September 2020

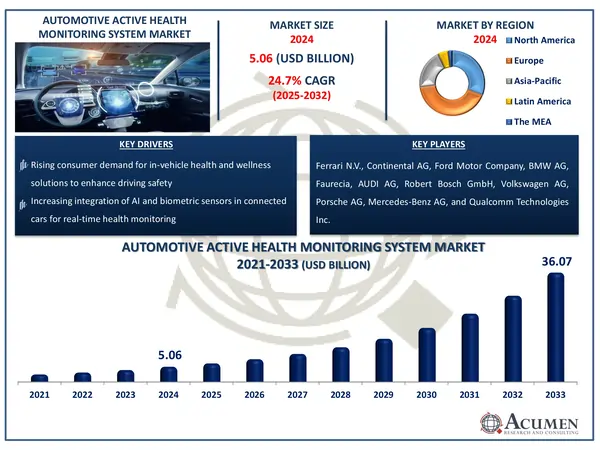

The Global Automotive Active Health Monitoring System Market Size accounted for USD 5.06 Billion in 2024 and is estimated to achieve a market size of USD 36.07 Billion by 2033 growing at a CAGR of 24.7% from 2025 to 2033.

The Global Automotive Active Health Monitoring System Market Size accounted for USD 5.06 Billion in 2024 and is estimated to achieve a market size of USD 36.07 Billion by 2033 growing at a CAGR of 24.7% from 2025 to 2033.

Automotive active health monitoring refers to monitor vital driver signs including fatigue, drowsiness, and distraction. Automotive active health monitoring involves health technology that, inside a vehicle, leads to safety improvements. Through tracking vital signs, medical technology inside a vehicle may lead to changes in safety as well as health and wellness aspects. In poor state of mind, injuries are often caused by exhaustion, irritation, or other medical conditions. Managing human factors requires controlling, recording and monitoring the driver's most critical vital parameters.

|

Market |

Automotive Active Health Monitoring System Market |

|

Automotive Active Health Monitoring System Market Size 2024 |

USD 5.06 Billion |

|

Automotive Active Health Monitoring System Market Forecast 2033 |

USD 36.07 Billion |

|

Automotive Active Health Monitoring System Market CAGR During 2025 - 2033 |

24.7% |

|

Automotive Active Health Monitoring System Market Analysis Period |

2021 - 2033 |

|

Automotive Active Health Monitoring System Market Base Year |

2024 |

|

Automotive Active Health Monitoring System Market Forecast Data |

2025 - 2033 |

|

Segments Covered |

By Location, By Component, By Vehicle Type, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled Aviation |

Ferrari N.V., Continental AG, Ford Motor Company, BMW AG, Faurecia, AUDI AG, Robert Bosch GmbH, Volkswagen AG, Porsche AG, Mercedes-Benz AG, and Qualcomm Technologies Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The demand for automotive active health monitoring systems is undergoing a powerful expansion due to the increase in the population of obese and diabetes, which requires constant monitoring. For instance, according to the World Health Organization (WHO), one in every eight people globally would be obese by 2022, with diabetes affecting 10.5% of adults aged 20 to 79. The active safety motoring device has an integrated biometric feedback sensor with electrodes placed close to the driver's seat, seatbelt, or steering wheel for health assessment.

Moreover, chronic disease is a common variable in road deaths, as several drivers were diagnosed with diabetes, cardiac and renal diseases, leading to road accidents caused by exhaustion and confusion. For example Road traffic accidents kill an estimated 1.19 million people per year according to the WHO. The Effective Automotive Health Monitoring Program tracks the safety of the driver and helps to prevent possible road deaths. Significant changes in safety standards by government agencies have led to the development of safety features for drivers as well as passengers and vehicle safety by auto manufacturers. This is a key factor anticipated to improve the demand for the automotive active health monitoring system in the near future.

Furthermore, the integration of artificial intelligence (AI) and machine learning into health monitoring systems is revolutionizing the automotive industry. For instance, according to the HealthSnap, Inc. if a patient's heart rate variability has gradually decreased over time, artificial intelligence (AI) can notify medical practitioners to an elevated risk of cardiac event. These technologies enable real-time biometric data analysis, allowing vehicles to identify indicators of weariness, stress, or medical emergencies and take precautionary measures such as sending notifications or altering driving conditions. Manufacturers' increased investment in connected vehicle technology supports market growth, as expanded telematics systems boost remote health tracking capabilities. Furthermore, the emergence of self-driving cars is expected to increase the adoption of these systems, ensuring long-term driver and passenger safety through increased health monitoring features.

The worldwide market for automotive active health monitoring system is split based on location, component, vehicle type, application, and geography.

