March 2025

Active Pharmaceutical Ingredient Market (By Type of Synthesis: Biotech, Synthetic; By Type of Manufacturer: Captive APIs, Merchant APIs; By Type: Innovative APIs, Generic APIs; By Application: Cardiology, Orthopedic, Oncology, Endocrinology, Pulmonology, Gastroenterology, CNS & Neurology, Nephrology, Ophthalmology, Others) - Global Industry, Share, Analysis, Trends and Forecast 2025 - 2035

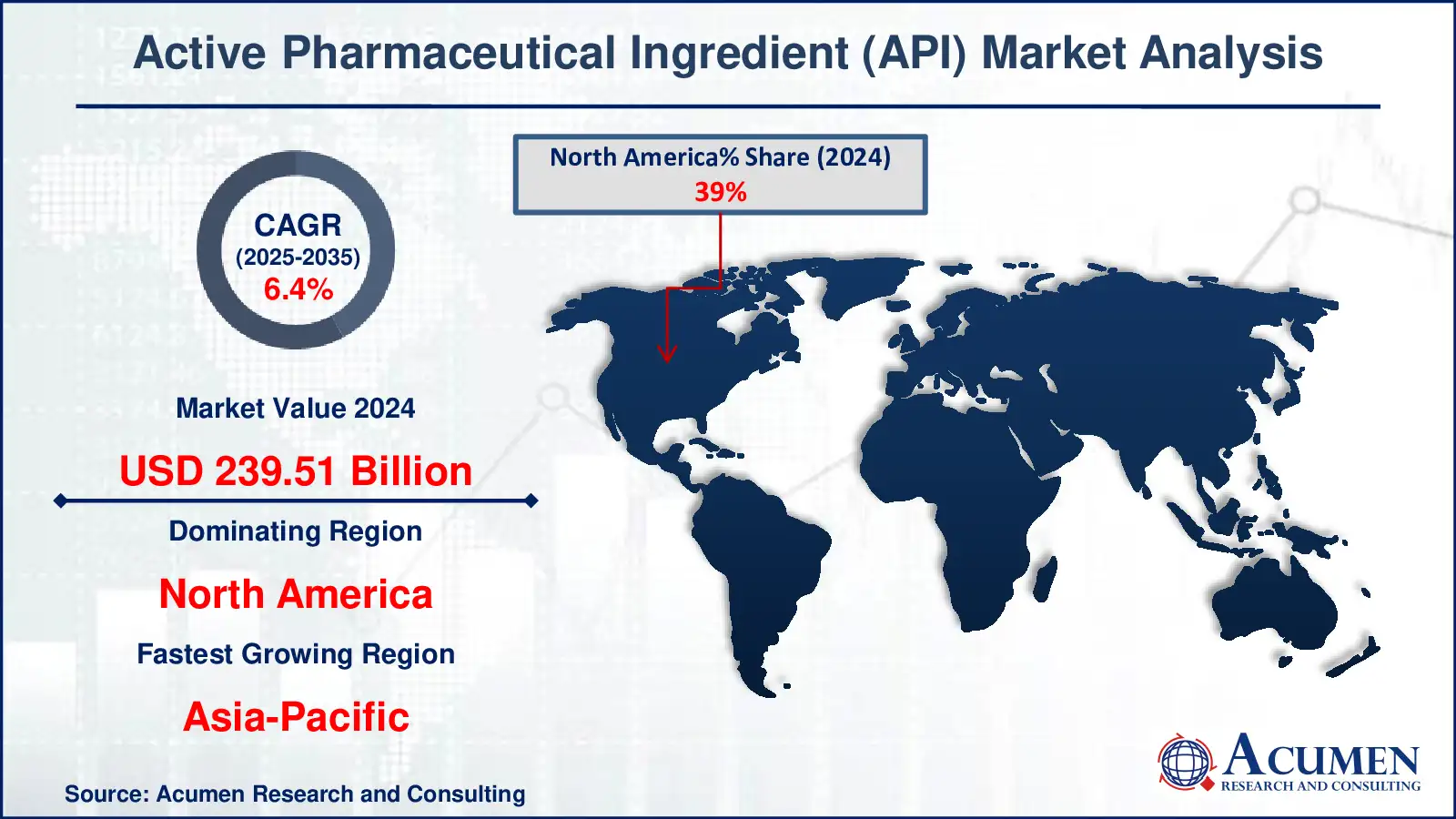

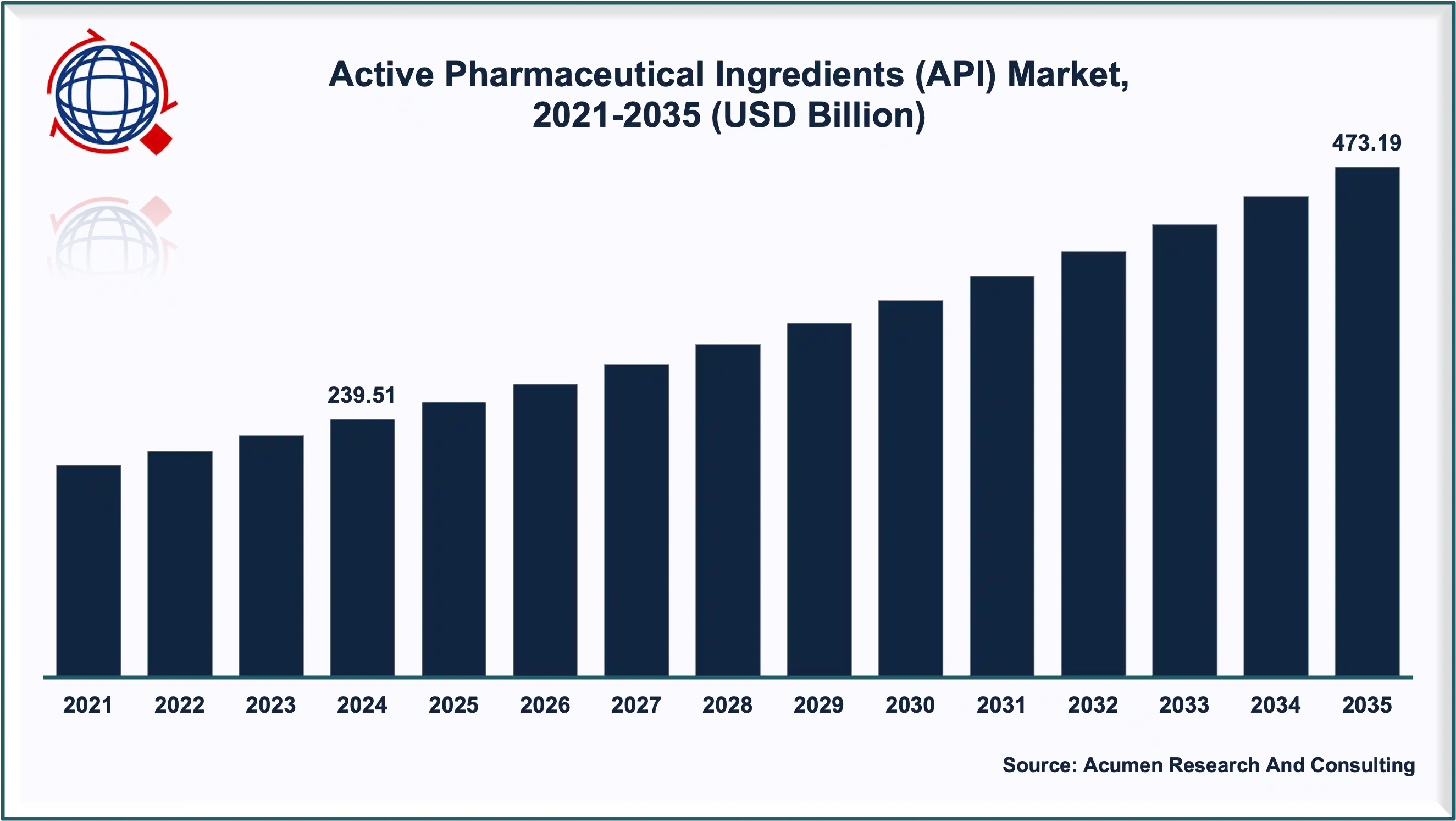

The Active Pharmaceutical Ingredient Market is witnessing a transformative phase driven by rapid advancements in drug formulation, biotechnology, and healthcare innovation. Valued at USD 239.51 Billion in 2024, the market is projected to reach USD 473.19 Billion by 2035, expanding at a CAGR of 6.4% between 2025 and 2035.

Active Pharmaceutical Ingredients (APIs) are the biologically active components in medicines that produce therapeutic effects. From antibiotics to oncology drugs, APIs are the foundation of modern pharmaceuticals. The continuous surge in chronic diseases such as diabetes, cardiovascular disorders, and cancer, combined with the global rise in biologics and biosimilars, is fueling substantial growth in this sector.

Active Pharmaceutical Ingredients are the essential chemical or biological components responsible for the therapeutic effect of a drug. They can be produced through synthetic or biotechnological processes, depending on the nature of the medication.

