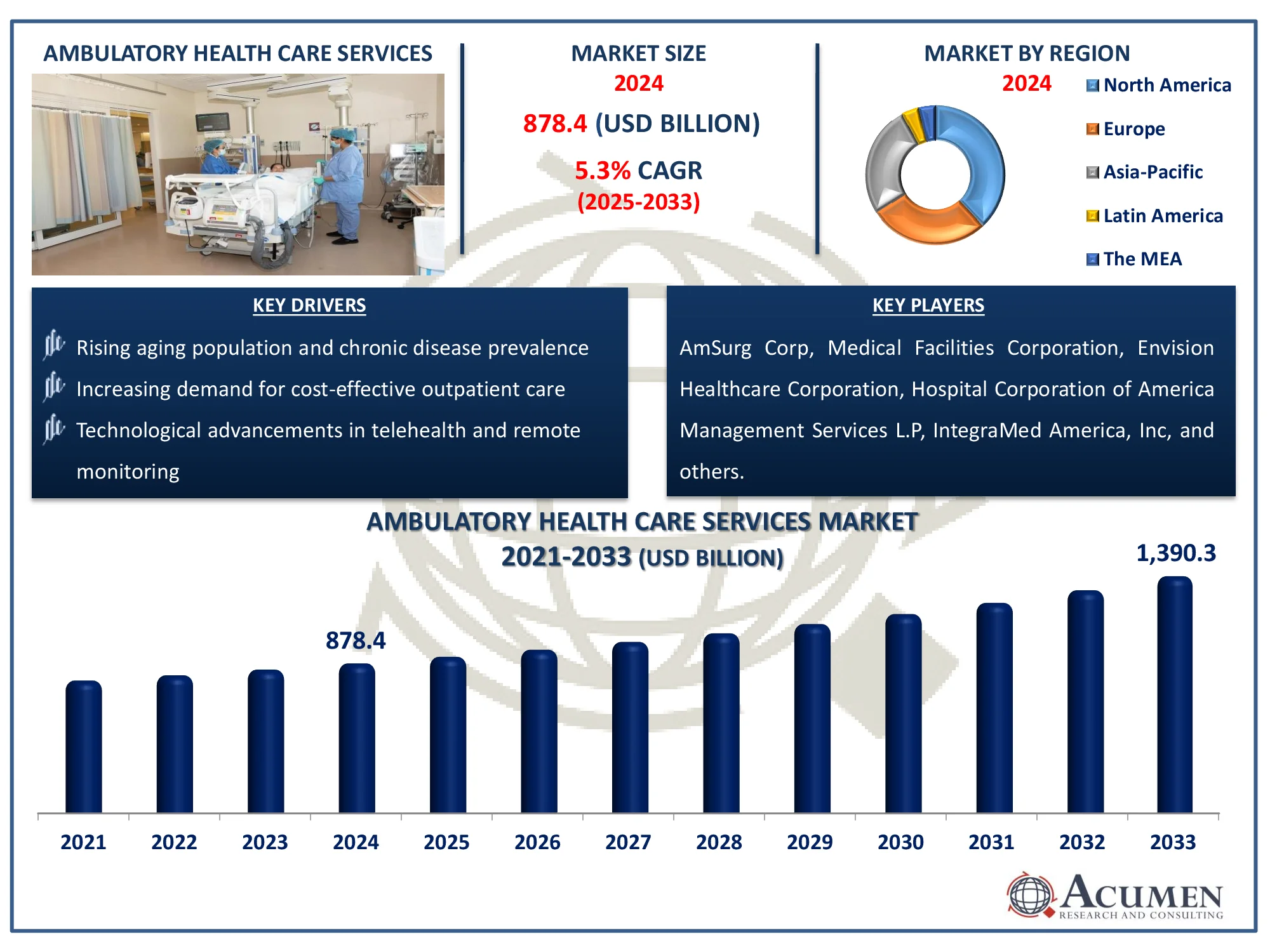

The Global Ambulatory Health Care Services Market Size accounted for USD 878.4 Billion in 2024 and is estimated to achieve a market size of USD 1,390.3 Billion by 2033 growing at a CAGR of 5.3% from 2025 to 2033.

The Global Ambulatory Health Care Services Market Size accounted for USD 878.4 Billion in 2024 and is estimated to achieve a market size of USD 1,390.3 Billion by 2033 growing at a CAGR of 5.3% from 2025 to 2033.