According to automotive active health monitoring system industry analysis, the dashboard category has the biggest market share. Its success is due to a number of factors. The dashboard's strategic location allows for optimal monitoring of the driver's vital signs and behavior. Sensors and cameras integrated into the dashboard can precisely monitor facial expressions, eye movements, and general concentration, which is crucial for detecting weariness or distraction. Furthermore, the dashboard serves as a consolidated platform for providing real-time health data and alarms, allowing drivers to swiftly assess their situation. The ease and cost-effectiveness of incorporating monitoring technology into the dashboard, as opposed to other areas of the car, adds to its widespread use. Overall, the dashboard's location and features make it a perfect hub for active health monitoring systems.

The sensors segment is currently driving the most revenue in the automotive active health monitoring system market. This is primarily owing to sensors' crucial role in gathering real-time health data from drivers and passengers. These sensors, which include heart rate monitors, blood pressure monitors, and fatigue detection systems, are critical for accurate and reliable health monitoring. The increased demand for advanced driver assistance systems (ADAS) and the emphasis on improving in-car safety and comfort have hastened the use of these sensors.

Furthermore, the integration of sensors with infotainment systems and other car components has resulted in a more smooth user experience, making them vital in current vehicles. The rise of health-conscious customers, as well as the aging population, particularly in industrialized countries, have contributed to the sensors segment's dominance. As automobile manufacturers prioritize safety and wellness, the sensors category is projected to maintain its market-leading revenue position.

The passenger car category has emerged as the driving force in the automotive active health monitoring system market. Several causes contribute to its prominence. For starters, passenger cars make up the majority of the global automotive market, resulting in increased adoption of modern technologies such as health monitoring systems. Second, the growing consumer emphasis on personal safety and well-being leads to a greater demand for these features in passenger automobiles. Automakers are responding to this demand by integrating sophisticated health monitoring systems into their passenger car models, particularly in premium and luxury segments, as a key differentiator. Furthermore, the growing popularity of ride-sharing and personal mobility solutions has contributed to the increased use of health monitoring systems in passenger vehicles, as companies prioritize passenger safety and comfort. Finally, the regulatory push for more advanced safety measures in passenger automobiles strengthens this segment's leadership position.

In the automotive active health monitoring system market forecast period, because of its importance in assessing driver alertness and overall well-being, the pulse rate monitoring sector is likely to account for the majority of industry. Pulse rate sensors, which are commonly integrated into steering wheels, seats, and seatbelts, offer real-time data on a driver's pulse rate variability, aiding in the detection of stress, exhaustion, and potential medical crises such as cardiac disorders. The growing emphasis on road safety, as well as the rising prevalence of heart-related diseases among drivers, fuels demands for this technology. Furthermore, incorporating AI-driven analytics into automobiles improves the accuracy of pulse rate monitoring, assuring proactive health management, and putting this category as the most significant contributor to market growth.

North America

Europe

Asia-Pacific

Latin America

The Middle East & Africa

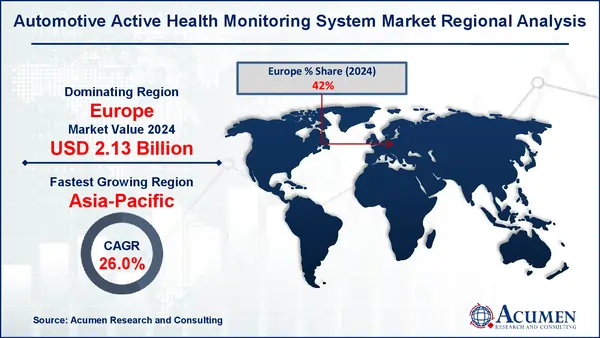

Europe is expected to have the largest market share of revenue throughout the automotive active health monitoring system market forecast period. High consumer spending power allows them to spend in feature-premium vehicles, mainly luxury cars, which in this region is a major driving factor. A key reason for introducing in-vehicle health monitoring systems such as the automotive active health monitoring system is to improve R&D to ensure the safety of the vehicle user. Asia-Pacific market for active automotive health monitoring systems is likely to be the fastest growing region over the forecast period.

North America is another important market for automobile active health monitoring systems, with strong technical adoption and an increasing emphasis on road safety laws. According to a recent Pan American Health Organization (PAHO) report on road safety, in 2021, traffic accidents killed over 145,000 people in the Americas, accounting for 12% of all road accident deaths worldwide. The region has a high demand for linked and self-driving automobiles, making biometric tracking an essential feature for premium and mid-range cars. Furthermore, increased worries about driver tiredness and chronic health disorders among the elderly contribute to market growth. Government measures to improve vehicle safety, as well as the presence of important automotive firms investing in health monitoring systems, continue to drive growth.

Some of the top automotive active health monitoring system market companies offered in our report include Ferrari N.V., Continental AG, Ford Motor Company, BMW AG, Faurecia, AUDI AG, Robert Bosch GmbH, Volkswagen AG, Porsche AG, Mercedes-Benz AG, and Qualcomm Technologies Inc.

Looking for discounts, bulk pricing, or custom solutions? Contact us today at sales@acumenresearchandconsulting.com

September 2020

May 2020

August 2020

May 2020