Many complex drugs, including combination therapies, rely on multiple APIs to treat different symptoms simultaneously. APIs are crucial for therapeutic applications in oncology, cardiology, neurology, endocrinology, pulmonology, nephrology, gastroenterology, orthopedics, and ophthalmology. Their innovation is instrumental in building a sustainable healthcare system by enabling access to effective and high-quality medications.

The global shift toward biological and biosimilar drugs is a major trend driving the Active Pharmaceutical Ingredient Market. Biopharmaceuticals such as monoclonal antibodies, recombinant proteins, and vaccines are increasingly replacing conventional synthetic drugs due to their higher specificity and efficacy.

Advancements in continuous manufacturing, process automation, and green chemistry are improving production efficiency and reducing environmental impact. The integration of AI and digital process analytics is helping pharmaceutical companies maintain stringent quality standards while lowering costs.

Precision medicine and targeted drug delivery systems are revolutionizing treatment protocols, particularly in oncology and rare diseases. APIs used in targeted therapies are designed to interact with specific molecular pathways, ensuring better patient outcomes with minimal side effects.

To gain a competitive edge, major API manufacturers are forming strategic partnerships, mergers, and acquisitions. These collaborations help companies expand their product portfolios, enter emerging markets, and enhance manufacturing capabilities.

|

Market |

Active Pharmaceutical Ingredient Market |

|

API Market Size 2024 |

USD 239.51 Billion |

|

API Market Forecast 2035 |

USD 473.19 Billion |

|

API Market CAGR During 2025 - 2035 |

6.4% |

|

API Market Analysis Period |

2021 - 2035 |

|

API Market Base Year |

2024 |

|

API Market Forecast Data |

2025 - 2035 |

|

Segments Covered |

By Type of Synthesis, By Type of Manufacturer, By Type, By Application, And By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

AbbVie Inc., Merck & Co., Inc., Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd, Cipla, Inc., Albemarle Corporation, Bristol-Myers Squibb Company, Sun Pharmaceutical Industries Ltd., Mylan N.V., Aurobindo Pharma, and Dr. Reddy’s Laboratories Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

APIs are the heart of the global pharmaceutical ecosystem. Over the past decade, the Active Pharmaceutical Ingredient Market has grown rapidly due to increased demand for advanced therapies and rising healthcare accessibility.