Ambulatory service centers (ASCs), also known as ambulatory care centers, are medical institutions that offer a variety of outpatient services, such as consultations, diagnostics, treatments, and interventions. They provide a convenient alternative to hospital-based outpatient operations. ASCs provide services in a variety of specialties, including ophthalmology, orthopedics, gastroenterology, plastic surgery, pain management, and gynecology. Physicians have played an important role in designing ASCs to improve patient care, quality, and cost effectiveness. The first ASC was created in the United States in 1970. As healthcare institutions faced increased workloads, hospitals faced issues such as limited operating room availability, scheduling delays, and financial limits that limited access to new medical technology. These factors contributed to the increase of ASCs.

|

Market |

Ambulatory Health Care Services Market |

|

Ambulatory Health Care Services Market Size 2024 |

USD 878.4 Billion |

|

Ambulatory Health Care Services Market Forecast 2033 |

USD 1,390.3 Billion |

|

Ambulatory Health Care Services Market CAGR During 2025 - 2033 |

5.3% |

|

Ambulatory Health Care Services Market Analysis Period |

2021 - 2033 |

|

Ambulatory Health Care Services Market Base Year |

2024 |

|

Ambulatory Health Care Services Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

AmSurg Corp, Medical Facilities Corporation, Envision Healthcare Corporation, Hospital Corporation of America Management Services L.P, IntegraMed America, Inc, Healthway medical group, Symbion Pty Ltd, DaVita Inc., and Aspen Healthcare. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Ambulatory care centers provide a more cost-effective alternative to hospital-based care by removing the requirement for hospital stays. This has resulted in increased patient preference, which is projected to fuel market expansion during the forecast period. Furthermore, the availability of finance for ambulatory healthcare facilities, together with supportive government measures, is expected to drive the market forward. For example, the Agency for Healthcare Research and Quality (AHRQ) prioritized ambulatory care by investing in research to address diagnostic errors, promoting patient safety and quality improvement, and funding primary care research through initiatives such as the National Center for Excellence in Primary Care Research (NCEPCR).

Technological improvements in minimally invasive operations, together with rising awareness of their advantages such as shorter hospital stays and lower healthcare costs, are projected to drive market growth. For example, advances in endoscopy and laparoscopy have considerably reduced the requirement for extended hospital stays. Furthermore, in December 2022, Abbott announced the launch of its next-generation transcatheter aortic valve implantation (TAVI) system, Navitor, making a minimally invasive device available to people in India with severe aortic stenosis that are at high or extreme surgical risk. Overall, these technological breakthroughs in minimally invasive operations thrives growth of ambulatory healthcare services in industry.

Governments around the world are boosting spending in basic healthcare institutions to improve access to medical care and relieve hospital overcrowding. For example, the World Health Organization (WHO) released the 2023 global health expenditure report, which gives new information on the trajectory of global health spending during the COVID-19 pandemic. Released ahead of Universal Health Coverage (UHC) Day, the report predicts that global health spending would hit a new high of $9.8 trillion in 2021, accounting for 10.3% of global GDP. Furthermore, various business tactics used by key industry players and investment companies, including as mergers and acquisitions, global expansion, and new product launches, are projected to contribute to market growth in the future.

Ambulatory Health Care Services Market Segmentation

Ambulatory Health Care Services Market SegmentationThe worldwide market for ambulatory health care services is split based on type, application, and geography.

According to ambulatory health care services industry analysis, the ambulatory healthcare services industry is divided into four segments: primary care offices, medical specialties, emergency departments, and surgical specialists. Primary care offices had the biggest market share in 2024, owing to strong global demand for services, technological improvements, ease of diagnosis and treatment, and cheaper costs when compared to other healthcare settings. However, the surgical specialty market is predicted to increase significantly during the projection period, driven by technology advancements and an increasing desire for minimally invasive operations.

According to ambulatory health care services market forecast, ambulatory care centers are classified according to their application: orthopedics, ophthalmology, gastroenterology, plastic surgery, pain treatment (including spinal injections), and others. Plastic surgery is expected to expand the quickest during the projection period, spurred by increased awareness of surgical safety and advances in minimally invasive techniques. Meanwhile, the gastroenterology category dominated the ambulatory healthcare services market in 2024, owing to the large number of surgical procedures conducted worldwide.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

