March 2023

API Contract Manufacturing Market (By Type: Inorganic, Organic, Others; By Form: Solid, Semi-solids, Liquid, Others; By End-Users: Pharmaceutical Industries, Research Organization, Others; By Distribution Channel: Retailers, Direct Tender, Others) - Global Industry Size, Share, Analysis, Trends and Forecast 2023 - 2035

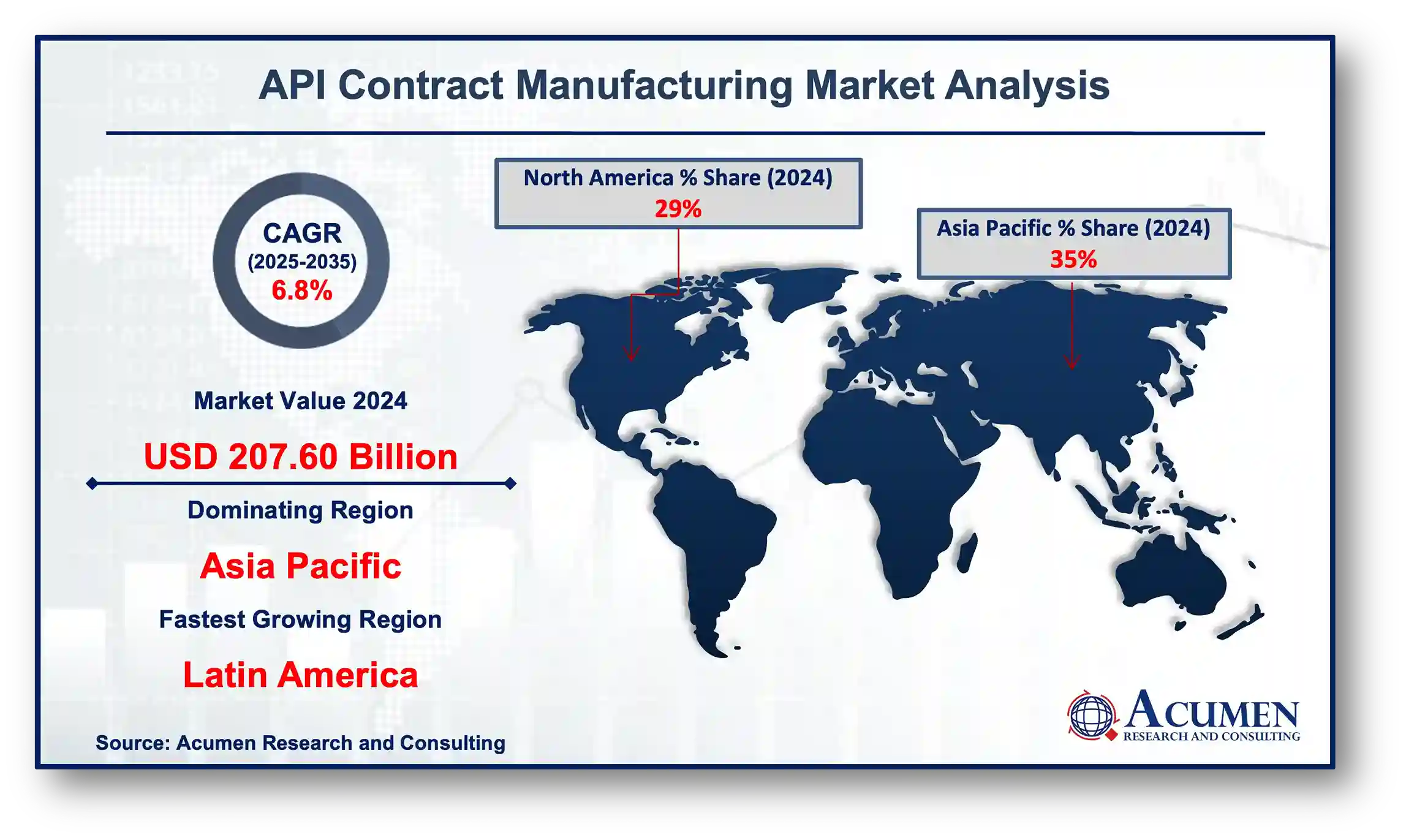

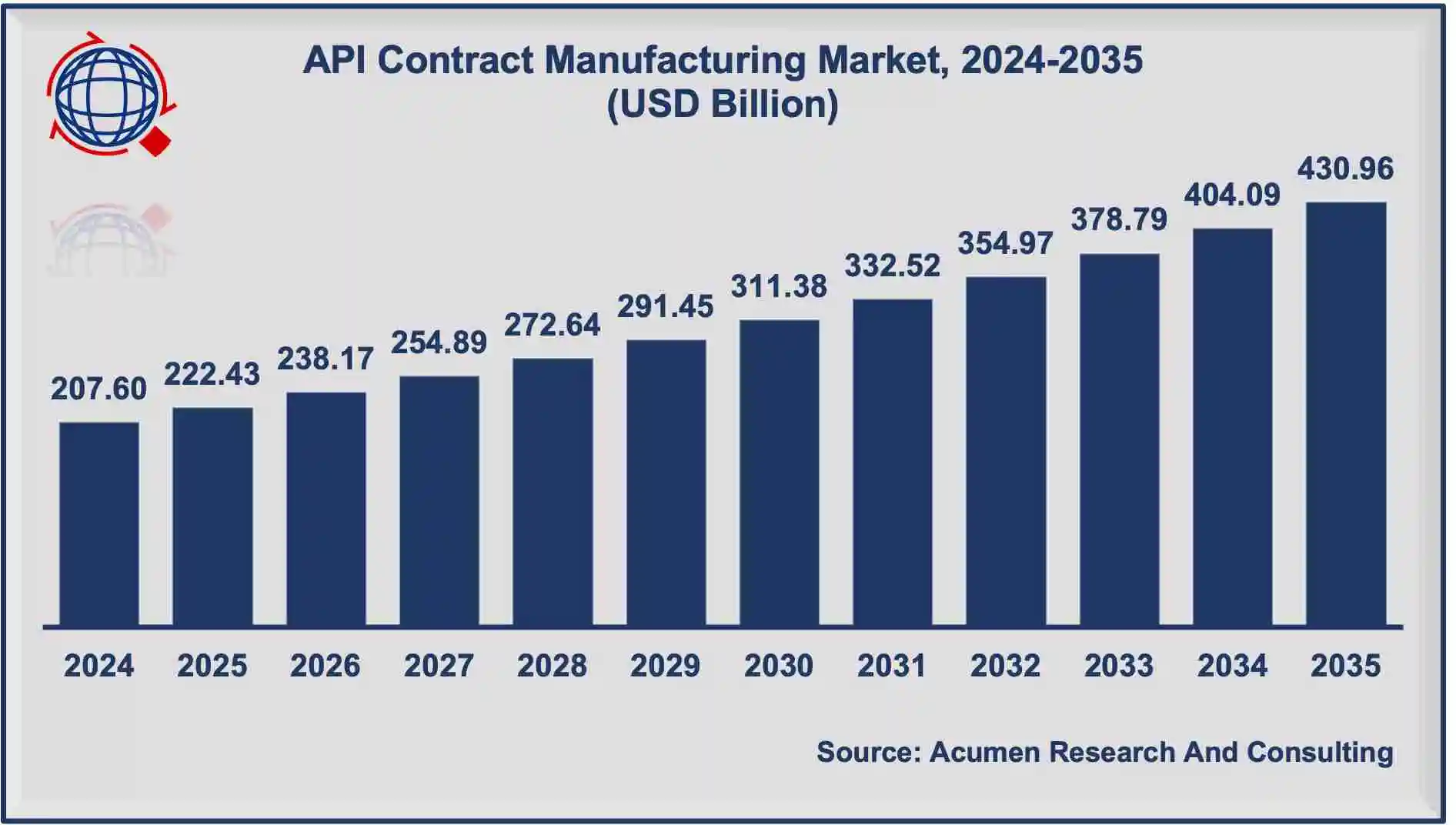

The global API contract manufacturing market size accounted for USD 207.60 billion in 2024 and is estimated to achieve a market size of USD 430.96 billion by 2035 growing at a CAGR of 6.8% from 2025 to 2035. Growing generics demand, increasing pharmaceutical R&D expenditures, and contract manufacturing & research projects capital in sophisticated manufacturing systems are propelling the worldwide API contract manufacturing market value. Furthermore, the patent expiration of certain pharmaceuticals is a crucial driver driving the API contract manufacturing market growth.