The enforcement of Good Manufacturing Practices (GMP) and International Council for Harmonization (ICH) guidelines has significantly elevated quality and safety standards. However, the industry also faces the challenge of balancing cost efficiency with quality assurance. Reducing development time, enhancing process design, and optimizing supply chain operations are key success factors for market players.

Additionally, the increasing number of drugs going off-patent has created new opportunities for generic API production, while innovative R&D efforts continue to support the growth of innovative APIs across multiple therapeutic areas.

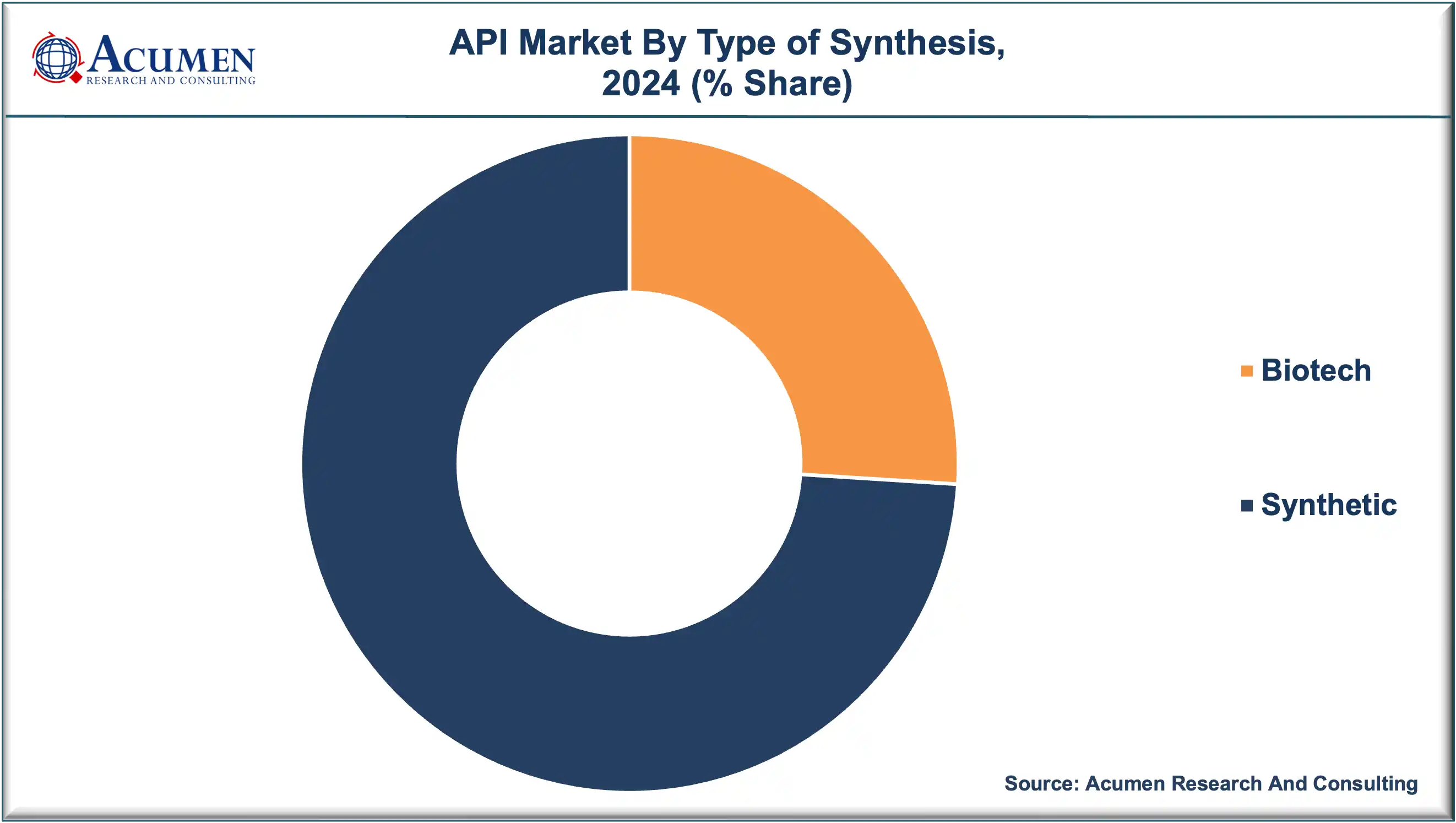

The synthetic API segment dominated the global market in 2024, holding approximately 74% of the total share. This dominance is attributed to the easier availability of raw materials, cost-effective production processes, and technological maturity in chemical synthesis. However, the biotech API segment is projected to register the fastest growth, fueled by the expanding biologics market and the rise of personalized medicine.

The captive API segment is expected to witness significant growth as leading pharmaceutical companies increasingly invest in in-house API manufacturing facilities. This approach allows better control over quality, regulatory compliance, and intellectual property protection. However, the merchant API segment remains crucial, particularly for small and mid-sized pharma firms seeking outsourcing advantages.