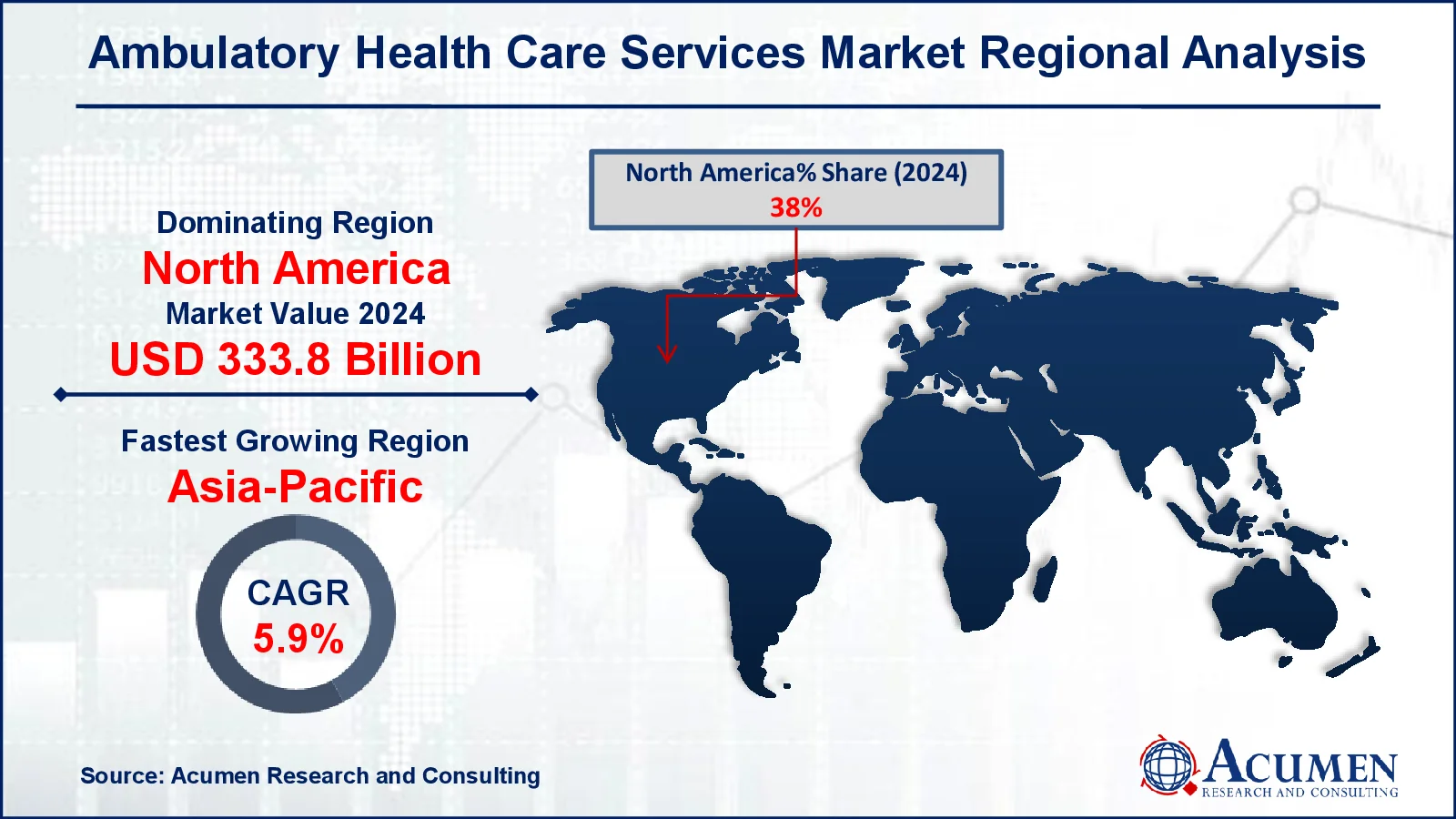

Ambulatory Health Care Services Market Regional Analysis

Ambulatory Health Care Services Market Regional AnalysisIn terms of regional segments, North America led the global ambulatory healthcare services market in 2024 and is predicted to remain dominant throughout the forecast period. This can be attributable to the large number of well-equipped ambulatory centers, attractive payment regulations for numerous operations, and an increasing patient preference for ambulatory facilities due to their advantages over hospitals. Additionally, government efforts and mergers and acquisitions in the ambulatory sector are propelling market expansion. For example, in January 2024, the Indian Health Service (IHS) of the United States Department of Health and Human Services awarded USD 55 million in financing. This grant was provided to 15 tribes and tribal organizations. It is part of the Small Ambulatory Program, a competitive program aimed at assisting with the establishment, expansion, or modernization of small ambulatory health care facilities. This investment promotes the expansion of the ambulatory health care services sector in North America by improving tribal health infrastructure, which may increase demand for associated services.

Meanwhile, the Asia-Pacific area is expected to enjoy the most rapid growth during the forecast period. This rise is fueled by increasing awareness of ambulatory centers, rapid technological adoption, and rising in-hospital readmissions, which encourage the expansion of outpatient care facilities.

Some of the top ambulatory health care services companies offered in our report include AmSurg Corp, Medical Facilities Corporation, Envision Healthcare Corporation, Hospital Corporation of America Management Services L.P, IntegraMed America, Inc, Healthway medical group, Symbion Pty Ltd, DaVita Inc., and Aspen Healthcare.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

November 2020

February 2023

February 2023

June 2024