Contract manufacturing is the method by which a manufacturer enters into an arrangement with a company to manufacture a component or a product. The production of pharmaceutical medications through contract manufacturing through outsourcing to other companies is referred to as active pharmaceutical ingredient (API) contract manufacturing. The market for API contract manufacturing is predicted to grow in the next years due to the availability of trained personnel at low cost, favorable government policies, and tax breaks.

| Market | API Contract Manufacturing Market |

| API Contract Manufacturing Market Size 2024 |

USD 207.60 Billion |

| API Contract Manufacturing Market Forecast 2035 |

USD 430.96 Billion |

| API Contract Manufacturing Market CAGR During 2025 - 2035 |

6.8% |

| API Contract Manufacturing Market Analysis Period |

2023 - 2035 |

| API Contract Manufacturing Market Base Year |

2024 |

| API Contract Manufacturing Market Forecast Data |

2025 - 2035 |

| Segments Covered | By Type, By Form, By End-Users, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ranbaxy Laboratories Ltd., Piramal Pharma Solutions, Teva Pharmaceuticals Industries Ltd, Novartis AG, Boehringer Ingelhein GmbH, Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Sandoz-Lek-Biochemie, AstraZeneca Plc, and GlaxoSmithKline Pharmaceuticals Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Technological improvement in the manufacture of API, which is very efficient in fulfilling regulatory criteria, as well as a strong demand for innovative bio-generic pharmaceuticals, drives the market growth. Furthermore, rising demands for low-cost therapies in emerging nations, as well as a growth in the authorization of novel pharmaceuticals for chronic disease treatment provide opportunities for market expansion. However, the lengthy production process and tight laws and regulations regarding equipment and facilities needed for sterile small-molecule pharmaceuticals may stymie the worldwide API contract manufacturing industry.