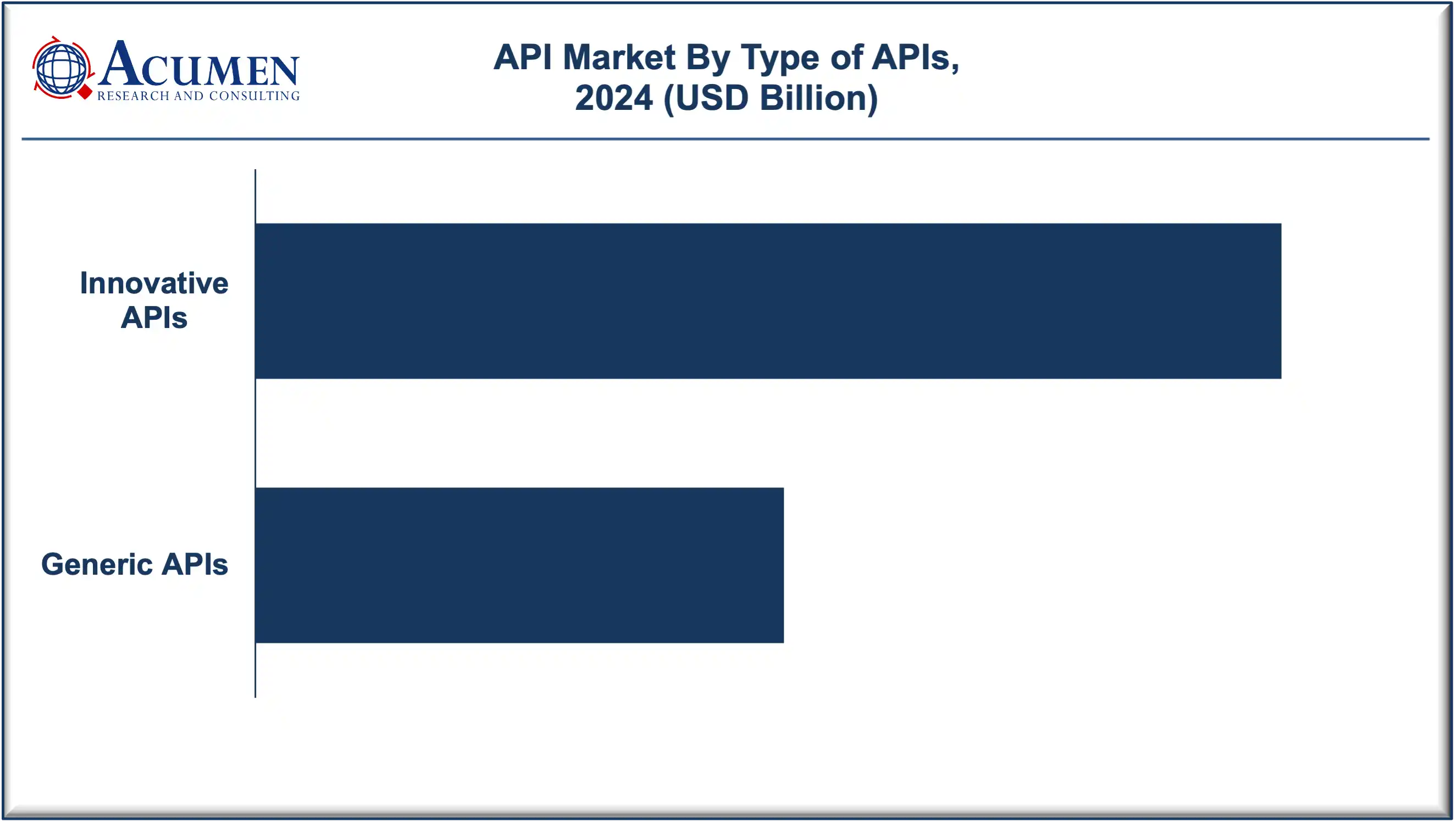

The innovative APIs segment accounted for more than 66% of the total market in 2024, supported by continuous R&D investments and favorable regulatory incentives for novel drug development. The generic APIs segment, on the other hand, benefits from patent expirations and growing affordability demand in developing regions.

Among these, oncology applications are anticipated to register the fastest CAGR through 2035. The escalating incidence of cancer, along with advancements in targeted drug discovery, continues to propel demand for oncology-specific APIs. Moreover, increasing hormonal and metabolic disorders are supporting growth in the endocrinology segment, where APIs like Levothyroxine are widely used for thyroid treatment.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

North America dominated the Active Pharmaceutical Ingredient Market in 2024, capturing more than 39% of the global share. The region’s leadership stems from a strong presence of key pharmaceutical players, a robust regulatory environment, and high demand for biologics and specialty drugs. The United States remains the largest API producer in the region, followed by Canada, driven by high R&D spending and advanced manufacturing technologies.

Europe holds a substantial market position owing to its advanced pharmaceutical infrastructure and supportive regulatory framework. Countries such as Germany, the U.K., and France are major contributors, focusing on sustainability, quality compliance, and biosimilar innovation.

The Asia-Pacific region is forecast to record the highest growth rate between 2025 and 2035. Emerging economies such as India, China, and South Korea are becoming global API manufacturing hubs due to low production costs, government incentives, and skilled labor availability. India, in particular, plays a vital role in generic API production and export, supporting the global supply chain.