|

API Contract Manufacturing Market Share Insights 2024 (% Share) |

||||

|

Market By Type |

Market By Form |

Market By End User |

Market By Distribution Channel |

Market By Geography |

|

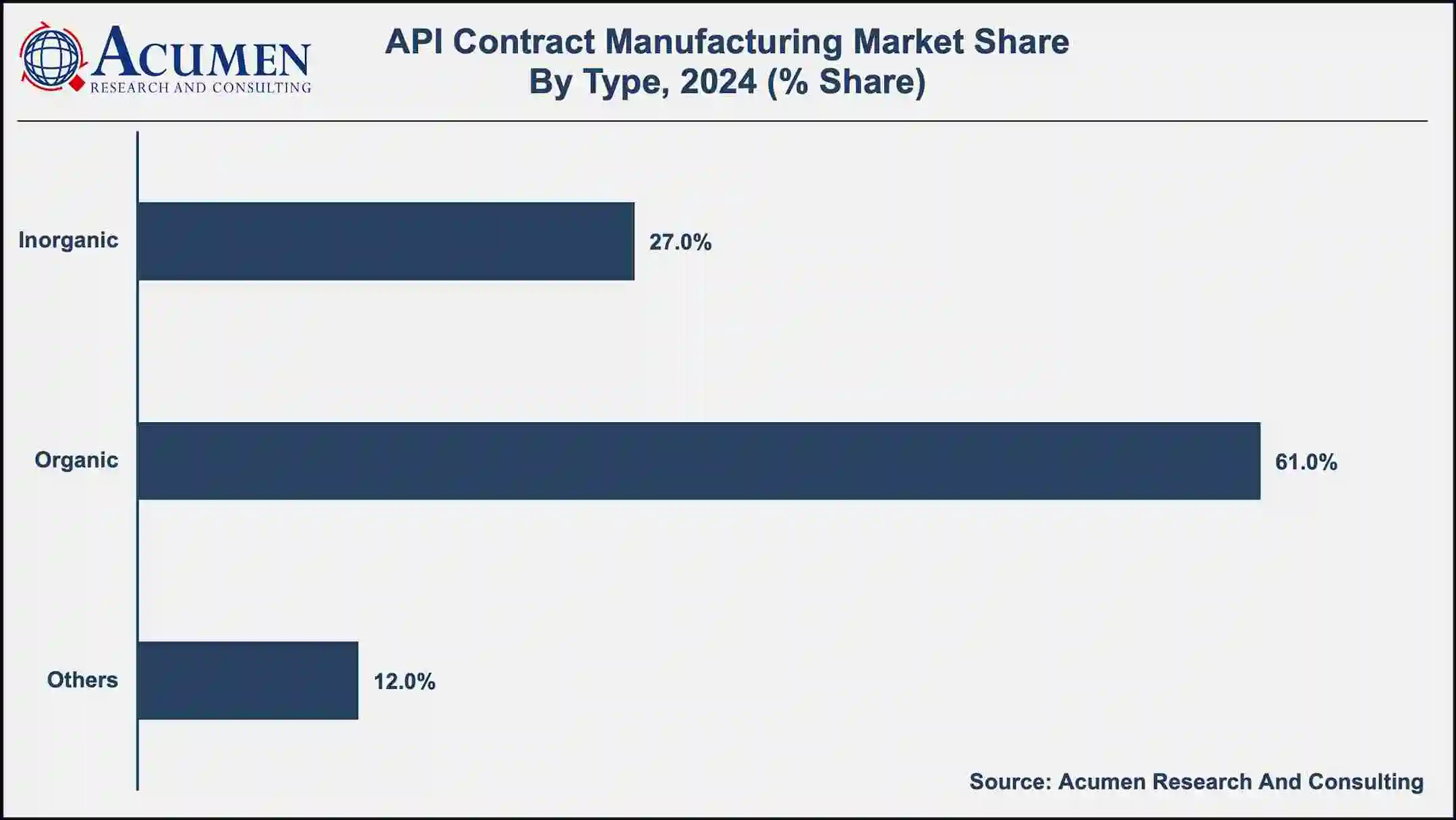

Inorganic: 27% |

Solid: 38% |

Pharmaceutical Industries: 66% |

Retailers: 35% |

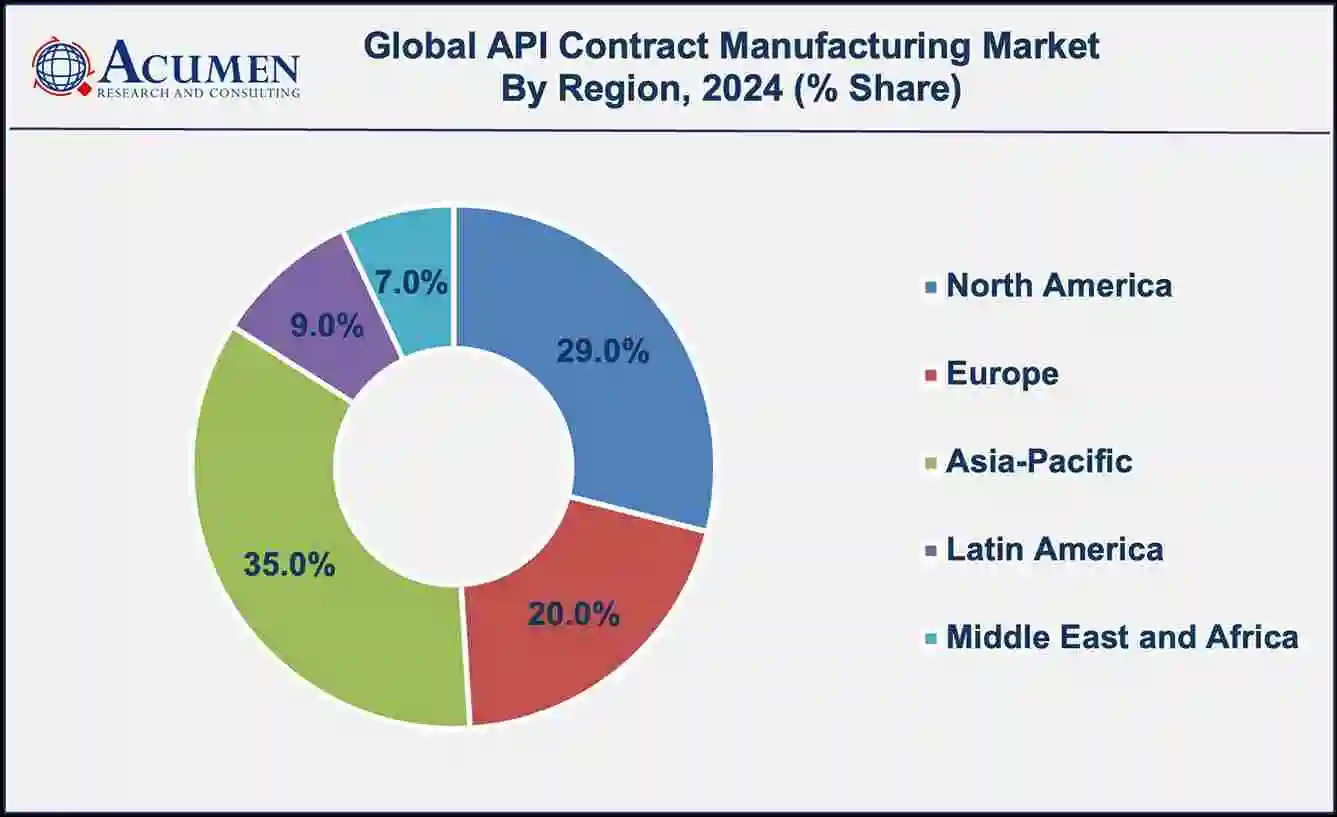

North America: 29% |

|

Organic: 61% |

Semi-solids: 26% |

Research Organization: 15% |

Direct Tender: 50% |

Europe: 20% |

|

Others: 12% |

Liquid: 24% |

Others (Miscellaneous end-users: biotech firms, universities, contract firms, etc.): 19% |

Others (wholesalers, distributors, third-party agencies): 15% |

Asia-Pacific: 35% |

|

|

Others: 12% |

|

Latin America: 9% |

|

|

|

|

|

|

Middle East and Africa: 7% |

Numerous variables are anticipated to fuel the total growth of the global API Contract Manufacturing Market. The availability of inexpensive labor in emerging nations has emerged as one of the main drivers fueling industry expansion. Reduced economic costs owing to the availability of inexpensive labor in developing Asia countries, better access to innovative technologies available on the market, and increased efficiency in such regions are primary driver’s factors for the expansion of the API contract manufacturing market.

The worldwide API contract manufacturing market segmentation is based on the type, form, end-users, distribution channel, and geography.

According to an API contract manufacturing industry analysis, the organics segment held the majority of shares in the global market in 2024. By limiting exposure to hazardous and persistent chemicals, organic products minimize public health hazards for laborers, their families, as well as consumers.

According to the API contract manufacturing market forecast, the solid segment is projected to expand at a rapid pace in the market over the forecasting years. Depending on the technique or route of administration, there are many different dosage form types in the pharmaceutical industry. Solid dosage forms, semi-solid dosage forms, liquid dosage forms, and gaseous dosage forms are utilized for the evaluation or treatment of the illness by multiple pathways. Solid dosage forms are among the most critical delivery systems in pharmaceuticals; that have 1 or even more unit dosage of a drug. In comparison to other dosage forms, the solid dosage form is the one most frequently utilized and prescribed by physicians.