Latin America is witnessing steady growth driven by expanding healthcare access and increasing investments in domestic drug production. Brazil and Mexico are the key markets contributing to regional expansion.

The Middle East & Africa (MEA) region is gradually developing its pharmaceutical sector, supported by rising healthcare expenditure and growing demand for affordable medicines. Countries like South Africa and the GCC nations are actively investing in local API manufacturing to reduce dependency on imports.

The Active Pharmaceutical Ingredient Market is moderately consolidated, with global and regional manufacturers competing through innovation, pricing, and product quality. Leading players are expanding their production capacities, entering strategic alliances, and focusing on sustainable manufacturing.

These companies emphasize GMP compliance, R&D innovation, and digital transformation to maintain competitiveness in the evolving pharmaceutical landscape.

The Active Pharmaceutical Ingredient Market is on the brink of a major transformation as pharmaceutical manufacturers adopt next-generation technologies such as AI-assisted formulation design, advanced process analytics, and eco-friendly synthesis methods. The growing penetration of biotech APIs, coupled with the rising trend of outsourcing API production, will redefine industry dynamics in the coming decade.

Emerging regions, particularly in Asia-Pacific and Latin America, will continue to offer high growth potential due to increasing healthcare investments and a rising patient base. Meanwhile, the shift toward sustainable and continuous manufacturing will remain a strategic focus for global API producers.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

March 2025

April 2023

August 2018

September 2022