In terms of end-users, the pharmaceutical companies sector dominated the API contract manufacturing market in 2024. Large pharmaceutical organizations' significant want of end-to-end services, increased competitive pressures and distribution challenges in corporate operations, as well as the increasing need to improve operational costs as popular drug patents expiration can all contribute to the market growth in the coming years.

In terms of distribution channels, the direct tender segment will gain major market attention in the coming years. Tendering is a formal technique for acquiring pharmaceuticals through public tender for a specific contract. Tendering, while effective for cost conservation, can result in less competitiveness in a particular market.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

On the basis of geography, the Asia-Pacific market is evolving and is ranked among the most attractive API contract manufacturing markets. Owing to the high costs of APIs production in Western Countries, India and China have become the most preferred regions for the outsourcing of contract manufacturing. These countries are ranked among the most stable democracies and are gifted with advanced technologies. Also, it has become an experienced market region for outsourcing API contract manufacturing as a large number of international companies are outsourcing API manufacturing to this region. Also, this region possesses large technical manpower and is further developing owing to technological developments, which will further boost the market growth.

Some of the top API contract manufacturing market companies offered in the professional report includes Ranbaxy Laboratories Ltd., Piramal Pharma Solutions, Teva Pharmaceuticals Industries Ltd, Novartis AG, Boehringer Ingelhein GmbH, Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Sandoz-Lek-Biochemie, AstraZeneca Plc, and GlaxoSmithKline Pharmaceuticals Ltd.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2023

May 2023

December 2019

July 2018